Liquity’s V2 Testnet is finally here, and in true Liquity fashion, they’ve introduced some new tools that in my opinion, may (once again) revolutionize the crypto industry.

In today’s article, I’m going to be breaking down all the major different components of Liquity V2 unveiled in their testnet, and why I’m so bullish on not just Liquity’s future, but all the forks that are rolling out now with Liquity V2’s codebase.

Let’s dive into it shall we?

User-controlled Interest Rates

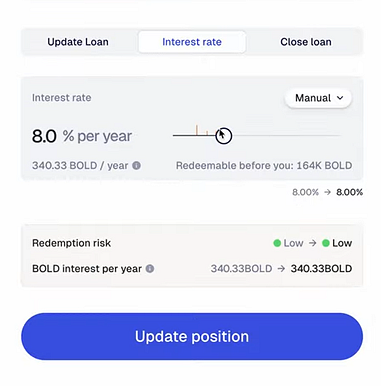

Imagine walking into a bank to take out a loan to buy your house. The average 30-year fixed mortgage rate in the US is about 7%, a rate that’s determined by a number of different factors — bank policies, government regulations, housing market standards, etc. But regardless if the average rate is 7%, imagine paying half of that, say 3.5% — this is what Liquity V2 allows you to do. Albeit with different liquidation risks, Liquity allows you to set different interest rates for your collateralized loan, ranging from 0.5% to 25% per year:

Why would you purposely set a higher interest rate? The interest rate that you set directly correlates with your risk of redemption — the higher the interest rate, the lower the risk. In other words, no matter how large of a position you borrow, as long as you’re paying a higher interest rate, you’re at much less likely to get liquidated.

If you’re familiar with popular lending/borrowing DeFi apps such as Aave and Compound, one of the frustrations that you’ve probably encountered are the dynamic interesting and borrowing rates that can fluctuate without a moment’s notice. Many times on Aave for instance, I’ve borrowed some $USDC, only to find that the borrowing rates have increased from 10% to 15% overnight — a rate change that is out of the borrower’s control, and with inadvertent consequences that can make liquidations more likely.

Changing rates: Speaking of rate changes, even after a loan has been opened, Liquity V2 users can manually adjust their rates after-the-fact and/or whenever they see fit.

Liquid-Staked Derivatives (LSDs) as Collateral

Another feature introduced with V2 are users’s ability to put up different types of collateral, namely Lido’s $wstETH and Rocketpool’s $rETH. Similar to Alchemix’s self-paying vaults, because they are LSDs, both $wstETH and and $rETH will inherently increase in value, essentially allowing your $ETH to earn yield while you have it put up as collateral.

Considering that the average staking yield for $ETH is roughly 4% APR, all other price action aside, this means that you technically could have a loan that pays for itself as long as you set your interest rate below 4%.

$BOLD — the new $LUSD

For those of you familiar with Liquity V1, the basic premise was that once putting up your collateral, you could then mint $LUSD. The original beauty behind $LUSD was that no matter its market value, 1 $LUSD was always redeemable for $1 dollar’s worth of $ETH — specifically taken from the trove (loan owner’s position) that had the lowest collateral-to-loan ratio. The ability to always redeem $LUSD for an equivalent amount of $ETH puts constant pressure on $LUSD to remain at peg , for the bigger discount on $LUSD would incentivize buyers to buy $LUSD so that they could arbitrage the price back to $1 dollar market value.

In similar fashion, 1 $BOLD will also be redeemable for 1 dollar’s worth of $ETH/$wstETH/$rETH, but rather than the worst LTV, $BOLD redemptions are applied to the loan with the lowest interest rate — a fate that can be deterred as long as the loan’s interest rate gets readjusted.

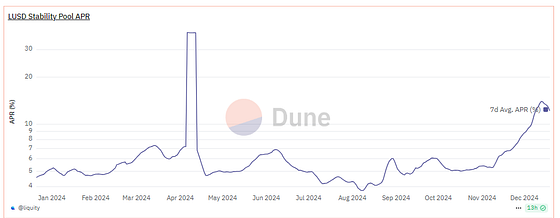

Shortcomings of V1 Fixed

The problem encountered with V1 was that due to external market forces (i.e., federal interest rates, RWA returns), many people were selling out of $LUSD in order to get into other stablecoins that had better interest returns, namely products like $DAI (which could be staked to earn interest via $sDAI) and even $USDC (which you can now simply hold on Coinbase to earn a flat 4.7% APR). V1 had interest fee loans, which meant that the only way you could earn yield from $LUSD was by staking it in their Stability Pool — a pool whose revenue was gained only from liquidated troves.

V2 has stability pools as well, but the fundamental difference is that revenue will not only be made from redemptions, but from interest rates as well. Therefore the higher the interest rates earned from loans, the more interest that will feed the stability pools. Theoretically, with dynamic fees V2’s stability should always be as profitable if not moreso, no matter the market condition.

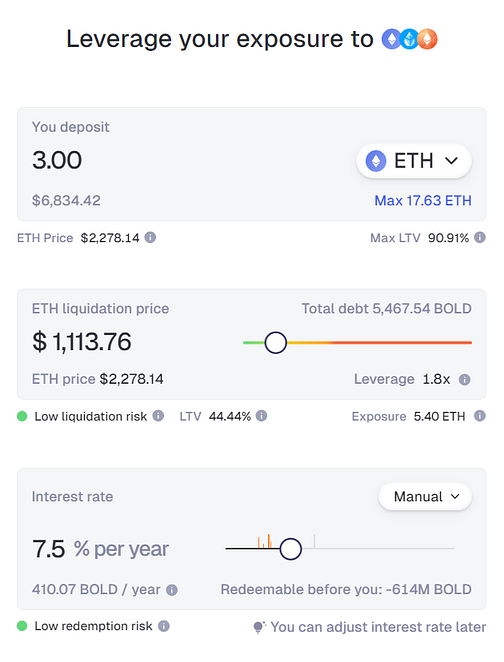

Up to 6x Leverage

Bullish on $ETH? V2 allows you to lever up your deposit to borrow even more $BOLD, whether it’s on your deposited $ETH, $wstETH or $rETH:

Please note however that leveraging comes with its own set of risks, especially if we extreme volatility and/or a flash crash.

Forks, forks, forks

Speaking of profitability, another game-changer with V2 is that unlike V1, it is no longer free and open-sourced (FOSS). Being FOSS made a great deal of copycats/forks which inevitably vampire attacked V1’s ability to be more profitable.

With V2, the codebase is under a Business Source License (BUSL) which fosters greater collaboration and integration of V2s framework. Critics would say that this goes against the ethos of crypto, but with all the stealth forks that have already been granted across many different networks, I’d say that it isn’t about building a fence to keep people out, but moreso an assurance to see that people are building things the right way. According to their docs, several platforms and protocols are deploying forks, most recently BeraBorrow on Berachain and Felix on Hyperliquid.

With several different forks (and more on the way) all roads will lead to Liquity V2, $BOLD, and revenue for its users

A $LQTY Revival?

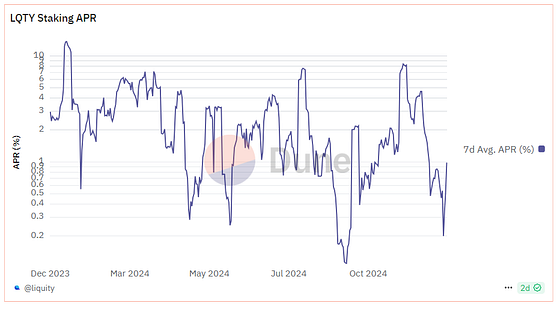

Most probably integrated due to an overwhelming community response, $LQTY will become the new governance token for V2, while at the same time still being able to continue to earn rewards from being staked on V1. There’s a couple of reasons why I’m especially bullish on $LQTY once V2 goes live:

Just because V2 is going live, doesn’t mean V1 is going anywhere, which means that $LQTY stakers will continue to earn #realyield

Just because V2 is going live, doesn’t mean V1 is going anywhere, which means that $LQTY stakers will continue to earn #realyield$LQTY has very limited remaining dilution, with a circulating supply of 94.36m tokens, out of a total supply of 100m.

In other words, Liquity’s mainstay token is already going to be coming in with a fee switch with little room for VCs to be able to dump on you — a combination which I’m super bullish on, especially if it one day becomes the most popular crypto-lending platform.

Conclusion

There are several bullish things that I continue to be excited about for Liquity’s V2, and now with their testnet, we’re finally able to start seeing how some of this will work in action.

If you’re curious in trying V2's testnet yourself, start playing with it on Sepolia: https://liquity2-sepolia.vercel.app/ and then head over to their Discord to join the conversation!

And as always thanks for taking the time to read this and be sure to follow me on twitter (https://twitter.com/CryptosWith) to get all my latest updates. Also, looking for a gift for your Crypto-loving/hating friend? Give them a REKT journal to cheer them up!

Disclaimer: This is not financial advice and this is for educational and entertainment purposes only. Please as always, do your own research and find what investments are best for you. Cheers everyone!