Hey folks, so this is a bit of a continuation from an article I wrote the other day involving $USDR, $TNGBL, and the Tangible ecosystem. If you’re unfamiliar with “Real USD” and Real World Assets (RWAs) I’d highly recommend you taking a read first before learning about $CVR.

$USDR and the RWA-narrative is really hot right now and a whole other side I didn’t mention in my last article is the CAVIAR token ($CVR). If you thought earning 16% APR on $USDR was pretty amazing, earning nearly 300% APR in $USDR based on $CAVIAR will excite even further.

But before we go into $CAVIAR, let’s talk a little about Pearl.exchange

What is Pearl.exchange

If you’re unfamiliar with solidly forks, essentially they work on a voter escrowed (ve) model which incentivizes token holders to gain incentives and/or higher APRs through bribes. So like in any solidly model, voter escrowed vePEARL holders earn voting bribes for whichever delegated liquidity pool they choose. Currently, the liquidity pools are running really hot on Pearl.exchange with significantly high APRs, running at more than 25% APR on stablecoin pairs and more than 30% APR on bluechip pairs — all in conjunction with significantly high TVLs:

As in any solidly-fork, $vePEARL holders are able to earn bribes from incentives given for certain liquidity pairs. And right now, the voting incentives are significantly high as well:

In other words, right now you could get incentives worth more than 250% APR on voting on the $USDC/$USDR LP. Why is this so significant? This is twice the amount of the highest amount for any stablecoin LP pair on Velodrome, which is Optimism’s premier solidly fork.

The problem however, is that solidly fork users normally need to pay constant or at least weekly attention to keep track of different incentives/bribes and which LPs have trending APRs.

Cue in Caviar

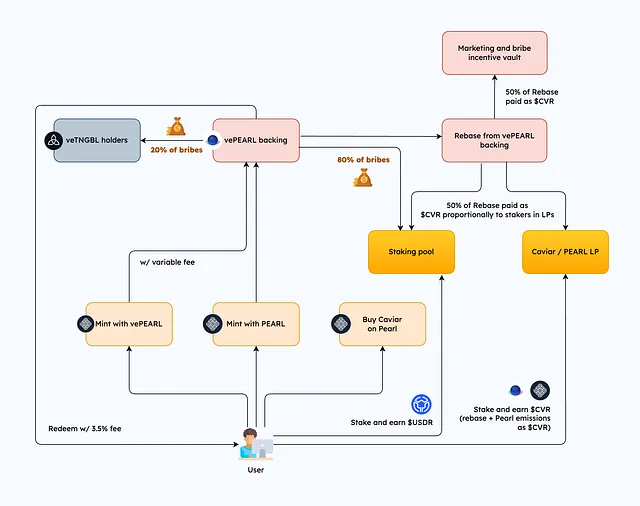

In a nutshell, $CAVIAR is liquid wrapper for vePEARL, which itself is an NFT representing locked $PEARL, the native token to the solidly-DEX Pearl.exchange on polygon, Ethereum’s OG layer-2 solution.

$CAVIAR gains bribes from the Pearl.exchange LPs, sending 80% of the voting rewards straight to $CVR stakers in stablecoins, thus giving one of the highest stablecoin yields for a single-side staked token:

One thing to note, it’s not necessary to go through $CVR in order to get some of these returns, but how the Tangible team has been able to automate all of these functions, thus removing the hassles of voting, claiming, locking etc. In return, you as the $CAVIAR staker simply have to go in claim rewards whenever you feel like it. Therefore if you don’t trust Tangible/$CVR, you can do all these steps manually yourself.

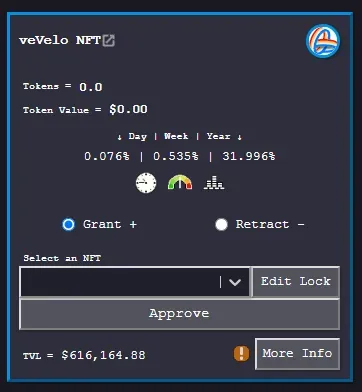

The thing is, this isn’t necessarily new. If you’ve followed my previous article on Velodrome, you might recall that the Byte Masons team had a similar getup that allowed you to stake your veVELO NFTs in order to earn more than 30% APRs in $USDC instead of $VELO:

The difference with Caviar is that the entire process is automated so you may never have to touch $PEARL (as opposed to $VELO) tokens at all.

Caviar Tokenomics

So with any solidly fork, the biggest problem is token dilution, and from a historical perspectives, as new solidly-platform tokens get emitted, price can get diluted really quickly.

$CVR is a wrapped version of $PEARL, which is the native solidly-token of pearl.exchange, and similarly, if you’re holding on to $PEARL and not doing anything with it, it’s only a matter of time until your price gets diluted out:

In order to combat price dilution and to help maintain CAVIAR-holders’ voting shares, up to 25% of weekly $PEARL emissions are distributed back to stakers in $CAVIAR in addition to their stablecoin rewards as an offset. Will this help maintain 300% APRs? Probably not, because it’s not that simple. But regardless, it will be exciting to see what $CVR will do in the future.

Great, so how do I get $CVR?

First head over to tangible’s Caviar website and connect your wallet.

From there you can either buy $CAVIAR with either $USDR, $DAI, $USDC, or $USDT or mint it yourself by using $PEARL or an existing vePEARL position:

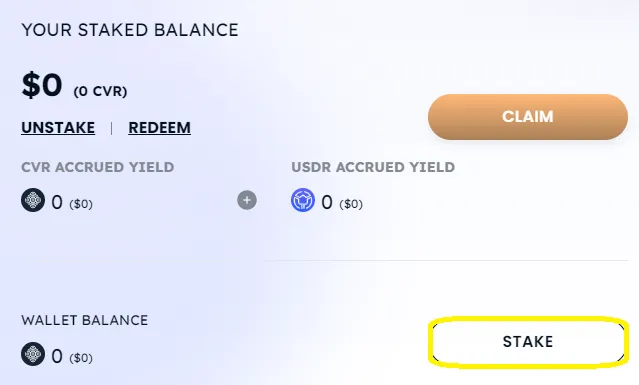

But you shouldn’t stop there — $CAVIAR must be staked in order to start accruing rewards — rewards which are mostly in $USDR but also more $CAVIAR (which should be restaked again to retain voting share):

Conclusion:

If you’re really bullish on $TNGBL, $USDR, and/or the Tangible ecosystem as a whole, then I would imagine that getting into $CVR is a bit of a no brainer. Personally I don’t think 3-digit APRs are sustainable for the long term, but with no lock-ups, $CVR might prove to be extremely profitable in the short-term, and yet still decently profitable in the long-term.

If you are interested in trying out $CVR yourself, please consider supporting my blog and using my ambassador link: https://www.tangible.store/caviar?referrer=mwc

If you’re already eaten some Caviar (pun intended), please let me know what your experiences have been in the comments below, I’d love to hear about it.

REKT Journal to cheer them up!And as always, thanks for taking the time to read this and be sure to follow me on twitter (https://twitter.com/CryptosWith) to get all my latest updates. Also, looking for a gift for your Crypto-loving/hating friend? Give them a

Disclaimer: And as a final reminder, this is not financial advice and this is for educational and entertainment purposes only. Please as always, do your own research and find what investments are best for you. Cheers everyone!

Congratulations @jaik83! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 100 replies.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPNice publication, What 's the caviar price?

Thanks! Right now it's trading at about $.39

Thanks for your attention.

hahaha just used some garbage that I had on coinbase and bought CVR with that, lets see how it goes!

agreed, small marketcap coins are sure to be volatile and the rates aren't (shouldn't) be sustainable