This is not investment advice, this is my opinion, I am not a registered investment advisor and please do your own due dilligence, and let the short sellers roast in their appropriate place.

First a bit of humor, since college, I have listened to this song whenever a stock I own is under attack from short sellers, to me, this song has nothing to do with height, it has everything to do with short sellers who short and distort.Randy Newman-Short People.

I stopped posting regularly because I held myself to such a high standard and others with good intentions recommending helpful and good suggestions to me led to me becoming a perfectionist making a work of art.

In this instance, I feel like this is important info I want as many people to see and hear as possible. So I don't care if you upvote the post, but please if you like it, link it to anyone who might be interested, talk about it, whatever you feel is right for you, or do nothing.

I'm gonna approach this more as I'm gathering and presenting this information to you and expect you to do you own research also beside reading what I've written here, but ill copy and paste some and explain a little also.

MEME STOCKS

Do you remember the meme stock craze with AMC and Gamestop, Bed bath and Beyond and many others?

"Now, finally, they believe their words are being heeded. The US Justice Department is said to have launched an expansive criminal investigation into short selling by hedge funds and research firms, scrutinising their symbiotic relationships and hunting for signs that they improperly coordinated trades or broke other laws to profit.

“I am very excited about this news,” said Brandon Fike, who has been trading meme stocks, taking part in online discussions and watching YouTube channels about them over the past year. “It’s about time someone did something about the hedge funds — people have been discussing short selling and corruption quite a bit this year and meaningful action needs to be taken,” said the English teacher and US Navy veteran who lives in the Philippines.

Meme stock traders targeted their ire at hedge funds en masse earlier this year, forcing several large investors to back down from wagers that companies such as GameStop would fail. A prevailing narrative in the retail crowd is that hedge funds have unfair access to information about companies and are able to keep prices low." Source

Well when the market crashed in 2022, the air came out of all the balloons, and tide came in as I like to say in financial cycles. And we saw who was swimming naked, and lets be honest. most of these meme stocks, whoever picked them, picked businesses that were failing. I myself have been against naked short selling and a big outspoken opponent of it for over 15 yrs since I was in college, but the problem is worse when good companies get shorted and manipulated, sometimes good businesses may be put into self-reinforcing cycles that ruin the business.

IF a short selling firm publishes a negative hit piece like they like to do, and the stock tanks, now the company can no longer issue stock to raise money, reducing corporate options for mergers and acquisitions. When doubt of the business infects bank lenders, credit could dry up or only be offered at very high interest rates, constraining growth or outright killing the business. And people dont want to do business with a firm they think will be gone soon, or even worse could be fraudulent. Most legitimate short selling activity is around, tax managment for a portfolio for example, or short selling a fraudulent company like Enron.

"To the Moon! Unprofitable high-growth names are back in favor to start the year, but several of the biggest movers don't really fit into the growth category. Those names are usually termed "meme stocks" — a basket of companies that have developed a strong following from retail traders and are touted across social media platforms.

As Bed Bath & Beyond Inc

BBBY

prepared for potential bankruptcy at the start of the year, the stock soared as traders latched onto high short interest in the name."Source Feb 2023 meme stock resurgence

But most of the Apes are still on yesterdays news. Unprofitable failing businesses, but some have found a better way.

What if everyone rallied behind a company that was being shorted, and instead of that company failing or declining, its actually expanding and flourishing? Imagine how high these stocks went and were actually bankrupt companies. Those left holding the bag were screwed. But if you are left holding the bag in a good company, you wont hurt anyone when you get them involved.

New York Community Bank

"Traders betting against shares of New York Community Bancorp have been saddled with roughly $64 million in paper losses this year, according to data from S3 Partners LLC. It’s by far the largest mark-to-market loss for US regional bank short sellers and the only unprofitable short position that’s greater than $5 million. In contrast, traders who have shorted regional banks are up nearly $7 billion in paper profits so far this year.

The slump for NYCB short sellers is because the stock is up nearly 10% this year, bucking the overall trend in regional banks. The KBW Regional Banking Index has shed 31% in the same period, crushed by multiple bank failures starting with the collapse of Silicon Valley Bank in March.

The Hicksville, New York-based bank has been an unlikely winner in the turmoil. The stock surged a record 32% on March 20, following the bank’s agreement to take over some of Signature Bank’s deposits and loans. NYCB said in its latest earnings release the deal should boost its net interest margin — a key measure of profitability.

Of course, NYCB hasn’t been completely immune from the regional bank contagion. The stock is on track to shed 11% this week amid the recent failure of First Republic Bank and renewed concerns over the safety of its peers."

(Source

Furthermore, we see that these individuals, have increased their short position in the last month, despite the positive news like:As we can see, the short sellers are out in force in the regional bank world because 4 of them have gone under and been bought in the last month. We know there is a short position in NYCB of account 40 million shares according to short squeeze data site I use, [free short interest info].(https://shortsqueeze.com/?symbol=nycb)

"New York Community Bancorp (NYCB) stock slipped 1.0% in Friday premarket trading.

Q1 net interest income of $555M, exceeding the $523.4M Visible Alpha consensus, increased from $379M in Q4 2022 and from $332M in Q1 2022.

Total revenue of $2.65B surged 360% Q/Q and 667% Y/Y. Noninterest income of $2.10B soared from $198M in the prior quarter and from $14M in the year-ago period. The current quarter's noninterest income included a bargain purchase gain of $2.0B related to the Signature deal. Excluding that item, Q1 2023 noninterest income totaled $97M vs $39M in Q4 2022.

Q1 preprovision net revenue, excluding merger-related expenses, was $263M, up from $209M in the prior quarter and from $212M in the year-ago period.

Provision for credit losses of $170M increased from $124M in Q4 2022 and compared with a benefit of $2M in Q1 2022.

Total loans were $82.5B at March 31, 2023 compared with $69.0B at Dec. 31, 2022, including $12B of loans, net of PAA, purchased from Signature and organic loan growth of ~$1.1B.

Deposits totaled $84.8B at March 31, 2023 vs. $58.7B at Dec. 31, 2022.

Wholesale borrowings at March 31, 2023 were $20.4B, relatively unchanged from Dec. 31, 2022 and up $5.7B compared with $14.7B at March 31, 2022.

Earlier, New York Community Bancorp (NYCB) non-GAAP EPS of $0.23 beats by $0.02, revenue of $2.65B" Source

NYCB currently has a market cap of 6.86 billion dollars. As we can see above, in the recent quarter, as a result of buying Signature bank, they made an instant accounting equity profit. It was more than just an accounting entry, the Bank also went from:

Total Revenue $2.65 billion up 360% Quarter on Quarter, and 667% Year on Year

58.7 Billion in deposits to 84.8 Billion

69 Billion in** loans** to 82.5 Billion

Quarterly Net Interest Income showing sequential growth

Q1 2022 $332 million

Q4 2022 $379 million

Q1 2023 $555 million

Quarterly Non Interest Income excluding Signature deal also rising

Q4 2022 $39 million

Q1 2023 $97 million

Total revenue of $2.65B surged 360% Q/Q and 667% Y/Y. Noninterest income of $2.10B soared from $198M in the prior quarter and from $14M in the year-ago period. The current quarter's noninterest income included a bargain purchase gain of $2.0B related to the Signature deal. Excluding that item, Q1 2023 noninterest income totaled $97M vs $39M in Q4 2022.

More to come....

""With New York Community's addition of certain deposits and assets of Signature's Bridge Bank, NYCB's balance sheet could be improved with less reliance on higher-cost wholesale funding. NYCB's loan-to-deposit ratio should decline from a high 119% in Q4 with the assumption of Signature deposits, while $12.9B in loans were bought at a discount of $2.7B, which equates to a 79% haircut," Bloomberg Intelligence analyst Herman Chan commented."Source

That discount in fair value vs cash paid by nycb is the origin of that huge one-time increase in revenue we saw this quarter. Because NYCB took more deposits than loans, and cherry picked which loans they wanted, their loan to deposit ratio went from 119% which means they had more loans than money deposited in their bank by 20% of total deposits. This could be a potential point of risk and perhaps one of the reasons shorts have disliked nycb in the past.

We now see Deposits are at $84.8 Billion, above the banks $82.5 Billion in loans. So that point is no longer a potential risk vector for the bank.

Public Service Announcement

Always do your own due diligence. If you are hardcore and want to dig through info yourself, Sec.gov, then edgar filings is the place to go for the actual filings of all public companies. Free to access for anyone, no sign in.

Please stop before you read another word if you actually are gonna follow in the foot steps of a maniac like me and look at the actual most recent quarterly report. Q1 2023 Quarterly Report Presentation

Always verify anything when it comes to this stuff, and make your own decision, as smart or good intentioned anyone can be, we all have blind spots and bias, in that spirit please share any views or things you see that I do not.

Today

"U.S. federal and state officials are looking into whether "market manipulation" has prompted the recent volatility in banking shares, according to Reuters, with short sellers raking in nearly $380M in paper profits on Thursday alone from betting against regional banks.

The brutal selloff saw PacWest (NASDAQ:PACW) and Western Alliance (NYSE:WAL) plunge 51% and 39%, respectively, as investors grew nervous about "strategic options," as well as the possibility of stockholder wipeout - similar to the ones that followed the collapse of Silicon Valley Bank (OTC:SIVBQ), Signature Bank (OTC:SBNY) and First Republic (OTCPK:FRCB). First Horizon (NYSE:FHN) also tumbled on Thursday after calling off its merger with TD Bank (TD).

"I can say the administration is going to closely monitor the market developments, including the short selling pressures on healthy banks," White House Press Secretary Karine Jean-Pierre declared. "I would have to refer you to the SEC on any possible actions, but certainly this is something that we're going to continue to monitor."

"We believe the banks are having their GameStop-like moment, where social media is amplifying non-traditional approaches to assessing solvency," countered Jaret Seiberg, analyst at TD Cowen. "This creates a self-fulfilling prophecy that pressures stock prices, which then leads to more questions."

Meanwhile, billionaire activist investors like Bill Ackman and Nelson Peltz are warning that more regional banks will fail unless deposit rules change, while the FDIC is looking to propose new payments on larger banks to replenish its deposit insurance fund." Source

Dick Bove- Bro, are you too old for this? I usually love what u say, but this time only half of it.

"Also on Thursday, Odeon Capital Group’s Dick Bove commented that hedge funds and traders who were shorting regional bank stocks “are doing the American public a meaningful service. They are winnowing the banking industry and forcing these companies to stabilize their financial statements.”

Bove said that federal regulators could and should have been doing this, if they had only issued rules against shorting bank stocks. An SEC spokesperson told Bloomberg that the agency was not considering a ban on short sales like the one imposed in 2008 when bank stocks plunged. That time, the SEC imposed a 15-day ban on shorting bank stocks that affected nearly 800 financial companies.

The American Bankers Association (ABA) agrees that the SEC should act. In a letter published Thursday to SEC chair Gary Gensler, the group’s CEO and president, Rob Nichols, wrote:

Since the two bank failures in March, some of our members have experienced significant short sales of their publicly traded equity securities that do not appear to reflect the issuers’ financial status or general industry conditions – indeed, short sales have followed relatively favorable earnings reports from some of the banks in question and from peer institutions. We have also observed extensive social media engagement about the health of various banks and the sector generally that appears disconnected from the underlying financial realities. We urge the SEC to investigate this behavior.

As for “winnowing” the banks, the ABA likely does not agree with Bove. The fundamental difference could boil down to how a financier like Bove looks at banking and how a banker looks at banking. In the financial view, banks take deposits (borrow short) and make loans or buy bonds (lend long) with the money. The value of the bank’s assets matters. When interest rates rise, asset values typically fall, and bad things happen. The virtually instant death of Silicon Valley Bank (SVB) is a textbook example.

From a banker’s point of view, banks take deposits which they believe will sit in their vaults for a long time (borrow long) and use those deposits to make loans or buy bonds (lend long). This viewpoint is based on the relationship (which is long term) that a bank has with its customers. In this case, rising interest rates cause the mark-to-market value of a bank’s assets to fall, but the bank’s net interest income rises. This is good for banks because they do not care much about assets and equity, as long as they have customers who believe their bank will still be in business next week and are willing to leave their deposits with the bank. Bloomberg’s Matt Levine has a more detailed and sophisticated analysis and cites Byrne Hobart, who shorted SVB in February:

[O]ne reason banks aren’t required to mark assets to market is that they can hold them indefinitely as long as they have deposits … it would take an absolutely titanic bank run to actually impair the company’s liquidity, so a run is unlikely."Source

So as we can see when Mr. Dick gave an interview which was published May 5, 2023 7:33 am Before the bell, Tricky Dick told the reporter that Short sellers were doing good work for the american people, and perhaps we should all send them christmas cards and greet them thankfuly on the streets. Im sure all the people worried about their funds in past few months are very thankful for these self-interested profiteers. To me, let them make money shorting legitimate bad companies or frauds, that is good work. But when you short good companies and then create false rumors and fear to accompany your short bet, and news articles, and tv appearances. Now we could have people who dont care about who gets hurt, they know money can be made, and for some reason did it to a good company along with bad ones.

Keep in mind the head of the american bankers association said there are definitely issues occurring with short selling of regional banks right now.

These are the battlegrounds that the fight against short sellers needs to take place, not at businesses that are on the way out like amc, gamestop, bed bath, hertz. IF you baghold, or invest, there, you are done. If you baghold nycb, you are gonna get paid a check every 3 months until u die, and when you sell it, I believe you are gonna think back to some maniac on the internet, this one time, who told u about how to fight the good fight.

Back to Tricky Dick:

"As pressures build on banks, "with every passing day it gets more likely that some form of relief will be provided to the sector," he said. That could occur in the form of the FDIC insurance cap being lifted, a Fed pivot, or for unusual stock and option trading in banks to be examined. He also mentioned the potential for reforms on the types of information that can be spread on social media or even traditional media.

Some analyst notes had speculated on the possiblity of temporarily banning short sales of banks to calm the markets. Odeon Capital's Dick Bove said that if shorting continued at the current rate, "it is quite likely the SEC would demand a short-term pause to allow fear to subside."

In an early Friday note, Bove said short covering is likely since the stocks had been "so devastated." And while that's likely to lead to a relief rally, the fundamentals of the industry remain unchanged, he said.

Among pressures on the banking industry that he lists: two Senate hearings in the next weeks, regulators are likely to require more capital, accounting rule changes, banks tightening lending and offloading securities, loan losses rising and stressed bank earnings." Source

A short time later, May 05, 2023 4:25 PM ET, Tricky Dick is quoted as saying a SEC demanded short-term pause of short selling to allow fear to subside is quite likely.

Damn Dick, you were my hero bro, I even thought u looked like another of my heros, G Edward Griffin the author of the Creature from Jekyll Island!

Now I feel betrayed by your friendly grandpa appearance.

Now even if NYCB passes everyone by, like a nothing burger, if you consider yourself an APE, or a person who believes that honest hard working companies/individuals should not ever come under unneccesary hardship for no other reason but to enrich individuals, especially if those individuals use illegal and unethical practices to make their trades become a self-fulfilling prophecy.

Here are the: Fibonaccis

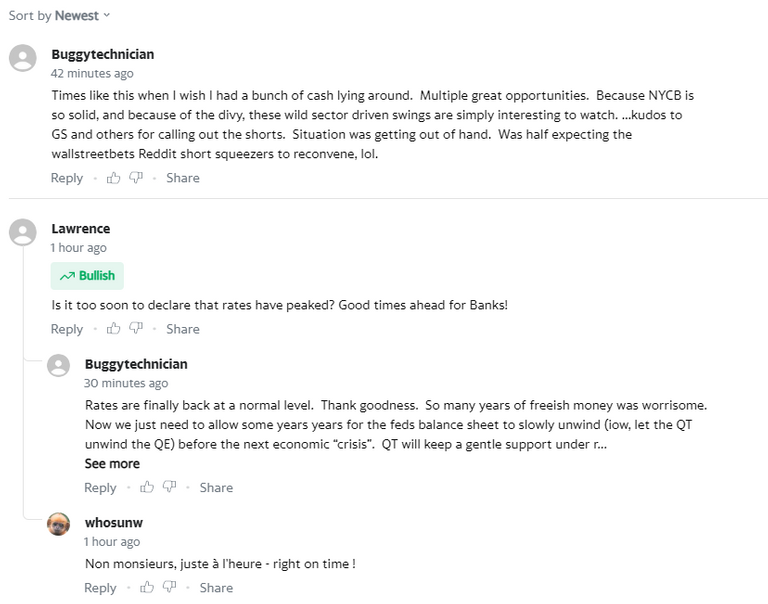

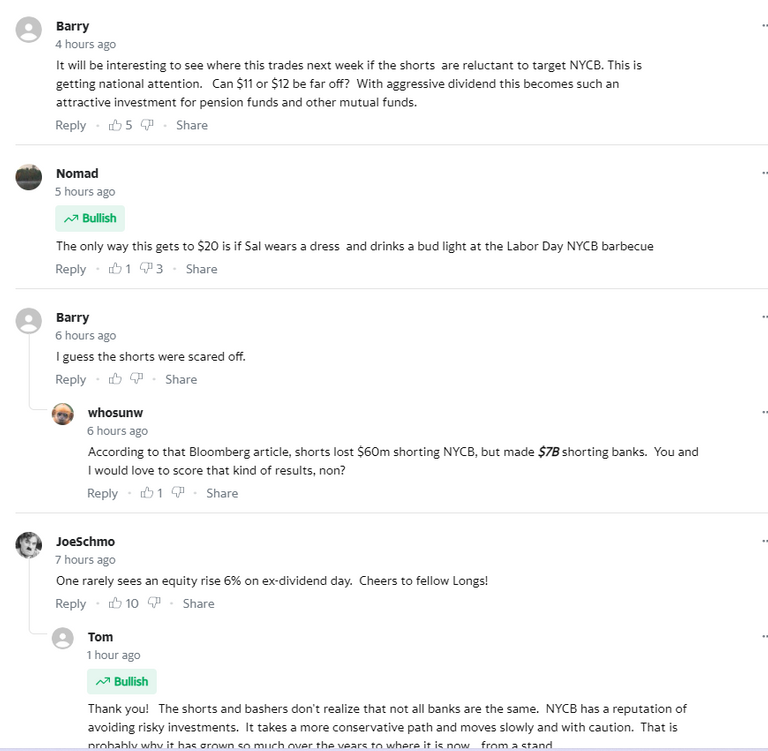

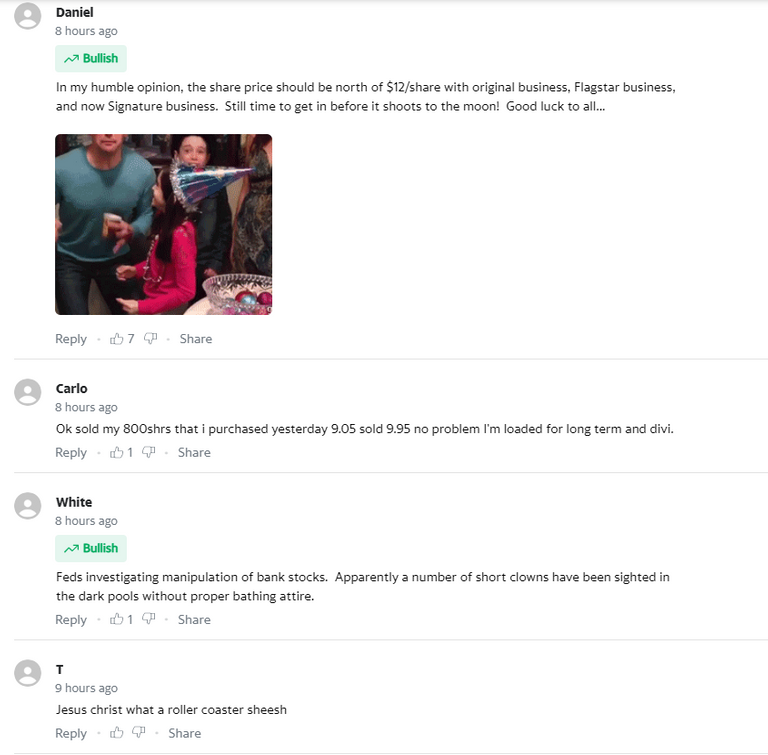

It looks like it could already be starting, look at these recent posts on yahoo investment message boards, which are normally ghost town, Ive owned the stock for over 5 years.

Dividend is 7% so unlike every other meme stock ever, you will get paid while you HODL.

P/E is below 10, it pays u, is a value stock. This is how you do it meme people, no more unprofitable companies.

God Bless.

Small banks. Think established banks like HBAN and BBT. Meme stocks are going to chase a ton of small banks so be ready.

NYCB is in same peer group as those two, much safer but those two are decent companies also.

Congratulations @forsakensushi! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 1500 comments.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Check out our last posts:

Support the HiveBuzz project. Vote for our proposal!

Yay! 🤗

Your content has been boosted with Ecency Points

Use Ecency daily to boost your growth on platform!

Support Ecency

Vote for new Proposal

Delegate HP and earn more, by @forsakensushi.

SRC

Woot!!! I’ll have to come back and read this in its entirety, but whenever I see something of this sort I just like to drop in and represent the DRS crew. Ok peace!

Update: price was $9.50 at the close March 4th, the previous trading day to this post.

Yesterday, July 8th the price closed at $11.36 per share

up 19.5% in capital gains since this post.

Will check back in next month or so ;)

Greetings sushi, would you be willing to delegate directly? If you want to discuss the proposal, my discord user is "lenkraff". I already negotiated with holoz0r and wilhb81

Hi @forsakensushi 👋 if I may comment here… DLease will no longer operate its HP leasing platform.

May I propose to lease your HP directly, at a rate of 10% APR, paid daily through Keychain’s Recurring Transfer method.

I hope to hear from you soon. Thanks 🙏

Hi cura, just saw this. that sounds great to me. i know weve had quite a few contracts over the years. im not familar with that function though, do you have a link for a guide?

Thank you for your witness vote!

Have a !BEER on me!

To Opt-Out of my witness beer program just comment STOP below

View or trade

BEER.BEERHey @forsakensushi, here is a little bit of from @isnochys for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.Hi @forsakensushi here's documentation about Recurrent Transfer that you may check.

In this case, I will be the one to set it up since you are the recipient of the transfers. So far, it has been consistently working as intended.

ok that works for me, how much hp would you like sir and what would the hive per day be for that amount. if you wouldnt mind doing the numbers good sir, do you want to contact me on discord? im in splinterlands, dcity, dcrops, rising star, and other channels

Sounds great! All of the deals that I made are 10% APR which is 0.28 Hive/day for every 1000HP.

You may choose to delegate between 1000HP to 10,000HP.

10,000 delegated. lemme know if you want more brother <3

Awesome! Thanks for accepting the deal. I have initiated the recurrent transfer.

Will do. Have a great day ahead 🙏

Thank you for your witness vote!

Have a !BEER on me!

To Opt-Out of my witness beer program just comment STOP below

View or trade

BEER.BEERHey @forsakensushi, here is a little bit of from @isnochys for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.View or trade

BEER.BEERHey @forsakensushi, here is a little bit of from @isnochys for you. Enjoy it!HIVE and on HIVE Engine.If you like BEER and want to support us please consider voting @louis.witness on

View or trade

BEER.BEERHey @forsakensushi, here is a little bit of from @isnochys for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.Hey man! I’m looking to lease more HP, around 5k or 10k—are you still interested?

10% APR too

Thank you for your witness vote!

Have a !BEER on me!

To Opt-Out of my witness beer program just comment STOP below

Thank you for your witness vote!

Have a !BEER on me!

To Opt-Out of my witness beer program just comment STOP below