.jpeg)

since the announcement of cooperation with the popular DeFi project Yearn.finance on January 15, the decentralized stable currency trading platform Curve token CRV has risen by more than 140% in four days, and the price has doubled.

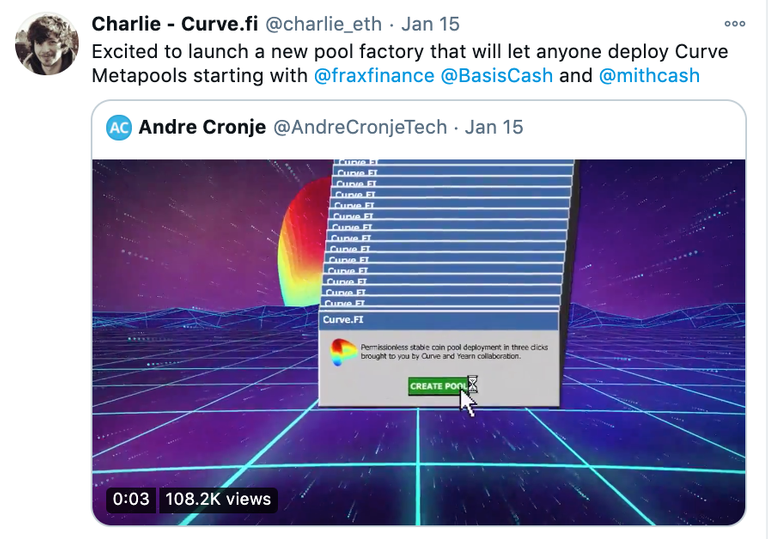

On January 15, Yearn and Curve announced the cooperation to launch 3 stable coin pools, which can be created with 3 keys. In addition, the Curve team member Charlie tweeted that the platform will launch a new asset pool factory, allowing anyone to deploy Curve Metapool, and initially support Frax Finance, Basis Cash and MITH Cash 3 popular algorithmic stablecoins.

Affected by this news, the CRV market performance began to strengthen. The price soared by more than 20% on the 15th, and continued to rise in the following trading days. The price rose from around 0.7 US dollars all the way to above 1.5 US dollars, and the current highest reached 1.79 US dollars. .

The price of CRV soared, partly because of speculation, and partly from Curve's recent performance. As we all know, since November last year, Yearn founder AC has successively announced cooperation with DeFi projects such as DEX platform Sushiswap, lending platform Cream, insurance platform Cover, etc., and the tokens of these cooperative projects have therefore risen strongly.

At its own level, Curve has now developed into one of the most popular decentralized trading platforms. In February last year, Curve was officially launched quietly, and developed rapidly in the DeFi boom from August to September. The lock-up volume soared from the initial 4 million to 1.6 billion US dollars in late September. Although the subsequent fork project Swerve in the market has "robbed" a lot of its liquidity, in the later market competition, Curve has secured its leading position in the stable currency trading platform of the DEX market.

Defipulse data shows that in the ranking of DEX platform lock-up volume, Curve currently ranks second, with an inflow of US$2 billion, second only to Uniswap.

In terms of transaction volume, Curve has a market share of 11.4%, ranking third, below Uniswap and Sushiswap.

In addition to fundamentals, Curve's recent business development direction is worthy of attention. First, the platform plans to launch a new asset pool factory, allowing anyone to deploy algorithmic stablecoins. As we all know, the recent popularity of algorithmic stablecoins has attracted market attention as an emerging stablecoin asset. Many people in the industry have revealed to Mars Finance that algorithmic stablecoins will become a hot track in 2021. Based on this, it is foreseeable that by arranging the algorithmic stablecoin trading window in advance, Curve will use the opportunity to capture more potential users and liquidity.

Second, Curve has launched a cross-asset exchange function, which increases user-friendliness and reduces transaction costs. Today, Curve Finance's official Twitter announced that it has launched the Synthetix cross-asset exchange function. "This function can realize the exchange of ERC20 tokens and ERC20 tokens through the Synthetix platform. For example, the process of exchanging DAI and renBTC: exchange DAI to sUSD, then exchange sUSD to sBTC, and finally exchange sBTC to renBTC."

Source of plagiarism

Direct translation without giving credit to the original author is Plagiarism.

Repeated plagiarism is considered fraud. Fraud is discouraged by the community and may result in the account being Blacklisted.

If you believe this comment is in error, please contact us in #appeals in Discord.

Please note that direct translations including attribution or source with no original content are considered spam.