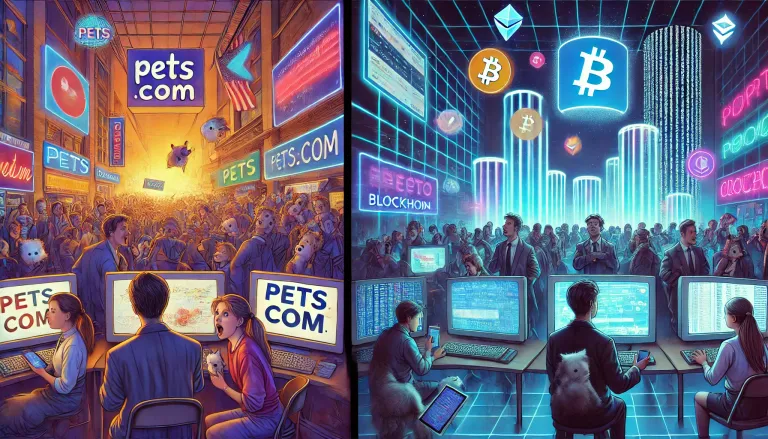

Are We in the Early Dot-Com Bubble of Blockchain?

Recently, I’ve had many discussions about the current state of the blockchain market. I honestly believe we’re still in the equivalent of the early Dot-Com Bubble. In this article, I’ll explore some of the similarities and differences between the two eras and explain how my investment strategy is affected by this perspective.

How the Dot-Com Bubble Formed

The early internet, during the Dot-Com Bubble, was clunky and far more complicated to use compared to the seamless experiences we’re accustomed to today. At the time, the only adopters were tech-savvy individuals—“nerds” who had embraced early computers. The majority of people didn’t even own personal computers yet.

This didn’t stop marketers from proclaiming that computers were going to change the world—which they eventually did—but the timeline was far longer than most were willing to admit. This narrative led to a wave of investors eager to capitalize on the new technology. Unfortunately, speculation vastly outpaced actual adoption. Rising stock prices only attracted more speculators, creating a feedback loop.

To cash in on the hype, many companies announced plans to launch websites, even if their business models weren’t sustainable. A famous example is Pets.com, which planned to sell pet supplies online. However, they hadn’t figured out how to profitably sell products, let alone address challenges like selling puppies online. During the bubble’s build-up, many investors bought Pets.com stock based solely on price action, mistaking it for a sign of success. This illusion unraveled when the Dot-Com Bubble burst, as unprofitable companies collapsed.

Meanwhile...

Amid the chaos, a small business figured out how to sell books online and, more importantly, how to ship them profitably. This company was Amazon, founded by Jeff Bezos in 1995 with five employees in a garage. Amazon’s success came from understanding both the internet’s current capabilities and its future potential.

Comparing Then and Now

Using blockchain today feels similar to using the early internet: clunky and complicated. As a result, blockchain adoption is mostly limited to crypto enthusiasts. Even within that group, speculation often outweighs actual usage of blockchain products. There’s also a striking similarity between the rampant speculation on companies like Pets.com and the rise of meme coins in crypto.

While the blockchain industry has evolved since I got involved in 2017, we’re still waiting for a transformative moment—our “Windows 95 start button” event. Personally, I see Hive as the closest thing to this experience in crypto. Hive’s lack of gas fees, social-media-like usability, and increasing adoption set it apart, though its biggest hurdle remains the sign-up process. (I haven’t tested the new Leo sign-up process yet, so maybe that’s no longer an issue.)

History Repeats, or Echoes?

I love the phrase, “History doesn’t repeat, but it sure does echo.” While we can’t expect the current market to mirror the Dot-Com Bubble exactly, the parallels are undeniable. One significant similarity is the ratio of speculation to actual adoption of new technologies.

I believe we’re in a speculative bubble that’s due for a major correction. This would wash out projects with inadequate use cases and redundant chains that don’t stand up to competition. During the Dot-Com Bubble, for instance, Pets.com failed while Amazon survived, even though Amazon’s stock price dropped by 97%. Critics dismissed the internet as a fad, but Amazon endured due to its sustainable business model and forward-looking vision.

However, there are factors that could alter the trajectory of today’s market. For example, Trump’s proposal for a Strategic Bitcoin Reserve and Russia’s adoption of Bitcoin for international trade might prevent a full crash by increasing institutional adoption. On the other hand, these developments could inflate the bubble further if junk projects aren’t cleared out.

How Does This Affect My Strategy?

I don’t anticipate a crash as severe as the Dot-Com Bubble burst, thanks to the higher level of blockchain adoption. Instead, I foresee smaller, frequent crashes that will gradually eliminate junk projects and redundancies.

Even if I think I’ve found the next “Amazon of crypto,” I plan to take profits during market peaks and reinvest in projects that demonstrate resilience. After all, even Amazon’s stock fell 97% during the Dot-Com crash, primarily due to market sentiment and the exit of speculative money.

For now, anything with hype can still pump and make money—just as Pets.com could have, if you sold before the bubble burst. Alternatively, if you’re confident you’ve found the Amazon of crypto, you may need to stomach significant dips and hold until blockchain adoption reaches levels comparable to today’s internet.

Posted Using INLEO

I'm all in on pets.com new crypto project lol.

Personally I think 2016-2018 was our dot com moment. With the icos, nfts, and the rest of the worthless garbage. As the debt spirals and the new issuance of fiat rapidly expands the value prop of Bitcoin is becoming clear.

Good to see you back Forrest! Kept thinking I needed reach out and maybe try to help get you going better. Mostly I think you just didn’t post into a community, with not the best tags, which gets seen by no one when you have no follower’s yet. I’d say you’re content was actually amazing, so I’m a bit surprised no one found it, and tried to help it get seen, but that’s one of the drawbacks to manual curation.

That said, thanks for the reply! Yeah I think it’s a mix of adoption happening, yet still a ton of speculation, and people acting differently because they are more aware of the history.

Plus if it is digital gold now, then buying and holding is the use case, and then technically the adoption ratio swings towards the adoption side.