Thank you for today!

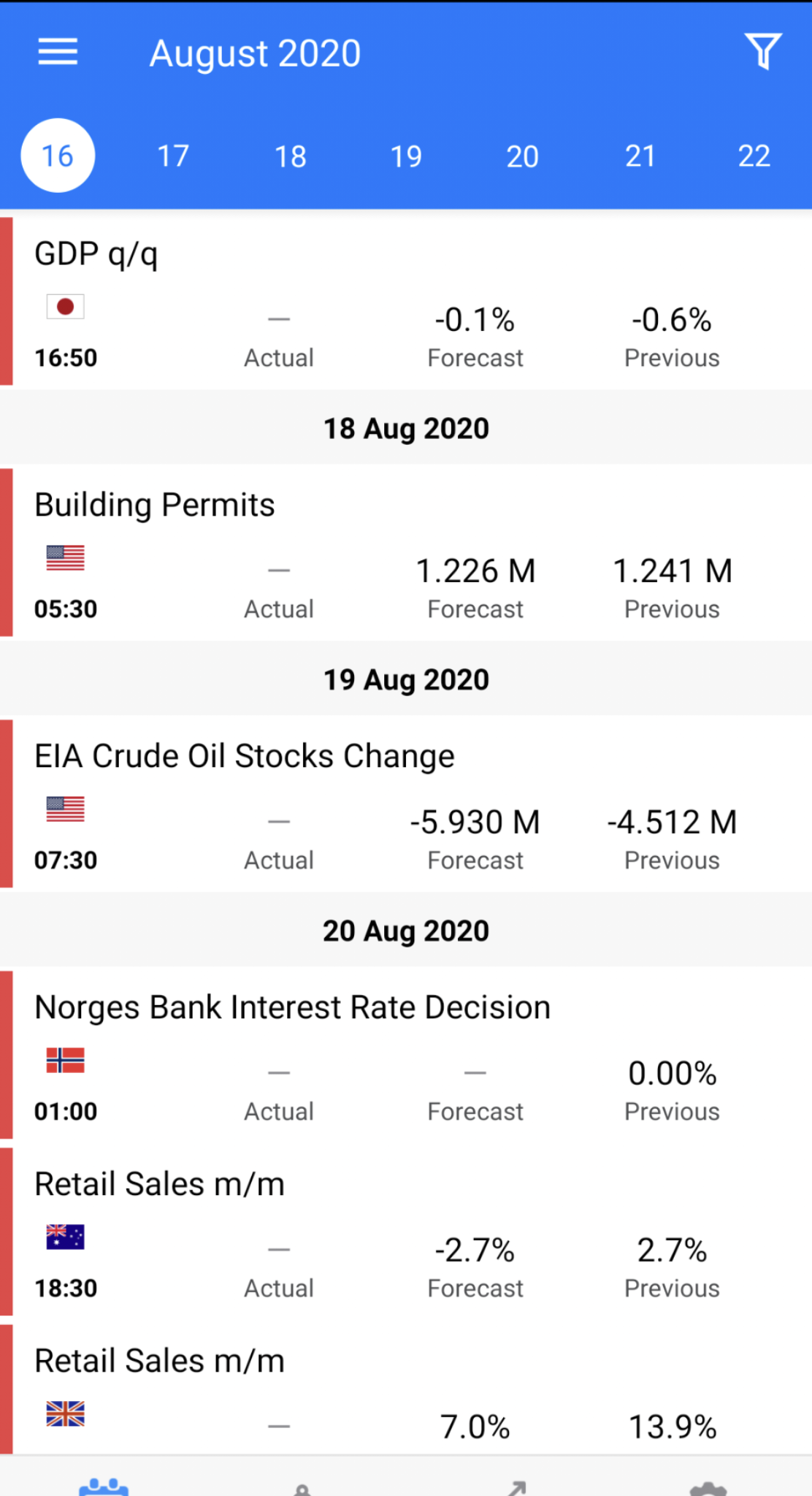

Upcoming Weekly Financial Announcements

SUNDAY

4:50pm pst . Japan GDP

$JPY

TUESDAY

5:30am . USA Building Permits

$USD $DXY . Lumber

WEDNESDAY

7:30am . USA crude oil

$USD $DXY $Oil

THURSDAY

1am . Norway interest rate

$DXY?

6:30pm . Australia retail sales

$AUD

11:30pm . British Retail Sales

$GBP

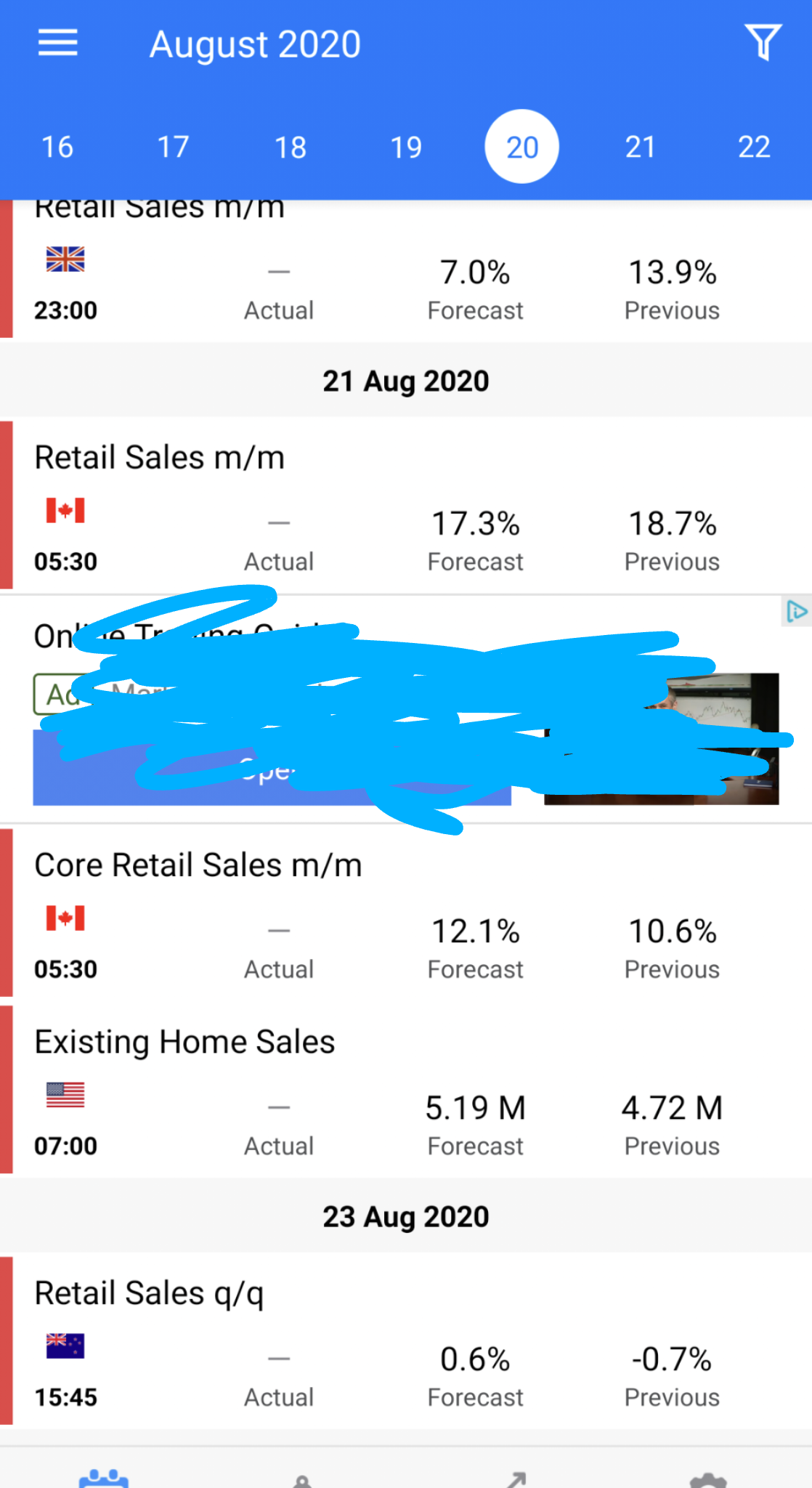

FRIDAY

5:30am Canada Retail Sales

5:30am Canada Core Retail Sales

$CAD

7:30am USA Existing Home Salea

$DXY $USD

SUNDAY

3:45p . Australia Retail Sales

$AUD

I pray I set the alarms a couple hours out for the setup, be present before and after news, if it seems to help a play on a pair...

CHARTS

$CHFJPY . Swiss/Japan

$USDCHF . Dollar . SFX on smallexchange.com

$USDJPY . Dollar/Yen

$EURUSD . Euro/Dollar . Risk on/off

$GBPUSD . Pound/Dollar . Small Caps? Financials? Watch global contracts...

$USDCAD . Dollar/Cad . SFX

$AUDUSD . Aussie/Dollar . Risk on . Gold

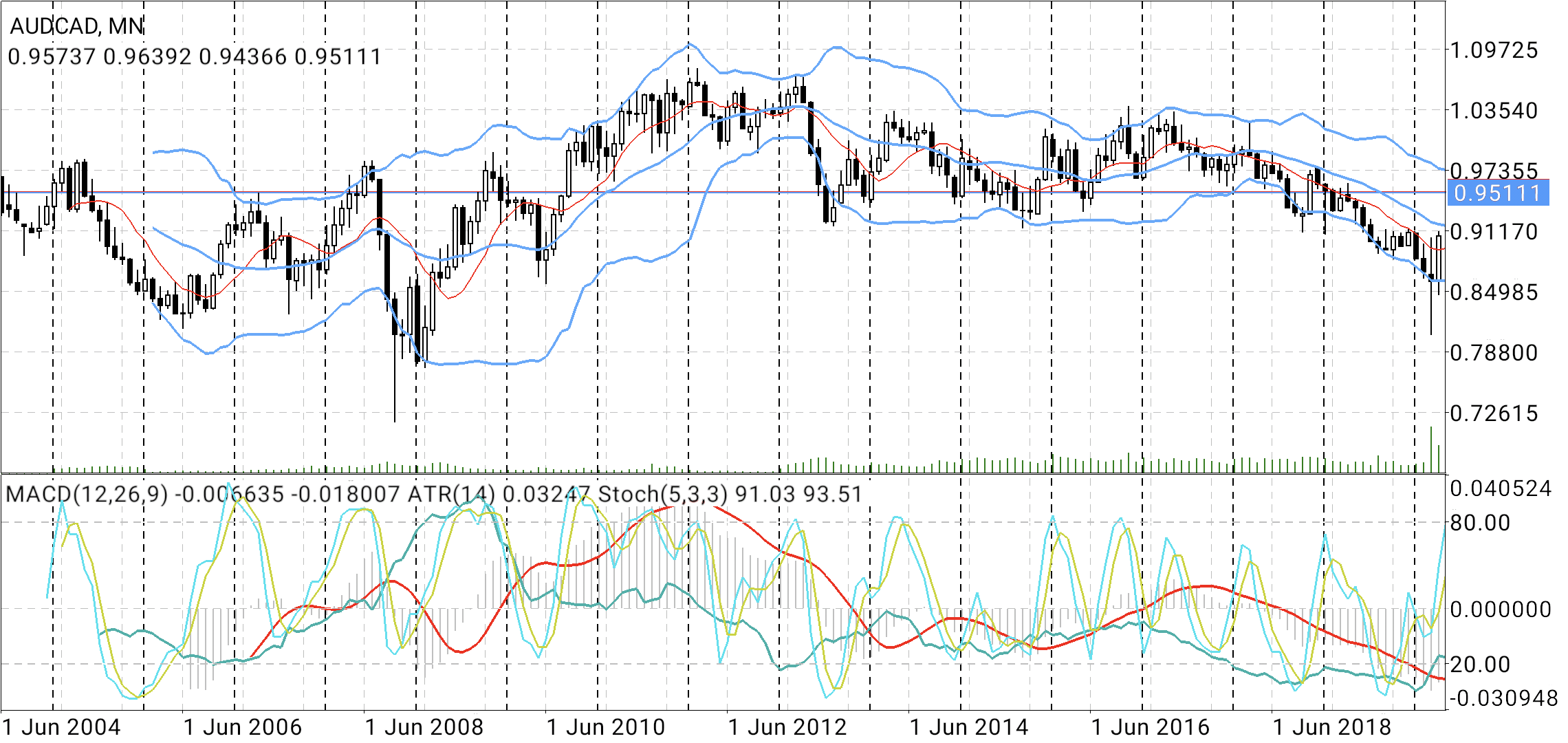

AUDCAD Gold/Oil play

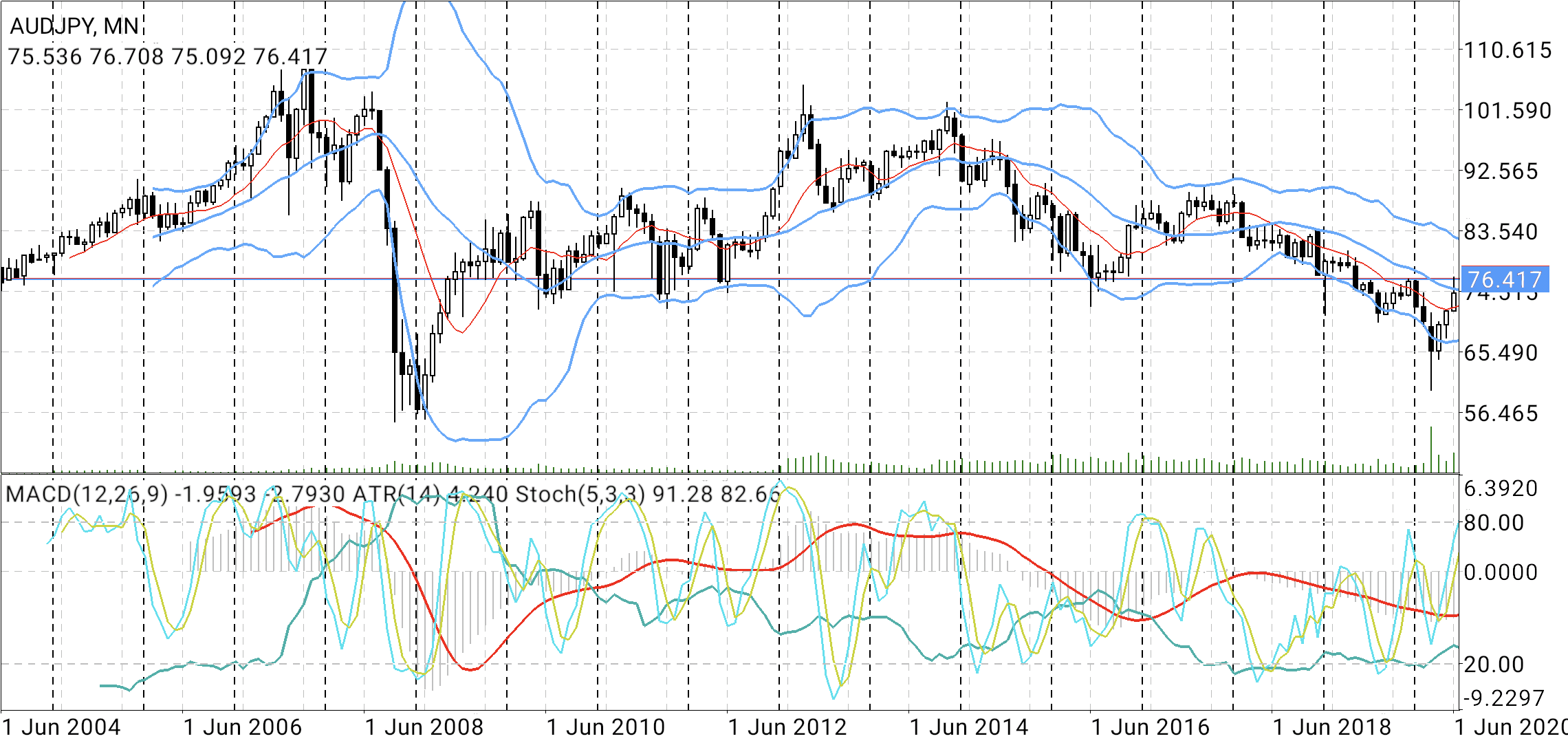

AUDJPY . Gold play . Risk on

EURJPY Lumber play . Risk on

CADJPY Oil play

EURGBP . Brexit play

GBPCAD . Personal interest. (ie, if uc 1.30 & gu 1.30 then gc the spread?)

$NZDUSD . Kiwi/Dollar

Going into the week I'm staying neither bullish or bearish on anything, in hopes of reacting to price movements after setups in zones. Some of the charts have arbitrary zones drawn. They're based on areas of support and resistance but subject to change m They'll probably change. But for now, whenever price is in these areas is when I will be looking.

The discipline I am praying for is to not enter a trrade unless I am entering or exiting these zones. That could mean anywhere from 100-10 pips away from the area. But the discipline stop I am praying to obey is to stay out of trades that are in the middle of nowhere. I will be looking for the strongest moves, at hopefully the right times, and specifically when price is moving distinctively towards, away from, or touching prescanned prize zones.

I pray I only risk .02 tops a trade. 2000 units. It's ok if I leg in 500 units at a time.

I pray I cut my losses quick and let my winners run, trusting my analysis and alerts.

Dear God let me review my alerts for each pair. And let me trust my analysis this week.

That said the trend is still risk on. Every dip is getting bought up in the greater indices. But my eyes see a rolling over. Could just be another dip. Watching SP500 (smallexchange.com) to some degree, but the SM75 tracks like the Russel and has a broader exposure to what might be going on with Stonks.

I am wishing everyone the Best cuz I guess I'm wishing myself the best so I'm wishing you the best! Much focus, luck, and abundance to you this week trading.