Have you heard of the Bitcoin S2F model?

If not, then you should make up the lesson. This is an exciting but highly controversial topic related to forecasting BTC prices.

One party believes that it is the "Holy Grail" in the mathematical model surrounding Bitcoin's valuation, while critics of "S2F" believe that it is very far from accuracy and should not be used to predict the future trend of BTC.

We write this article to explain the confusion surrounding the Bitcoin S2F model, explain how it works, and its potential use cases and limitations.

What is the Bitcoin S2F model?

The Bitcoin S2F model is a way to measure the scarcity of assets — more specifically, to measure commodities such as gold and silver — is now being applied to BTC.

For a better understanding, let us look at how the S2F model measures commodities like gold.

In the traditional form, the S2F model is used to calculate the abundance of a resource or commodity (we use gold as an example), taking into account the existing total supply and the annual output of assets.

According to estimates by the World Gold Council , by the end of 2019, about 197,576 tons of gold were mined, with an annual output of between 2500 and 3000 tons.

Now, to calculate the SF model, we divide the total supply (stock) of gold by the annual output (flow) to get:

197,576 / 2,750 = 71.85

Explain that we used the average annual gold production of 2750 in the above example.

As a result of the calculation, the S2F model shows us how much newly mined gold enters the market each year compared to the total supply of gold.

According to our example, it is estimated that it will take 72 years to produce the same quantity of goods on the market today.

As a rule of thumb, the higher the stock ratio, the fewer new gold bars are minted each year compared to the total supply.

Therefore, a high stock-to-flow ratio can theoretically indicate an increase in the long-term value of an asset, indicating that the tool is not only scarce, but also takes a long time to extract the remaining supply.

How does the Bitcoin S2F model work?

Since Bitcoin is generally regarded as a store of value similar to commodities such as gold and silver , a user named PlanB applied the S2F model to digital assets. He published an article on this topic on Medium in 2019 Article.

It is actually very meaningful to apply the S2F model to Bitcoin. Unlike bulk commodities that can only estimate the stock and flow, the supply changes of BTC are transparently recorded on the blockchain.

Although the maximum supply of Bitcoin is capped at 21 million coins, its supply issuance is programmed at the protocol level, so it is predictable.

As part of the deflation mechanism, in the Bitcoin halving event , the number of BTC created every 210,000 blocks (about once every four years) will be reduced by half.

After the last halving in May 2020, the block reward has been reduced from 12.5 BTC to 6.25 BTC.

According to the statistics of Blockchain.com , 18.595 million BTC have been mined, with an annual flow of 328,500 BTC (before the next halving event, approximately 6.25 BTC were mined every 10 minutes).

Therefore, the ratio of Bitcoin stock to flow is equal to 56.60, which means that it will take nearly 57 years to mine the current total supply of BTC (regardless of the maximum cap and halving).

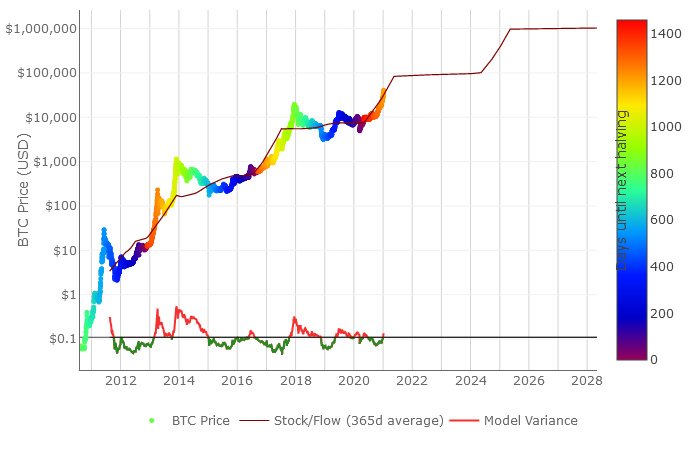

In addition to calculating the stock and flow of BTC, PlanB also compares the Bitcoin S2F model with BTC prices to (potentially) predict the future value changes of digital assets.

From the chart calculated by the author , we can see that the BTC price more or less follows the 365-day average of the Bitcoin S2F model. In fact, during the period from April 2020 to January 2021, its predictions have been quite accurate.

Limitations of the S2F model and the criticism it faces

Although from a historical point of view, the ratio of bitcoin stock to flow may show a certain correlation with BTC, the model obviously has some limitations in predicting the future value of bitcoin.

For example, the model only takes into account the supply of Bitcoin, but does not consider the market demand for Bitcoin.

Supply and demand are the two main factors that determine asset prices. For this reason, although the stock and flow ratio of BTC will rise in the halving event every four years, if there is a huge drop in demand, its price will drop significantly.

In addition, the Bitcoin S2F model does not take into account the following factors that may have an impact on asset prices.

- Black swan event: In the economic field, the black swan event represents an unpredictable event with serious impact, especially on asset prices. As far as Bitcoin is concerned, the Black Swan incident may have been caused by a major regulatory crackdown, which prohibits people from buying and selling cryptocurrencies. In theory, if something happens, the price of BTC may be severely hit.

- Volatility: Although Bitcoin's volatility has decreased significantly in the past few years, Bitcoin is still subject to severe price fluctuations. After a significant decline in value during a period of high volatility, many investors may panic sell their bitcoins and liquidate the long positions of traders, leading to a sharp decline in the price of BTC.

Some critics go further. Nico Cordeiro, Chief Investment Officer of Strix Leviathan, will use the Bitcoin S2F model to reveal future price changes and compare financial results based on astrology .

The importance of delving into it yourself and drawing conclusions based on it

The Bitcoin S2F model is a fairly controversial topic in the crypto community.

Regardless of whether the model is effective in practice, it is important not to base important investment decisions solely on S2F Bitcoin price predictions.

The market is complex, and many factors play a role in price discovery. Therefore, it is impossible for anyone (and mathematical models and algorithms) to accurately predict the future long-term price changes of an asset.

However, the Bitcoin S2F model can be a useful tool that allows people to understand the scarcity of Bitcoin and cultivate a long-term value investment thinking, rather than just focusing on temporary price fluctuations.

Posted Using LeoFinance Beta

This is new to me.

Thanks for this update, @jessn0limit.

Posted Using LeoFinance Beta

S2F is an excellent model of one factor which plays a dominant role in btc pricing at this time. Excellent post.

Posted Using LeoFinance Beta

Although altogether different in purpose and complexity, this reminds me of the famous Black-Scholes Model for pricing options. What is interesting to me is the psychology of people represents a fairly well-known set of behavioral patterns. When enough people are given access to the same information, they can act in fairly predictable ways. For example, look at how everyone can point to support and resistance and trendlines and such on charts, and convince themselves their effective chartists. I believe most people apply the same parameter values for all the chart indicators they use, and thus end up not acting very independently at all.

What I'm Getting At

Black-Scholes came from an academic analysis, and was publicly available. It remains useful. But years ago I read about a trading company that did quite well with a proprietary model they'd spent a ton of money to develop. They claimed it was indeed more accurate than the model everyone else was using. Let's assume they told the truth and their customers were happy with the trading edge they benefited from. That pricing model remained proprietary.

When only Ed Seykota had access to his exponential moving average trading system, he had a true advantage. As it grew in popularity, people started trading the same way, and it became both more and less reliable (see above on everyone using the same parameters, and I now recall Seykota didn't invent the EMA).

This Stock-to-Flow ratio is very interesting, and potentially useful. What happens to all those who blindly use it to guide their trading, to reinforce whatever predispositions they have about Bitcoin? They'll exhibit the same behavior, and like an increasing use of a given arbitrage scenario, the potential advantage of S2F as applied to Bitcoin will become more mysterious and could dissipate.

The fundamental calculation would remain the same, but the result in the market of a bunch of messy traders acting upon the same information in the same way could force a change in the way it must be used in order to remain useful. I'm not attacking it at all; I'm curious to learn more. I'm merely instantly fascinated by both the danger and utility of such a calculation, as it becomes more broadly known and applied in people's trading toolbox.

And as you say:

Cheers!

Posted Using LeoFinance Beta

More info why you see this.

Posted Using LeoFinance Beta