Let's talk about inflation...

“Inflation is always and everywhere a monetary phenomenon” — Milton Friedman

What is Inflation?

Within ‘Orthodox’ (actually neo-classical — why do they get to decide what is orthodox?) economics, inflation is typically defined as the rate of increase in prices over time. Within the context of a national economy, there are close relationships between the monetary base and price levels. In some heterodox economics schools, such as Austrian economics, inflation is explicitly defined as expansion of the monetary base. The monetary base is the total amount of money circulating in the economy. There are several ways of measuring the monetary base, which makes the debate particularly challenging. If your opponent claims there is no relationship between monetary base and inflation, you accuse them of measuring the monetary base incorrectly!

The actual monetarist argument is more nuanced:

Monetarist theory is governed by a simple formula: MV = PQ, where M is the money supply, V is the velocity (number of times per year the average dollar is spent), P is the price of goods and services and Q is the quantity of goods and services. Assuming constant V, when M is increased, either P, Q, or both P and Q rise. — Investopedia

This means that as long as money moves through the economy at a consistent rate, an increase in the monetary base will result in increased prices, increased output, or some combination of the two. Constant velocity worked as a fundamental assumption for many years . . .

A Joke

I heard this joke when I was studying economics as an undergraduate student:

An engineer, a chemist, and an economist are stranded on an island. After some days, a crate of canned goods washes up on shore. They begin discussing how best to access the food. The engineer starts talking about banging rocks together to get a sharp broken piece that can be used to open the cans. The chemist wants to put them over a fire so the building pressure within the cans will cause the metal to warp and break open the seals at the top. After listening a few minutes, the economist interrupts: “You’re going about this all wrong!! First, assume that we have a can opener…”

It is common for economics arguments to depend on assumptions that don’t stand up to scrutiny in the real world. Can you really hold velocity to be a constant?

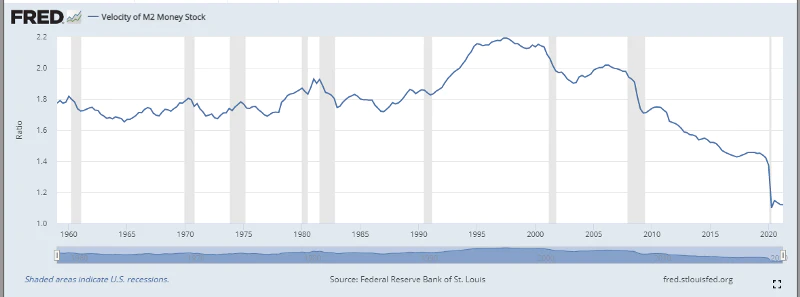

img src: St Louis Federal Reserve

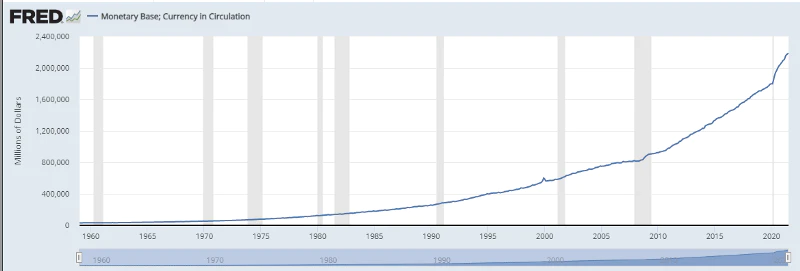

The Milton Friedman quote that we opened with is from a 1970 paper. In the decades around that argument, holding velocity constant (within a relevant range) was a reasonable assumption. In the last decade, the assumption has completely broken down. This allowed for a rapid expansion of the monetary base with minimal price inflation — but notice the sharp angle changes during in 2009 and 2020.

img src: St Louis Federal Reserve

Inflation and Bitcoin

Bitcoin was originally released right as the expansion of the U.S. monetary base accelerated in the ‘great financial crisis’. The dominant narrative for much of its life (particularly since the latest halving) has been an anti-inflation argument:

Fiat money will continue to expand its monetary base over time. The pace at which bitcoin’s monetary base expands is now slower than the pace at which USD monetary base expands. Over time, these differences will result in a rising bitcoin value (bitcoin is a superior store of value to USD, and likely a superior store of value to gold).

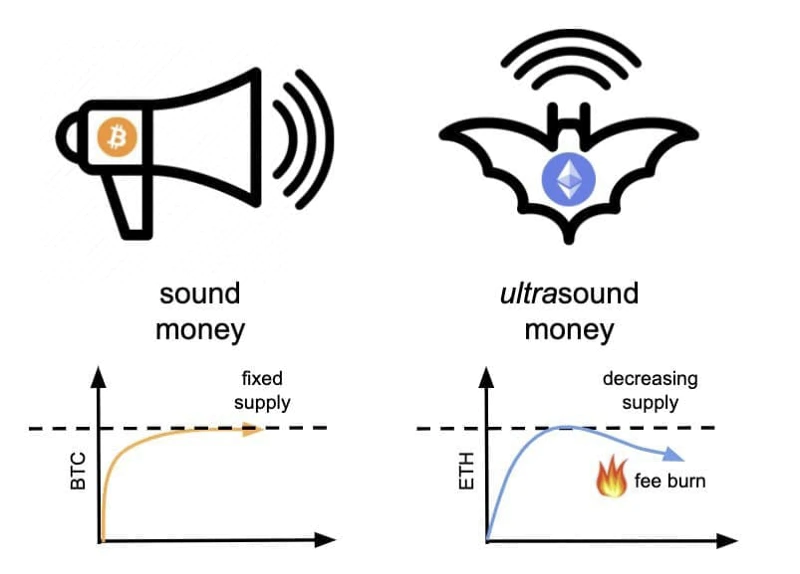

Leading up to EIP-1559, Ethereum has begun to carry this same narrative. Burned transaction fees could result in a decrease in Ethereum’s monetary base, making ETH an ‘ultra sound money’ compared to bitcoin’s slowed monetary expansion, which is only ‘sound money’.

If MV = PQ, then the lack of price inflation from the recent hyper-expansion of the USD monetary base is only because of the record low velocity of money. If monetary velocity picks up, we could move into a hyper-inflationary price environment even if there is no further expansion in the monetary base! This seems to strongly support the long-term HODL thesis that underlies the crypto markets.

What about Tokenomics?

Individual crypto projects have their own release and distribution schedules, commonly referred to as “tokenomics”. Since tokens are not the established currency of national economics, we need to think about variations of MV = PQ.

M is still the monetary base, but now we are looking at the total tokens outstanding, and their token emission plans. (Market capitalization). While some tokens are “locked”, I would argue that all tokens that have been created are the current monetary base. Inflation in crypto discussions almost always refers only to M- the rate at which new tokens become available.

V continues to represent velocity… the rate at which tokens normally change hands within a community. This is where time-locks and staking strategies come into play. ‘Locked’ tokens slow the overall velocity for a particular crypto ecosystem.

PQ together are a measure of economic activity. Price times quantity of goods the token is used for. We’re looking for utility… what usefulness does the token actually have? Even though we know the primary use of every cryptocurrency is speculation.

When demand for a token, for either ‘utility’ or speculation, exceeds the rate at which new tokens become available, MV — monetary expansion or increase in velocity (tokens coming out of time-lock) the token price will increase.

When demand falls to below the MV — too much monetary expansion, or too many tokens coming out of time-lock, the token price will decrease.

Fundamental analysis closely looks at tokenomics and anticipated utility (long-term factors), with less attention paid to speculative adoption. Technical analysis focuses on price action, using various analytical tools, under the assumption that all speculative and utility demand is incorporated into the price.

Summary

Inflation narratives drive the ‘macro winds’ that push the whole cryptocurrency market along. On a micro level, the inflation of tokens for particular projects is a dominant factor in their individual token performance. Adoption of any token has to continually outpace that token’s release schedule (colloquially “inflation”) in order for the token to have upward price movement. Projects with ‘good’ tokenomics may be more resilient to sudden changes in speculative demand, because there is ‘utility’ demand.

Understanding the macro inflation narrative, along with individual project tokenomics can help you better assess and manage the potential risks of your crypto. In the long-term, better risk management usually results in better outcomes!

If you found this helpful or informative, please like, subscribe, and share! Either way, please let me know what you think.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. Additionally, the Savage Corner writers hold crypto assets and actively trade in certain markets.

Posted Using LeoFinance Beta

With the USD as reserve currency of the world, inflation was exported and spread out throughout the world partially explaining why they have been able to do this for decades without immediate inflation. Even so we are now seeing rapid inflation which shows how much they are expanding the monetary base.

Correct me if I'm wrong here but Ethereum doesn't have a maximum cap on its coins so even though they are being burned they are also being created offsetting the burning.

https://etherchain.org/burn

Inflation is a form of unofficial taxation and it always ends the same way with the devaluation and eventual collapse of the currency. BTC can't be inflated to zero and I look forward to the day when countries abandon central banks and use BTC as their currency which will help all people apart from those running our current corrupt central banking system.

Yes, I think this exporting of dollars has been a big contributor to the massive decline in monetary velocity over time.

That's correct. Notice that I said "Burned transaction fees could result in a decrease in Ethereum’s monetary base" instead of "Burned transaction fees will result in a decrease in Ethereum’s monetary base". There would only be a decrease in Ethereum's monetary base during periods where burned transaction fees more than offset the issuance. Under Proof of Work, those periods are rare, under Proof of Stake they could become much more common.

BTC also has steady inflation; it is only considered deflation relative to other currencies that all have higher deflation rates. (It is possible, but unlikely, that the ongoing 'loss' of BTC due to poor key storage is already greater than its inflation rate. If so, then BTC is technically deflationary.)

Don't get me wrong, I like Bitcoin and I hold BTC in my portfolio, but potential investments should always be considered relative to your other opportunities. A maximalist position is intellectually weak, unless it is constantly reexamined in light of other narratives and new information.

This is awesome man but way above my ability to understand fully. How will the price of BTC fair now that it seems the inflation of the dollar is finally being seen as a bear in bull's clothing...

I personally think that 25k is going to hold, but we're likely to see some more chop between current levels and 25k before we start breaking into a clear uptrend. I'm not the best chartist though; I seem to do better when I focus on fundamentals.

!gif chop chop

Via Tenor

I agree with that statement. Overall the 30k resistance level doesn't seem to hold and I think we will see lower levels in the near future.

Posted Using LeoFinance Beta

Fact is that inflation is built in by the Keynesian economists. It is in fact a form of taxation as we are borrowing from the future and that doesn’t come without a cost obviously. Is it the wrong approach, I don’t know, it sure hurts sometimes for a lot of people!

Discord Server.This post has been manually curated by @bhattg from Indiaunited community. Join us on our

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

Please contribute to the community by upvoting this comment and posts made by @indiaunited.

I learn things

!PGM

BUY AND STAKE THE PGM TO SEND A LOT OF TOKENS!

The tokens that the command sends are: 0.1 PGM-0.1 LVL-2.5 BUDS-0.01 MOTA-0.05 DEC-15 SBT-1 STARBITS-[0.00000001 BTC (SWAP.BTC) only if you have 2500 PGM in stake or more ]

5000 PGM IN STAKE = 2x rewards!

Discord

Support the curation account @ pgm-curator with a delegation 10 HP - 50 HP - 100 HP - 500 HP - 1000 HP

Get potential votes from @ pgm-curator by paying in PGM, here is a guide

I'm a bot, if you want a hand ask @ zottone444

👍💪🇦🇷

Dear, @josephsavage

found hereMay we ask you to review and support our @cryptobrewmaster GameFi proposal on DHF? It can be

If you havent tried playing CryptoBrewMasteravailable here on the YouTube with a pitchdeck of what we building in general you can give it a shot. Our @hivefest presentation

Vote with Peakd.com, Ecency.com, Hivesigner

Thank you!