Why the U.S. Should Hold Bitcoin in Its Reserves

The world is changing, fast. Money isn’t just paper bills or numbers in a bank account anymore. With the rise of digital currencies, Bitcoin has become a big deal. It’s not just something tech enthusiasts talk about—it’s being taken seriously by countries, businesses, and even some skeptical investors. So, here’s the big question: Should the U.S. start holding Bitcoin as part of its national reserves? Short answer? Yes. Let me explain why.

Bitcoin Isn’t Just “Internet Money”

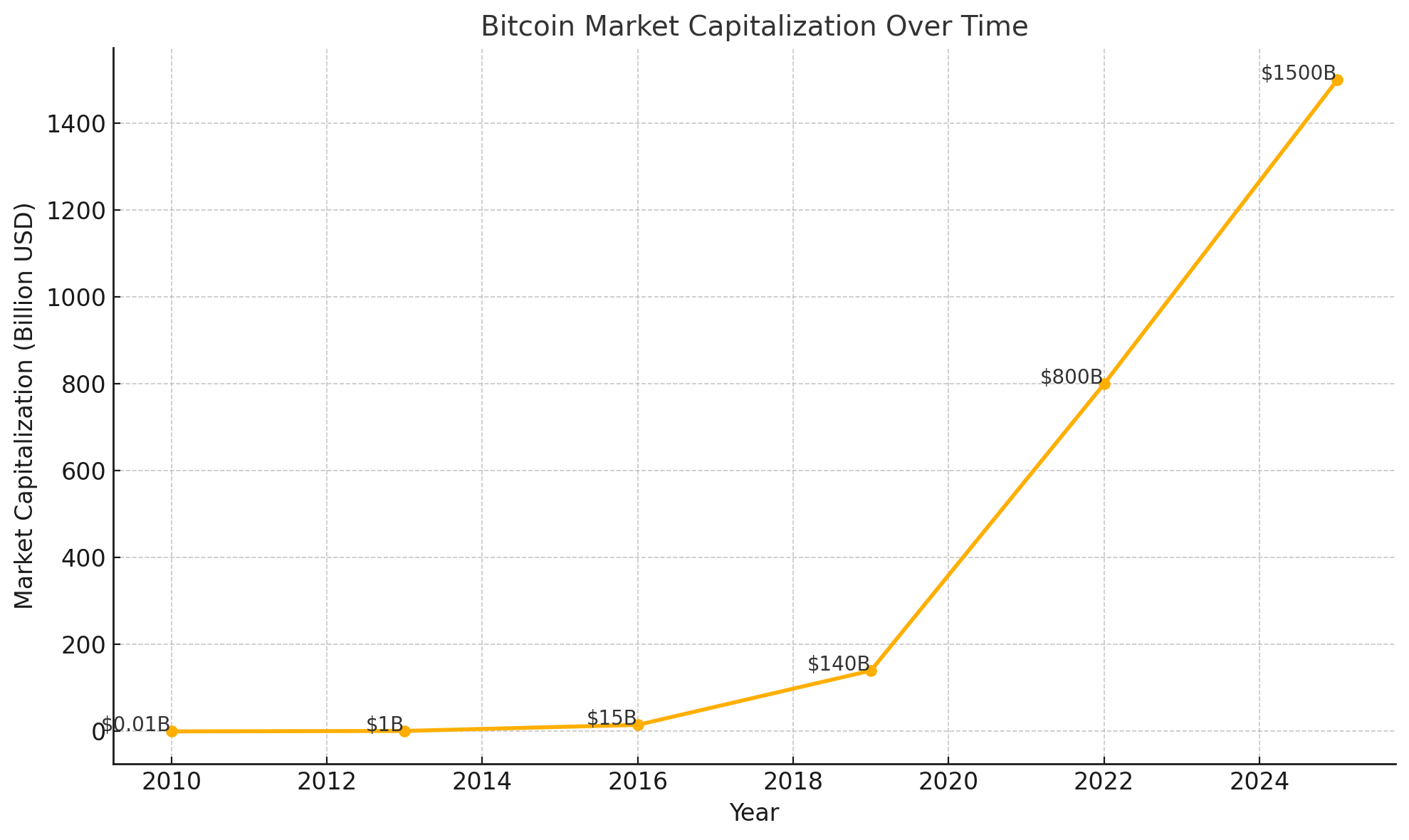

Think about gold for a second. People have valued it for centuries because it’s rare and hard to get more of. Bitcoin works the same way, but it’s digital. There will only ever be 21 million Bitcoin, no matter how much demand grows. That’s why some people call it “digital gold.” And unlike gold, Bitcoin is way easier to store and move around. You don’t need vaults or trucks—you just need a secure digital wallet.

Right now, countries like El Salvador are making big moves with Bitcoin, and others are starting to explore it too. If the U.S. doesn’t get ahead of the curve, we risk being left behind in this new financial world.

Why It Could Be a Game-Changer

Imagine if the U.S. held some Bitcoin in its reserves. It would do a few things:

Protection Against Inflation: Ever noticed how prices seem to keep going up? That’s inflation at work. Bitcoin doesn’t inflate the same way because its supply is fixed. Holding it could help the U.S. protect some of its wealth if the dollar loses value.

Tech Leadership: Bitcoin isn’t just about money—it’s about technology. By embracing it, the U.S. could show the world that we’re leading the charge in this new digital era. It would attract tech talent and investment to the country.

Staying Competitive: Other countries are already looking at Bitcoin as a way to strengthen their economies. If the U.S. doesn’t act, we might lose some of our edge in global finance.

And the more important, pay the national debt of the US.

But What About the Risks?

Of course, nothing’s perfect. Bitcoin’s price can be all over the place. One day it’s up; the next day, it’s down. But that volatility is starting to settle as more people and institutions adopt it. And let’s be real—every investment has some risk. The key is to manage it wisely.

Then there’s the question of regulation. We’d need clear rules about how the government would store and use Bitcoin. But those challenges aren’t deal-breakers; they’re just things to figure out.

Why It Matters

Here’s the bottom line: The financial world is heading in a digital direction, whether we’re ready or not. Bitcoin is at the heart of that shift. By holding some as part of its reserves, the U.S. could secure a spot at the table in this new financial game.

It’s not just about dollars and cents—it’s about staying ahead, being innovative, and making sure we’re ready for whatever the future throws at us. And honestly? That sounds like the kind of move the U.S. should make.

Did you like it?

I hope you liked this publication. If so, I would appreciate upvotes and or follow me! :)