The halving has finally occurred - interestingly neither hashrate nor price has taken a hit. The fundamentals, of course, have never been better. The long view is bright but whether the current bullish price trend continues is anyone’s guess.

As per usual, crypto remains fast-paced and fascinatingly rich in terms of competing narratives - BTC vs gold, Eth v BTC, and stablecoins vs fiat etc.

Picks of the Week

Hard to look past ‘The Breakdown’ which for months now has been producing on-point content focused on the crypto world and beyond. Two recent highlights are this discussion of the co-option of the FED and an in-depth explanation of Paul Tudor Jone’s qualified endorsement of BTC. Continuing the podcast theme, this one hour BTC explainer is an excellent evangelical resource.

BTC fundamentals look positive - a thread:

https://twitter.com/n3ocortex/status/1259584098932318208

BTC charts support a bullish outlook:

https://twitter.com/RaoulGMI/status/1258567633168932874

Highlighting the differences between BTC and ‘digital currency’:

https://twitter.com/AlexSaundersAU/status/1259806334658023430

So what’s that $1200 stimulus check worth now?:

https://twitter.com/BitcoinStimulus

Exploring the commonalities of early iterations of Visa and BTC:

https://twitter.com/litocoen/status/1259644683610804224

Retail FOMO? - not yet:

https://twitter.com/lawmaster/status/1258715293708419072

Brendan Blumer on EOS and BlockOne:

https://twitter.com/BrendanBlumer/status/1259287214128640000

Oracles a slide presentation (recommended):

https://twitter.com/SergeyNazarov/status/1258905882538110976

A thread on markets:

https://twitter.com/SahilBloom/status/1259141067938557952

Why China matters - a thread (recommended):

https://twitter.com/mattysino/status/1260019705206599680

So, US debt just crossed $25T:

https://twitter.com/ssaurel/status/1260617561667973122

Articles

BTC as peaceful protest (recommended):

https://medium.com/in-bitcoin-we-trust/bitcoin-as-protest-866a368f55b9

An argument for embracing BTC:

https://medium.com/in-bitcoin-we-trust/bitcoin-is-your-red-pill-and-u-s-dollar-your-blue-pill-e66842980ca3

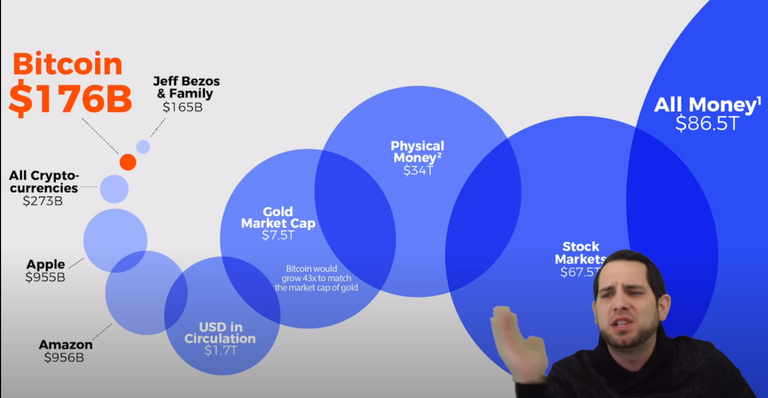

Is BTC undervalued relative to gold?:

https://bitnewsbot.com/bloomberg-bitcoin-is-undervalued-in-relation-to-gold/

Learn from Chad’s BTC missteps:

https://chadsbitcoin.com/mistakes-ive-made-with-bitcoin/#

https://medium.com/in-bitcoin-we-trust/bitcoin-is-the-fastest-horse-in-the-profits-race-e66a7aa180ff

Crypto lending a disaster in the making?:

https://medium.com/swlh/the-crypto-lending-industry-a-ticking-time-bomb-rather-than-a-shortcut-to-mainstream-adoption-ec1fafec525a

Mining pools explained:

https://www.binance.vision/blockchain/mining-pools-explained

FED is expected to go negative and soon:

https://www.zerohedge.com/markets/it-begins-first-time-ever-market-prices-negative-rates-starting-january-2021

Podcasts

From comprised to complicit - the co-opting of the FED (highly recommended):

Looking beyond the Paul Tudor headline (highly recommended):

An excellent 1hr intro to Bitcoin (highly recommended for those new to crypto):

Discussing current broad market conditions:

YouTube

Notable investors continue to move into BTC:

Is that a large futures gap I see before me? (Yes, it is.):

Swap lines, commodities and more(recommended):

Stimulus packages a brief overview (highly recommended):

Infographics

Are we there yet?

https://youtu.be/AT6yzNQlCaQ?t=639

If only there was a discernable trend:

https://twitter.com/danheld/status/1260555555195817986/photo/1

Website / Utility

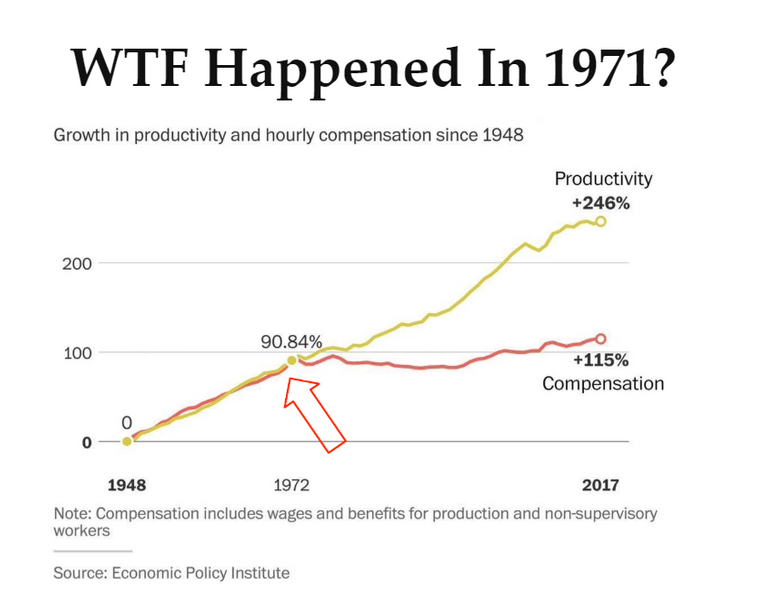

1971 changed a lot of things -checkout this website to see how (highly recommended):

As we can clearly see, crypto hasn’t lost its mojo - exciting times ahead. As always, looking forward to your comments and suggestions.

Note on Sources:

Twitter & Reddit (cryptos current meta-brains) / Medium / Trybe / Hackernoon / Whaleshares / TIMM and so on/ YouTube / various podcasts and whatever else I stumble upon. The aim is a useful weekly aggregator of ideas rather than news. Though I try to keep the sources current – I’ll reference these articles and podcasts etc. as I encounter them – they may have been published just a couple of days ago or in some cases quite a bit earlier.