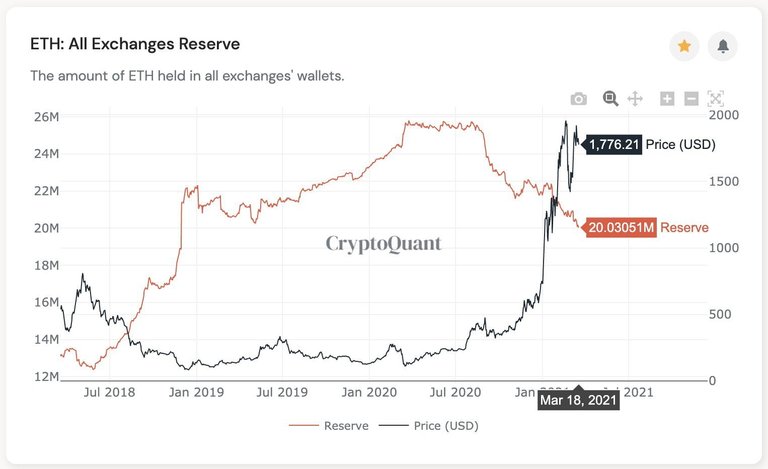

According to a recent data released by CryptoQuant, the supply of Ethereum, the second largest cryptocurrency by market capitalization, has reached a two-year low across the exchanges. CryptoQuant then went on to present the chart below to clearly show how the reserve of Ethereum in the exchanges has been depleting overtime until it reached the recent lows.

Experts believe that the depletion of Ethereum reserve in the exhanges either means that investors are transferring their funds to cold storages in anticipation of the top gear of the bull market or the digital asset is finding new use cases outside of the exhanges. Whatever, the case might be, the scarcity of Ethereum in the exchanges will have significant increase in price as long as its demand remains at least constant.

Investors Moving Ethereum Out of The Exchanges

In the past few months, institutional investors have been accumulating Ethereum. In this regard, Grayscale, the world's renowned cryptocurrency investment fund manager, plays the lead role with an acquisition of a staggering 47,895 ETH worth about $86.9 million in the last 30 days according to a report credited to Bybt.com. Also, retail investors have been accumulating Ethereum and moving it, like the institutional investors, from the exchanges to cold storages in line with the popular cryptocurrency aphorism, not your keys, not your crypto.

Ethereum Finding Uses Cases Outside Of The Exchanges

The next general reason why Ethereum's supply in the exchanges is declining is because of the use cases that it is finding outside of the exchanges. Users are transferring Ethereum to platforms, especially DeFi protocols, where it can be staked to earn high interests. Presently, the Ethereum locked in DeFI protocols is estimated at 9.2 million units, which is estimated at 33 billion dollars and constituting about 15% of its entire market capitalization.

In addition, the emerging NFT-mania in the cryptospace is also one of the reasons why Ethereum is fleeing the exchanges. The newly emerging NFT platforms, many of which are built on the Ethereum blockchain, are attracting recent volumes in Ethereum as users continue to move their coins from the exchanges. At present, NFTs appear to be the next big thing on the Ethereum blockchain and are expected to make more waves in the coming days.

Can Ethereum Set A New All-Time High Above $4,000 By The End Of April 2021?

By April 2021, it will be exactly a month to the date of the last Bitcoin halving. As Bitcoin continues to move at the present pace, perhaps to set a new all-time high above $70,000 next month, Ethereum can easily hit $4,000 at the same time frame. Also, the movement of Ethereum out of the exhanges technically means fewer sellers and less selling pressure. With the expansion of NFTs, the launch of Ethereum 2.0 and the ever growing DeFi ecosystem, there is room for much optimism as it concerns the price action of Ethereum, no doubt.

Posted Using LeoFinance Beta

Super!

I just made a post about Ethereum blowing up without even realising this. There's a new update coming to the eth smart chain that is supposed to optimize the exorbitant gas fees and also burn some.

With gas fees getting lower, we'll see more use cases for the Ethereum smart chain making it a more worthy competition to the new and thriving Binance smart chain. Also, with part of fees being burnt, more scarcity.

I believe we're about to see ETH explode.

Posted Using LeoFinance Beta

You've made very fine observations here. It is good to see that the Ethereum Dev team is working on reducing the gas fees to make it more scalable. For sure, the future is bright for ETH.

Posted Using LeoFinance Beta