Another week and another massive BTC consumption week for Grayscale

Grayscale continues to buy more BTC each week than is being created...

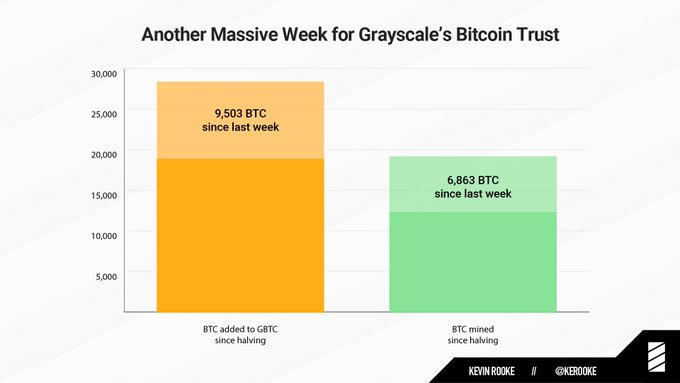

This last week Grayscale and their bitcoin investment trust (GBTC) have added 9,503 to their trust.

Over that same time period only 6,863 new bitcoin have been created.

That means Grayscale consumed almost 150% of the newly created BTC last week!

(Source: ~~~ embed:1268642107486593024) twitter metadata:a2Vyb29rZXx8aHR0cHM6Ly90d2l0dGVyLmNvbS9rZXJvb2tlL3N0YXR1cy8xMjY4NjQyMTA3NDg2NTkzMDI0KXw= ~~~

This has been going on since the halving...

This latest week of consumption by Grayscale and GBTC has been going on pretty much ever since the halving.

Looking at the totals, it now looks like Grayscale has consumed roughly 28,400 BTC since the halving.

Over that time period only 19,200 BTC have been created.

Which means...

Since the halving, Grayscale has consumed roughly 150% of all the new bitcoin created during that time!

Grayscale is a great proxy for institutional involvement.

And judging by the recent numbers, we are seeing pretty good institutional demand. Not to mention that the CME bitcoin futures products continue to see robust and increasing volume just about every week as of late which is another proxy for institutional involvement.

I can't imagine this level of demand will continue for much longer before it starts to seriously impact the price of bitcoin.

If just one fund is buying 150% of the newly created bitcoin each week, that sure doesn't leave much bitcoin for the rest of the world!

Stay informed my friends.

-Doc

😊

This can only mean someone is dumping shitload of Bitcoin to keep the value down... When that someone runs out of Bitcoins, we will see the off the charts climb that I promised...

Yea, if you look at the miner inventory levels it shows they have been selling more than they mine every week for several months now. So, it is most likely miners that are dumping all their inventory as well as everything they are mining. Probably in an effort to stay in business as the break-even cost of mining is said to be around $14k currently (average).

Not really. GBTC is backed by only 10% in BTC.

Even if only 10% of the trading volume of GBTC is real, it still creates buy pressure for other big companies. I have no statistics how much of the trading volume is because of buying by companies and how much is by individual persons, but 15% (10% of 150%) by single entity still sounds quite large number.

Thanks JR for this news

You got it.