When I first stumbled across Bitcoin in 2011, it was priced at less than a cup of coffee. At the time, I had no idea I was looking at the foundation of a financial revolution—I thought it was just some niche internet experiment that nerds were excited about. Fast forward to today, and I can confidently say I’ve laughed, cried, and learned a lot on this wild crypto ride.

This post is a reflection on my journey through the crypto space—complete with mistakes, lessons, and the occasional cringe-worthy anecdote. Whether you’re a crypto OG or just starting your journey, I hope this gives you a mix of laughs, insights, and maybe even a little inspiration.

2011: The Year of Bitcoin and Missed Opportunities

Let’s set the stage: It’s 2011, and Bitcoin is trading for less than $1. I read about it in an obscure tech forum where someone confidently declared, “Bitcoin is the future of money!” At the time, I thought, “That’s cool, but how do I buy it, and why would I even want to?”

Here’s why I didn’t invest back then:

- I Was Broke: Like, ramen-for-dinner-every-night broke.

- It Was Confusing: Wallets, mining, private keys—it felt like a digital labyrinth.

- It Sounded Too Good to Be True: Decentralized money? No banks? It sounded like the plot of a sci-fi movie.

Looking back, I realize how revolutionary Bitcoin was even then, but hindsight is 20/20. Let me just say this: If I could time travel, I’d give 2011 me a stern lecture and a few hundred bucks.

What Bitcoin Taught Me About Money

Before Bitcoin, I thought money was just paper and numbers on a bank statement. Bitcoin flipped that notion upside down. It made me question everything I thought I knew about how money works, who controls it, and how it’s created.

Here are three things Bitcoin taught me:

- Inflation is a Sneaky Thief: Fiat currencies lose value over time. Bitcoin’s capped supply made me realize the value of scarcity.

- Ownership Matters: “Not your keys, not your coins” became my mantra after learning how centralized systems can lock you out of your own assets.

- Decentralization is Freedom: Bitcoin’s peer-to-peer nature empowers individuals to take control of their finances without intermediaries.

2013: The Bitcoin Boom and My First Mistakes

By 2013, Bitcoin had skyrocketed to over $1,000. Suddenly, everyone was talking about it—well, not everyone, but more than just tech nerds. I was excited, but I also made my fair share of rookie mistakes during this time.

Mistake #1: Chasing Hype

In my eagerness to “make it big,” I threw money at random altcoins I barely understood. Names like “MoonCoin” and “GalaxyChain” come to mind (and no, they didn’t go to the moon).

Mistake #2: Falling for Scams

I got burned by a cloud mining scheme that promised massive returns. Turns out, the only thing they were mining was my wallet.

What I Learned

- DYOR (Do Your Own Research): If you don’t understand it, don’t invest in it.

- Beware of Hype: Just because everyone’s talking about something doesn’t mean it’s legit.

- Patience Pays Off: Crypto is a marathon, not a sprint.

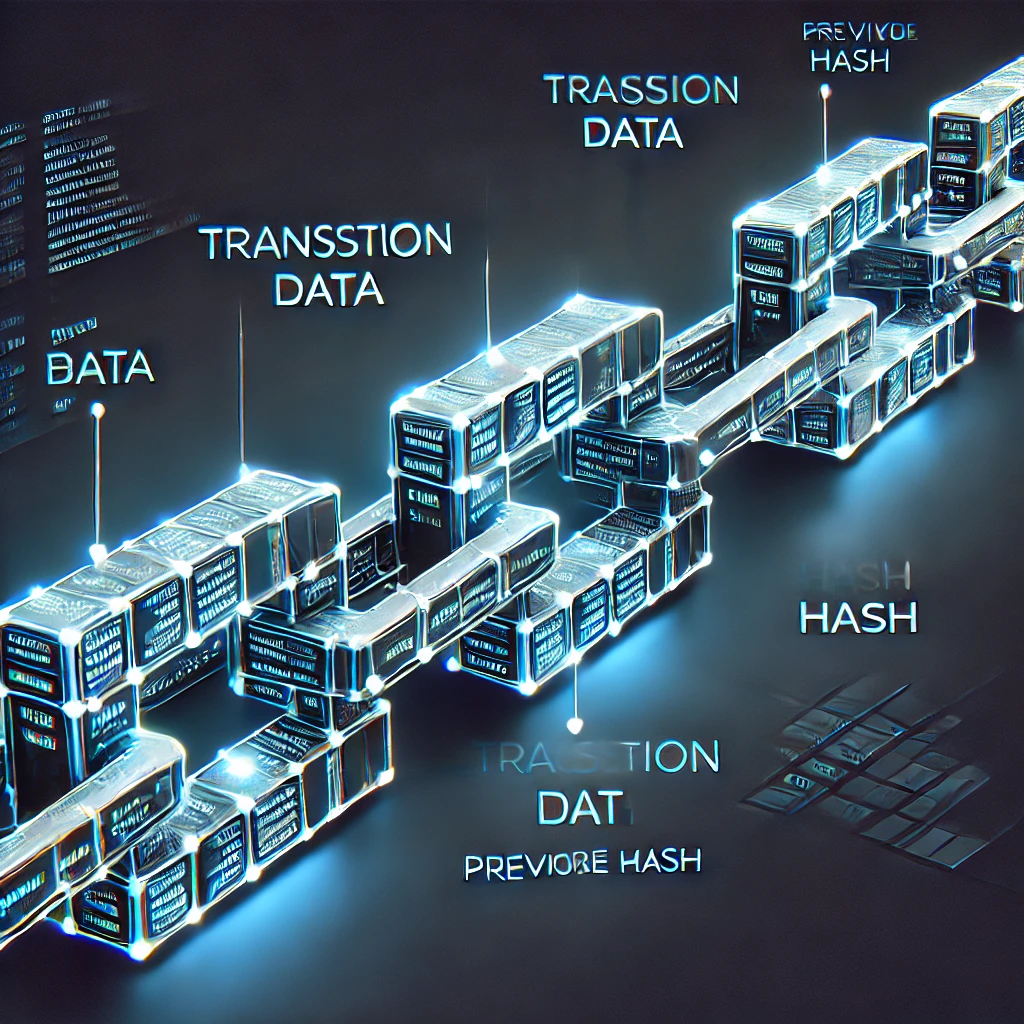

How Blockchain is Changing the World

As I delved deeper into crypto, I realized that Bitcoin was just the beginning. Blockchain technology has applications far beyond digital currency. Here are a few that blew my mind:

- Smart Contracts: Platforms like Ethereum enable self-executing agreements. Imagine never needing a lawyer for basic contracts!

- DeFi (Decentralized Finance): Borrow, lend, and earn interest without a bank.

- NFTs: From digital art to music, blockchain is revolutionizing ownership.

- Hive: A decentralized platform where creators can share content and actually get paid for it.

Tips for Crypto Beginners

If you’re just starting out in crypto, here’s what I wish someone had told me:

- Start Small: Only invest what you can afford to lose.

- Use Reputable Platforms: Stick to trusted wallets and exchanges.

- Secure Your Assets: Hardware wallets are your best friend.

- Learn Constantly: The crypto space evolves quickly, so stay informed.

- Avoid FOMO: If it feels like you’re late to the party, you probably are. Wait for the next opportunity.

Community: The Heart of Crypto

One of the most surprising things about crypto has been the sense of community. Platforms like Hive exemplify this by rewarding creators for their content and fostering genuine connections.

Looking Ahead: What’s Next for Blockchain

The future of blockchain is bright. From Web3 to decentralized social media, the possibilities are endless. As someone who’s seen the space evolve from its humble beginnings, I can’t wait to see where we go next.

What’s Your Crypto Story?

Now that you’ve read mine, I’d love to hear yours:

- When did you first hear about Bitcoin?

- What lessons have you learned in your crypto journey?

- What excites you most about blockchain technology?

Drop a comment below—I’m here to learn from you as much as I hope you’ve learned from me.

Thanks for reading! If this post made you laugh, think, or nod in agreement, feel free to upvote and share your own crypto adventures. Let’s keep building the future together!

Congratulations @hypegawd! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 100 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOP