Hello everyone, long term I'm still bearish but in the short term, there is a bullish structure on LTF which began with a perfect tap with nPOC. There is a high chance that price will continue to rise until it encounters demand zone which is slightly above $43000. If we get a strong rejection from that level then we should see a move down probably to CME at $40600.

Data Analysis

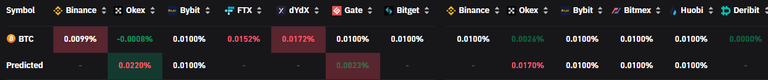

1. Funding Rates For Perpetual Swaps

All rates quoted are 8-hour rates. Positive funding rates suggests speculators are bullish and long traders pay funding to short traders. Negative funding rates suggests speculators are bearish and short traders pay funding to long traders. Funding rates (0.01%) is neutral. Funding rates(below 0.01%) are green colour,it's bullish .Funding rates (above 0.01%) are red color, it's bearish. The stronger the bearish or bullish sentiment, the darker the color.

2. Total $BTC Futures Open Interest

Open interest measures how many long and short contracts there are in the market. There is an equal amount of logs and shorts, but that doesn't necessarily mean that there's an equal number of long and short traders. It is used as an indicator to determine market sentiment and the strength behind price trends. Increasing open interest is typically a confirmation of the trend whereas decreasing open interest can be a signal that the trend is losing strength.

3. Total Liquidations $BTC

In the context of cryptocurrencies, forced liquidation happens when the investor or trader is unable to fulfill the margin requirements for a leveraged position.

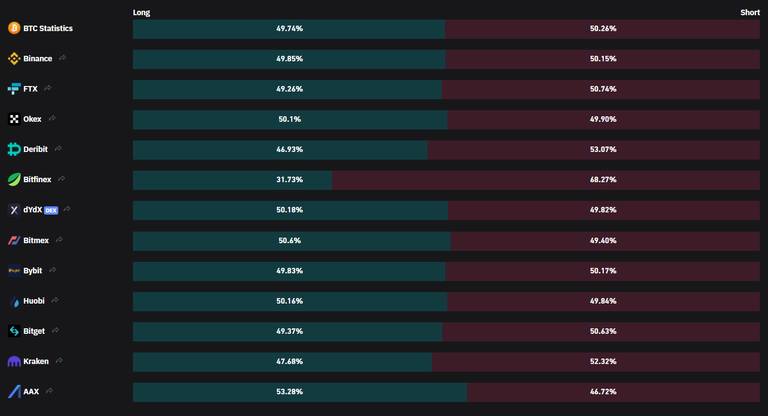

**4. Exchange $BTC Long/Short Ratio **

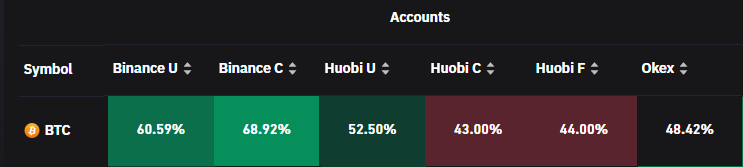

5. Top Futures Traders Positions/Accounts

All percentages represent long percentages. U=USDT or USD Margined ,C=Token Margined,F=Futures.

Long Position % = Long positions of top traders / Total open positions of top traders

Short Position % = Short positions of top traders / Total open positions of top traders

Long/Short Ratio (Positions) = Long Position % / Short Position %

Long Account % = Accounts of top traders with net long positions / Total accounts of top traders with open positions

Short Account % = Accounts of top traders with net short positions / Total accounts of top traders with open positions

Long/Short Ratio (Accounts) = Long Account % / Short Account %

Disclaimer: Not financial advice. If you blindly follow people on the internet you deserve to lose money.

Earn Passive income with NEXO

Nexo is a crypto platform that pays interest on deposits and allows you to borrow against your crypto. Right now, Nexo is offering the following promotion to new users. You can get $25 in BTC when you open a new account, complete KYC, and deposit at least $100 in any supported asset on the platform (You must keep the $100 minimum for at least 30 days). Feel free to join :)

Hope you found today’s article helpful. If you want to learn more about trading and crypto in general follow me at @fizzonmyjayyce. Have a nice day

Posted Using LeoFinance Beta