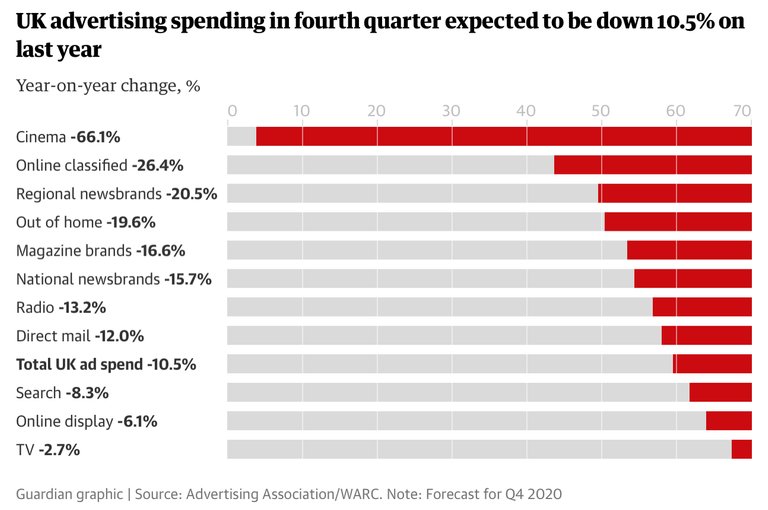

As Covid-19 continues to ruin economies, one of the biggest measures of confidence in spending is expected to drop even further in Q4 2020 in the U.K. After crashing an initial 33% in Q2, the British advertising sector expect to drop another 10% in the upcoming fourth quarter, which is usually the most big budget and spend period of the year thanks to the Holidays season.

This year, driven by poor economy and also the mindset of people, the otherwise lucrative quarter, lacks confidence in continued spending as people tighten the belt with possible new lockdowns upcoming. The £725m ($942.3m) drop for Q4 is expected to be the biggest since the British advertising industry started recording figures in 1982.

The sector expected to suffer most is the movie industry, with cinemas suffering due to lack of blockbuster releases.

Further dramatic decline is expected in the print sector, which has suffered for years already leading to closure of many print outlets. Print news and magazines are expected to see declines of more than 15% compared to Q4 2019, rising to more than 20% on regional level.the radio industry also is predicted to suffer a drop of more than 13% in revenue, further potentially altering the media landscape as the internet, and streaming (podcasts), find always more foothold in the consumption of news.

Unsurprisingly the “out of home” advertising sector, which includes billboards and posters in public locations is also expected to be almost 20% lower, an obvious outcome of lower footfall as people tend to stay home more and additional (regional) lockdowns are expected.

TV advertising and online display advertising will escape the worst though, with a predicted drop of less than 3% for the former and around 6% for the latter. Internet advertising continues to be the sector though, expected to represent 53% of the Q4 and spend in the U.K., more than two and half timeslarger than the TV advertising spend at £3.57bn ($4.64bn) vs. £1.35bn ($1.75bn).

While most of online display ads will continue to be spent mostly on Google and Facebook, increasing lower advertising revenue for larger media platforms may result in more platforms trying out their own advertising solution as the Dutch public broadcaster NPO has successfully done since early 2020, with increasing ad revenue compared to previous third-party options.

As Covid-19 continues to change “the normal” and human behavior, it will be interesting to observe whether — especially online — advertising will change and we will see new power brokers emerge or platforms of all sizes will go stand-alone and create their own advertising solutions in order to maximize revenue without middleman.

Much of the insecurity in the expected and spend decline is Covid-10 related, as well as due to the still not clear Brexit situation in the UK. But continued advertising revenue declines for the print media and also radio broadcasting are starting to reach critical levels for always more publishers and broadcasters, especially on regional level and the pandemic may result in more closures and job losses in journalism.

The advertising industry, shrewd as it is, will continue to exist and excel but there’s a clear shift happening and the victims will be the traditional media which still rely on print revenue as the internet continues to become the dominant player in our lives and spending patterns.

It may even lead to less “creepy” ads.

Credits: Graphic via the Guardian

Posted Using LeoFinance

When we also look at how many businesses are closing and cutting spending it would make sense that advertising is cut, I think that advertising when your product cannot be purchased online or via delivery is also cut off a lot of businesses since before they could advertise and take the knock of a low conversion as customers who eventually walked in the door spent big to cover the margins.

As someone in marketing, I can see the effects, but in some cases we also see advertising spike as there's a bigger concentration of ads lets say for food delivery or buying contact lenses online then there was before, not that it offsets the losses in the other industry

overall its a massive drop, marketers and businesses are going to have to become smarter and leaner with their marketing campaigns

Posted Using LeoFinance Beta

This is an interesting aspect. While I wouldn't call my experience in the advertising industry representative (too short, only at one agency albeit a major one, early in the switch to mobile first Era) many brands just don't offer any possibility for agility as digital and traditional are different budgets.

So this is mostly left to smaller and more nimble brands, and also brands which aren't on retainer since in the latter case the internal agency departments will fight to protect their own revenue.

In many countries the digital adspends are whole new budgets actually, not just taken from traditional adspend. Those budgets have grown so quickly that they became whole new wallets. Additional spending.

Here in the Philippines everything can be ordered. While essentials/groceries is rather recent - earlier attempts never worked because the monopolies of few local corporations - we can even order prescription glasses since several yeats, with an assortment of more than 500 frames and delivered within 5 days. What we don't really have are the larger items, like bigger furniture, which would be covered by mail order catalogue brands in first world (another dying dinosaur).

!ENGAGE 30

Posted Using LeoFinance Beta

I'd say you're right and I want to know how quickly this shifts, people may not buy as many magazines and newspapers, they may not watch as much TV as before or rather its not as impactful as it once was so the margins don't justify the spend.

Online magazines are also often heavily subsidizes as their income from ads isn't always enough so they also get hit and closed down, I've seen a few local news sites here close already the online ad network has overall also shrunk so there's less spend going around than before and sites had staff and expenses based on that, the knock-on effects are far too much for us to imagine

We're only really starting now with groceries and a few more artisanal items in South Africa, we do have some general retailers but their service isn't very good in terms of online.

Lol I used to work on an online furniture brand it was an absolute bloody nightmare, not even Ikea wants to do it, in fact in Dubai they rather pay you to come to the store and get your own stuff, that's how much they want to avoid doing furniture eCommerce sales.

ENGAGEtokens.That's quite a shift in favour towards online advertising.

No surprises at all in those stats, but it's interesting to see the size of the effect, you've got to feel for anyone doing a marketing degree, it's going to be tough times ahead!

Posted Using LeoFinance Beta

Cinema Industry definitely facing the Crisis Phase due to this Pandemic and inturn this change is shifting the Preferences of Viewers too. Stay blessed.@fknmayhem, In my opinion

Cinema will recover as the industry mostly owns the real estate and also heavily relies on zero-hour contracts.

Thank you for adding my Knowledge.

Have a pleasant time ahead.

Well, thats something new I learned today!

Posted Using LeoFinance Beta