Hi everyone.

Here is the question: what is the meaning of money to you? Does it seem to disappear once it comes between your hands? Has it put you in a vulnerable position due to lack of it? The weakness that may bring you closer to scammers and their magical methods to gain money or those who keep telling you that after buying that course you going to be rich, and money will embrace you. One day, you will realize the fact that sometimes our conceptions regarding money become more importantly from being able to generate it specifically when our brains work in a way that prevents us from being financially sane. Even if your income is high, is your six digits income (wage) that nothing left of it at the end of the year important? Where do we lose that understanding, or what we think is our understanding of money? It’s time to solve this puzzle. Also, it’s time to discover or give a clear idea about money…. A framework, which is often missed in formal education (schools).

Part 1: What is Money?

Question: what is money? Or what does money represent? When you purchase something from the convenience or when they pay you for your time at work, what is the significance of these financial transactions? Generally, money is known as a medium of exchange or a tool that facilitate selling, buying, or gambling between peers. However, I do not think this definition is enough. It does not give money its sufficient rights. Let me ask the question again. What is money? I think there is another definition which define money better than that. Money is an expression of value. Money is equivalent to value. Now, keep this information aside and let me ask you another question. What is the thing that binds the entire humanity? Some of you will say communicating or rather the language that we if it is true. The person who has romantic sense will say it is love. Philosophically, those answers might be right, but practically we will find that its money which binds humans even in the temporal dimension. The paper currency that we knew today was not like that before. It has traveled through time and its shapes changed, it affects politics, economics, and made wars, built empires, and may take down others. Always, its shape or the type of that currency is not important besides the idea of exchanging from our ancient ancestors or cryptocurrencies that showed up within few years ago. The essential idea keeps remaining: what is money? The answer: money is value. As you can see, we are back to definition that says: money = value

When you hand over a specific amount of money to buy something, you realize that item value is equivalent to the amount that you handed over. Certainly, the cost or the value of that item is not going to be determined by me or you as individuals. Actually, it is determined by market which considered as large pit that collects money, materials, and individuals who have money, materials, or both. Am I confusing you? Maybe. But don’t worry the next example is going to clarify idea.

The value of loaf of bread for someone who has not eaten for days differs from a person who just ate a fatty meal. However, the cost of the loaf of bread is still the same in their perspective. That’s why I said the value is determined by the market. Not individuals. There are many market factors or economic factors that determine the value or the cost of everything including money that we take for work we do. On other words, the money that we take for wasting our time at work. Obviously, there is a huge difference between those two phrases.

Part 2: Expense and Consumption

First, you have to understand solidify that money is equals the value, and the market determines the value. It is not you or me as individuals. To manage money successfully, you have to evaluate your relationship towards it. Your usage of money is the decision maker here which decides if you are going to live a financial balanced life or not because money enters your life and goes from it. That what they express as incomes and expenses which I personally like to define it as:

Production VS Consumption

So, most of the time, money will enter your life because you produced a type of value. For the majority of people, this value is in “work” form. Money goes away when you consume something or buy something such as new phone, new car, and a home. Simply, this is your relationship between you and money.

Now, Think. Think about money that entered your life and left it. How much of that money is left with you? Or how much money did you invest in a type of assets like a plot of land or an amount of gold? Which part of this relationship you feel it is not balanced or needs to be enhanced? Your answer may be that both parts are not balanced and needs to be improved, but for most of us the problem is what we consume. We all like consumption. We all love those whiffs of that extra happiness every time when we buy something new. Therefore, you must solve your consumption problem before thinking of leveling up your income level. No matter how high your production is, it won’t suffice you if you have a consumption problem. We all live in a consumer society or rather in the time of consumption, in the time of huge industrial companies that want to sell their products whether you need them or not. Search a little bit in your memory. You’ll find many advertisements for different products solidified in them. Wherefore, from a one side, they don’t teach us how to deal with money. Plus, from another side, they overburden our lives with consumption culture. So, you won’t be able to balance between the money you make and what you consume. To find your pockets empty at the end of each month without investing in anything or at least saving money.

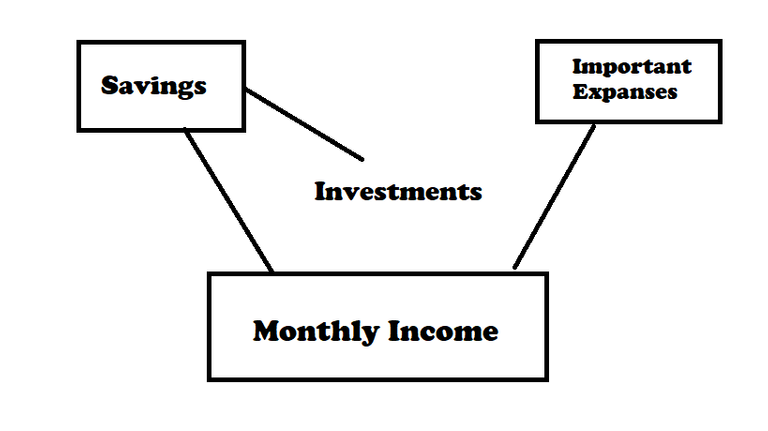

Let’s go back to the prevailing idea: keep your monthly income aside. Take important needs from it, save the remaining balance, then invest it in some assets. If it is insufficient, save your money aside until you reach the sufficient balance to start your investments.

Wait a minute!!

How can you determine your important needs? There is a simple way to do so. Your important needs are everything that you keep buy even when you don’t see advertisement of any kind about it. To understand each other, I don’t suggest you to be stingy. To establish a balanced financial life, it is normal that you crave things, chase satisfaction, luxury…. But it is not wise to drive your car until the last drop of fuel without refilling it. It is not wise that you want a healthy body without consuming healthy food. Also, it is not wise that expect your financial changes without changing your consuming habits.

To simplify the idea, money is scalable resource, and its value cannot be determined by how much you earn. It is determined by how much is left with you. It is not determined by the 1st day of a month. It is determined by how much is left with you at the end of the month. So, you have to understand yourself as a consumer. You have to control your desire of consumption. It is stupid to buy the phone of the year whose price is equal to your monthly income just because it is the phone of the year, or it has many cameras. You must comprehend this paradox. If you realized it, you will be able to change your financial life. Your appearance does not have to show how rich you are. Just become rich!

To understand me more, let's go back to the phone example, the phone of the year one. Instead of buying the phone of the year that you really don’t need because you already have an older one which works perfectly and fulfill your needs, but you started to feel that you don’t like this phone anymore due to that odd camera. Control your instinct of consumption. Instead of buying that new phone, invest that money in an asset.

Let’s calculate it:

Once you take this phone out from the box, the value of your money will reduce. On the other hand, if you put that money in an asset, the value of your money won’t reduce. After a while, it may increase.

This is the paradox. You should not consume everything. Just consume what you need, and invest the rest.

Part 3: Generating Money

Exactly, as same as the money that we consume everyday, the money that we gain is the result of the value of work that we do. The majority of jobs relates to the number of hours we work. The more hours we work, the more money we get. Nevertheless, there is a determined number of working hours that equals to a specific value that we can produce. So, how can we break this chain?

We have to look beyond those working hours, and that returns us to the fact that the market is the main core of determining the value. There are many jobs worth more than other jobs. Most likely, jobs that have less value are jobs that don’t need specific skills or consume the physical and mind strengths which lead to live a tough life. So, instead of looking for more working hours, you have to find a problem to solve. Then, measure that solution to generate a value.

Determine a problem or identify a demand in the market. Offer a solution or fill that gap and make this solution scalable. I knew you guys like examples. Let me tell you something.

The prospects for work in a videogames company are limited. However, the prospects for work in making an app or a game for smart phones are available. The prospects for work in a 5-stars hotel are limited. Another example is transforming the old family’s house to a guest house, the prospects of developing it are available. Also, for instance, a Youtube channel owners look for what people are looking and put information into a video which easy to consume. They keep publishing new content periodically. Then, the content of that channel starts spreading and they number of views keeps increasing. After that, they start building a project based on their content.

Take those examples into consideration. Your goal is to find an area that your income cannot be determined by the number of your working hours. Your value of your work is determined because it is solving a problem or fill a gap in the market. The higher value you give, the higher your income will be.

Nowadays, the internet has offered many opportunities which make you able to produce something, and introduce it to a significant markets

Remember those points:

Control what you consume, save and invest, then look for methods to increase your income through increasing the value that you give to the society through a job, a business, a project, or any kind of production. The higher value is when you resolve a problem.

Remember…. The first time you ride a bike is still and will be the toughest.

Tell me! In your opinion, what does money mean?

Thanks.

K2X

Where the K impersonates the X.

Posted Using LeoFinance Beta

that is quite the article did you write this? For hive?

I am not sure what do you mean "For hive" but..... someone helped me with writing it

Congratulations @k2x! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

Your next target is to reach 50 upvotes.

Your next target is to reach 50 upvotes.

Your next target is to reach 50 comments.

Your next target is to reach 50 replies.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPSupport the HiveBuzz project. Vote for our proposal!