[ go to Part 1 of the report ]

Treasury Analysis

The treasury of each DAO consists of all assets contained in wallets belonging to the DAO. The treasury is defined as assets under the discretion of a DAO — i.e., fully governed on-chain funds. A different way to measure the value of a DAO’s treasury would be to include additional wallets, which may not be freely available to the DAO. Such wallets can contain reward fees or staking accounts.

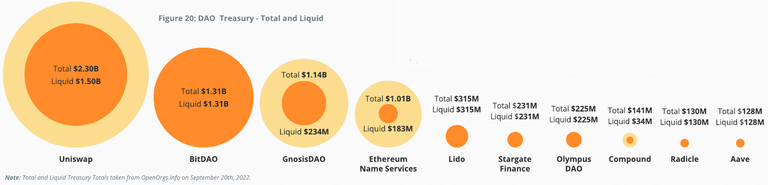

The table below displays how potential discrepancies can arise between total treasury holdings and what is liquid. While GnosisDAO’s total treasury is $1.14 billion, its liquid treasury is $234 million at the time of this writing, according to OpenOrgs.info. This report breaks down the makeup of each of these 10 DAO treasuries in more detail. It is important if DAOs continue to grow in popularity as a form of group organization, the revenue, treasuries and investment profiles of this up-and-coming class of companies can rival or surpass top Fortune 500 companies. As this class of business “structure” continues to grow, due to the competitive advantages of the DAO operations, as we will cover later, it may eat entire industries.

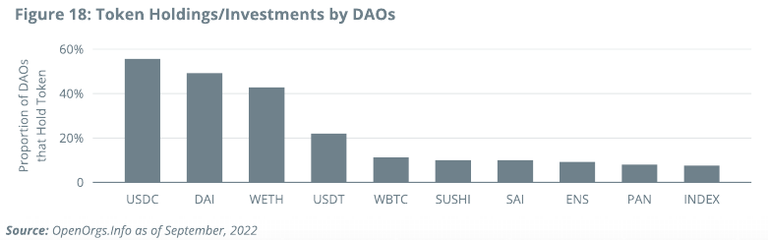

On the right of this page, are the assets and projects DAOs have invested in to hold as part of their balance sheets. Many DAOs hold the stable coins USDC, DAI, and USDT, while wrapped Ether (WETH) is the top non-stable asset.

Bounties, Contributions & Governance: How DAOs Get Things Done

In a DAO, participants must use their funds to participate in voting and events proposed by other participants. To sustain this economy, there are incentives rewarded for participating in a DAO.

“Bounties” are a type of incentive granted to a DAO’s participants when they fulfill a task, such as a development project.33 Typically, DAOs will have bounties listed with the corresponding task and award amount to encourage users to view what needs to be done in order to achieve the ultimate mission of the DAO.

There are contributor DAO tools to allow the administration of incentives. Rabbit Hole is an example of an on-chain contributor tool. Through Rabbit Hole, users can see what “Quests” are available to earn tokens and/or NFTs across several different DAOs. They can also choose to complete mini-courses on introductions to blockchain concepts to earn rewards as well.34

As with governance and treasury tools, there are also off-chain options. Off-chain contributor tools don’t automatically execute the awarding of the incentives when a task is completed, rather it relies on a user to self-report this action. This decreases the fees associated with on-chain tools but can lead to more friction. 35

Gitcoin is an off-chain contributor tool that enables users to learn, participate, earn rewards and even invest in other projects. They also offer hackathon options, grants and a platform to allow users and developers to network with each other and give “kudos” to reward other users for their participation.36 Coinvise, similar to Gitcoin, encourages users to create their own token, rewards and, ultimately, their own DAO community. A user can explore other DAO communities to see what bounties and quests they’re offering and how to promote participation in these DAOs.37

PoAP, or proof-of-attendance protocol, rewards users with an NFT proving their attendance or participation in an event, whether it’s virtual, online or a task. PoAP can be used to issue NFTs to users in order to boost their credibility within a DAO. Users holding a specific PoAP might have access to a certain platform or event that non-collectors are not permitted to attend.38

MintGate depicts credibility within a DAO ecosystem through memberships and membership tiers through the issuance of NFTs. They refer to this as “Token Gating” to verify users who are allowed to view and participate in certain aspects of the DAO.39

What’s it like to work in a DAO with thousands of bosses?

“DAOs in the real world are no longer a futuristic fantasy of developers but an opportunity to make it here and now. As an example of our biggest case study, we digitized a crypto-oriented city of 50,000 sq/m. Every apartment is presented as a rental and also ready-to-buy NFT. Residents are members of the DAO who will vote daily, thereby creating the most favorable living conditions. Surprisingly, we regularly get requests from real-world companies to digitize their businesses. They want to use DAOs to attract investment and manage assets transparently, as well as to vote. Blockchain offers substantial advantages. From a legal perspective, DAOs are already recognizable organizations; they can pay taxes and show their accounting on a par with companies but in a more modern and automated way.” -- Vlad Shavlidze CEO XDAO

Case Study: Coinshift

Coinshift is an advanced treasury management and infrastructure platform for DAOs and crypto businesses. With Coinshift, treasury teams can have a unified view of their treasury on multiple chains and multiple safes, helping improve visibility and save time. In addition, Coinshift is integrated with Gnosis Safe, allowing clients to run mass payouts, easily collaborate on multisignature transactions, and save up to 90% on gas fees. Coinshift’s team will also be able to solve more advanced use cases, such as reporting, stream payouts, automating payouts and delegating off- chain operations to its team. Coinshift currently supports the following chains: Ethereum, Polygon, Arbitrum, Optimism, Gnosis Chain, BNB Chain and Avalanche.

Features of Coinshift V2

- Moved from one Gnosis Safe to managing an entire organization with multiple Gnosis Safes on multiple chains, which are integrated into one interface with Coinshift v2, with global user management, global contacts, proposal management and many other features shared across the entire organization.

- Users can pay multiple contributors in different tokens with just one transaction, stream payments, and automated salary payments with built-in transaction batching. Coinshift’s native integration with Superfluid will enable its users to create and manage real-time streams directly from Coinshift’s dashboard. Streaming is a revolutionary way of making payouts that unlock benefits for both the DAO and the contributor.

- Organizational-level financial reporting, combining all transactions across all Safes and all chains, with unified tagging for more seamless auditing and tax reporting.

- Users can deploy custom asset allocation strategies with built-in tagging and reporting.

- With Coinshift’s transaction batching solution, users can save a considerable amount of time and gas fees on deposits, withdrawals, token approvals, etc. while interacting with DeFi protocols.

- Coinshift’s infrastructure has a deep integration with Gnosis Safe smart contracts, which enables a host of benefits such as delegation of proposal workflows, better handling of error scenarios and nonce management, and an accurate gas estimation service for mass-payout transactions that help reduce transaction failures. Furthermore, its modular architecture enables easy integration with third parties, making the platform highly composable for advanced and evolving use cases. With deep integration and in-house control over infrastructure, Coinshift aims to provide a platform with best-in-class service- level agreements akin to Web2 platforms.

Social Media Tools DAOs Use To Communicate

Successful DAOs can attribute their performance to their community. As discussed earlier, there are several different types of DAOs that can be considered similar to social networks, as they contain like-minded individuals and organizations. Although some DAOs are social networks themselves, all DAOs still establish contact with their communities through the use of social media sites.

Social media networks, including Twitter, Telegram, Discord, Reddit, GitHub and LinkedIn, are being used to facilitate communication inside DAO communities. The table on the right of this page shows in more detail how each social media tool is useful for DAOs to communicate.

Some argue that DAOs will replace the social networks that are known today. Traditional social networks are beginning to look at the utilities of social media, when before the main function was to connect people and encourage them to create content. More people are realizing the consequences of centralized organizations running social media sites, especially when it comes to collecting and selling their personal data.

This is why some agree that DAOs are the future of social media. DAOs are decentralized and are powered by participation in a network. Users don’t only have the opportunity to communicate and connect with one another but can incorporate assets and capital into their communities in a private, secure manner. By combining the utilities that social media platforms are looking to implement but remaining decentralized, DAOs are paving the way for a new type of social networking.

Some Common Social Media Tools for DAOs (Social Network, Purpose for DAOs)

Twitter

Best for broadcasting news and updates.40 Enables the opportunity for information to spread across multiple Twitter feeds, which could in turn build the DAOs business network. Can lead to interactions between members of a community or outsude communities.

Telegram

Quick and direct communication with the DAO community. Allows members to “join” rather than “follow” a DAO, making it more personal.41 Option to secret chats which are end-to-end encrypted.42

Discord

DAO Masters claim it’s the “tool of choice for many Web3 organizations”. There can be several channels for one Discord group, making it easier to separate conversations from each other. It also supports 3rd party bot integrations, including Token Gating.43 (Token Gating authorizes the Discord group to manage access to channels, depending on a user’s crypto wallet holdings.46)

Reddit

Promotes the posting of social news and opinions. Users can choose to create an account to interact with a DAOs subreddit community or to only view the subreddit to catch up on news and updates. Each subreddit has its own rules and culture, which is important to note.44

Github

Tech-focused community network that encourages developers to share their DAO projects and collaborate on them. Developers can upload their code files and track changes made by them or other users. Users are encouraged to developers to network and share ideas.45

LinkedIn

Best for strengthening a DAOs business network and building the credibility of the DAO. Four out of five LinkedIn users have the ability to influence business purchasing decisions, meaning LinkedIn ads can be effective for DAOs wanting to partner with other organizations.46

All of DAO 3.0? Case Study: Alien Worlds

In 2020, Dacoco, a Switzerland-based DAO technology firm, created and launched Alien Worlds , an NFT- and DAO-based metaverse and is currently the world’s leading play-and-earn blockchain game. Founded by Sarojini McKenna, Rob Allen and Michael Yeates, Alien Worlds was influenced by concepts in decentralized communities. Its success is rooted in players’ ability to gather, build and compete in a metaverse using strategy over skill and building communities with one another — all set in outer space. Alien Worlds was the first project to put DAOs into competition with one another within a single economy. Players earn Trilium (the metaverse’s cryptocurrency token) through the Mining and Missions games, which they can then stake to one or more of the Planetary DAOs to either run for governance or to vote for leaders. In the game, each of the six Planetary DAOs (which are also known as Syndicates in the game lore) must organize itself by holding regular elections for Custodians who will control the vast treasuries, which are funded by tokens staked by the DAO’s members and topped up by the game economy. By April 2021, Alien Worlds had become the largest gaming DApp in history and is now the No. 1 blockchain game by monthly users.48

Over 7.9 million lifetime players (DappRadar)

The Alien Worlds ecosystem is rooted in interpersonal relationships, giving players purpose and meaning through community building, user collaboration and crypto incentives, including Trilium (TLM) and NFTs (digital objects/property).

Alien Worlds aims to unlock the social possibilities of Web3 gaming by featuring DAOs as game elements. Each DAO is governed by an elected Planetary Council. These Planetary Councils, in turn, will decide how to spend their treasuries on the projects or programs they choose to support. Players who have already staked to planets can vote and govern the community. By working together, they build genuine social connections that can evolve into cultural identities unique to each DAO, to which they have pledged their allegiance. Collectively, the preferences of the “team” and the management of the treasury of each Planetary DAO shapes the outcome for the community with the power to influence both players’ metaversal and personal lives.

Advancing in the game requires mining, trading and staking TLM, as well as acquiring different special NFTs, thereby fostering economic competition or collaboration among different DAOs vying for power. This gameplay offers a unique petrie dish that political scientists and economists could only hope to replicate in real life. There is just enough economic decision making in the Alien Worlds ecosystem that produces real consequences to actions taken by each DAO community — ultimately influencing the direction of the game.

There are direct analogous substitutes for items we all utilize in our daily physical lives: mining (careers/work), money (TLM), objects (NFTs), social units (DAOs) and competition or cooperation over scarce resources (DAO vs. DAO). These dynamics have helped to propel Alien Worlds to the top spot for metaverse and NFT games, and with its dynamic structure, it can adapt to the needs of its participants who can then bring their visions to life.

Is Alien World a Glimpse of DAO 4.0?

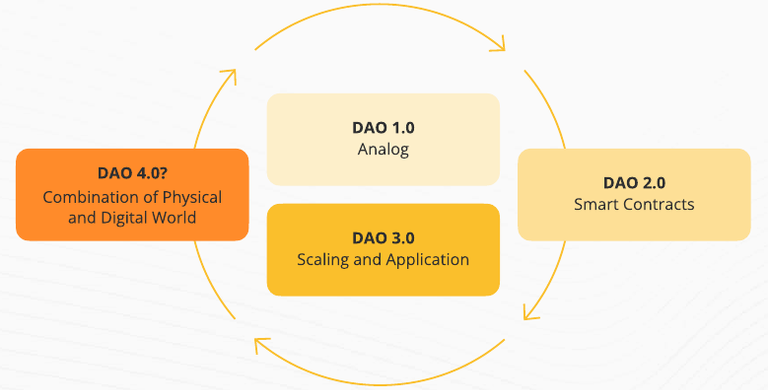

Alien Worlds is a fun, interactive NFT metaverse game. But is that all there is to this phenomenon? If we look at how some DAOs are evolving, there may be something to glean about the next phase of how DAOs unravel. For example, in Alien Worlds, we can observe DAOs competing over scarce resources within the same universe. This is not unlike a real-world community where different groups have banded together and have to interact with different groups. On a global scale, there is the United Nations, which can act as a certain type of arbitrator between countries. Imagine, instead, it was based on the Lex Cryptographia mentioned earlier. While we may not be able to perfectly replicate what this social experiment would look like or play out, games like Alien Worlds can provide glimpses of potential applications not just through a computer screen but in the physical world as well.

We also see this with DAOs whose members experience utility in the physical world. DAOs like the Bored Ape Yacht Club, utilizing its APE token, have real-world events like Ape Fest, which are exclusive to Bored Ape Yacht Club members. The bleed-over from being a DAO in the digital realm now also includes utility outside of one’s computer. We have already seen firms like Erik Voorhees’ ShapeShift, a decentralized exchange (DEX), literally shift and dissolve from a traditional company with a top-down structure into the ShapeShift DAO. If ShapeShift is successful, it may potentially spur other software-as-a-service companies, and especially DApps, to either transition like ShapeShift or just launch as one outright. Whether a DAO can transition from the digital screen to a large manufacturing facility will only be determined in the future. However, we may see these applications sooner than we might expect.

Legal Considerations on DAOs: Risks & Drawbacks

Although DAO treasuries command over $11 billion in assets, DAOs have been out of regulators’ watchful eyes so far. Currently, there is no globally recognized legal structure for DAOs, but this is likely to change, given the speed at which regulators are creating blueprints for regulating crypto. Existing frameworks limit the ability of a DAO to operate as a completely decentralized structure with no particular leader or representative and low human intervention to operations. Yet the need to interact with the off- chain world in order to develop and grow pushes more DAOs to opt for a legal entity road.

Since DAO is a specific type of an organization, any centralized structure to represent it off-chain comes into conflict with its decentralized nature and may contradict its key principles. Thus, while some DAO members may be ready to proceed with a legal structure, others may question the choice as it often means sacrificing anonymity, autonomy and decentralization, at least in part. Yet remaining regime-less may be a sound option for a DAO unless it needs off-chain representation to ensure its future growth prospects. There are three key factors driving the decision of a DAO to set up a legal entity, often referred to as “legal anchoring.” Ensuring limited liability for DAO members and obtaining tax clarity are one of the main reasons, but much of the rationale appears to be the strategic and operational management of a DAO.

There are plenty of reasons to bridge a DAO to the traditional world despite the trade-offs of partial centralization. A legal structure may be crucial for the day-to-day operations of a DAO in order to build third-party integrations, sign legal contracts, establish legal agreements with companies and clients from TradFi, or set up bank accounts to pay employees and contributors in fiat, all of which would require a DAO to seek legal representation. There is an array of scenarios when a DAO might have to create a legal entity beyond those named, but each may be important for DAO maintenance.

Equity investments from traditional VCs also come with legal anchoring, with Uniswap’s Delaware C corporation being a vivid example. Protecting intellectual property also requires legalization from a DAO, especially if its members would like to assert their IP in court. Curve DAO could be the case if it eventually decides to move forward with legal action against Saddle protocol for “wholesale copying of Curve code” after one of the Curve DAO tokenholders submitted a proposal to enforce its IP rights. Curve DAO then made a decision not to proceed with the case, given the size of the rival protocol, but it probably won’t be able to do it for legal reasons — Curve DAO was not a legal entity at the time, but it would need one to handle its IP properly.

The tax reasons for legal anchoring may be less relevant for DAOs at their current stage of development. While DAOs may want to clarify their tax obligations, there is still minimal guidance to DAO token distribution and the subsequent capital gains. Meanwhile, DAO members may report their DAO taxes personally: “In the US, DAO token holders could be viewed as holding interests in pass through entities, resulting in taxable income for DAO token holders in a variety of situations,” according to dYdX’s legal documentation.48 Overall, DAOs may point to complying with tax requirements as a rationale for setting a legal entity; yet no DAO actually pays taxes so far, according to the law firm Buzko Krasnov.

“ We are not going to know the true long-term feasibility of a DAO as a corporate structure until one gets sued and we see how the courts interpret these organizational formations.” -- Dr. Brian Houillion University of the Cumberlands' Program Coordinator for MS of Global Business with Blockchain Technology

Conclusion

DAOs are an exciting phenomenon. The possibilities are seemingly endless as to how a DAO can be implemented and how it can drive new engagement among the global society in general. This is not to suggest that the road ahead for DAOs will all be easy. After all, this is an unbeaten path into a wild jungle with dark storms potentially brewing.

The wild jungle is the market, and the market seems to have an interest in clearing this unbeaten path, expanding DAOs to social, infrastructure, NFTs, metaverse, gaming, and many other use cases. It seems that every day a new DAO is formed.

There are storms brewing, however. All governments do not really have a good handle on what a DAO is and how to deal with the issues of liability, culpability, and taxation. An organization that exists everywhere and nowhere is subject to exactly what laws?

The Bitcoin cypherpunks who started this cryptocurrency revolution would say it is not in the purview of the state to make these decisions. It is more than likely that the rest of the world is not ready for this and will seek regulation in some form. This regulation, if light enough, may still allow for the implementation of the DAO concept to continue unabated and down its natural course.

After the brush is beaten, after the wild jungle is tamed, and after the storm is dealt with, there is a sunny and bright future ahead for DAOs. Just like the blockchain industry is growing exponentially, DAO adoption will see continued ups and downs on its way to a standard operating practice each new firm will have to consider. It also may be one that current TradFi may have to adopt in order to stay competitive — we do not know for sure. Not every industry and perhaps not every business size is best-suited to utilize a DAO process. All we can and should do is let the market take its course and allow DAOs to shape their own destiny.

Cointelegraph Research: DAO Report Authors

Michael Tabone / Sr. Economist

Michael Tabone is an economist at Cointelegraph Research. A Ph.D candidate, engineer, economist, and business strategist, he also provides strategic consulting to firms concentrating in the DeFi and blockchain space.

Demelza Hays, Ph.D. / Head of Research

Demelza Hays, Ph.D. is the Director of Research at Cointelegraph. Over the last eight years, she has authored over 30 analytical reports on digital assets and managed two regulated cryptocurrency funds. Formerly, she was a Forbes 30 Under 30 and U.S. Department of State Fulbright Scholar. In 2021, Demelza completed her Ph.D. in Business Economics at the University of Liechtenstein under the guidance of her doctoral supervisor, Dr. Andrei Kirilenko, the former chief economist of the Commodity Futures Trading Commission in the U.S.

Ron Mendoza / Research Analyst

Ron has worked in business development for several investment firms in Dubai and Abu Dhabi for more than six years. He has been covering cryptocurrency, blockchain, and fintech topics for several publications since 2019.

Alexander Valentin / Sr. Research Analyst

Alexander is a Senior Researcher at Cointelegraph and focuses on quantitative analyses of blockchain data. He completed his MSc degree in Economics at Goethe University in Frankfurt, Germany, where he is currently working towards his Ph.D. in Economics and Finance.

Vladimir Shapovalov / Sr. Research Analyst

Vladimir is a Senior Researcher at Cointelegraph and has a Master of Engineering from the University of Cambridge. His previous experiences in London brokerage services, brain cancer treatment firms, and scientific background is beneficial to his research in the blockchain industry.

Bryan O’Shea / Research Analyst

Bryan O’ Shea is a Research Writer at Cointelegraph. He holds a bachelors’ degree in political science and co-founded the Emerald Foundation, a free-market think tank in Ireland.

Zack Samochin / Research Analyst

Zack Samochin is a research analyst at Cointelegraph. He holds a bachelor's degree in Economics and has 10 years of overseas teaching experience. Co-author of multiple reports at Cointelegraph Research.

Riley Fay / Student

Riley Fay is the Digital Communications Analyst at the Global Blockchain Business Council (GBBC) and a current student in the M.S. Global Business with Blockchain Technology program at the University of the Cumberlands. Prior to GBBC, Riley worked for SIMBA Chain on the Business Development team, working to bring blockchain education to universities across the world. Riley is also a member of the Fellowship of the Ledger Advisory Board at Portland State University.

Rashad Paige / Student

After finishing his MBA with a Project Management specialization at the University of South Carolina, Rashad Page enrolled in the Master’s in Global Business with Blockchain Technology program at the University of the Cumberlands. He has seeks to transfer his knowledge and experiences in Project Management into new Blockchain projects that are being developed.

Greg Solt / Student

After finishing his B.Sc. in Management Information Sciences at Franklin University, Greg enrolled in the M.Sc. in Blockchain program at the University of the Cumberlands. He focuses his research on use cases such as Supply Chain Management utilizing Blockchain technology. Greg has received several professional certifications in Blockchain Technologies.

Disclaimer

Cointelegraph Research is not an investment company, investment advisor,or broker/dealer. This publication is for information purposes only and represents neither investment advice nor an investment analysis or an invitation to buy or sell financial instruments. Specifically, the document does not serve as a substitute for individual investment or other advice. Readers should be aware that trading tokens or coins and all other financial instruments involves risk. Past performance is no guarantee of future results, and I/we make no representation that any reader of this report or any other person will or is likely to achieve similar results. The statements contained in this publication are based on the knowledge as of the time of preparation and are subject to change at any time without further notice. The authors have exercised the greatest possible care in the selection of the information sources employed; however, they do not accept any responsibility (and neither does Cointelegraph Consulting or for the correctness, completeness, or timeliness of the information, respectively the information sources made available as well as any liabilities or damages, irrespective of their nature, that may result therefrom (including consequential or indirect damages, loss of prospective profits or the accuracy of prepared In no event shall Cointelegraph Consultingbe liable to you or anyone else for any decision made or action taken in reliance on the information in this report or for any special, direct,indirect, consequential, or incidental damages or any damages whatsoever, whether in an action of contract, negligence or other tort, arising out of or in connection with this report or the information contained in this report. Cointelegraph Consulting reserves the right to make additions, deletions, or modifications to the contents of this report at any time without prior notice. The value of cryptocurrencies can fall as well as rise. There is an additional risk of making a loss when you buy shares in certain smaller cryptocurrencies. There is a big difference between the buying price and the selling price of some cryptocurrencies and if you have to sell quickly you may get back much less than you paid. Cryptocurrencies may go down as well as up and you may not get back the original amount invested. It may be difficult to sell or realize an investment. You should not buy cryptocurrencies with money you cannot afford to lose.

Posted Using INLEO

Congratulations @janinleo! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 50 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPHello.

There is reasonable evidence that this article is machine-generated.

We would appreciate it if you could avoid publishing AI-generated content (full or partial texts, art, etc.).

Thank you.

Guide: AI-Generated Content = Not Original Content

Hive Guide: Hive 101

If you believe this comment is in error, please contact us in #appeals in Discord.