There is good news for crypto coming from the land of the rising sun Japan.

As per a latest news report coming from this island nation the corporate tax guidelines for crypto tax on paper gains have been revised.

What are paper gains ?

Paper gains are not realized gains and since they are not yet realized profits there is a debate that such profits should not be taxed.

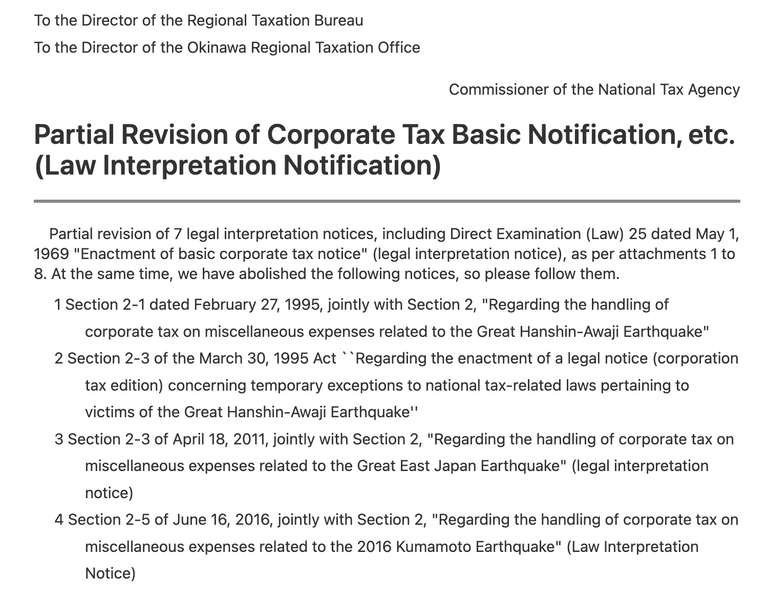

The National Tax agency of Japan has tweaked and revised the guidelines in terms of the cryto corporate tax laws.

As per the modification which pertains to the the token issuers those issuing tokens would not have to pay corporate taxes on un realized gains.

The law got revised on the 20th of June 2023.

Is the tax policy implementation slow ?

Japan is considered to be a nation which works on the bleeding edge of technology and no wonder its think tank and leadership wants the country to succeed in the field of crypto as well.

However it may be noted that these tax exceptions has been in the pipeline for a a long time.

The implementation part has taken a pretty long time to see the light of day as it was announced way back in August as part of the broader tax reform for 2023.

However these changes have been under discussion for almost six months and got approved only now.

Perhaps a move that needed a lot of scrutiny and deliberation.

As per the new rules any Japanese firm that issues tokens is exempt from paying the 30% tax which is other wise applicable for holding crypto in Japan.

Before implementation of this law the tax rate was 30% on all gains and holdings even the unrealized gains were taxed in this tax scheme.

These rules are are applicable as per the notification which can be read here

Is Japanese regime getting crypto friendly ?

This marks a new liberalized wave of doing business. By the look of it it should encourage more businesses to be involved in the crypto industry.

Is setting up crypto business in Japan getting easier ?

This liberal taxation scheme for corporates can be seen as an initiative of the ruling Liberal Democratic Party to make it easier for the corporates to do business.

This news comes in the backdrop of a regime that has been tightening and enforcing the anti money laundering AML legislations in December.

Another step which the Japanese government took in June last year was the issuance of stable coins by any non banking entity and limits it to licensed banks, the registered money transfer agents as well as the trusted companies.

It may be noted that Japan has been quite progressive when it comes to crypto blockchain and financial businesses.

It was one of the first countries to legalize crypto as a private asset.

Yet as compared to other countries Japan's regulations are considered to be quite strict when it comes to crypto laws.

This is primarily to protect its citizens from crypto frauds as well as ensure proper taxation and misuse of crypto as per its AML regulation.

Can this tax policy be extended to individuals?

Currently this policy pertains to corporate tax which applies to crypto businesses but maybe someday we may see it being extended to citizens as well.

There is no announcement about this but at least that is what most crypto holders would hope for.

Posted Using LeoFinance Alpha

The rewards earned on this comment will go directly to the people ( itsme9001 ) sharing the post on LeoThreads,LikeTu,dBuzz.https://leofinance.io/threads/itsme9001/re-itsme9001-2sdsftw4k

Congratulations @itsme9001! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 800 replies.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts:

Awesome this is great crypto content right here :)

Thank you for using our new hashtag #BRK for your blockchain content. You are now earning IceBreak token rewards on top

Posted using IceBreak

!HBIT, !hivebits