One could easily argue that bitcoin has had more important news affecting it in the past month than it has in the past year.

It's recent 160% price rally has accompanied a great deal of content highlighting the contrast of bitcoin's halving to fiat's explosive increase in supply, suggesting that this is some of the most bullish news there could be for bitcoin. Except, is it?

There is one major macro-economic concern which could give bitcoin a ride for it's money. Approaching 30 years of existence, the EU now faces a serious threat of failure for which Brexit may just have been the trigger.

According to a forceful Twitter thread by Tuomas Malinen, CEO and Chief Economist of GnS Economics,

"The breakup of the Eurozone is a near certainty."

While popular tweets ought to be taken with a grain of salt, due to their nature of often being exaggerrated for effect, Malinen raises important concerns which cannot be swept under the crypto bull rug.

The long and short of the tweet can be summed up as follows:

- Germany's Constitutional Court made a staunch ruling regarding the ECB, suggesting it is entertaining thoughts of withdrawing from the EU.

- The bailouts being proposed to counter the COVID-19 outbreak may cause citizens of creditor countries to object to their taxes being used to bail out banks of other financially distressed countries, thus eroding the cohesiveness of the union.

- The "unlimited QE" that the EU is currently implementing will serve to further distend the already high sovereign debt burdens of key European countries.

According to Travis Kling - founder of Crypto Asset Management firm Ikigai and former manager of a $200m Equity Portfolio - this is an important macro-economic factor to consider for bitcoin's price. He explains in a tweet that this would lead to investors wanting to take risk off the table, thus leading to a crash in bitcoin's price.

Interestingly, he notes that this could subsequently be a principal cause of "hyperbitcoinization", a state where Bitcoin becomes the world's dominant form of money.

Despite bitcoin's delirious price rally, it was only last month that the king of cryptocurrencies endured a devastating 45% crash on Black Thursday.

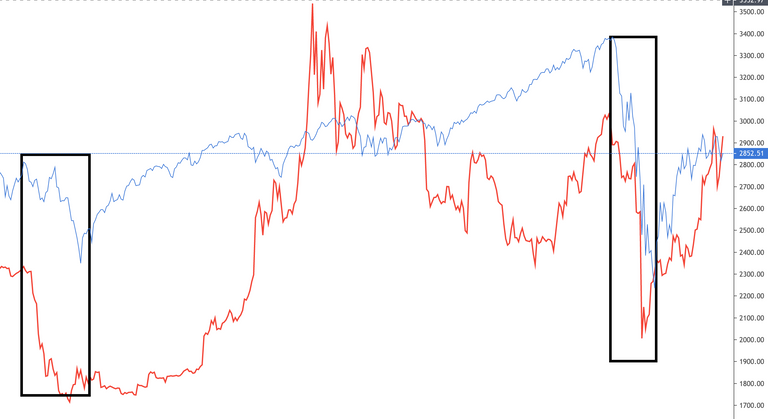

Bitcoin has had a strong correlation with the largest retracements of the S&P 500, in spite of the effort of a myopic retweet by bitcoin's largest (unofficial) Twitter account to suggest otherwise, as can be seen below.

In conclusion, the very factors which present excellent arguments for buying and using bitcoin over fiat - a crumbling of existing financial institutions - are the very factors which will likely lead to large interim crashes in bitcoin's price.

Want to connect and see more of my content? Follow me here at @hooked2thechain, follow me on Twitter, subscribe to my YouTube channel or follow me on Publish0x.

Note that this article contains a referral link and I may earn a small commission for my effort in spreading the word about crypto if you click on it.

Image Source [1]

good stuff

Thanks!

Congratulations @hooked2thechain! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board and compare to others on the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @hivebuzz:

Support the HiveBuzz project. Vote for our proposal!

Thanks for sharing. Malinen's Twitter thread is an interesting read for something like me who thinks the Eurozone has grown way beyond what is good for the people within it.

This sort of made me laugh because people in the smaller countries who stand to lose the most for the good of the union, didn't give a fuck when Greece was getting bent over, did they?

As for linking the EU crumbling, directly to the price of Bitcoin crumbling, I think that might be a bit of a stretch.

If the EU did crumble in spectacular fashion, it would have an effect on everything, not just Bitcoin.

Not to mention we still don't know what Bitcoin actually is...

Everyone talks about it being a store of value like Gold, but it certainly doesn't act like a risk-off asset when shit starts to hit the economic fan.

In my opinion, I think once the market matures a little bit more, that it will be the store of value every Bitcoiner wants it to be.

But we're not quite there yet and like you've charted, will continue to follow risk assets like stock market indices up and down for now.

Posted Using LeoFinance