The global tension is still so high and the fragile nature of markets cannot bear such fearful times. On one side, the risk of more wars in the world has gone up while, on the other side, the upcoming presidential election in the U.S. is seen as a big uncertainty for investors.

The reason why the election matters is that several giant companies revealed their support for one of the nominees of the upcoming election. In the case that the supported one is not chosen, then these companies may undergo some investigations, extra taxes or more risks.

In addition, the attitudes of the nominees regarding the ongoing wars and other global risks differ to great extent. Finally, the future of crypto will be directly impacted (!) according to the common belief in the markets.

When we go over the political sides, it is time to focus on the data coming from the U.S. economy.

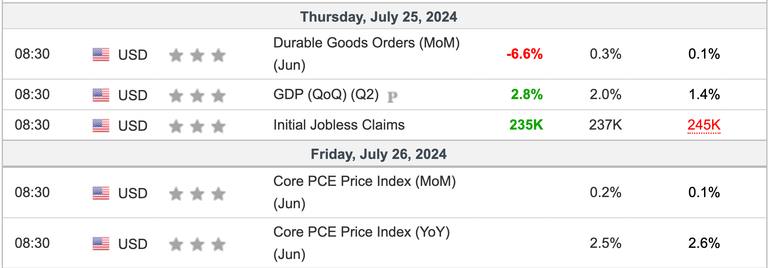

Economic Calendar by Investing

The market awaits the Core PCE Index coming tomorrow.

Before discussing it, we need to mention the new fear unlocked: the risk of recession.

If the data hints that we are slowing down the economy more than necessary, as we saw in today's data with -6.6%, then we are in big trouble. The recession is an utimate killer for the market because it drastically drops the revenue of the companies and forces the businesses to fire thousands of workers due to the imbalance in the spreadsheets!

If it takes place, or the market assumes that we are in a recession, then the stroy fundamentally changes for the markets. Though we were expecting a soft - landing for the U.S. economy, the " black swan " can give birth to up to 30% - 40% corrections in all markets.

Supporting the claims / fear of recession, the price of copper, a.k.a Dr. Copper, has been going down for 9 days in a row! This is one of the indicators that the economies are at risk.

The interest rates have to happen. However, the FED might be already late for that. If so, we need to make our investment decisions according to the change in the paradigm.

What do you think about the hints of recession in the global economy?

Share your thoughts below 👇

Hive On ✌️

Posted Using InLeo Alpha

In this upside-down world the markets rise when economic data is bad, because it means lower interest rates and money printing.

We have to assume those in control of the agencies that produce these numbers (census bureau, bureau of economic analysis, etc.) are finessing the numbers to fit a narrative, because reality on the ground often doesn't line up.

Now, the beauty about economic data on blockchains (tx count, tvl, user accounts, etc) is that it cannot be manipulated!

I believe the election outcome will truly impact the markets. Let's see how companies handle these uncertain times.