The crypto world is seeing innovation with each passing day, and it is an indication that cryptocurrency is here to stay.

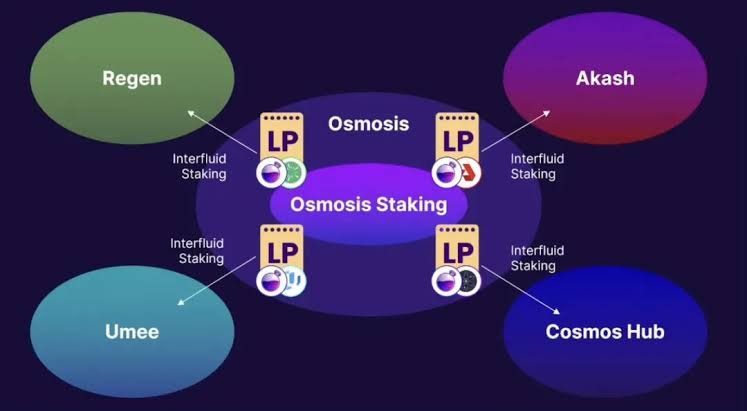

Osmosis, the first decentralized Automated Market Maker on the cosmos Ecosystem has announced the introduction of SuperFluid Staking in their Ecosystem.

Many investors are anxiously waiting for the novel staking to kickoff but are also concerned about the fate of the APR of pools.

There has always been a huge APR for Liquidity providing on decentralized exchanges which is the main reason why people prefer it to single staking. Now, with the coming of Superfluid Staking on osmosis Dex, there are fears that APR will drop drastically for pools that will be eligible for the Superfluid staking.

What is Superfluid Staking?

In providing liquidity, the liquidity provider has to contribute an equal amount of the two tokens ( 50%/50%) to the pool. For example, to join the OSMO-ATOM pool with $1000, you need to combine $500 OSMO and $500 ATOM to generate $1000 worth of LP token. With Superfluid Staking, the LP provider in addition to earning liquidity rewards earns staking rewards as well.

How is this achievable?

Using the OSMO-ATOM pool as a case study, the Liquidity provider stakes 50% of the OSMO contribution to a validator and earns staking rewards from it. For a pool with 100% APR and a contribution of $1000, the LP provider earns 0.27% ( $2.7) per day. By Superfluid Staking, he delegates 50% of the OSMO to a validator. Assuming the APR for delegating to the validator is also at 100%, the LP provider earns also 0.14% daily profit ( $1.35) for the 50% OSMO contribution. This means he earns a combined total of $4.05 from the OSMO-ATOM pool.

Now, for investors to enjoy this amazing reward, the APR will certainly decrease to balance the scale and make the process sustainable.

Also, removing your LP token will come with a longer unbonding period. Normally on the Osmosis Dex, one is free to select a day unbonding period, 7 days Unbonding, and 14 days unbonding period. Because part of the tokens can be delegated to validators, there will likely be only two weeks unbonding period to sustain the proof of stake mechanism used by validators. This means that those who want to enjoy the superfluid staking will be ready to wait for a minimum of two weeks to receive their tokens. The challenge with a longer unbonding period is the fact that one may lose out from the bull market. The crypto market is very volatile and as such, the end of the unbonding period may be the time when the market is on correction.

Amidst these concerns, the Superfluid innovation will present to investors a better way of putting their assets to work. So, should you be interested in earning through Superfluid staking, now is the best time to bag some OSMO.

Just a tip, the cosmos network is growing rapidly and many projects are coming into the ecosystem. The good thing here is that new projects start by airdropping a certain amount of tokens to stakers and Liquidity Providers on the cosmos network. The Airdrop is usually massive. Neta airdrop rewarded people with $3k plus worth of tokens, 60% of Stargaze airdrop gave people between $500 to $700, Huahua rewarded people up to $1000 worth of tokens, and many others, just in 2022 alone. If you love passive rewards, you should consider the cosmos network.

NOTE: THIS IS NOT A FINANCIAL ADVICE. ENSURE TO DO YOUR RESEARCH.