How you can profit from stablecoin farming on Hive DeFi.

Unless you’ve had your head in the sand, you’ll have heard we now have DeFi on Hive in the form of Tribaldex Diesel Pools.

Along with this capability, comes a range of Diesel Pools for you to choose from including my personal favourite, the SWAP.HIVE:SIM LP.

But with the price of HIVE crypto going up, many looking for DeFi opportunities are rightly worried about impermanent loss.

For risk-averse yield farmers however, Hive DeFi now has LP rewards on offer for pure stablecoin farming.

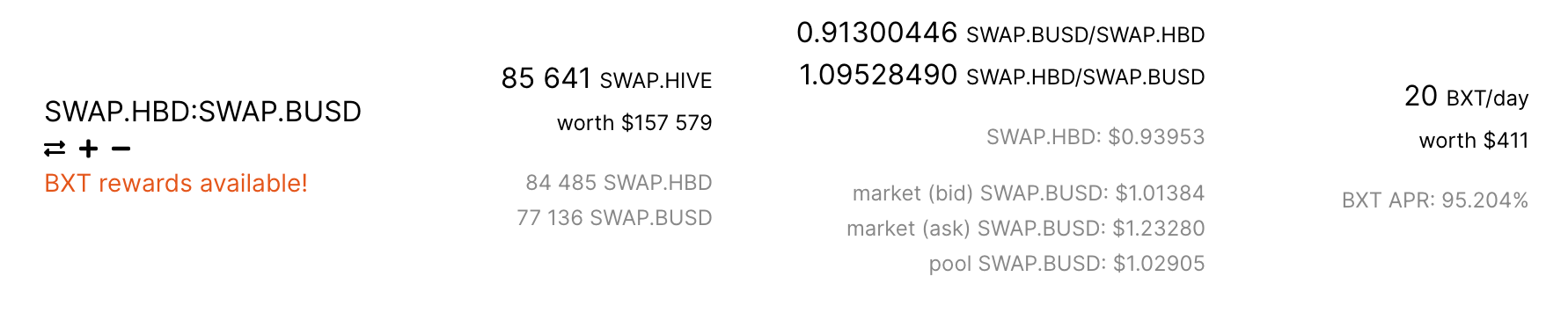

The SWAP.HBD:SWAP.BUSD LP

As we mentioned above, the most conservative and low-risk way of investing in DeFi yield-farming LPs, is by providing liquidity to those consisting only of stablecoins.

If you want to protect your precious HIVE crypto balance from the risk of impermanent loss, then you’re going to want to take advantage of Hive Backed Dollars (HBD)?

With BXT rewards now on offer, that means providing liquidity to the SWAP.HBD:SWAP.BUSD LP:

As you can see, the pool still has a relatively low amount of liquidity.

But the BXT APR of 95.133% at the time of writing is certainly a juicy piece of yield on offer for a pure stablecoin farm.

You'd be mad to not at least get involved with any spare HBD that you're earning on post rewards.

Final thoughts on stablecoin farming on Hive

Now this is still an early APR that simply can’t last and there are various other risks associated with these being Hive-Engine issued SWAP tokens.

But overall, the pros far outweigh the cons when it comes to stablecoin farming on Hive DeFi via the SWAP.HBD:SWAP.BUSD LP.

I’ve said it before and I’ll say it again to finish up - Development within this ecosystem makes HIVE crypto a good investment in 2021.

Best of probabilities to you.

Direct from the desk of Dane Williams.

Why not leave a comment on what you think about stablecoin farming on Hive DeFi. All comments that add something to the discussion will be upvoted.

This Hive DeFi blog is exclusive to leofinance.io.

Posted Using LeoFinance Beta

I changed out some HBD in for the pool. However I don't think the current APR will last because its the BXT emission rate will drop in the next few weeks. So I wonder if leaving it in the savings or putting it into the pool for BXT will be more profitable in the end. The base rate should be 1/4th of what we currently get and it should be at that point in 3-4 weeks.

Posted Using LeoFinance Beta

Looking forward to doing this follow up post when the initial rewards dry up.

Posted Using LeoFinance Beta

Hey man, maybe you can help me out...

I'm trying to make sense of Tribal Dex / Bee Swap stuff and my only 'experience' in DeFi and providing liquidity in Cub Finance.

So on CUB, I send 2 tokens to a pool...I am then rewarded in CUB for providing liquidity. I understand that....

Now flip it to the ones on Hive, and other than the 'LP Rewards' we seem to get for a bonus, I see nothing being sent to me for providing liquidity.

I was in a few pools, but the only one that seem to send anything other than the bonus LP rewards, was a BXT pool.

Am I missing something? Or is this staring me in the face and I'm just the world's worst investor?

I don't think there is any current existing 'front end' record that shows you your rewards.

The rewards show up in your regular HE wallet I think, rather than being added (compounded) to the pools - when they pay out depends on the pool provider - with the oneup pools it's regular - daily, I think the BXT pools are bit more irregular - with the HIVE-PIZZA pool i was in a while back it was once a week.

It's a bit eerie, and a lot of trust is involved.

Yeah I guess what I'm not seeing is any ONEUP rewards for my liquidity, other than the bonus LP rewards that I get. I think I found the answer though...Thanks man :)

I defo get the right amount of oneup in my wallet daily for the oneup pool at least.

Also if you stake BXT, you get rewards in Hive, regular Hive, not filthy swap,hive.

Yeah, I believe many don't like they can't see a record of their incoming diesel pool rewards yet. This creates a lot of confusion. I hope they'll add this soon, wherever the ball is, at the diesel pool API level or the front-ends.

They are good these pools,

NB I don't think @gerber would define his pools as DEFI - he said in his original post on the matter that this was centralised, like anything else built on HE.

I remember that line, made me chuckle, then cry.

If BSC and Solana based pools get to be called DeFi, then so do ours ;)

Haha, but no, I had the same reaction to gerber's comments when I read them too.

It's not true Hive DeFi in the purest sense, but it is the closest thing we have.

Hive at least has a greater chance of getting there than the above-mentioned networks!

Posted Using LeoFinance Beta

Yes fair points, it would be great if Hive Engine were decentralised. I'm not even sure how it works TBH.

The register of these conversations pretty much get over my head but I know I'll eventually get a hang of it.

You seem to really really know your onions, I follow you keenly too.

Thanks Pappy, we've all got to start somewhere :)

Stay engaged and you'll pick up the intricacies of Hive in no time.

There's certainly money to be made by being here!

Posted Using LeoFinance Beta

Shhhhhhh!!!

Posted Using LeoFinance Beta

I know, I know, I'm sorry haha.

Posted Using LeoFinance Beta