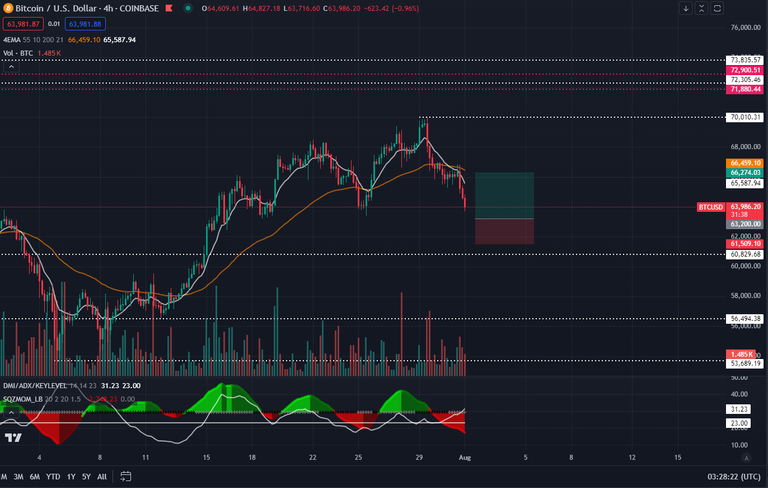

I expected the price to test the lower part of the range on the 1D from $60k to $56k and it looks like its going to but after a couple of days of waiting another opportunity on the 4hr Bitcoin chart shows up.

- Entry: $63200

- Exit: $66300

- Stop: $61500

On the 4HR chart the price is also looking like retesting the lower part of the recent range to then bounce to the 55 EMA (Orange EMA) to then keep going down, as I mention on my previous posts I'm only doing long positions based on indicators.

- SQZ: about to start second half of the red valley

- ADX: positive direction and force

- Speculation: price will try to hunt stops bellow the previous low to then bounce to the 55 EMA

This are the reasons why I will take this long on 5x with a 2.7% stop loss, that's about 13% that I'm willing to loose against a potential 20% - 25% gain if it plays out correctly.

On the daily, it has been the same so far stuck on the range although, I think the price might fall down to the lower part again and that's where most people will think it will break $52k even might start saying bull run is over but I think the closer we get to the end of the year the more is likely that the price will break ATH again, just some opposite direction thinking.

I'm going to look for two or three more setups but wanted to put this trade setup out before it happens, all this is paper trading for me, my goal 100 trades, on Bitcoin; with 70% success, when I'm done with that I would love for the market to turn bearish so I could do another say 50 trades during bearish environment and keep testing my skills before I move on to trade with real money.

Trade #002

Posted Using InLeo Alpha