'Getting rich slow' is the principle we all gathered around LBI, didn't we. No doubt about that. However, when we decided to take part in the project, we were also told it's a community governed project. So let me just put few things to vote before we re-launch the LBI.

1, 2, who put his shoulder to the wheel and decided to take over the project. He also presented his views and paths he thinks LBI should follow.Before you proceed with this post please get familiar with posts by @jk6276,

Yet, it does not mean we, as LBI stakeholders, should agree with it to the thinest detail. The idea of a community project relays on community have a say in the project.

1. @jk6276 idea:

So, aside from HIVE power and LEO power, here are the assets I’d like to build into LBI’s balance sheet:

HBD – as mentioned above, half of the yield would go to liquid income, half would remain in HBD and compound into savings. This gives a growing asset, and a growing income over time. The main risks are a HBD de-peg event (small risk but must be noted) or a decrease in yield (fair chance of this happening at some point in the future). Goal would be a minimum of 5000 HBD to begin with. This would yield asset growth of around 19 HBD per week, and the equivalent in LEO (roughly 240) going straight into the income distribution wallet, significantly boosting this from the start.

2. My amendment

- Let's get to 5k HBD goal as soon as possible, until then no dividends.

- Let's use all liquid rewards (HBD savings, author rewards, Leo etc), to get to target of 5k HBD in savings.

The reasoning

HiveBackedDollars (especially against Leo-sphere investments) has proven to be reliable and trustworthy leg of Hive ecosystem and quite safe investment. Hive has introduced mechanisms to keep it pegged. Of course past events do not guarantee any future ones, but in our decision making we cannot omit how the HBD performed.

We stopped getting the dividends eo that the project would grow, unfortunately, the Leo part underperformed and we didn't get the growth we expected.

'All on Hive' means less on Leo and even though the Leo token is central to LBI project, why waste more money on something that doesn't perform? Why invest more into project that did not listen to us and purposely made us a horrendous damage? Let's keep LBI project denominated in Leo, but let's keep growing our wealth on Hive as it has proven to be better option. If this vote would succeed, LBI would still use Leo so in the long run, it will support Inleo ecosystem better (since the better performance).

What is more, @jk6276 wrote we need to go 'All on HIVE' and I agree we need to focus on Hive (with small exception in terms of our BTC and ETH holdings, which I think should stay the way they are now). Accepting my amendment and holding more HBD is pro Hive - if it wasn't the case why would witnesses vote 20% APR on HBD savings?

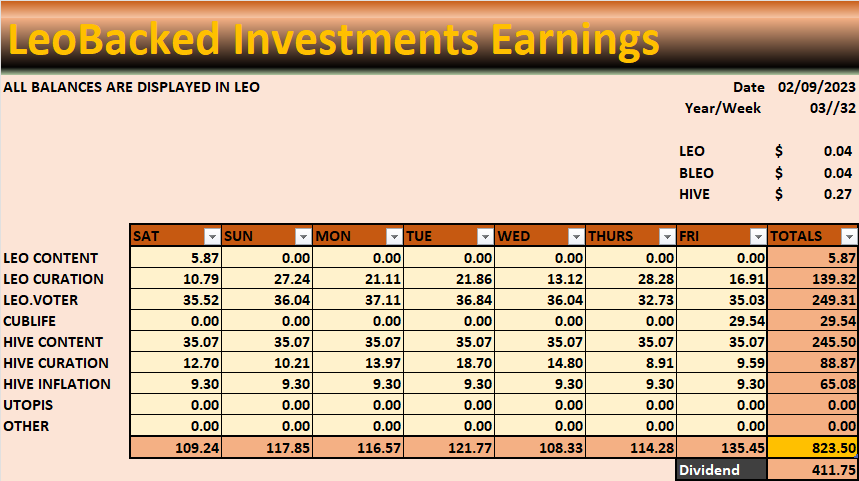

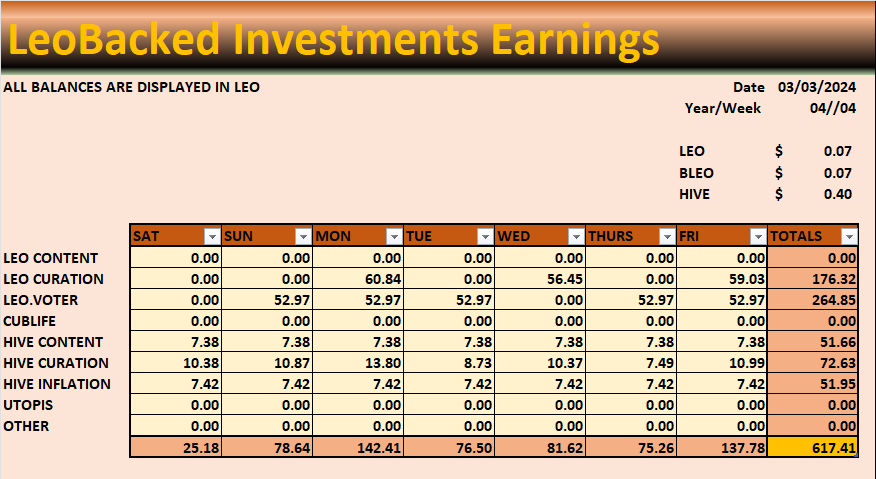

Please look at earnings report

Source: https://hive.blog/leofinance/@lbi-token/lbi-earnings-and-holding-report-or-year-03-or-week-32

Source: https://hive.blog/leofinance/@lbi-token/lbi-earnings-and-holding-report-or-year-04-or-week-04

Our income comes from Hive, not from Leo - compare Leo curation, Leo author rewards to Hive (inflation, curation, author and leo.voter).

This image was generated by canva and I couldn't resist to post it

If I remember correctly I should call @bozz and @alexvan @lbi-gov

I'll also call @silverstackeruk @trumpman and @taskmaster4450

50% rewards are set to @lbi-token

I more or less agre with the sentiment. I also dont care much about divs, i'd prefer em to go towards token appreciation and for establishing a pool or whatever other option there is for easy investor exit. Hey even a manual token swap on request basis with a small fee is fine by me!

So if vote is set to happen you may vote for my proposition - HBD is easily claimable, it takes 3,5 days, but it's easy to unstake it

Well let's see if there's a vote first and the options? 😄

We'll see 😂