(日本語は後半にあります)

【English】

The Best Time to Save Money

I believe that this year and next year will be the best time for our family to save money.

From April, my elder son will start junior high school, and my second son will start elementary school. Since both are public schools, there should be minimal school-related expenses. Over the past two years, especially due to my elder son’s preparation for junior high school entrance exams, the cost of his cram school fees has been considerable. In addition to regular classes, we enrolled him in spring, summer, and winter courses, mock exams, and even special courses hosted by another cram school. The total annual cost was quite significant... I dare not calculate it😅

Generated by Leonardo.ai

Starting in April, our elder son will continue attending the same cram school at his own request. However, since the entrance exam is over and the number of classes will decrease, our financial burden will be a bit lighter. As for our second son, we’re not sure yet if he will take the junior high school entrance exam, but even if he does, the significant costs wouldn’t start for another 3 to 4 years.

Additionally, our elder son’s high school entrance exam is coming up in three years. If cram school fees become a burden again, it will probably start about two years from now. In any case, it seems safe to say that this year and next year will be a good time for us to save money.

The Payment Period for Our Life Insurance Will End

Additionally, the payment period for our two life insurance policies will end this year. These are savings-type variable insurance policies that we signed up for when our elder son was still in daycare. We initially contacted the insurance company to discuss an educational insurance plan, but ended up being persuaded by the sales representative who visited us.

Generated by Leonardo.ai

In recent years, it's become well-known that savings-type insurance is inefficient and not very beneficial. However, at the time we signed the contract, I had almost no financial literacy, so I signed up without much thought, simply following the sales representative’s recommendation. Both are whole life variable insurance policies with a 10-year payment period, after which no further payments are required.

These are insurance policies that invest in stocks and bonds, with the surrender value and insurance payout amount fluctuating based on investment performance. Fortunately, due to the recent growth in the stock market and the depreciation of the yen, the surrender value is expected to soon exceed the total amount we’ve paid. Although such policies are generally considered “not good,” for us, they seem to have turned out well.

Originally, we started these policies as an alternative to educational insurance, but if we can continue to hold them without cashing out for educational expenses, they could serve as a supplement to our retirement funds. Ideally, we would like to keep them without surrendering and continue to invest for the long term.

We primarily used our child allowance to pay the premiums for these insurance policies. Once the payment period ends this year, from next year onward, we’ll be able to save or invest the full amount of our child allowance. For these reasons, the next two years indeed seem to be a good time for us to save money.

Considering SCHD (Rakuten SCHD) 🤑

How to grow my money during this period...

I feel like going all-in on Bitcoin and HIVE, but looking at recent movements in Japan, I'm still scared of having too much of my assets in cryptocurrencies.

Recently, apps from overseas exchanges were removed from the Apple App Store and Google Play Store in Japan. It seems that it's only that new downloads are no longer possible, but considering the purpose behind it, I feel a bit uneasy. Also, the tax system for cryptocurrencies is uncertain for the future (it might not change at all). For me personally, it's not so much about the tax rate, but rather the complexity of calculating gains and losses that bothers me. It takes too much effort, so I don't want to increase my transactions as much as possible.

So, I'm forced to invest in things other than cryptocurrencies and am considering utilizing the NISA account, which involves less hassle.

Recently, I’ve been researching and have become interested in Rakuten SCHD.

Rakuten SCHD is an investment trust that invests in SCHD (Schwab U.S. Dividend Equity ETF), a high-dividend ETF in the U.S., and it can be purchased through Rakuten Securities in Japan. It mainly diversifies investments in U.S. blue-chip companies that pay stable dividends, aiming to secure dividend income while targeting medium- to long-term capital gains.

Source:楽天証券

The reason I thought this fund might be a good option is because it allows me to receive dividends while building up the principal. The thing is, while I can make the decision to "buy," I find it difficult to decide to "sell" 😅. I’ve been investing in a global stock index fund through iDeCo, but I have no idea how I’ll be able to withdraw from it smoothly in the future... It’s the same with HIVE POWER.

So, a product that allows me to receive usable money without touching the principal seemed like a good fit for me. Even though the growth of assets might be a little slower compared to reinvestment-type products.

Although I plan to buy Bitcoin little by little on exchanges, I’m thinking that SCHD will be my main investment moving forward. I'd love to hear about your savings and investment plans as well!

LEO POWER UP DAY🦁

Lastly, about LEO POWER UP DAY.

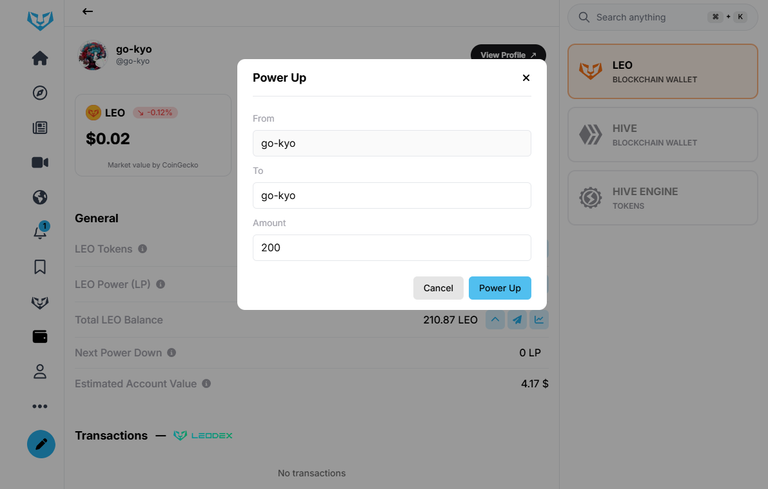

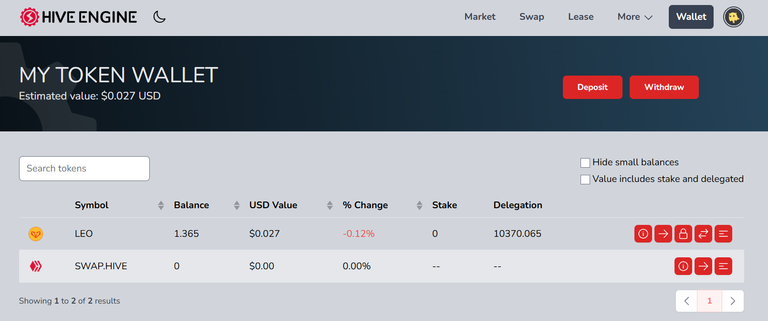

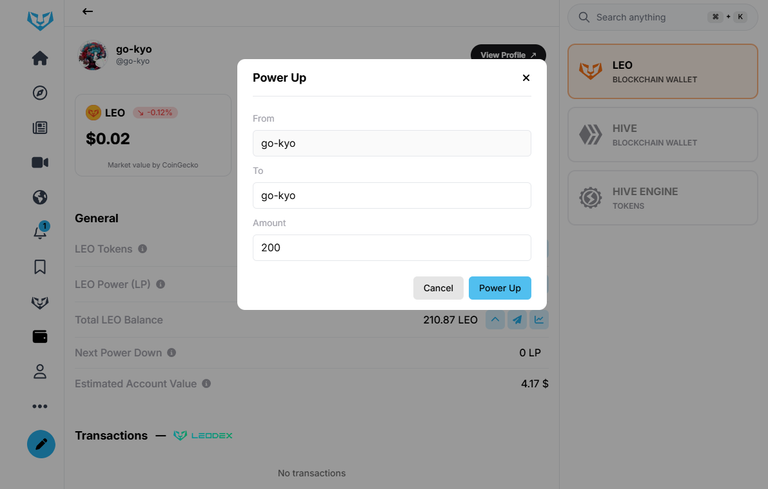

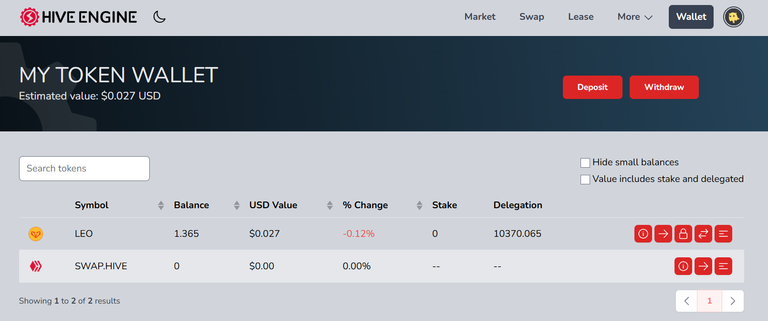

This month, I powered up 200 LEO. Although it's just a small amount, I plan to continue increasing my LEO POWER going forward.

※I have delegated my entire LEO POWER to @go-kyo.leo and use @go-kyo.leo to upvote.

:----------------------

【Japanese】

お金の「貯め時」

今年から来年は、我が家にとってお金の「貯め時」になると思います。

4月から長男は中学校、次男は小学校に進学します。共に公立なので、学校関連の費用はほとんどかからないと考えてよいはず。ここ2年ほどは特に、中学受験のため長男の塾代が嵩みました。通常授業に加えて春季、夏季、冬季講習、模試、さらに別の塾が主催する特別講習にも参加させたので、年間にするとかなりの費用になりました・・・敢えて計算はしません😅

Leonardo.aiで生成しました

長男の希望で4月からも同じ塾で継続予定ですが、受験が終わって講座数が減るため、金銭的には少し楽になります。次男が中学受験をするかどうかは分かりませんが、もしするとしても、本格的にお金がかかり始めるのは3~4年後からになると思います。

また長男の高校受験の方が先に控えており、3年後に迎えることになります。再び塾代が嵩むとしたら、2年後くらいからになるのかな。いずれにしても、今年から来年はお金をためやすい時期だと考えてよさそうです。

生命保険の払込期間が終わる

さらに、今年で生命保険2本の払い込み期間が終わります。これらの保険は長男がまだ保育園のころ、学資保険の相談をしようと思って保険会社に相談したところ、やってきた営業マンに勧められて加入した貯蓄型の変額保険です。

Leonardo.aiで生成しました

貯蓄型保険は効率が悪いためあまりよくない!というのは近年では有名な話ですが、契約当時の私はそこらへんのリテラシーがほとんどなかったため、勧められるままに契約してしまいました。共に終身型の変額保険で、10年間の払い込みが完了するとそれ以降の支払い負担がなくなるタイプのものです。

株式や債券に投資するタイプの保険で、運用成績によって解約返戻金や保険金額が変動します。幸いなことに、近年の株式市場の成長や円安の影響もあってか、支払額に対して、そろそろ解約返戻金がプラスになる見込み。一般的には「良くない」と言われるものの、私たちにとっては良い保険だったといえそうです。

当初は学資保険代わりに始めた保険でしたが、学費のために崩さずにそのまま持ち続けることができれば、老後資金の足しにできます。できれば解約せず、長く運用を続けられれば・・・と思っています。

これらの保険の保険料には、主に児童手当を充てていました。今年で保険料の払込期間が終われば、来年からは児童手当をまるまる貯金するか、投資に回せるようになります。ということで、今後の2年はやはり「貯め時」だと思われます。

SCHD(楽天SCHD)を検討中🤑

この期間にどうやってお金を増やしていくか・・・

気分的にはビットコインとHIVEに全ツッパしたいくらいなのですが、ここ最近の日本の動きを見ていると、暗号資産の割合が大きくなりすぎるのはやはり怖いです。

最近、海外取引所のアプリがアップルのAppストア、GoogleのPlayStoreから相次いで削除されました。単にアプリの新規ダウンロードができなくなっただけ、ということのようですが・・・とはいえ、その目的を考えると少し不安です。また暗号資産の税制も、今後どうなるか分かりません(どうにもならないかもしれない)。私自身は税率がどうこうというより、損益計算が煩雑過ぎることの方がイヤで、あまりに手間がかかりすぎるためできるだけ取引を増やしたくないなあと思ってしまっています。

というわけで暗号資産以外のものにも投資せざるを得ず、手間の少ないNISA口座の活用を検討しています。

最近調べていて、気になっているのは楽天SCHDです。

楽天SCHDは、米国の高配当ETFであるSCHD(Schwab U.S. Dividend Equity ETF)に投資する投資信託で、楽天証券で買えます。主に安定した配当を支払う米国の優良企業に分散投資していて、配当収益を確保しつつ中長期的な値上がり益を狙う商品です。

画像出典:楽天証券

私がこのファンド良いかも・・・と思ったのは、元本を積み上げながら、分配金を受け取れるからです。というのも、私は「買う」決断はできても「売る」決断がなかなかできないんですよね😅iDeCoでは全世界株式インデックスファンドを積み立てていますが、将来これを上手に取り崩せる気が全くしない… HIVE POWERなんかもまさにそうです。

だから、元本を取り崩さなくても手元に使えるお金を受け取れる商品というのは、かなり私向きなんじゃないかと思ったのでした。再投資型の商品と比べて、資産の成長スピードが多少遅くなるとしても。

ビットコインも取引所で少しずつ買う予定ではあるものの、メインの投資先はSCHDで行こうかなと考えている今日この頃です。皆さんの貯蓄・投資計画もぜひ教えてください!

LEO POWER UP DAY

最後に、LEO POWER UP DAYについて。

今月も200LEOをパワーアップしました。少しずつではありますが、今後もLEO POWERを増やしていきたいと思います。

※私のLEO POWERは全額@go-kyo.leoにデリゲーションし、@go-kyo.leoを使ってUpvoteをしています。

Posted Using INLEO

wow 10000 leo!

yes, i have😉

o.o i want it

Congratulations @go-kyo! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 16000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts: