When news broke that BlackRock was interested in bitcoin as an investment and submitted an application with SEC for a stop ETF, the entire world started talking about bitcoin again, positively. It was a welcome news, and since then anticipation for stop ETF approval have been among the top topics in crypto and investment worlds. Not just because BlackRock is among the top money managers, but also because they have a near perfect record in approvals. Not only BlackRock has shown great interest in bitcoin, but its CEO Larry Fink described investment in bitcoin as flight to quality. BlackRock is not the only applicant for stop ETF. In fact they are among the latest ones. Another giant money manager that has shown interest in bitcoin a while ago is Fidelity Investment. Fidelity too has interests in launching a bitcoin spot ETF and have submitted their application. Fidelity is not too far behind BlackRock in the amounts of money they manage. Both are big players in investment world, and their involvement in bitcoin will have massive impact, I think.

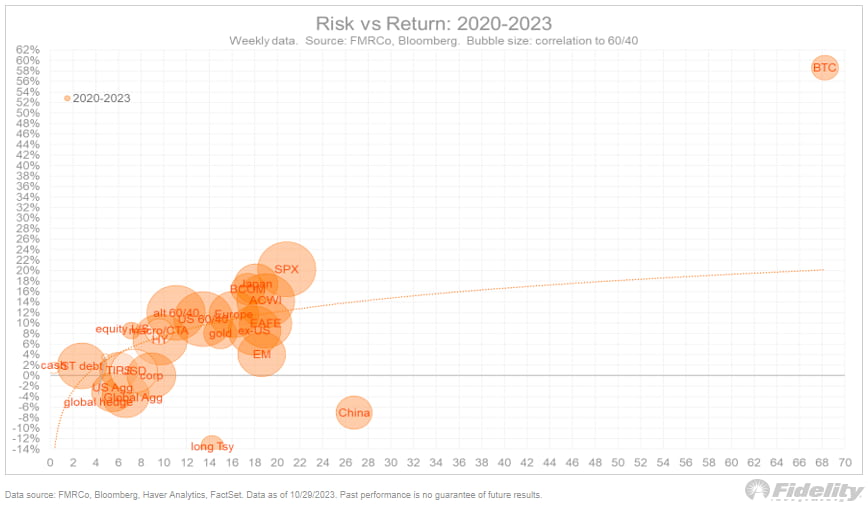

Jurrien Timmer, Fidelity's Director of Global Macro has published a risk-reward analysis on various assets which also included bitcoin. The results of the analysis is very interesting that it also caught Timmer by surprise who described the phenomenon by saying - "Bitcoin's risk-reward is in a different universe". It becomes very clear why Timmer made such a statement when we look at the chart produced as a result of the risk-reward analysis by Fidelity.

Can you see bitcoin? It is at the top right corner, far away from any other investment assets. Horizontal line represents the risks and the vertical line represents the reward. The data used was for the last four years, 2020-2023. Knowing how bitcoin performed in the last decade, the chart for longer term would probably be even more impressive. What does it all mean? In my opinion, it just mean what already knew for a while, bitcoin is something completely different, it is in its own category.

The second best performing assets according to the chart above is SPX, S&P 500 Index. That is interesting too. We can derive multiple things looking at this chart. One of them is that investing in market indexes like SPX has been one of the safest and profitable ways to invest for a very long time. However, the presence of bitcoin as an investment option changes everything. Not only bitcoin too is a viable option for long term investment, but it has much more interesting risk-reward numbers. Fidelity and other money managers, financial firms and expert research and analyze all available data all the time to somehow understand the markets and create an edge for themselves. There will be more and more data and analysis coming up, and mostly likely bitcoin will continue to impress us. Not all data is becomes available for public. Some analysis are only intended for internal firm use. Those will make their way out as time goes by too.

What is clear is that bitcoin is an interesting investment instrument for many including those who have ruled the traditional markets for a long time. Bitcoin is no longer an asset only for crypto enthusiasts. More and more investment firms and executives will continue to discover that bitcoin is one of its kind and shouldn't be ignored as investment. While all this is happening, it seems the next obvious step is bitcoin spot ETFs, to unlock the doors for traditional investment funds.

Bitcoin's risk-reward numbers are a lot higher than other investment assets considered in this analysis. Both risk and reward numbers seem to be proportioned and balanced too. We already know in a short term bitcoin investment is of high risk but also high return. Its price can double in short period of time, and its price can be slices in half in even shorter time. However, in a long periods of time bitcoin has demonstrated again and again that it continues to appreciate in value. There is nothing to suggest things will be different this time around. We all know (think) that 100k price for bitcoin is within reach. This was difficult to image in that last cycle, when it made all time high of $20k and dropped all the way to around $3k.

What really makes bitcoin interesting is the technology. This post is not about bitcoin as a technology bur rather its potential as an investment instrument. But the technology is what makes its fundamentals solid. When considering any investment opportunities market players always consider the fundamentals, especially for the long term investments. Bitcoin's fundamentals are great, and keeps getting better as time goes by. But its best feature when it comes to investment is the scarcity. All market participants are aware of this. There is only 21 million of bitcoins can be created. But the real supply would probably be less due to millions of coins being lost in the past.

In open and free markets price is normally discovered by supply and demand. Bitcoin's supply continues to go lower. Next spring when halving event happens, miners will be receiving half of rewards as they do today. As this played significant role in the past, next event is anticipated to do the same. More and more big players enter the market demand for bitcoin will continue to grow, and supply will continue to go down. This can only mean one thing for its price, numbers go up. I might be wrong, but also kinda stating the obvious that everybody already knows. Regardless, the potential of rewards for bitcoin investment seem to be worth the risks, even if they are higher than usual.

Bitcoin's market cap is not even a trillion yet. Fidelity manages $4.5 trillion, BlackRock manager more, and there many other players. If only 2-5% of the money they manage starts pouring into bitcoin, that will definitely bring bitcoin's market cap to a trillion and beyond. Considering the risk-reward and the analysis done by Fidelity it looks like bitcoin is the kind of asset they would be interested in investing and trading. After all that is how they make money. Those who trade make profits from volatility in the short term. Those invest long term, make their profits from the long term price appreciation. While these are two different types of players in the market, both wouldn't be able to stay away from the opportunities bitcoin presents.

Another win for bitcoin. Hodl on! More buyers are coming for your bitcoins.

Risk it for the bisect. Read this article and it makes a lot of sense. Very high risk for sure but also very high rewards.

I believe that Bitcoin and the other valuable cryptos will be traded as traditional instruments in the future.

Bitcoin is the obvious choice, but I like to invest in altcoins. So, I am waiting for the bull market to see altcoins outperform Bitcoin.

This news is wonderful to hear. However it’s a wake up call for the retail investor to start positioning themselves before things get out of hand and they can no longer own bitcoin

BTC i would invest 90% of my portfolio. Whereas altcoins it just be 10% total. Its just so ahead of any other stable coin !

Bitcoin is truly in its own category

It's no mate with any other asset

BTC is definitely a great asset. I am not surprised because of how well it performed. It's the king of crypto and I don't think that will ever change.

We all knew that Bitcoin, as an asset, was better than other asset categories for growth. Yes, it is risky, but we should not be afraid of risk. We are crypto people, we understand that the odds are against us but we also see the potential it all has because we are in this space. Unlike others that look in from the outside and make opinions, we know what bitcoin is capable of. Great article, lets see what happens once the first ETF is approved.

In my opinion crypto is like a box full with jerks. And those jerks sometimes gives pleasure whereas sometimes prooves as tragedy. Anyway a lot of appreciation for quality.

The risk reward attached to bitcoin creates its uniqueness among all other investments opportunities

Discord Server.This post has been manually curated by @bhattg from Indiaunited community. Join us on our

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.

BTC was the beginning of a market and will set the tone for a while. I think you have to invest in several cryptocurrencies but never abandon BTC. Historically, it has given us profits, it is just a matter of knowing how to wait.

It's like the whole investment scene's getting a fresh shot of adrenaline with Bitcoin shaking things up.

The fact that the big-wig firms are eyeing Bitcoin like the last slice of gourmet pizza says heaps about its potential.

I believe that Bitcoin has great potential to continue growing and providing opportunities for investors. this is because Bitcoin has unique characteristics that make it attractive to various types of investors. For instance, Bitcoin is scarce, decentralized, transparent, censorship-resistant, global, and digital. These features make it adaptable to different contexts and needs. Furthermore, Bitcoin has a very active and diverse community that supports and constantly innovates it. This makes Bitcoin dynamic and evolutionary.

Congratulations @geekgirl! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 250000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts:

Congratulations @geekgirl! Your post has been a top performer on the Hive blockchain and you have been rewarded with this rare badge

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts:

Let's hope the trend continues and we experience another bull. Then I am putting a chunk of profit savings into HBD.

Waoh! For the likes of BlackRock to see the need to invest in Bitcoin it means that they have seen the bigger picture of a handful of opportunities Bitcoin present and still will be presenting in the future. That is a clarion call for Bitcoin lovers to take their rightful position now so as to gain maximally when the big fish comes trailing..