Due to the recent crash in FTX has led its price to continue loosing worth has called for the need to perform further analysis. This is a summary of FTX price performance in the month of December, 2022.

I will consider the following points useful which are maximum / minimum price and line graph analysis.

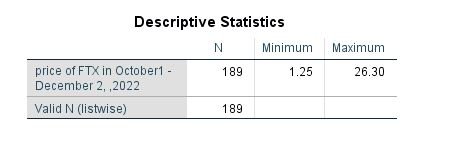

Maximum and minimum price

The maximum and minimum price of FTX is seen in both images below. There is a collection of two prices showing for maximum and minimum. The first at minimum price was in December 2 and the second was in December 20,2022.

The first image shows the price of FTX from October – December 2, in 2022.

It can be seen that the minimum price of FTX was $1.25 during the period. Having considered an extension in the date, it is been seen that the price of FTX continues to dip further than expected in the image below.

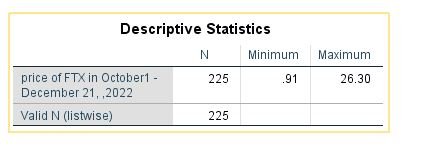

Price of FTX October - December 21, 2022

The minimum price of FTX in the stated duration was $0.91.

However in this analysis there was a difference in minimum price of FTX between December 2 and December 21 with a reduced rate of 27.2%. However this calculation is in line with my prediction of the recent FTX price analysis that FTX price might read in cent and this is true as the recent price of FTX reads 91 cent.

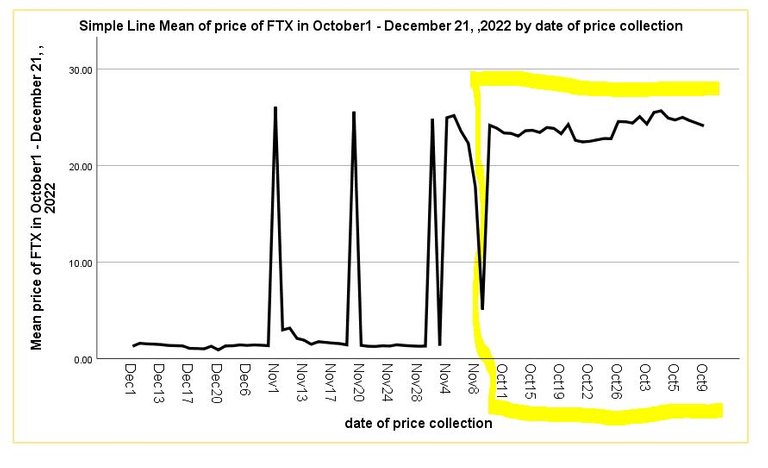

Line graph showing FTX price

Below is a line graph showing the continuous fall in FTX price.

It is seen that during the month of October, 2022, the price of FTX was even better than in November and December. However considering the trend, the price of FTX way loose worth in its value as it drips closers to $0.00.

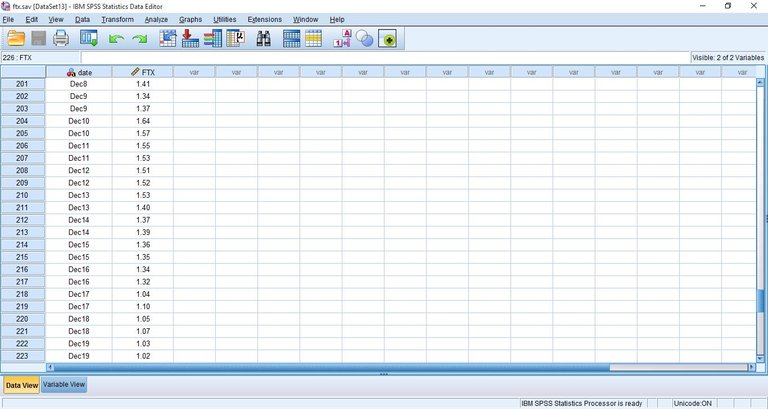

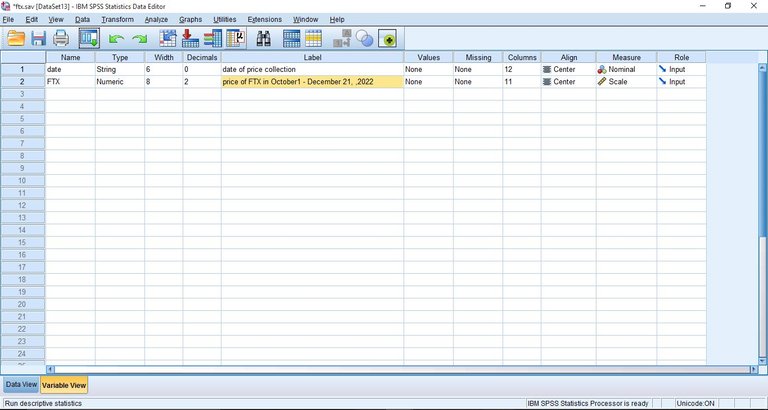

Data and variable view

Data view allows for the collection and entry of FTX price in SPSS.

Whereas the variable view is the frame work of the analysis.

Conclusively

This article has been able to put to present the price of FTX from an analyst point of view. It can be concluded that the price of FTX continues to dip further and now in cents as its lowest recent price reads $0.91 equivalent to 91 cents equivalent to 20.2% reduction. As it continues this way taking a period of 2 weeks to account of 20.2% reduction, it simply means in a week, it reduces in price by 10.1%, in four weeks to come, it might reduce 40.4% which warrants its price to be predicted in 16 weeks’ time as $0.02. This is as a result of mismanagement of funds by the CEO Manager but means on how we prevent this from occurring in the nearest future should be taken.

Thanks for your reading time

Posted Using LeoFinance Beta

I guess FT X will soon become an insolvency estate and the bruised investors will make whatever money they can. Really a hard thing with all the scammers on the net, I hope for more regulation in this regard.