Another day, another Tweet from big investors diving into Balancer. Watching BAL rise on the charts today, thoughts go rolling round in my head. How high will BAL go?

You see, the higher BAL goes, the less BAL I have. Most of my BAL tokens sit in a liquidity pool that consists of 60% BAL / 40% wETH.

With a higher weight in the pool and BAL outperforming wETH (for now), I'm losing BAL! But.....all is not lost. As my BAL in the LP (Liquidity Pool) goes down, my wETH goes up! That relationship between BAL & wETH is almost back to where I started.

What Is Balancer & How Does It Work?

In simple terms, Balancer is a DEX protocol. We hear this descriptive term as well as AMM, or Automated Market Maker. Balancer gives their own description quoted from their Whitepaper below:

A Balancer Pool is an automated market maker with certain key properties that cause it to function as a self-balancing weighted portfolio and price sensor.

Balancer turns the concept of an index fund on its head: instead of paying fees to portfolio managers to rebalance your portfolio, you collect fees from traders, who rebalance your portfolio by following arbitrage opportunities.

What Sets Balancer Apart From Other AMMs?

As soon as I first heard about the Balancer AMM, it drew my attention. What's so different about BAL in comparison to other Automated Market Makers (AMMs)?

Balancer pools can have multiple assets (up to 8) with different weighted values. Most AMMs function with a 50/50 split between two assets in any given liquidity pool.

Liquidity providers may enter any Balancer pool by allocating only one asset. The Balancer Protocol will swap the single asset, divying it up according to the pool assets by weight.

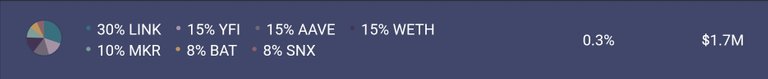

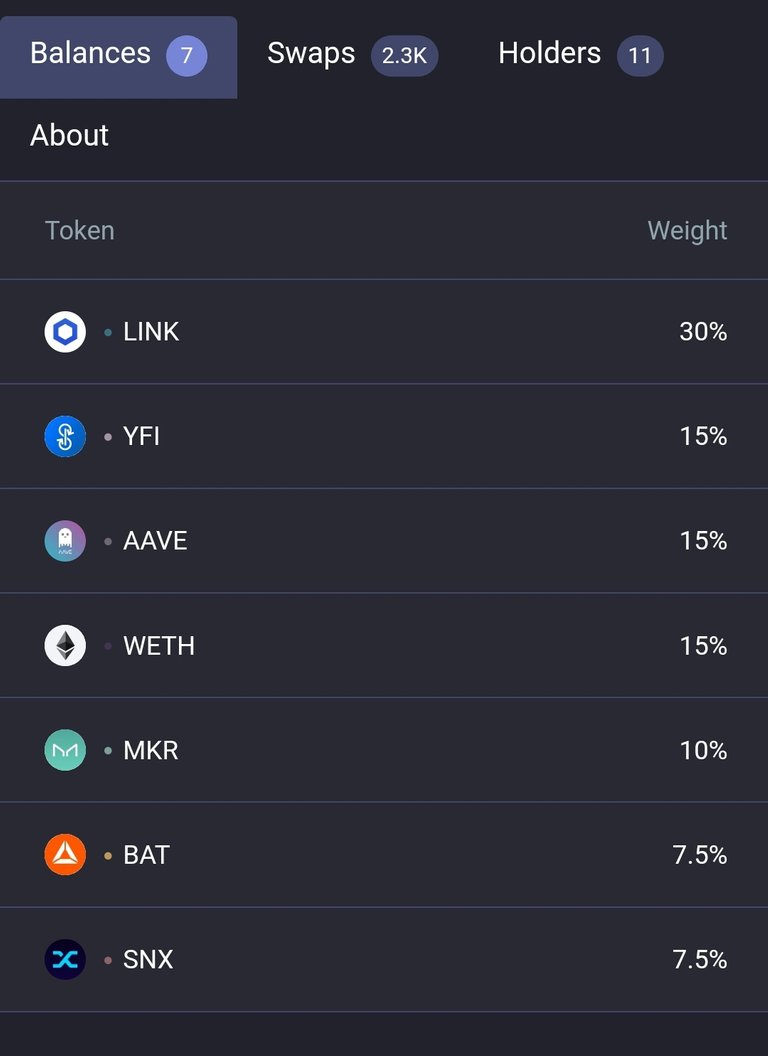

To clarify the first point, take a look at a Balancer pool with seven different weighted assets:

Because this is a public pool that any provider can enter, the weights of each asset are fixed. They will not change per the contract. Other (privately held smart contract) pools can change the weights of their assets.

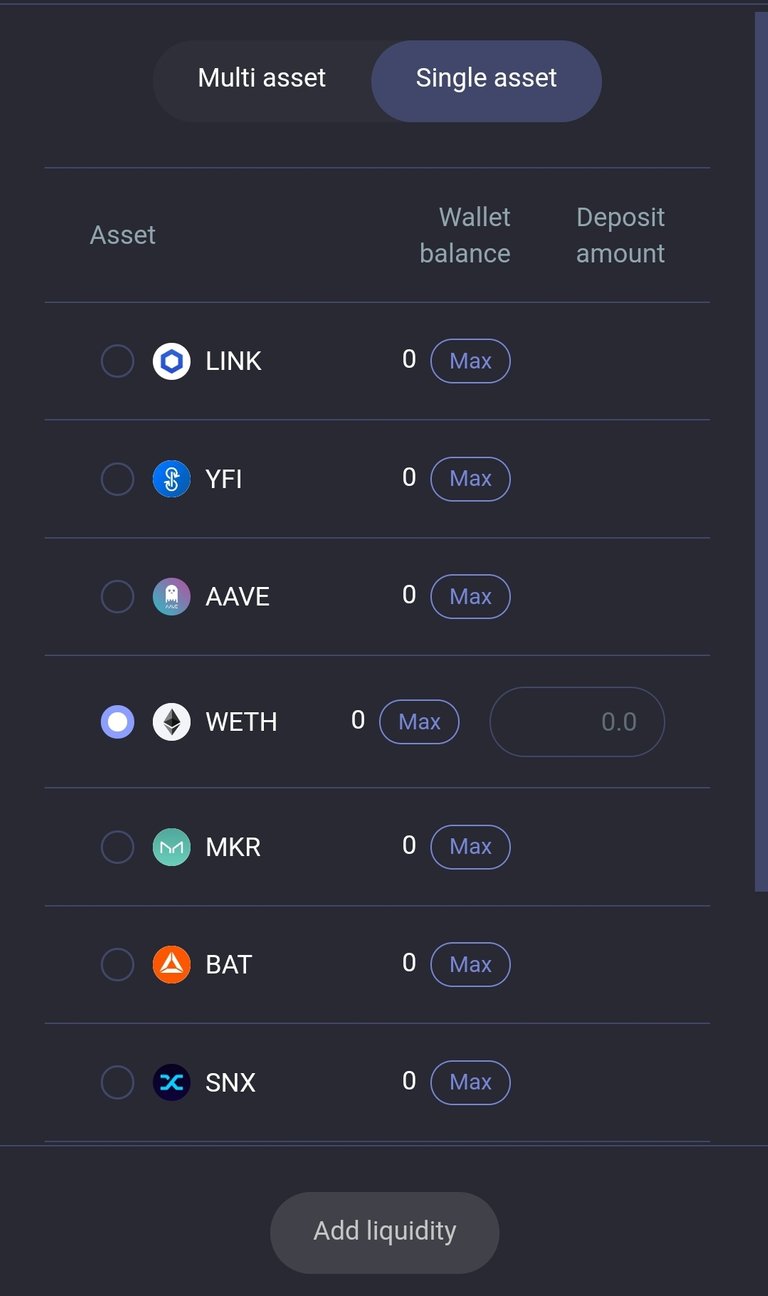

To iterate the second point: say you wanted to provide liquidity to this 7 asset Balancer pool. You have ETH but none of the other assets in the pool. No problem. Simply use the Single Asset option when you go to add liquidity to the pool. See below:

Note: Your single asset does have to be one of the assets in the pool.

What Tools Does A Provider Need To Enter A Balancer Pool?

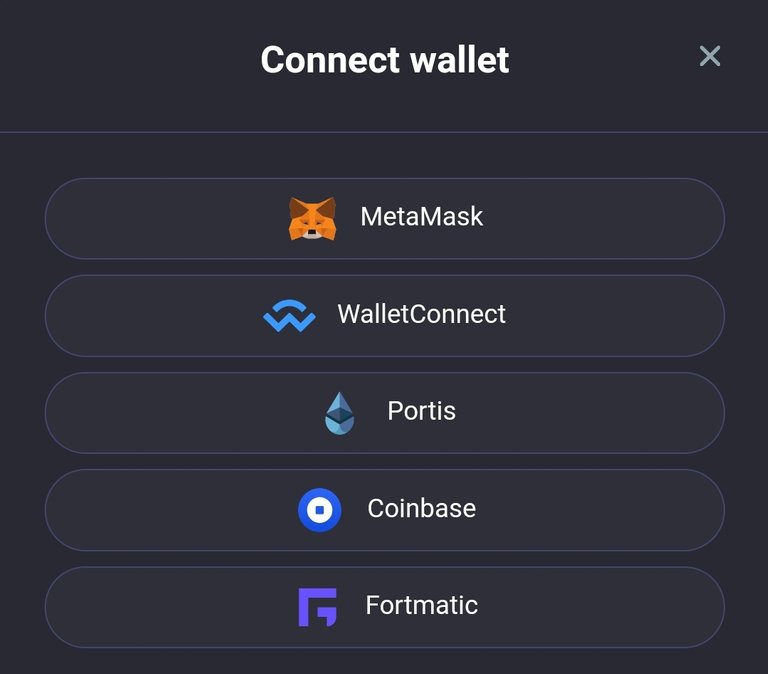

Balancer lives on the Ethereum Mainnet. As such, they support the following services to connect to your wallet. The most secure connection is using a hardwallet in combination with MetaMask. See below:

Providers first access the Balancer Exchange and then connect their wallet with their preferred method. After that, it's a matter of finding the right pool, setting the amounts, and authorizing the transaction.

Note: All transactions come with a variable amount of ETH gas fees.

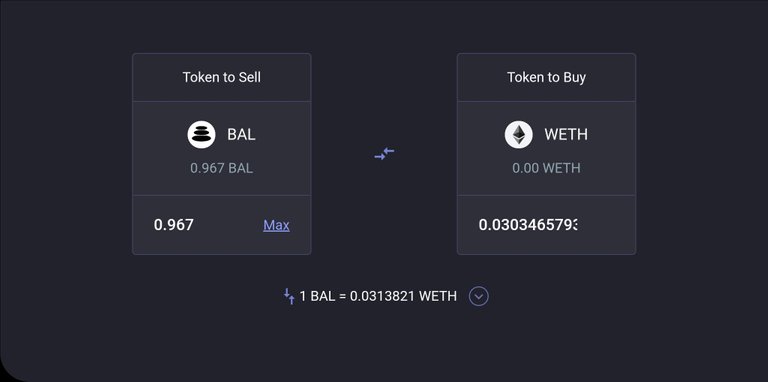

Swap Assets With Balancer

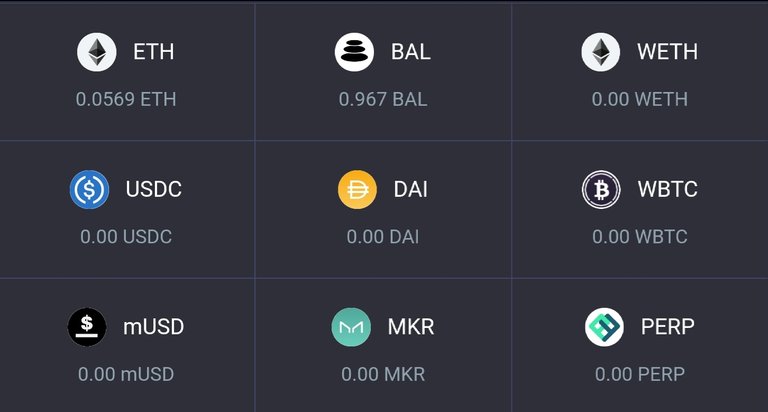

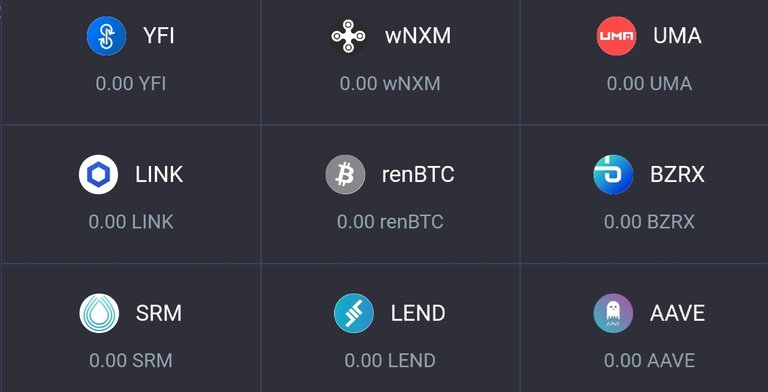

With a wallet connected to the Balancer AMM, you can swap between any token with liquidity on the protocol. The Balancer swap exchange provides an extensive list as well as a search query box.

Here's a small example of a few of the tokens available to swap:

Possible Reasons For The Recent BAL Price Action

As an Ethereum based protocol, the BAL governance token moves alongside ETH. This helps explain the price spike, though perhaps only in part. BAL seems to be outpacing wETH this past week.

That could change quckily in the coming days, weeks, and months. Just recently, BAL is showing the benefit of a couple of major investors. The Medium article below (dated November 9th) shares the news of new investors, Pantera Capitol & Alameda Research.

Yes. BAL Is A Governance Token

Individuals or entities that Hodl BAL have a say in the future of the Balancer Protocol. A quote from the FAQ section on the Getting Started Page best describes the utility of the BAL governance token:

...Balancer Governance Token, BAL, can be used to vote on proposals and steer the direction of the protocol. Every week 145,000 BALs, or approximately 7.5M per year, are distributed to liquidity providers. They are typically distributed directly to liquidity providers on Tuesdays at 2300 UTC.

Balancer goes into some detail about the purpose and vision of the governance token, as well as its distribution.

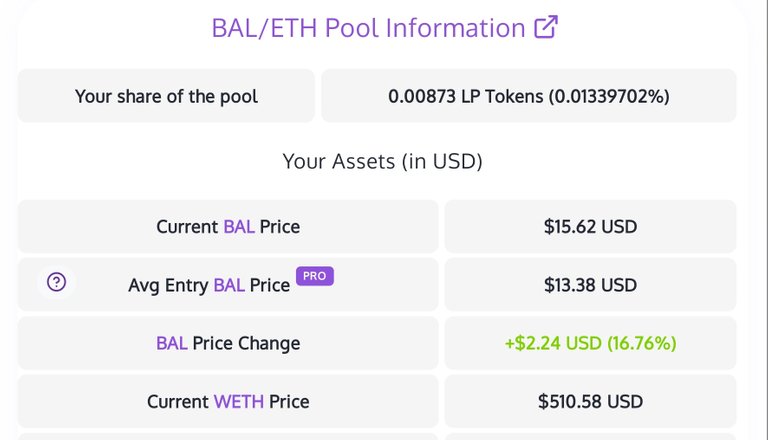

Personal Pool Performance

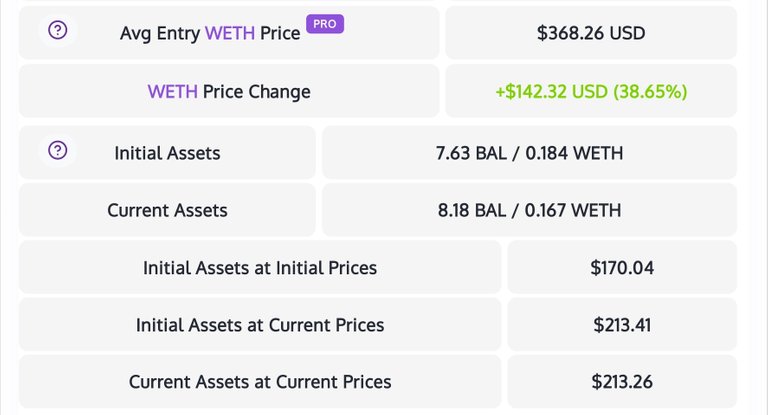

My position in a 60% BAL / 40% wETH pool is outperforming expectations. I started with a small amount of assets, with a combined value of $170.00 at the time of entry. This was about five weeks back.

Using a tool that APY.Vision provides, you can see the progress of my liquidity position below:

In addition, my yield comes to about 1.3 BAL for the past five weeks of providing liquidity.

Learn More About Balancer

Are you aching to learn even more about Balancer Labs, the BAL token, or the AMM in general? There are several more links you can follow to find useful information.

Balancer is even working on creating a Balancer Academy, much like the learning center that Binance offers. Check the links below:

Links to previous LeoFinance articles on Balancer:

https://leofinance.io/hive-167922/@inalittlewhile/balancer-liquidity-pool-update-back-to-even

https://leofinance.io/hive-167922/@inalittlewhile/balancer-lp-update-2-5-weeks-of-liquidity

https://leofinance.io/hive-167922/@jk6276/research-notes-on-setting-up-a-balancer-pool

https://leofinance.io/hive-167922/@jk6276/making-bank-in-a-balancer-pool

Stay tuned for more Balancer updates snd leave a comment or a question. Thanks for reading and as always...

Images Captured As Screenshots

Bottom Image Courtesy Of Hive.io Brand Assets

LeoFinance Illustrations Courtesy Of @mariosfame

Want To Join The HIVE Community? Use My Referral Link To HiveOnboard.com

Posted Using LeoFinance Beta

Love these updates on BAL.

I'm in the BAL poos as well :)

Posted Using LeoFinance Beta

Nice! Thanks Dalz! Balancer was looking a little shaky there for a bit, but I'm glad I stayed in. Hope your BAL pools perform just as well. 👍

Posted Using LeoFinance Beta