A project I'm developing a keen interest in is Comdex. They are building a Dex for synthetic assets, focusing on Commodities, as well as some other use cases. Currently there is a Liquidity Bootstrapping pool underway on Osmosis. I just pulled the trigger and started accumulating CMDX.

In my post a couple days agodetailed guide to the process. Given my familiarity with Osmosis I figured it would not be an issue. So here is the step by step of what I did: I looked at the launch, and the Liquidity Bootstrapping Pool. Also, @nulledgh0st posted a

- Find some spare assets.

- Send them to Binance.

- Trade to ATOM.

- Then I hit a roadblock. ATOM withdrawals from Binance were suspended (native anyway). Impatient me figured I'd withdraw on BSC and then bridge across. But with Binance bridge now closed, I wasn't sure how to do that. So I waited for a while to see if they would restart ATOM withdrawals.

- After a couple hours, I got impatient. So I traded those ATOM's into LUNA.

- Withdrew LUNA to my Keplr wallet.

- Deposited to Osmosis.

- Traded to ATOM.

- Traded via the LBP into CMDX.

- I ended up doing this process twice for two different amounts that I gathered.

Where to stake CMDX?

My goal is to build a decent stake of CMDX for the long term. Getting these tokens I have just acquired staked is a priority. The Comdex team have tweeted out a couple of options to get started. As the chain does not have full Keplr access set up, other options are needed at this early stage.

I used the Omniflix option as it is a much more familiar project to me. But having a look at the Unagii app, it seems like a decent option also. But either way, they will prompt you to add the Comdex chain to Keplr. This will add a wallet in the "Beta support" section. I have no idea for Ledger or other options how this works, or even if there is any other options yet.

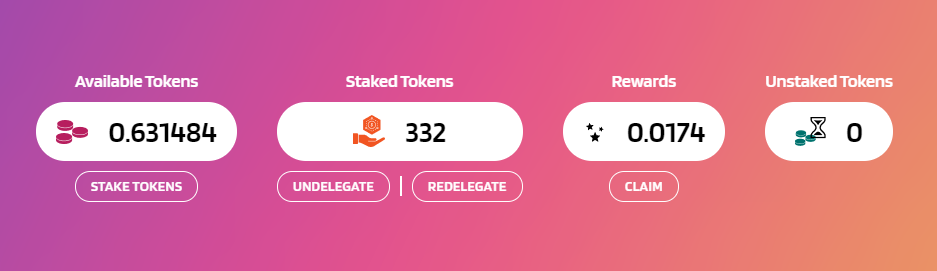

Once your wallet is linked, in my case to the Omniflix site, the UX is pretty good. A straightforward withdrawal from Osmosis to your wallet, and an equally straightforward staking process through the OmniFlix UI. Always remember to keep a little amount unstaked, to cover transaction fees when they come up. Inflation is running at 30% at the moment, and the current supply of CMDX has a very high staking level.

So there it is, the start of my Comdex stake. These tokens I acquired at an average price of $2.65 each. This price could fluctuate a lot, depending on how the remaining LBP process unfolds. However, when I add in my airdrop, then my average cost per token will come down significantly. What the final price from the LBP ends up is anyone's guess, but I'm hoping it is well supported and the price does not decline much more.

My CMDX is proudly staked with GhostStake - the validator for Comdex being run by @nulledgh0st. Please do your own research, this post is not financial advice, just my personal thoughts.

Thanks for reading,

JK.

EDIT

I just bought some more at $1.77 each. My average price now is $2.27 each if anyone is interested.

Further links:

- Guide to LBP by @nulledgh0st

- Comdex launch underway by me.

- The LBP on Osmosis

- Comdex twitter

- Comdex website

- Airdrop checker for CMDX

- OmniFlix website for staking

Posted Using LeoFinance Beta

Great. I am lost :P So, I bought ATOM inspired by your series of posts. How do I get into COMDEX? Will I still be eligible for airdrop if I start now?

Posted Using LeoFinance Beta

Airdrop snapshots are already done. Buying now won't qualify for the drop unfortunately.

To use your ATOM's to buy CMDX...

Posted Using LeoFinance Beta

What about the reward the osmosis AMM home page displays? They have that 10 day snapshot ongoing now.

Posted Using LeoFinance Beta

Hmmm, I'm not seeing that. What link is that on?

Posted Using LeoFinance Beta

Sounds like and interesting project and thanks for the step by step break down.

I have to laugh about the "find some spare assets.. lol, it's that time of the season! :)

Posted Using LeoFinance Beta

Haha, finding spare assets is half the battle these days. I keep staking and pooling, and then keep scrounging to find more liquid assets to use.

Posted Using LeoFinance Beta

The rewards earned on this comment will go directly to the person sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

I wish there would be alerts on Leofinance, so I could always read your posts asap, keep up the good work!

Posted Using LeoFinance Beta

Glad you enjoy my posts. A notification method so you get an alert when your favorite people post would be a good idea.

Posted Using LeoFinance Beta

Thats exactly what i was thinking :)

Posted Using LeoFinance Beta

Woot woot, much love! I was wondering if that was you that's been delegating, haha. I didn't realize it was live on Omniflix - good stuff!

We're now in the $1.50s, interesting timing for price discovery with this market correction. I definitely think sub $3 is a bargain, stack stack stack :D

Made one last buy (for now) at 1.29.

My average buy in now (including the airdrop coming soon) works out at $1.67. Happy with that. Now I'll let staking rewards bring that down over time, and pick up small amounts every now and then from Osmosis income.

We'll see what happens - crappy market conditions to have an LBP running. May be impacting the enthusiasm short term.

Posted Using LeoFinance Beta

Nice, glad you were able to DCA downward to at least a quite reasonable point, even considering where the price is now.

I'm focusing on promoting things now (both our validators/people staking to them, and the tokens themselves) via Twitter/etc, and having my team start to work their magic on that end as well.

Also will be throwing up another Comdex post later, PLUS a JUNO post (I think this is going to be an INSANELY huge project, that is being overlooked by so many, but there are already more dApps in development than the entire Cardano ecosystem has) - easily see a 10x+ here in the next 1-2 years.

Market conditions suck, but also the best time to buy. Definitely affected the LBP, but i mean they kinda got unlucky / shoulda launched a bit sooner (they were supposed to do this over a week ago supposedly).

Posted Using LeoFinance Beta

Juno is definitely one to watch. I've got mine pooled with OSMO. Just riding along.

Good luck with it all mate.

Posted Using LeoFinance Beta

I also have a small amount (~$500) pooled in the JUNO/OSMO pool, but those extra rewards run out in a few days, and the APR will no longer be worth it. Better off staking each individually and earning about 20%+ more each, while also eliminating Impermanent Loss risk, and also maintaining eligibility for airdrops.

Posted Using LeoFinance Beta

That is what peeked my interest. For now I'm all things HIVE but eventually I'll stop having all my eggs in the same basket. Good luck with your investments.

!BEER

!PIZZA

PIZZA Holders sent $PIZZA tips in this post's comments:

(5/8) @rentmoney tipped @jk6276 (x1)

Learn more at https://hive.pizza.

They have an airdrop for Luna stakers also but it requires a 0.01 payment I wasn't sure if it was real or scam. Is it a good project?

The project is legit, as far as I can tell. My airdrop was pretty small, but I've been actively buying some more each day to build to a target amount. Once I hit that target, then I'll use the stake income to build an LP position.

One of the better projects I think personally. Long term play for me and if they gain adoption it could be significant.

Posted using LeoFinance Mobile