A little touch of halving excitement entered the market. The coming weeks will indeed be telling in setting the tone for the rest of the year. Nonetheless, up, down, or sideways - zooming out and gazing upon a financial system in chaos would seem to bode well for Bitcoin and crypto in general.

Picks of the Week

This examination of dollar strength despite record printing and this discussion of BTC’s coming moment. Also this thoughtful appeal to those still sitting out Bitcoin. Another highlight - this straightforward examination of the role of debt in an economy.

A succinct take on BTC:

https://twitter.com/pierre_rochard/status/1254205732934877186

A BTC in context thread (highly recommended):

https://twitter.com/ChrisEspley1/status/1252330764605296640

On hodling BTC (recommended):

https://twitter.com/MiguelCuneta/status/1255073231431557123

Has BTC really performed poorly in this market? (recommended):

https://twitter.com/AlexSaundersAU/status/1255285965922480128

A thread on the second iteration of the famed S2F model (recommended):

https://twitter.com/dilutionproof/status/1255041851863810053

Protecting ETH’S value proposition:

https://twitter.com/zackvoell/status/1254120535237197832

Twitters’ two data point bias:

https://twitter.com/QWQiao/status/1254469559261814786

Articles

An appeal to those still sitting out Bitcoin (highly recommended):

https://medium.com/@dergigi/dear-family-dear-friends-6ef7ee7a1a2b

The world is already moving away from cash. Is Bitcoin and cryptocurrency the logical next step?:

https://cryptobriefing.com/cashless-futures-foreshadows-cryptocurrency-mass-adoption/

Revising the S2F model (recommended):

https://medium.com/@100trillionUSD/bitcoin-stock-to-flow-cross-asset-model-50d260feed12

Market ‘fear’ doesn’t seem to be putting off new buyers for BTC:

https://www.coindesk.com/first-mover-bitcoin-attracting-more-buyers-even-with-market-stuck-in-extreme-fear

Schnorr Signatures explained:

https://medium.com/@rajarshi149/what-the-heck-is-schnorr-52ef5dba289f

On (crypto) startups and capital efficiency (recommended):

https://medium.com/craft-ventures/the-burn-multiple-51a7e43cb200

What lies ahead for Argentina:

https://medium.com/dlabvc/will-argentina-be-the-next-venezuela-45617728d4c7

Podcasts

A multi-layered examination of dollar strength despite unprecedented levels of printing:

Explaining BTC to non-crypto investors (recommended):

Surveillance and its expansion explored (recommended):

https://open.spotify.com/episode/7HuhbXIsgqM0UHhRygBmOj

YouTube

Legacy finance is beginning to unravel - what this may mean for Bitcoin (highly recommended):

Andreas Antonopoulos on Lightning, the looming halving, privacy and the dollar (highly recommended):

A brief overview of DeFi warts and all:

Colin outlines his continued bullish stance on crypto:

Debt explored (highly recommended):

Does China stand to benefit from the current broad economic chaos?:

Infographics

Um…bullish?:

https://twitter.com/TheCryptoDog/status/1251225175141437440/photo/1

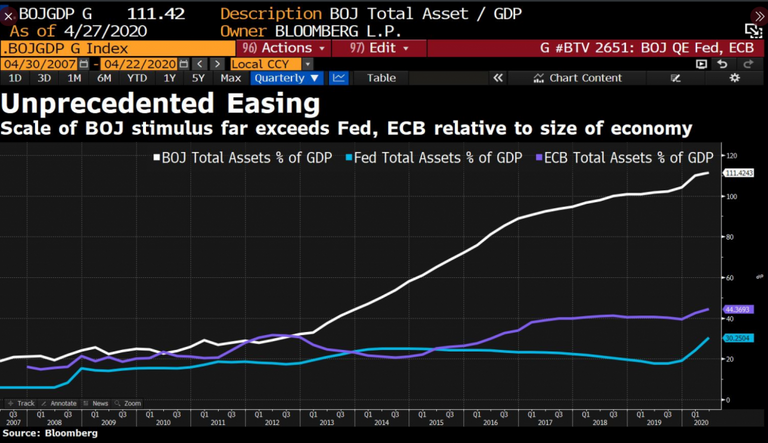

Just in case you thought central bank policies were sustainable:

https://twitter.com/DavidInglesTV/status/1254621374720565248/photo/1

Website / Utility

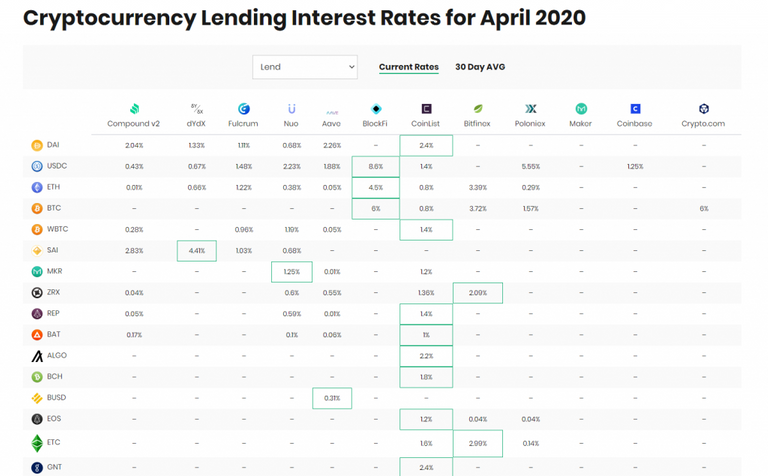

A useful tool for tracking rates across a range of Defi platforms:

https://defirate.com/lend/

Lots to learn and of course never quite enough time in which to learn it! As always, looking forward to your comments and suggestions.

Note on Sources:

Twitter & Reddit (cryptos current meta-brains) / Medium / Trybe / Hackernoon / Whaleshares / TIMM and so on/ YouTube / various podcasts and whatever else I stumble upon. The aim is a useful weekly aggregator of ideas rather than news. Though I try to keep the sources current – I’ll reference these articles and podcasts etc. as I encounter them – they may have been published just a couple of days ago or in some cases quite a bit earlier.