I don't like this expression of "printing money", perhaps because it lost its aura as people started to find out how printing money takes place and what... doesn't back them. But I use it, because now printing money (in the loose sense, in crypto) has been democratized in a way never seen before. We will see where this will lead.

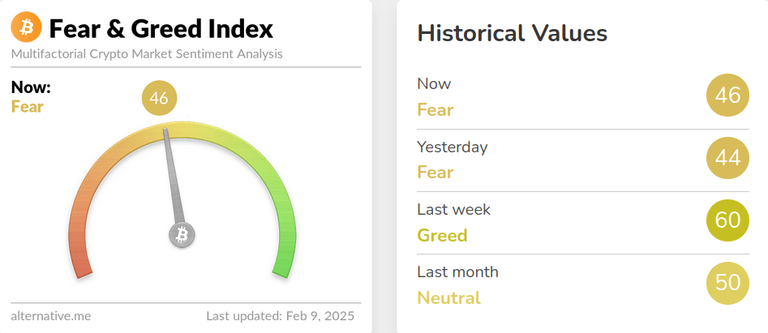

We have this thing called market sentiment in crypto and financial markets as well. Since most people want prices to go up, the sentiment goes up with them, and goes down when prices go down. Usually, in crypto, that follows the bull-bear cycle seasons. But we've seen things aren't as straightforward as that. We are now in a bull market with a relatively low market sentiment. If we check the Fear & Greed Index, it says we are in the Fear territory. Look:

In a bull run, people can earn from the appreciation of their volatile crypto holdings that are going up in price, in dollar terms. That's an easy way to earn, and everyone feels like a genius.

In a downtrend, people can either protect their gains by having them (or parts of them) in stablecoins, or for the knowledgeable, brave, and experienced, there is the option to short assets going down and earn as their price goes down. Mostly from other people's experience in this domain, I've heard it's not a very good idea to short crypto, other than for hedging purposes, as chances are you will lose your bet.

But then there is the long sideways, boring market. It doesn't even have to be long anymore. But a type of market that wears participants down because it is undecided.

Well... guess what? Still a great way to print money.

Before I go there, let me just say that the AMMs are a fantastic innovation in crypto. Defi may have been side-tracked for a while with farm tokens and farming pools, or stuff like that, but it evolved since then.

First of all, why were farm token and farming pools created? Because LPs didn't generate enough earnings from fees to keep liquidity providers in, especially considering impermanent loss, particularly in pools with new tokens.

But then, concentrated liquidity pools got invented (Uniswap did it, who else?), and that made two things possible:

- much lower price impact for users of the pools

- much higher fees earned by liquidity providers

All of the sudden, just leaving tokens in a concentrated LP started to make sense. Not as much on Ethereum, unfortunately, due to high gas fees, which impacted the profitability of those pools, but other chains with lower fees took advantage of this problem Ethereum will likely never solve (or not soon enough).

Maybe I didn't choose the right words up there. You rarely "just leave tokens" in a concentrated LP. I mean, you can choose some LPs where you could do that, but you won't earn much more fees than using a simple LP. Some active management is needed to earn more. And some learning, because it isn't straightforward to understand how they work.

It isn't customary to calculate APR for fees earned in concentrated LPs, since fees fluctuate significantly even inside the same day, but "normal" APRs for concentrated LPs other than stablecoins are 3 digits at least, without going for any wild option. But if you calculate your profit/loss in dollars (and not, for example, in number of tokens you want to have more of), what matters is that at the end you have a positive amount, after impermanent loss and when adding fees earned. Would be better if you actually earn in dollars both through IL and fees (and is perfectly possible). Of course, once you have all that, you can calculate PnL. I've seen some really high numbers put out by some, but also losses.

But I'd rather use my own experience as a guideline. My current LP is set since noon on Friday and has mostly stayed in range. If I were to close it now, it would have a profit percentage of 2.45% from fees and IL. Not fantastic, but that's in 54 hours of sideways trading, mostly, where I practically did nothing, in this case, except keep an eye on the position from time to time.

That seems like one useful instrument for the long boring markets. They can also be used during volatile times, but things get more complicated then. Speaking of instruments for boring markets... HBD remains one simple to use, elegant such instrument, and you need no PhD to use it, nor active management.

Concentrated LPs aren't without risks, like most things in crypto. But some things are riskier than others. I've finally seen some people who won't touch meme coins on the platform that somehow became synonymous with them, despite having other products too. Maybe there is some hope...

Either way, to recap. How do you print money any time in crypto?

- in the bull run, by riding the volatile assets

- in the downtrend, by protecting (some of) your gains with stablecoins, particularly if you earn some yield

- in a range, one option is to use concentrated LPs; there are other options too (staking, trading).

Posted Using INLEO

Those are the ways to protect your assets, but the markets are unpredictable. They can change at any point, but 2.45% from a few days is pretty good. What was your maximum risk if the pool decided to get out of your range?

I closed that position after earning 3%+ on it. But the position was SOL-USDC. If the price of SOL broke to the downside, I would have ended up holding only SOL (which, theoretically, being in a bull market, would have been pretty good, as it turned out today, for example). If SOL price would have broken the upper limit of the range (as it did, slightly), I'd end up with only USDC. The downside in this case would have been if SOL kept going up and I wouldn't be around to swap USDC for SOL or go into another LP on a different range/strategy. I would have kept the dollar value, but would have lost from the gain SOL had.

I need to study more on the range part about printing money anytime in crypto. I've learnt to be patient when the market is on a sideways movement but the attitude is usually not to do anything and wait for the tides to shift again. If the sideways movement is long, then I may potentially be missing out on some extra earnings.

From what I see, this can be highly lucrative. And if you are smart instead of very greedy, you can have almost guaranteed decent (and even high) returns while the market is boring.

HBD savings is my printing machine 😂

Works like a charm. Especially while the market takes it steady.

Congratulations @gadrian! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOP