All markets have turned red with the reciprocal tariffs announced by the largest economies in the world. The tariffs on goods may directly impact the purchasing power of people and the prices as the cost of an imported product will increase and will give birth to a push for inflation in the economy.

The sellers do not suffer as much as the buyers do when it comes to asset inflation or shrinkflation. Unless the tariff war is concluded, the common people will experience even worse days by affording fewer things with the same amount of money or lower quality products for the same price as before.

The best part of globalization was the abundance and availability of things around the world. However, the shift in the macro trend forced countries to push themselves to be self-efficient by themselves or with some trade partners that are geopolitically close to themselves. The paradigm shift has gotten to show its worst side with the increasing tension and rivalry among the leading economies.

Now the markets will be seeking two types of stories:

1- The declaration of 0% taxes (better if applied reciprocally)

2- Further threats by using taxes and products as a weapon

The tariff wars did not occur out of thin air. Actually, Trump wants to hit one of its strongest rivals while its economy is not going very well.

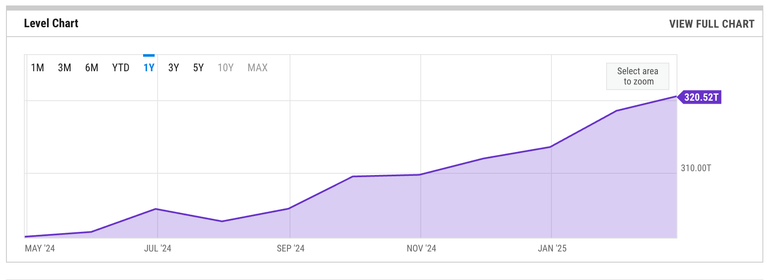

YCharts Chinese CB - M2 Supply

This is a solid 7% increase in M2 money supply by the central bank of China.

As money is printed, the value of the currency goes down. As Yuan gets cheaper, the importers make more money in China thanks to cheap labor and costs in the country.

The tariff war is not a perfect black swan, in fact, it was something expected by many of us. However, we cannot predict the second phase of this dispute which terrifies the markets more. Until one side can no longer resist economically or sociopolitically, we may see the drama keep going for some more time.

I still have high hopes for 2025 and 2026 as an investor. However, I do my best to balance the risk / reward ratio of my whole portfolio with safer investments on the other side.

What do you expect to see on the other levels of the tariff wars?

Share your thoughts below 👇

Hive On ✌️

Posted Using INLEO

tariffs can mess with prices and purchasing power but its also interesting how some countries might start trying to be more self sufficient it makes you wonder if we’re heading towards a less globalized world?? Im not into politics but for sure 2025 its going to be all about tariffs from start to finish, I dont like to take sides on this topics but does make me wonder if not been autosuficent is what makes a country become consumist as some are, it’s also a good point about how the central bank's money supply affects the situation something i had not thought about, I still see 2025 and 2026 as years with investment opportunities, just how cheap ETH and Hive are today ✌️ 🤑

As the interest rates go lower, stagflation threatens the economies and the money in the deposit accounts wait for the turbulence to be over, not investing in crypto might be a big mistake for risk lovers 😉

Thanks for insights ✌️

It's difficult to say what will happen because of the tariff issue. I find it hard to imagine that this will help the USA itself. Especially not in the short/medium term. My opinion is therefore that there will be almost only losers here, i.e. the USA and the other countries. But who knows, maybe I'm wrong.

Congratulations @idiosyncratic1! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 31000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOP