In this article ,I am sharing this article with the INLEO platform community to help people understand how big investors manage their portfolios and make strategic decisions for sustainable growth.

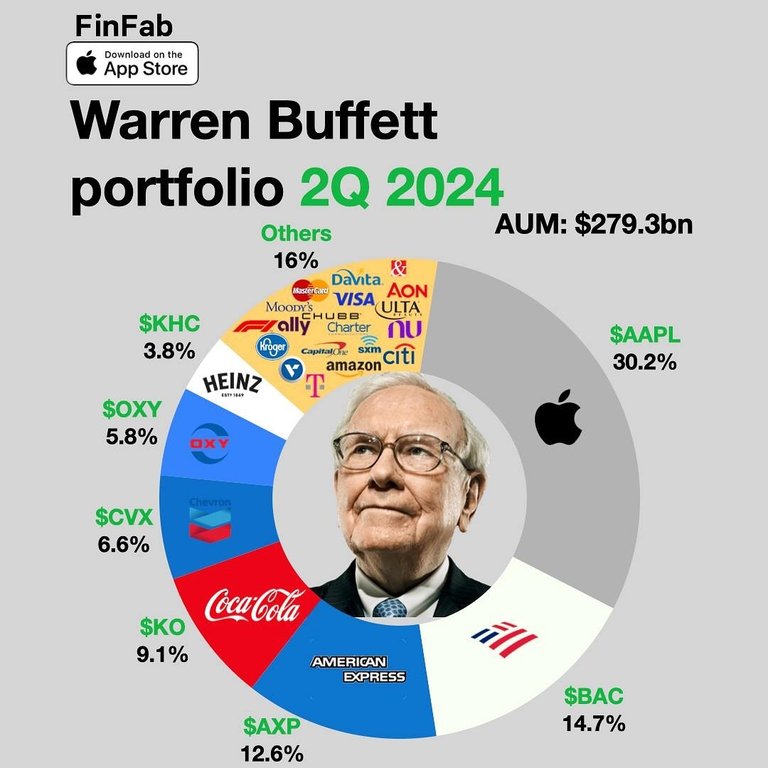

Warren Buffett, one of the most respected investors of all time, manages a massive portfolio worth $279.3 billion under Berkshire Hathaway. Known for his disciplined, long-term approach, Buffett invests in companies with strong fundamentals and durable brands. Here's how his portfolio breaks down for the second quarter of 2024.

Warren Buffett’s Portfolio: A Peek into Q2 2024

Warren Buffett, one of the most respected investors of all time, manages a massive portfolio worth $279.3 billion under Berkshire Hathaway. Known for his disciplined, long-term approach, Buffett invests in companies with strong fundamentals and durable brands. Here's how his portfolio breaks down for the second quarter of 2024:

Apple (AAPL) – 30.2%

Buffett’s love for Apple is no secret. With over 30% of his portfolio invested in the tech giant, it’s clear he believes in its strong ecosystem and consistent profitability.

Bank of America (BAC) – 14.7%

His second-largest holding, Bank of America, represents Buffett’s faith in the financial sector's stability and growth potential.

American Express (AXP) – 12.6%

Buffett has held American Express for decades. He appreciates its brand loyalty and customer retention, making it a cornerstone of his portfolio.

Coca-Cola (KO) – 9.1%

Coca-Cola is one of Buffett’s favorite investments. His long-standing association with the company shows his trust in its global brand and steady returns.

Chevron (CVX) – 6.6%

Buffett's energy investments include Chevron, reflecting his bet on the oil and gas sector's continued relevance.

Occidental Petroleum (OXY) – 5.8%

Another energy bet, Occidental Petroleum, signals Buffett's confidence in oil’s future, even in a shifting energy landscape.

Kraft Heinz (KHC) – 3.8%

Buffett's investment in Kraft Heinz reflects his interest in food and beverage companies, though this investment has seen its ups and downs.

Other Investments – 16%

The remaining slice of his portfolio includes various companies, such as Visa, Amazon, Citi, and Moody’s, which add further diversification.

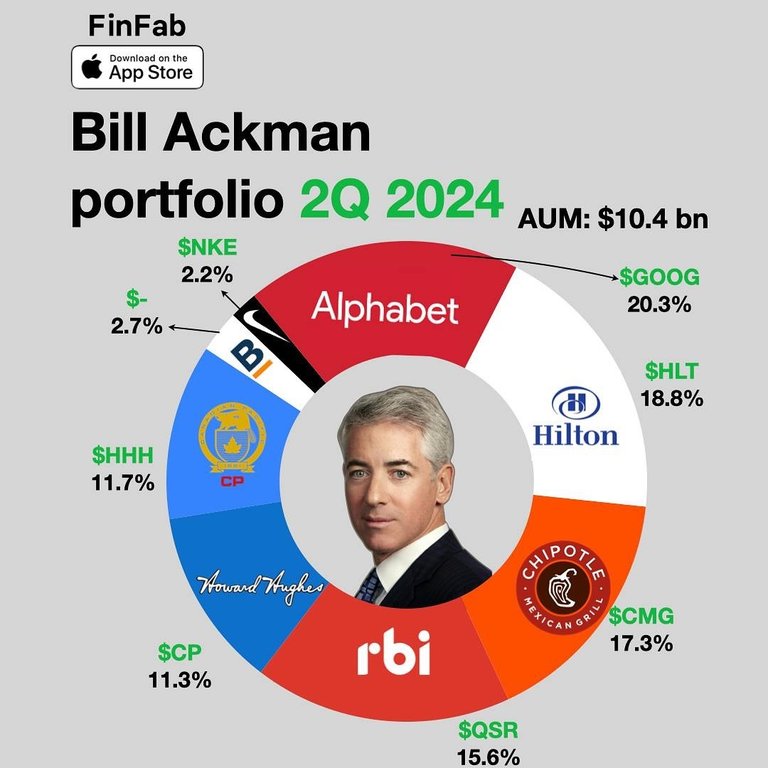

Bill Ackman: Known for his activist investing, Ackman often takes significant stakes in companies and pushes for changes to unlock value.

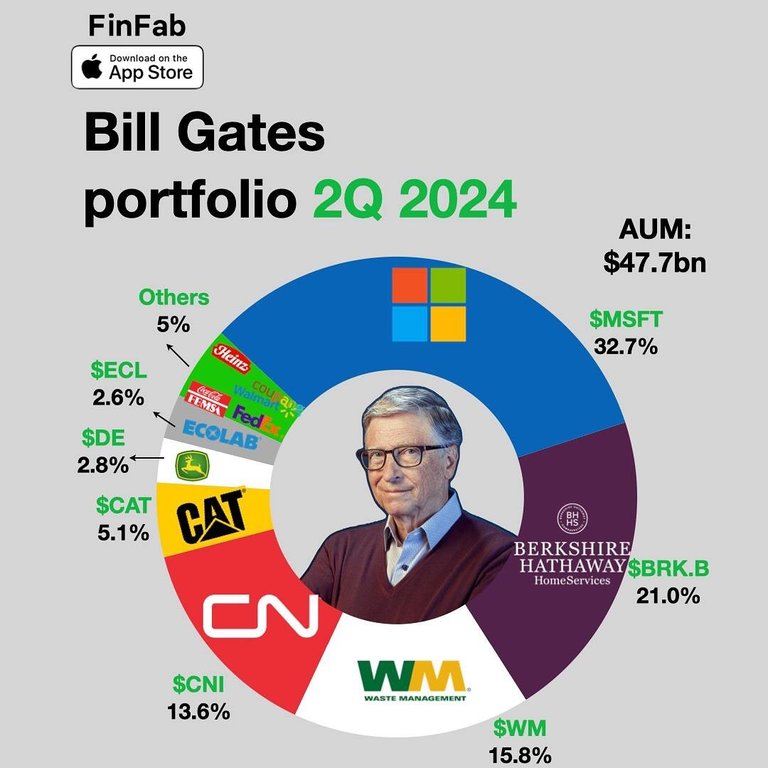

Bill Gates’s Top Holdings

In Bill Gates’s portfolio, as of 30 June 2024, the top 5 holdings reflect his interest in technology, infrastructure, and sustainability:

Microsoft Corp (MSFT) – 32.71%

Gates continues to hold a significant stake in the company he co-founded, signaling his confidence in Microsoft’s future.

Berkshire Hathaway Inc CL-B (BRK.B) – 21.01%

Gates’s long association with Buffett is also reflected in his portfolio, with Berkshire Hathaway being a major holding.

Waste Management Inc (WM) – 15.77%

A clear example of Gates’s focus on sustainability, Waste Management aligns with his broader interest in environmental solutions.

Canadian National Railway Co (CNI) – 13.59%

Gates’s investment in Canadian National Railway highlights his belief in the importance of infrastructure and transportation.

Caterpillar Inc (CAT) – 5.14%

Caterpillar fits Gates's portfolio with its focus on heavy equipment and infrastructure, playing a vital role in construction and industrial sectors.

"Thank you for taking the time to read this article; your support helps me grow here on the HIVE platform!"

Posted Using InLeo Alpha

Congratulations @genuinetraderr! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 50 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts: