Here’s to the crazy ones. The misfits. The rebels. The troublemakers. The round pegs in the square holes. The ones who see things differently. They’re not fond of rules. And they have no respect for the status quo. You can quote them, disagree with them, glorify or vilify them. About the only thing you can’t do is ignore them. Because they change things. They push the human race forward. And while some may see them as the crazy ones, we see genius. Because the people who are crazy enough to think they can change the world, are the ones who do.

Rob Siltanen (John Chapman - a dash of Apple advertising)

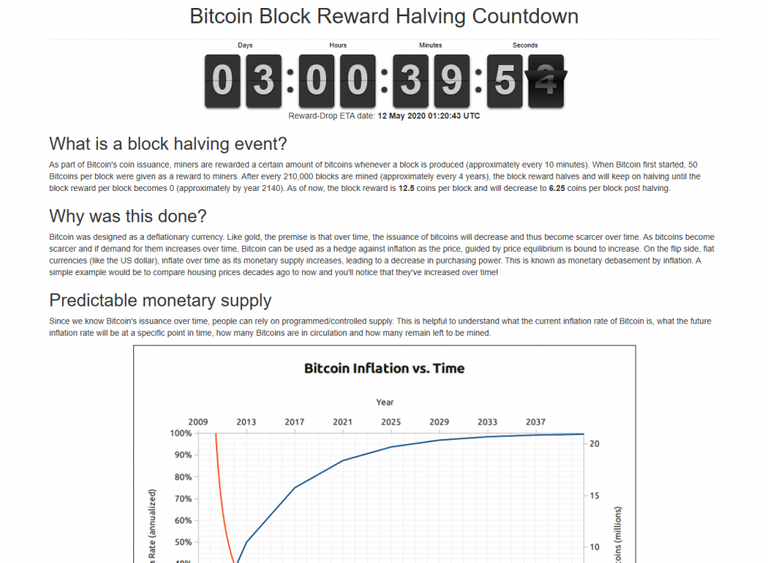

Nothing going on in crypto. Aside from this little known event ‘the Bitcoin halving’. In all honesty, outside the crypto bubble - it’s still not a widespread topic of discussion. Odds are - that this is the very last halving to escape broad public notice - 2024 I going to be wild. As to short-term price action - who knows? The last two halvings would indicate a pullback followed by a long and ultimately impressive bullrun but time will tell.

Bitcoin was built during a crisis, for a crisis, and here’s a crisis.

This week you’ll notice a preponderance of material focused on monetary policy, inflation, and debt - enjoy!

Picks of the Week

This epic thread on the two-way relationship between Bitcoin and those who hold it. Also well worth the investment of your time - this discussion of fiat inflation/deflation and BTC. While you’re at it - you might as well delve into the ever-inflationary relationship of fiat and central banks. Finally, this insightful analysis of the ever so close BTC halving.

BTC (for most) is not just an investment - a thread (highly recommended):

https://twitter.com/johnkvallis/status/1258578344834207745

A visual cue on BTC supply:

https://twitter.com/hodlonaut/status/1257353372493058049

On hodling:

https://twitter.com/bezantdenier/status/1258368095661568000

BTC macro drivers:

https://twitter.com/krugermacro/status/1258154710181253120

Why Bitcoin?

https://twitter.com/GordonBuckley3/status/1258922767983902720

On gold:

https://twitter.com/johnkvallis/status/1256779254584442882

XRP continues to underwhelm:

https://twitter.com/lawmaster/status/1256123668213698561

A thread on Ray Dalio’s ‘new world order’ and BTC’s place in it (recommended):

https://twitter.com/Breedlove22/status/1256721182495174656

The FED is boxed in - expect much lower negative) rates going forward:

https://twitter.com/AlexSaundersAU/status/1258553344362070016

Articles

BTC as common sense (recommended):

https://unchained-capital.com/blog/bitcoin-is-common-sense/

An illuminating examination of the lack of pension fund investment in crypto to date (highly recommended):

https://medium.com/@nickvprince12/where-are-the-institutional-investors-in-crypto-demystifying-the-ever-elusive-wall-of-capital-9ab8fc54b0c0

Bitcoiners are here to stay (recommended):

https://medium.com/in-bitcoin-we-trust/bitcoin-hodler-one-day-bitcoin-hodler-forever-7cdb2477214d

Insightful market analysis pre-halving and what may follow (recommended):

https://blocktower.substack.com/p/towerwatch-13-the-halving-approaches

A lesson in crypto loss (highly recommended if you day trade):

https://medium.com/@katmai_9201/how-i-lost-30-000-in-the-march-2020-bitcoin-crash-9b435a3d2a45

BTC hit 10k - a trader’s perspective:

https://mentormarket.io/cryptocurrencies/bit-brain/bitcoin-update-reaching-10k-again/

Highlighting the benefits of utilizing blockchain to timestamp your work:

https://sebastiaans.blog/why-timestamp-content-blockchain/#whytimestamp10

Binance has become a behemoth:

https://cointelegraph.com/news/is-binance-getting-too-big-cz-responds

MakerDAO continues to struggle after the recent market crash (recommended):

https://www.longhash.com/en/news/3339?f=r

An insightful examination of human behavior - non-crypto specific but entirely relevant in any case (highly recommended):

https://www.epsilontheory.com/sheep-logic/

Podcasts

A wonderfully illuminating discussion of inflation/elation, debt and Bitcoin (highly recommended):

Tweaking the S2F model - with an upwards revision in projected BTC valuation (recommended)

https://www.whatbitcoindid.com/podcast/could-bitcoin-really-be-heading-to-288k-with-plan#description

A brief examination of the inflationary relationship of fiat and central banks (recommended):

https://anchor.fm/the-two-minute-crypto-podcast/episodes/Two-Minute-Crypto--Key-Concepts-15---Explaining-the-Relationship-between-Fiat-Paper-Money-and-Central-Banks-edd39t/a-a1pvsb

YouTube

Pull up a seat and learn about BTC from some of its most informed adherents (highly recommended):

Data Dash outlines his bullish thesis for BTC:

Bitcoin mining outlook and a discussion of what may be gleaned from the halvings of BCash and BSV:

Perhaps check your enthusiasm (recommended):

Quality overview of Chainlink:

Rough and ready but nonetheless intro to crypto ledgers, transactions and DeFi (recommended):

Infographics

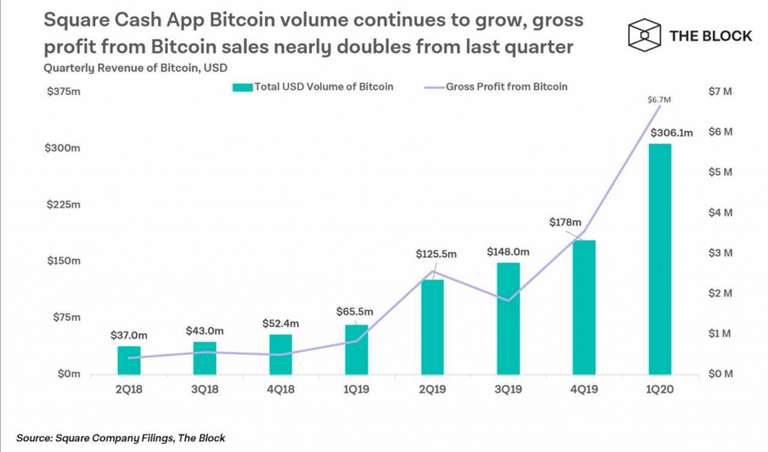

BTC seems to be creating meaningful revenue streams:

https://twitter.com/MartyBent/status/1258159516060958720/photo/1

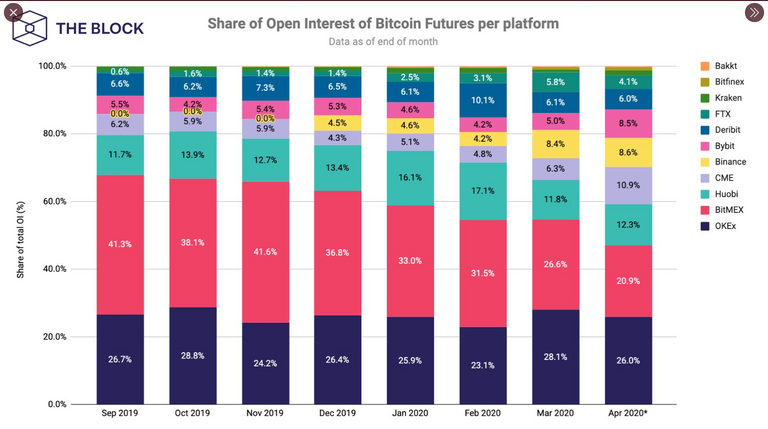

BitMex is bleeding market share:

https://twitter.com/lawmaster/status/1255736961303797761/photo/1

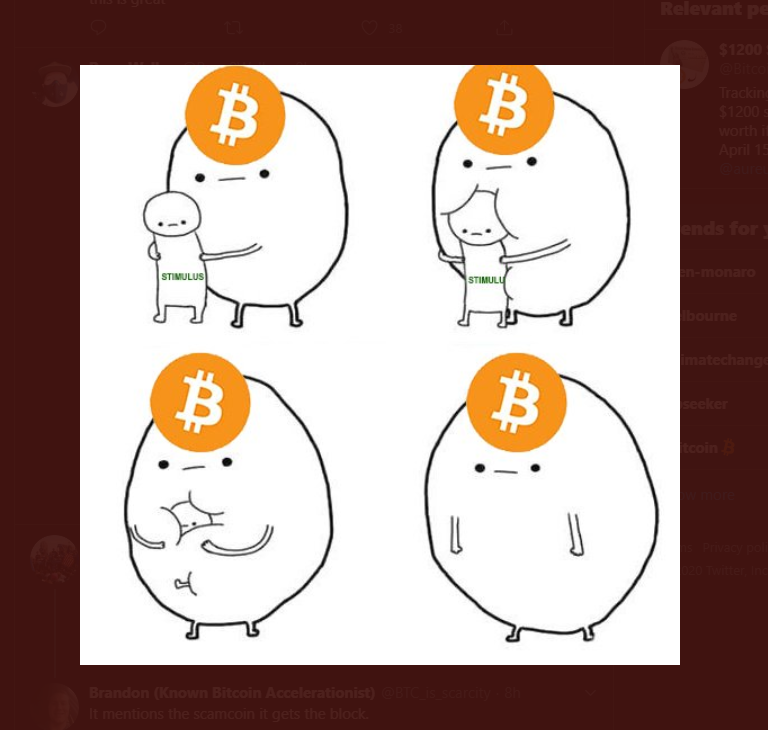

Unintended consequence?:

https://twitter.com/Ryan0Walker/status/1255586773763325952/photo/1

Website / Utility

This timer is about to reset and the next 4 years may be epoch defining:

https://www.bitcoinblockhalf.com/

Enjoy the eventful week ahead but expect extreme volatility and a lot of hot air in the coming months. As always, the more you know, the better placed you will be to benefit from crypto over the long-haul.

Note on Sources:

Twitter & Reddit (cryptos current meta-brains) / Medium / Trybe / Hackernoon / Whaleshares / TIMM and so on/ YouTube / various podcasts and whatever else I stumble upon. The aim is a useful weekly aggregator of ideas rather than news. Though I try to keep the sources current – I’ll reference these articles and podcasts etc. as I encounter them – they may have been published just a couple of days ago or in some cases quite a bit earlier.

Really awesome content as usual.

Posted Using LeoFinance