While I was on my little break the OP token launched and kickstarted a farming frenzy on Optimism. Things were a bit too crazy during the first few days but now that the dust has settled we can make some realistic estimates.

OP Token Overview

After a lot of wait Optimism finally launched their governance token and introduced a novel governance model that splits governance into two entities - the Token House and the Citizens' House. Token holders can vote on governance proposals or delegate thir voting power to others so the only value proposition for $OP right now are governance rights.

The airdrop itself wasn't executed as everyone wanted since claim contracts were deployed before the frontends so many have managed to claim their $OP drop hours before everyone else causing the token to go as high as $25 and as low as $0.7 per $OP in the first few hours of trading. Everything has settled down after that rocky start only to be shook once again yesterday when the OP team announced a misplacement of 20M tokens that were stolen due to a series of unfortunate events.

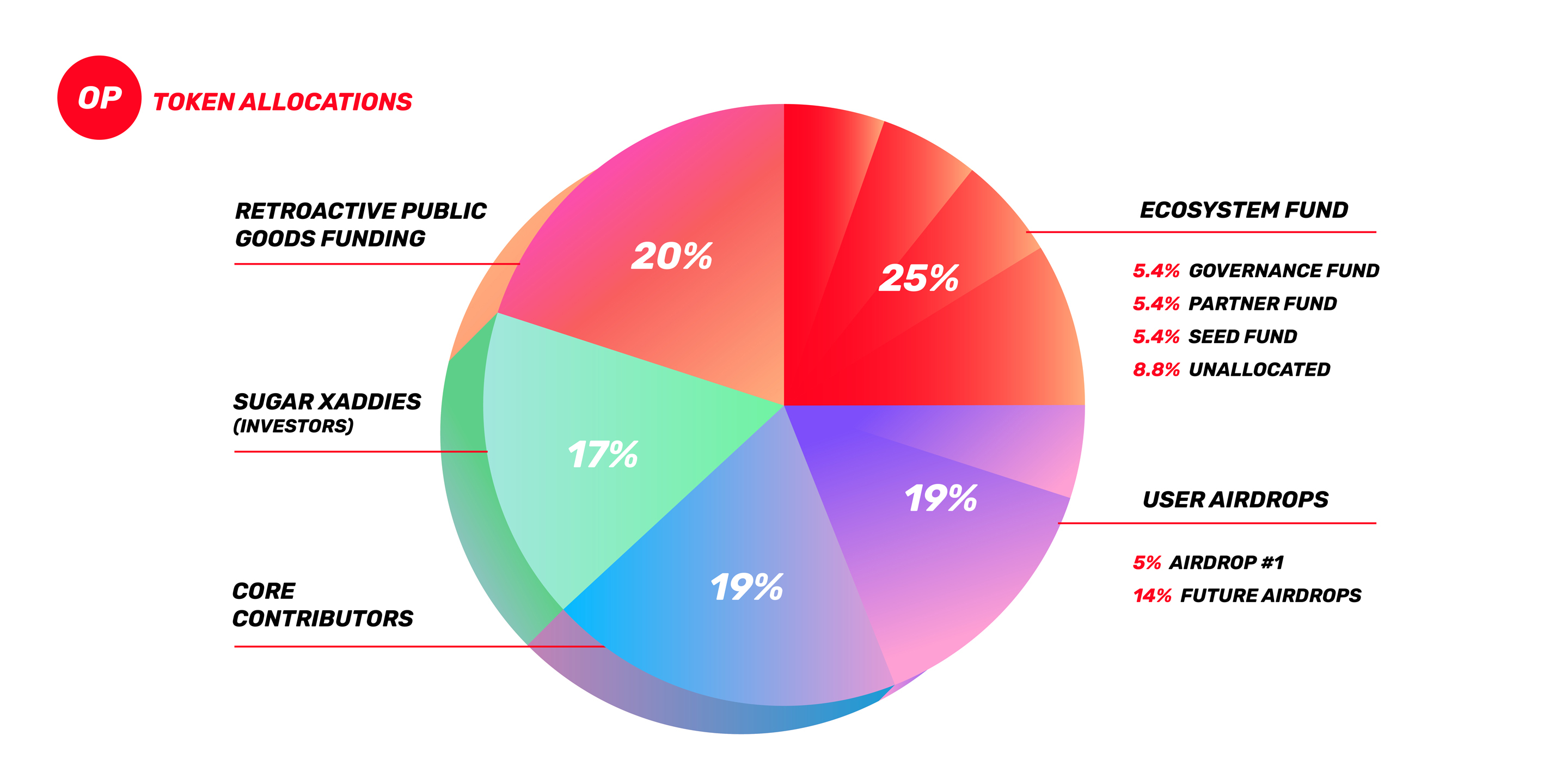

As far as tokenomics go, here is all the info you will need for now:

At genesis there will be an initial total supply of 4,294,967,296 OP tokens. The total token supply will inflate at a rate of 2% per year.

So far only Airdrop #1 tokens have been put into circulation along with some small emissions for project partners meaning that there are roughly ~200M OP tokens in circulation right now.

More on tokenomics and emissions can be found here.

Yield Farming Opportunities

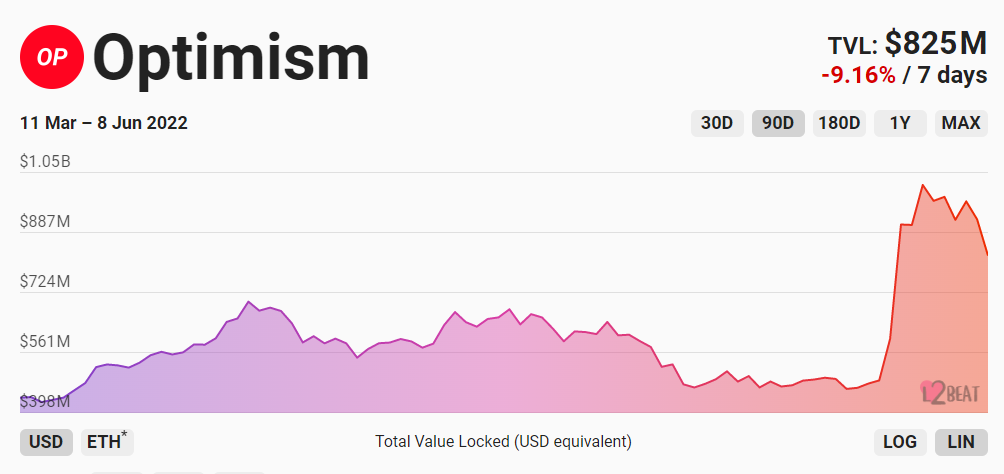

The $OP token launch did generate a lot of activity on the network and brought life to a very boring environment. Liquidity on Optimism got a huge boost in the first two days but the price action is slowly taking it's toll.

Volume on the network is also a bit dry compared to a few days back but you can still find a few good farming opportunities:

- Velodrome

Velodrome launched their Solidly fork on Optimism one day after the $OP token airdrop went live and distributed some $Velo tokens to those that were eligible for the Optimism airdrop. The main aim of the project is to correct the errors made by the Solidly team by introducing different voting mechanics and token emissions. More about the project can be found in the docs.

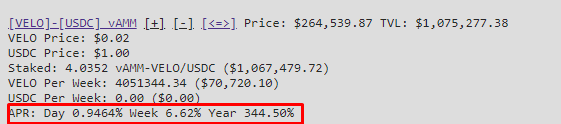

APR numbers are still not visible on the website but you can find all of them using Vfat Tools. The highest paying farm is Velo/USDC with a 344% APR.

- Tarot Finance

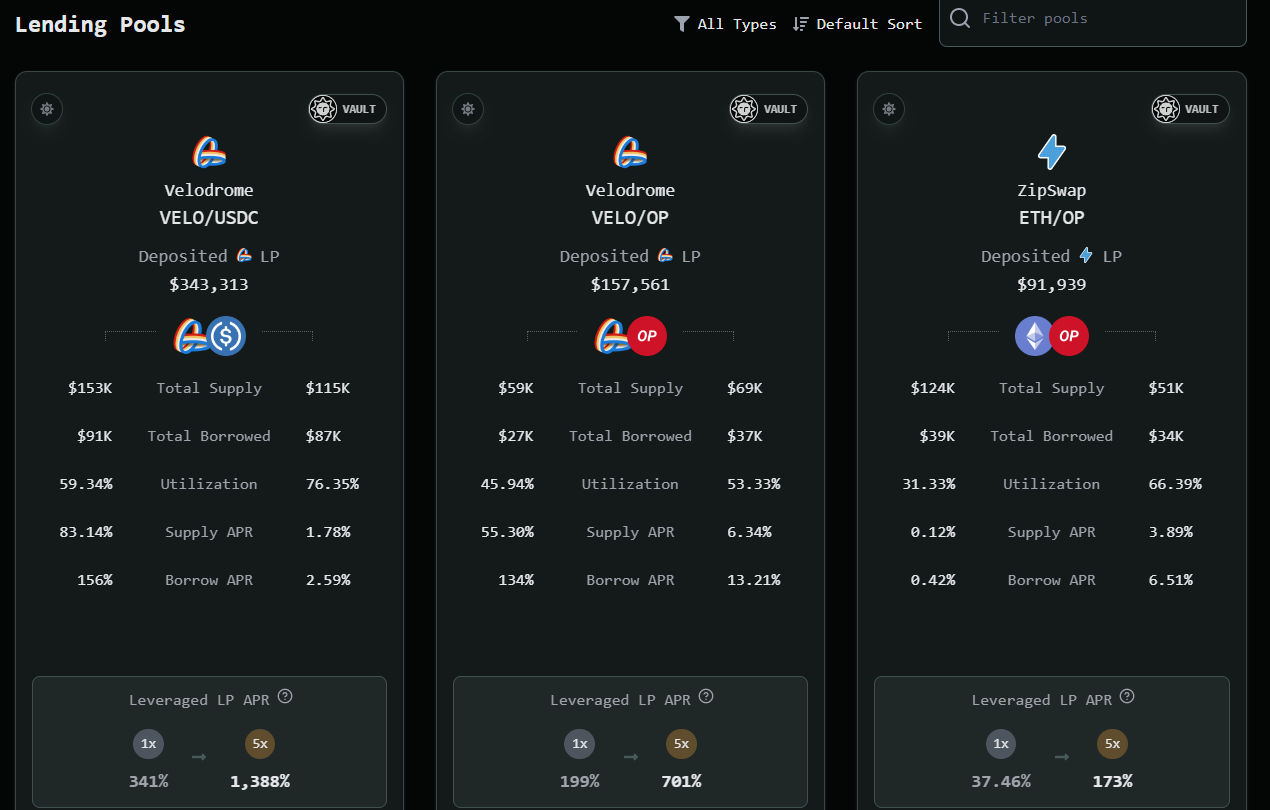

Shortly after Velodrome came to Optimism Tarot also deployed their yield farming tools. With Tarot you can autocompound your farms and even leverage them up to 10X.

When you leverage your position you are borrowing funds from others meaning that you will also have to pay interest rates. These are not static and depend on supply and demand.

Be sure that you are familiar with all of the risks before engaging in leveraged yield farming.

The highest paying farm on Tarot is also Velo/USDC ranging from 340% to 1388% depending on your leverage.

- Liquidity Pool Fee Farming

Optimism has three main AMM protocols and they include Sushiswap, Zipswap and Uniswap. The one thing that binds all three of these is their lack of liquidity. Uniswap is surely leading the charge but if you check the numbers there is a lot of room for earning very high fees wtih very low risk strategies.

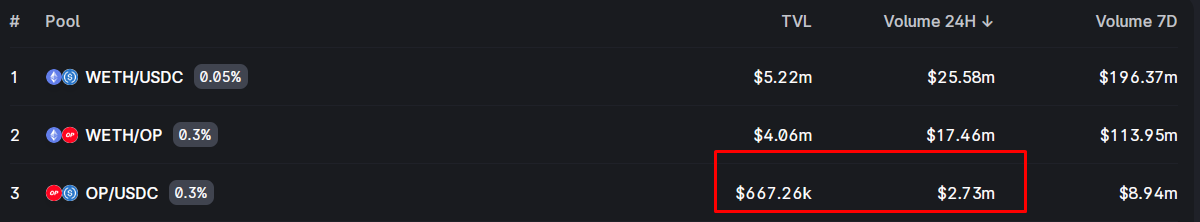

In the past 24 hours the OP/USDC pool has generated $8190 in fees meaning that for every $100 provided as liquidity you would get back roughly $1.22. That is 1.2% daily...

The main reason this pool lacks liquidity is probably the volatile nature of the OP token but Uniswap V3 allows you to be creative with your positions. If you provide liquidity outside of the current trading range Uniswap will allow you to add only USDC or only OP to the pool.

In simple terms, you can virtually program your LP how to behave. Here is a practical example.

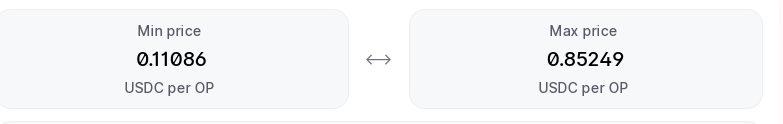

In this pool if OP reaches $4.4 all of my OP tokens will be converted to USDC while at $0.85 all of my LP tokens will consist of USDC. As long as OP is trading within this range I will collect fees and sell OP slowly for profits on the way up.

The second half of my total position sits in a different pool.

This one will generate fees below $0.85 and slowly buy more OP tokens on the way down to $0.11 per OP.

IMO this is the most valuable alpha regarding yield farming on Optimism that no one is willing to share publicly. Do with it what you will.

- Lyra Finance

Stablecoin farmers and those that want pure single-sided staking can check out Lyra Finance. It is an options trading platform that allows you to provide liquidity and earn yield.

Pros and Cons

We are still in the early days so there is a lot of room for "smart farming" but if sentiment continues to deteriorate Optimism farming season may not last as long as we would want it to. For now, the pros are obvious:

Low transaction fees when compared to Ethereum ($0.5 on average)

High yield and auto compounding tools

High volume and network activity

The bad side is that Optimism is still pointless for small investors. A few transactions here and there could burn $10 of your capital in no time and a lot of people can't afford this. People also don't seem to be very excited about new projects like Velodrome if we take price action into consideration.

Posted Using LeoFinance Beta

Great post, as usual. I always look forward to reading your posts, and this is why:

You tell it like it is ;).

Thanks for that!

!LOLZ

Cheers mate. We need more alpha-sharing frogs around here. This is too much work for just one.

Posted Using LeoFinance Beta

lolztoken.com

It is clearly capsized.

Credit: reddit

$LOLZ

Use the !LOL or !LOLZ command to share a joke and an $LOLZ

(1/2)@jerrythefarmer, I sent you an on behalf of @cryptokungfu

One of the main issues with token issuing and allocation is that some times there's not a fair launch and we saw this happen with OP, but we are glad to hear they are back on track and the tokenomics support your statements! We'll definitely give this a more thorough look.

We noticed OPTIMISM and the farms are based on Ethereum, which is great because we recently launched an app that reports every details regarding farms in ethereum, including profit & loss for every farm a user may have with a transaction history.

We would appreciate it if you check it our at https://defireturn.app, any feedback is more than welcome!

Posted Using LeoFinance Beta

Thank you for this analysis.

Posted Using LeoFinance Beta