I'm actually pretty positive about the current direction #cub is heading. Just, tell me if I'm wrong, when liquidity of HBD/Hive pools 1/2

I'm actually pretty positive about the current direction #cub is heading. Just, tell me if I'm wrong, when liquidity of HBD/Hive pools 1/2

2/2 goes up, the yield goes down. If it's down, not many new bHBD are being minted and less revenue for cub buybacks. Am I right? We may get to the point that these buybacks will be not as significant as they are now.

Yes, when liquidity is added the bHBD/bHIVE LP, yield goes down.

But remember this yield is paid in CUB tokens, not bHBD.

There is no bHBD being minted here.

Of course, I'm talking about lesser incentive for HBD holders to mint bHBD which gives less funds for cub buybacks. So the problem is, we will reach the threshold where yield goes down to a point it won't be feasible to mint bHBD. And there will be no or little funds to buy cubs.

Do arbitrage trades generate funds for multi token bridge cub buybacks?

It is just a manner of offering incentives - Something that on the centralised Cub, Khal is in control of.

If he keeps them higher than the 20% you can get by putting your native HBD in savings, you will always get people putting them through the bridge and pooling.

Yep, trading fees for all the arbitrage churn generate revenue.

Once liquidity in the LPs gets really fat, it's here that will generate more revenue for CUB buybacks than new deposits.

Every time someone takes native HBD and bridges it to BSC via the LeoBridge, Cub takes a fee.

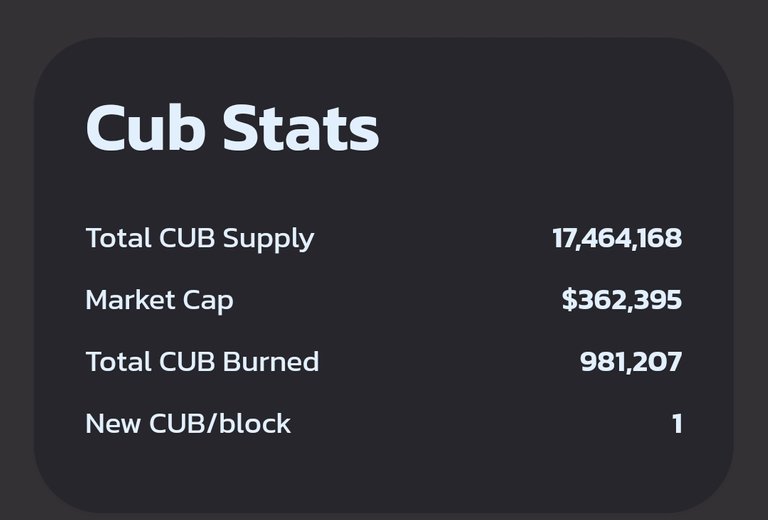

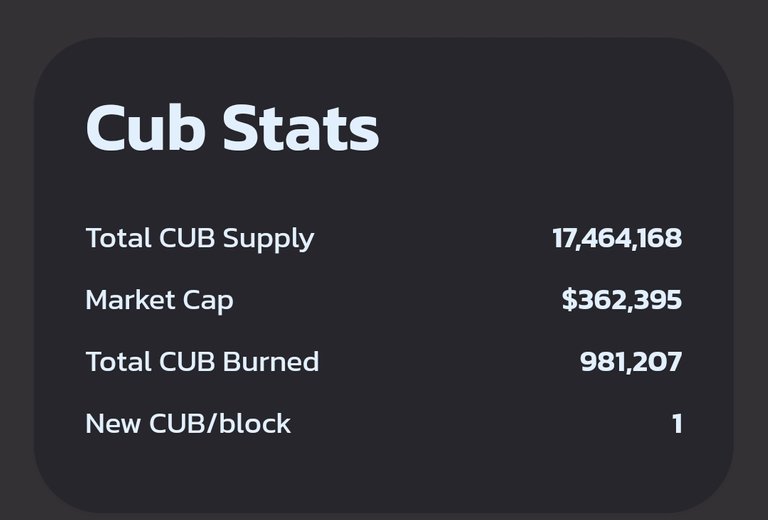

This fee is used to buy back and burn CUB.

While the yields will go down as more money is added to the LP, the fact that LP has more liquidity will allow people to do bigger arbitrage trades.

Thus generating more bridge fees and bigger buy backs.

More liquidity is a net positive!