The SWAP.HIVE:SIM Tribaldex Diesal Pool is a DeFi opportunity that all HIVE stakeholders can take advantage of.

While many Hive account holders are rightly focusing on DeFi opportunities for Splinterlands DEC, there is another gamified yield farming opportunity that even allows you to keep one side of your LP in HIVE.

In case you missed it, Tribaldex’s addition of Diesel Pools means that zero-fee DeFi is now on Hive.

While the selection of pools, especially pools that offer rewards for those providing liquidity is still quite limited, the SWAP.HIVE:SIM pool is certainly worth a look.

Whether you’re an active dCity gamer or not, by offering LP rewards for a pool featuring HIVE, the in-game currency of SIM is now a valid investment for all HIVE DeFi degens.

In this section of our dCity SIM guide, we discuss the SWAP.HIVE:SIM LP, how and why all HIVE investors shouldn’t sleep on this opportunity.

SIM is massively on sale right now

For newcomers to dCity, what you may not know by looking at a chart is that SIM is meant to be soft-pegged to 0.005 HIVE.

Within the dCity game itself, buying 1 card costs either 4 HIVE or 800 SIM tokens.

So as you can see, 800 x 0.005 = 1 HIVE, which is where the basis behind the peg comes from and why we only refer to it as being soft.

With the price of SIM currently sitting well below the 0.005 peg, players are obviously better off buying new cards with SIM rather than HIVE.

This creates demand for SIM, helping to soak up any excess supply being dumped onto the market by established players.

3rd edition cards came and went without bringing SIM supply/demand back into equilibrium around the soft peg price.

Right now, the established players ability to generate SIM which they need to dump on the market far outweighs any demand from new or growing cities.

The SWAP.HIVE:SIM LP will generate demand

The addition of the SWAP.HIVE:SIM LP has the ability to alter this supply/demand imbalance.

Potentially further to the complete opposite direction but soaking up all of the available supply... and then some!

You see, any SIM placed in the LP still counts towards your in-game SIM POWER.

SIM POWER is used within the dCity game itself for:

Earning holding rewards

Governance voting

So if you add liquidity to the SWAP.HIVE:SIM LP, you not only receive all of the above listed benefits, but also earn LP rewards for providing liquidity on top.

Now, as the Hive blockchain doesn’t have fees, all Tribaldex LP rewards must come from the token’s inflation.

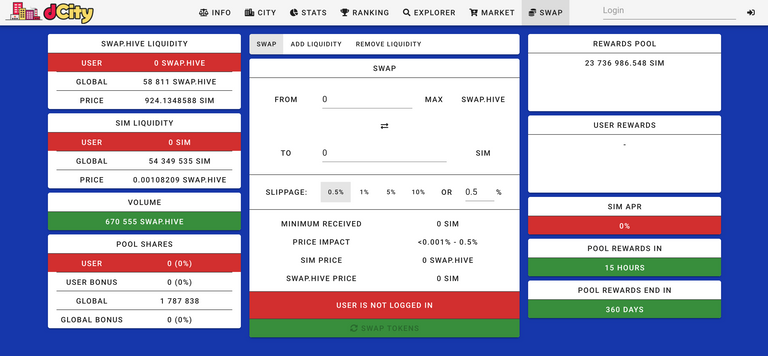

Take a look at the dCity swap tab and you can see what’s on offer:

With over 23 million SIM diverted to the rewards pool this year, this will again be all about finding that equilibrium between supply and demand.

Something I’m excited to watch play out in real time.

With 58K HIVE and 54 million SIM currently in the pool, it has certainly gotten off to a cracker of a start.

Without a new player boom like we’re seeing in Splinterlands, any changes we start to see will likely all be from current in-game whales.

If we do start to see a turn in price as the total liquidity added increases, it will be an excellent sign before the eventual new player rush does come.

Don’t sleep on dCity!

Final thoughts on dCity SIM + Defi in the SWAP.HIVE:SIM Tribaldex Diesel Pool

With a current APR of just over 25%, the incentive is certainly there to provide liquidity.

Especially if you’re a dCity player and current owner of a city that generates a huge SIM income you’d normally dump straight onto the market.

With the price of SIM still well below its soft peg, there’s certainly an opportunity to take advantage of the SWAP.HIVE:SIM LP.

While the risk of impermanent loss always remains, the fact the LP is pooled with SWAP.HIVE means that even if SIM rips higher and returns to its peg, you’re simply seeing it sold for HIVE.

A token you obviously want to stack if you’ve remained here through the bear market.

On the other hand, if HIVE outperforms in the short term, your SIM position simply increases while the supply/demand imbalance that we talked about the LP correcting, comes back into line.

Whether you’re a dCity player or not, there’s certainly an opportunity for all HIVE investors to take advantage of dCity’s DeFi markets.

Best of probabilities to you.

Direct from the desk of Dane Williams.

Why not leave a comment and share your thoughts on dCity SIM + DeFi in the SWAP.HIVE:SIM Tribaldex Diesal Pool, within the comments section below? All comments that add something to the discussion will be upvoted.

This dCity SIM blog is exclusive to leofinance.io.

Posted Using LeoFinance Beta

Well it made sense for me to pool into the diesel pool because I don't have enough SIM to qualify for the holding rewards. I just wished there was a way to see what the rewards I got daily were in an easy to see place (along with history of previous days).

Posted Using LeoFinance Beta

A history of payouts is definitely another section that's lacking from the Tribaldex interface.

Right now all you can do is check the 'user rewards' section of the dCity swap tab.

That tells you how much you will receive when the daily timer hits zero.

Then just manually confirm in your Hive-Engine balance.

Posted Using LeoFinance Beta

Thank for good news. !PIZZA

$PIZZA@forexbrokr! I sent you a slice of on behalf of @tin.aung.soe.

Did you know Pizzabot speaks Spanish if you use the command ESPIZZA? (7/10)

Are you playing dCity?

Hopefully this section of our guide to dCity SIM can help you out :)

Posted Using LeoFinance Beta

Started doing this myself as a way to build more passive with SIM. What I really like is the ability to do it right from the games dashboard as I still have yet to really understand the diesel pool site itself. DeFi gaming at its finest!

Posted Using LeoFinance Beta

The Diesel Pool dashboard sucks, doesn't it...

The fact that in the dCity swap tab you can see the APR is the best.

Tribaldex really needs to better display how much you can earn as an LP on each pool.

Posted Using LeoFinance Beta

yeah it would make sense to model it more after other DeFi projects and how they are laid out instead of trying to come up with a new design. Would be much easier to understand and better adoption from those already involved with DeFi. I honestly haven't really touched the platform simply because I don't really get it and understand it.

This looks very interesting. So right now I get a small HIVE payment just for holding some SIM in my wallet. You're saying that if I pair it with swap.hive and put it in a liquidity pool, I will still get that small payment, as well as whatever benefits the pool pays out?

Posted Using LeoFinance Beta

That's what I'm saying :)

But obviously you open yourself up to impermanent loss risk.

However, as the other side of the LP is SWAP.HIVE, I don't think you can really go wrong.

Posted Using LeoFinance Beta