Today the Federal reserve,FED released CPI data for July. And,it's not what everyone expected.

It was lower.

There’s a lot of attention being paid to the Consumer Price Index (CPI) today following the news.

CPI is the measure of the average change over time in prices paid by urban consumers for a market basket of consumer goods.

In other words, it measures inflation.

Analysts have so far predicted that the upcoming FOMC meeting could be more dovish(lower interest rates) with a 50 bps in play.

Others have also argued that CPI data peaked in June.(Do your own Research)

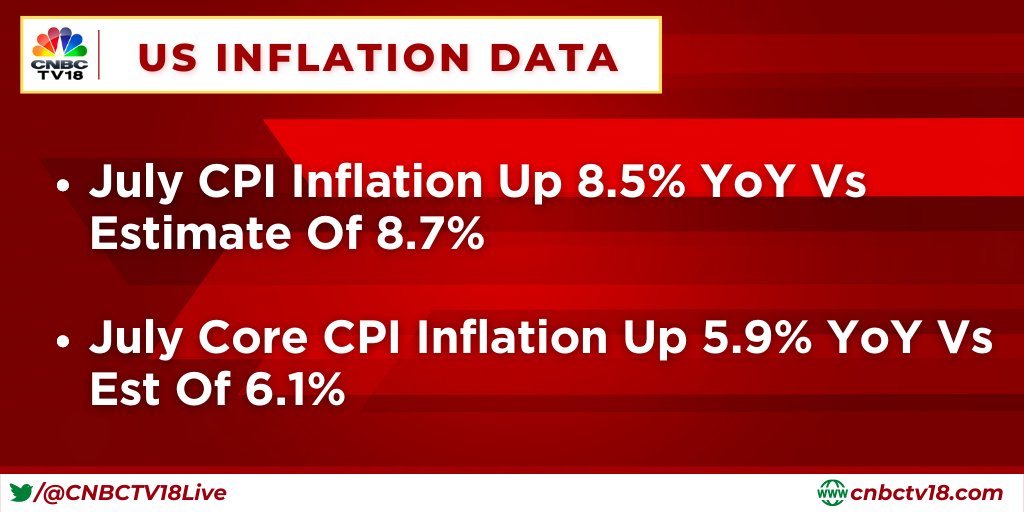

Conversely,CPI data understates inflation because it doesn't capture other scarce assets like luxuries, education, property, artwork among others.CPI data suggests that #inflation is at 8.5% YoY over expected 8.7%.( as it was expected by most financial institutions and players )

#Crypto Markets responded by pumping with #Ethereum at more than 6%,just a few hours after the reading, #Bitcoin hit more than 2% to $24,000.

Play the market as you wish upto the next FOMC meeting in September; so no major data until then.

Let's be on the look for the US 10year yield .

Note: not financial advise, #dyor

Let's link up Twitter

#30daywritingchallenge