Today we are focusing on Venus, the coin and the platform, its features, what it's trying to solve and how to make it work for us.

I'll try to give explanations in a very simple fashion (as much as I can) and will share my very recent experience with it.

Note this is a 2-way learning process, I'm not expert at all, just trying to learn everyday about this crypto world.

I believe sharing my progress and my mistakes can help people (including myself !).

That's why I encourage you to ask questions in comments and point out things I should have done or not.

First part is more about theory but the second part is hands-on with all my transactions on Venus platform.

In a nutshell

Venus protocol is a new algorithmic money market system bringing Decentralised Finance (DeFi) onto Binance Smart Chain.

It's very similar to what Compound and MarkerDao are doing with lending and borrowing capabilities but it's faster and cheaper thanks to the use of BSC insteand of ETH chain.

Lenders provide liquidity to earn a compounded interest rate and borrowers access those assets by providing collaterals (stable coins or cryptos) and pay interests on the assets borrowed.

These interest rates are set by the protocol in a curve yield, where the rates are automated based on the demand of the specific market

Another key difference is the ability to use the collateral supplied to the market not only to borrow other assets but also to mint synthetic stablecoins with over-collateralized positions that protect the protocol.

Finally, users who want to mint stablecoins do not have to remove their assets from the money market protocol and lock it up in a smart contract with no benefit of the underlying asset as collateral.

The token: XVS

XVS is the native governance token of the Venus protocol. It's not based on Ehtereum token standard ERC-20 but on Binance Smart Chain token standard (BEP-20).

The first thing you might think about (as I did) is :"finally a coin I can use with DeFi protocols and without getting murdered by ETH gas fees".

And that's true that fees are very low, we will go through some examples later.

XVS tokens are minted when people use the Venus protocol and are distributed to the lenders (35%), the borrowers (35%) and the stablecoin minters (30%).

XVS tokens will be used for proposing and voting on governance issues on the Venus protocol.

At the moment Swipe Token (SXP) is used as the governance token but XVS will be used when 10M XVS tokens are minted.

The Venus protocol

Lending Assets

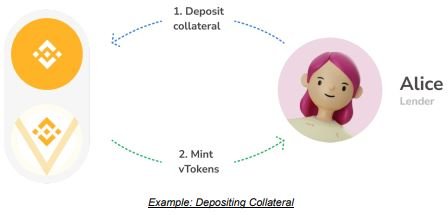

Venus Protocol users will be able to deposit their idle assets into liquidity pools and earn interest on it.

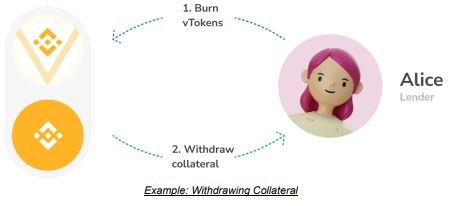

A vToken will be issued and distributed to lenders which can be redeemed later to withdraw their assets from the pool in addition of the accrued interests.

For example I provided some FIL coins, so I received some vFIL tokens in exchange.

Borrowing Assets

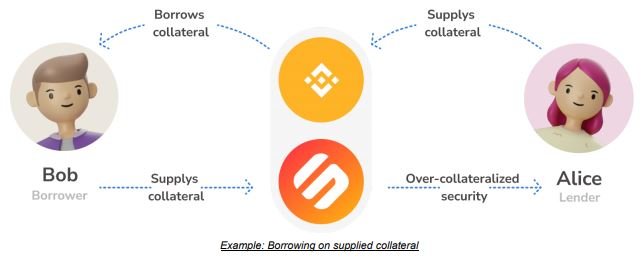

Venus Protocol users will be able to borrow any of the supported crypto or stablecoin by providing and locking collaterals in the protocol.

Indeed there is a need for over collateralisation and between 40% and 75% of the collateral can be borrowed.

These collateral ratios are determined by the protocol and are controlled through the Governance process

Users can redeem their loan anytime by returning the value of their borrowed assets plus interest.

Venus Synthetic Stablecoins: VAI

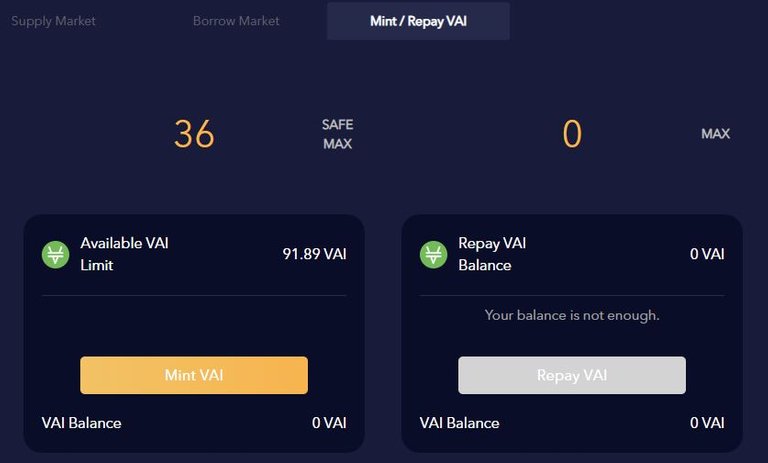

Venus protocol users have the ability to mint VAI by using the vTokens retrieved from a previous supply of assets.

They can actually borrow up to 50% of the remaining collateral value they have on the protocol from their vTokens to mint VAI.

VAI is backed by the underlying collaterals in the Venus protocol to be of a value of 1 USD per VAI token.

The main advantage of such fully backed synthetic stablecoins is that users can generate more value from their staked assets, by staking VAI directly or by swapping VAI for another coin.

Algorithmic-Based Risk Management

The Venus protocol is set to be a decentralized lending and borrowing protocol managed by pre-set algorithms for each money market.

Interest rates are calculated after each transaction, taking into account the supply and demand of each asset.

For example, if an asset is low in supply, the interest rate for this asset will be adjusted higher to incentivize deposits from lenders.

Automatic liquidation protocols are also in place to restore the value of each money market when the collateralized asset value falls below the borrowed value.

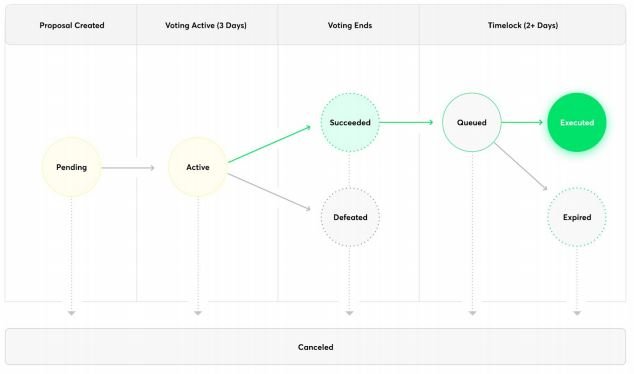

Governance

Venus protocol is designed to be a fully decentralized money market protocol.

There are no pre-mined tokens for the team, founders and developers, this means the protocol is controlled by the users mining Venus Tokens.

Governance features include:

● Adding new cryptocurrencies or stablecoins to the protocol

● Adjusting variable interest rates for all markets

● Setting fixed interest rates for synthetic stablecoins

● Voting on protocol improvements/proposals

● Delegate protocol reserve distribution schedules

Hands-on ! Experience sharing

The main page of https://app.venus.io/dashboard is the dashboard, that's where you can find how much unstaked XVS and VAI you have, your supply and borrow balances, and the available assets on the market.

The main page of https://app.venus.io/dashboard is the dashboard, that's where you can find how much unstaked XVS and VAI you have, your supply and borrow balances, and the available assets on the market.

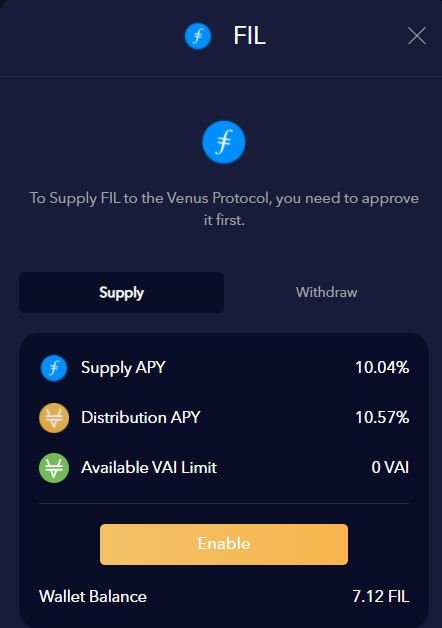

I had some FIL and XVS in my Metamask wallet so first thing I've done was to supply those 2 coins in Venus liquidity pools.

Following the same principles as DeFi on ETH chain, you have to enable the coin first to be then able to add liquidity.

That's actually 2 transactions per coin and you know how much that could cost with DeFi based on Ethereum.

With BSC it's incredibly cheap AND fast, finally we poor people can play with DeFi ;)

So now I have vFIL and it's time to double the fun.

On Venus you can mint the stablecoin VAI up to 50% of you vTokens.

What for ? you can swap in on a DEX for another crypto for example.

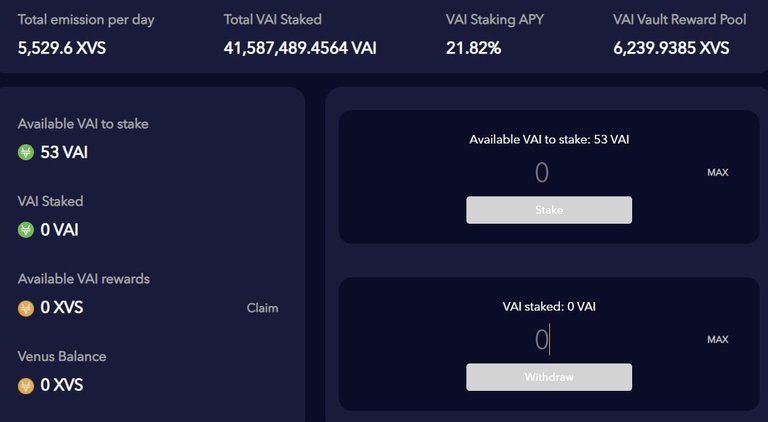

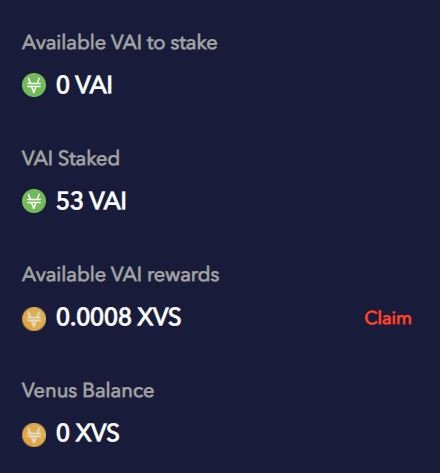

Or just like me you can stake it on Venus and get some nice interests from it.

Let me repeat this another time:

1- you provide liquidity to earn interests

2- you mint a stablecoin from your collaterals

3- you stake this new minted coin to earn more interests

The VAI staked in the "Vault" tab will pay interests in XVS and can be claimed there.

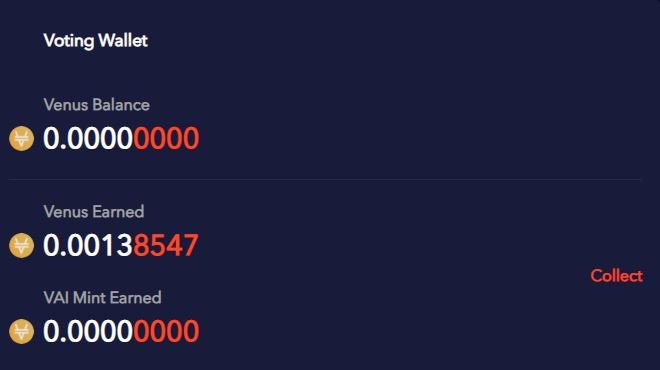

And the XVS earned from your collaterals will be collected in the "Vote" tab.

What about the fees ?

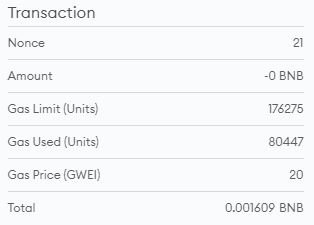

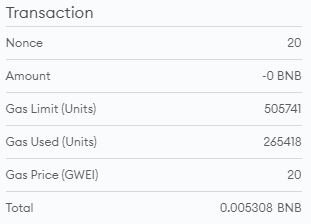

Let's start with the total number of transactions: 7

- 4 to unlock and stake XVS and FIL

- 3 to mint, unlock and stake VAI

Keep in mind that the unlock transaction won't be needed fro mnow on.

Following screenshots picked randomly to show you how low are the fees.

Total damages for 7 transactions: 0.018454 BNB, around 0.7 USD !

I can't tell you how good I feel compared to my S&M sessions on 1INCH pools and farms.

Posted Using LeoFinance Beta

Very nice explanation of this protocol.

You mention it’s Binance Smart Chain based, can I deposit Bitcoin or Ethereum here? Do they get wrapped first, then deposit BNC-BTC?

Do they require KYC?

Thanks

Posted Using LeoFinance Beta

You’re right I forgot to mention that I used MetaMask wallet to do all this.

It means no KYC.

You can’t send ERC20 token directly to BSC so yes there is a wrapping done. In my case it was easy as the coins where on binance and I sent them from there to my wallet. Binance takes care of the chain change but bridges services exist.

But yes you can use BTC and ETH on Venus.

Posted Using LeoFinance Beta