The Imminent DeFi Boom in Cosmos

A wave of DeFi applications is engulfing Cosmos and the pace will accelerate as the new year unfolds. I believe that we will see an explosion of DeFi activity, one filled with many dApps that push the boundaries of decentralized financial innovations.

DeFi focused blockchains like Kujira and Injective are leading the charge; however, new DeFi sector specific blockchains or protocols like dYdX, Sei, Inter, Comdex, Mars, Shade, Prism, Nomic, Quasar, and Duality have initiated their launch sequence or will engage them soon. In addition, existing blockchains such as Osmosis, Crescent, Carbon, Terra, Umee, and Evmos are rapidly expanding into ecosystems of inter-connecting DeFi dApps.

Strategic Partnerships are the Key to Success

The goal of this article is to spotlight the incredible DeFi dApps being built in the Cosmos, some have been released already or are planning to do so in 2023. I will introduce two use cases to demonstrate the technical innovation taking place in this forward thinking ecosystem.

In 2022, we witnessed a carnage of Cosmos DeFi, with plummeting TVL, token price declines, and large-scale exits of users from the greater ecosystem. Yet, the talented developer teams did not stop building and the fruits of their labor will be on full display in the new year.

There is a developing theme of new DeFi ecosystems in the Cosmos. Many of the ecosystems coming up right now have hybrid AMM or decentralized limit order book exchange infrastructures. Others are closely aligned with existing decentralized exchanges and have multiple teams working on advanced DeFi dApps. And, all are ready to launch with the tools in place to begin building up liquidity again. Crucial for this new wave to gain momentum is the expanding suite of collateralized stable tokens being released. They will play a key support role to the success of all of these DeFi endeavors.

Because of the Inter-Blockchain Communications (IBC) protocol there is a built-in opportunity for teams to join together through strategic partnerships whether as blockchains, protocols, or dApps across the Cosmos. While exploring all over this technological landscape, I see many favorable combinations of circumstances for all the talented teams to work together to achieve a common goal: build a bustling, expanding, and prosperous ecosystem!

Think of this article as your springboard into Cosmos DeFi! And, I am providing you with the information to start your own journey. With this in mind, I have left links in the Sources section below, so that you can easily find additional information about the blockchains, protocols, and dApps mentioned here.

Use Case - The Blockchain for Real Yield

The Kujira Team has built a collection of interconnected dApps that all revolve around a common objective, generating real yield and revenues. While the new blockchain gives its users access to tokens from across Cosmos, the Kujira dApps work together seamlessly to create a bustling DeFi economy. All the required infrastructure and tools are at our fingertips.

Here is an overview of the dApps and what they offer.

BLUE

- staking

- governance

- stable token minter

- swap

- wallet

- IBC transfer

- Bridge for external chains

- dashboard

FIN

- order book exchange

ORCA

- liquidation markets

BOW

- liquidity pools

FINDER

- blockchain explorer

CALC

- investment strategy provider

- dollar cost averaging (IN and OUT)

BLACK WHALE

- market maker

- vaults

TRACK

- dashboard

The dApps all share a beautiful and consistent user interface and the network transactions complete quickly and effortlessly. There is a vibrant and growing community, actively engaged on Discord and Twitter, governance participation is high, and the Kujira Team frequently provides updates and speaks on Spaces and livestreams. Because all functions in the economic stack are interconnected there are real opportunities to generate profits in this DeFi ecosystem. Kujira is indeed the blockchain for real yield!

Stable Tokens are the Foundation

One common element across all these great economies is the need for native stable tokens. Stable tokens from Ethereum are great, but bridging them into Cosmos continues to be a weak link. Above all, events of the past year have proven that diversification is critical and stable tokens are not an exception to this golden rule.

Several teams in the Cosmos are already offering or are nearly finished building fully collateralized or over-collateralized stable tokens, natively available. Most of these are fully IBC enabled. These include:

- USDX from Kava

- USC from Demex

- NOTE from Canto

- USK from Kujira

- IST from Inter

- CMST from Harbor

- SILK from Shade

- SOLID from Capapult.

The dApps in many sub-sectors of DeFi rely on the use of a reliable stable token. Taking advantage of the power of IBC and spreading the stable tokens far and wide across Cosmos is key! Let’s take a look at another use case, an economy built from the ground up with a stable token at the heart.

Use Case - the Inter Stable Token

Recently, Agoric’s Inter Protocol Parity Stability Module (PSM) launched and over 1.4 million Inter Stable Tokens (IST) have already been minted. Nearly all of the IST have been deployed to interchain DeFi dApps, primarily in liquidity pools on Crescent Network and Osmosis Zone.

When dApps start launching on the Agoric blockchain, IST will be the fee token used for all transactions. This will greatly increase the amount of IST in circulation. I also firmly believe that as more use cases for IST are rolled out across the blockchains of the Cosmos, we will see the adoption of IST increase. Traders, consumers, and developers across Cosmos are eager to use a native stable token.

The benefits of having a stable token as the primary token in an ecosystem of dApps are:

- maintain a stable cost of transactions

- maintain consistent valuations for digital goods and services

- maintain consistent valuations for e-commerce apps

- establish a store of value for traders and consumers

- ideal safe haven asset during times of volatility

- easy to denominate with fiat currencies

- ideal for payment, settlement, and trading dApps.

Using IST as an example as to how a stable token can support the coming boom in DeFi, let’s examine opportunities for growth.

Availability from DEXes and Aggregators

Most of the native Cosmos stable tokens mentioned above are just trading on the blockchains of their origin. However, IST is the first one to venture out and it is currently trading on both the Crescent and Osmosis Automated Market Makers (AMM). It can also be swapped on the TFM aggregator.

Currently IST has stable swap pools on Crescent and Osmosis with USDC and has just been added to a brand new 3-pool with DAI and USDC, as well as a 4-pool with DAI, CMST, and USDC. As the landscape of stable tokens in the Cosmos expands, additional pools with CMST, USK, SILK, and other top tokens will accelerate usage and adoption of all these stable tokens.

Many opportunities to expand to other existing decentralized exchanges and aggregators exist now, including:

- Loop on Juno

- Rango Exchange

- FIN on Kujira

- Coinhall

- Helix on Injective

- Demex on Carbon

- Diffusion, Kinesis, and EvmoSwap on Evmos

- Astroport, Phoenix, and TerraSwap on Terra.

All support either the Keplr, Cosmostation, TerraStation, or MetaMask wallets and many Cosmos native IBC assets are already trading there. For example, Kujira has onboarded a large amount of native tokens from across Cosmos and created many trading pairs on FIN. Rango has one of the largest selections, aggregating trades for Cosmos pairs and many others, for a grand total of 50 blockchains.

In addition, several exciting new DEXes are launching soon in Cosmos and having widespread stable token representation there would also expand usage:

- the new Wynd DEX on the Juno Network

- ShadeSwap from Shade Protocol on the Secret Network.

DeFi dApps

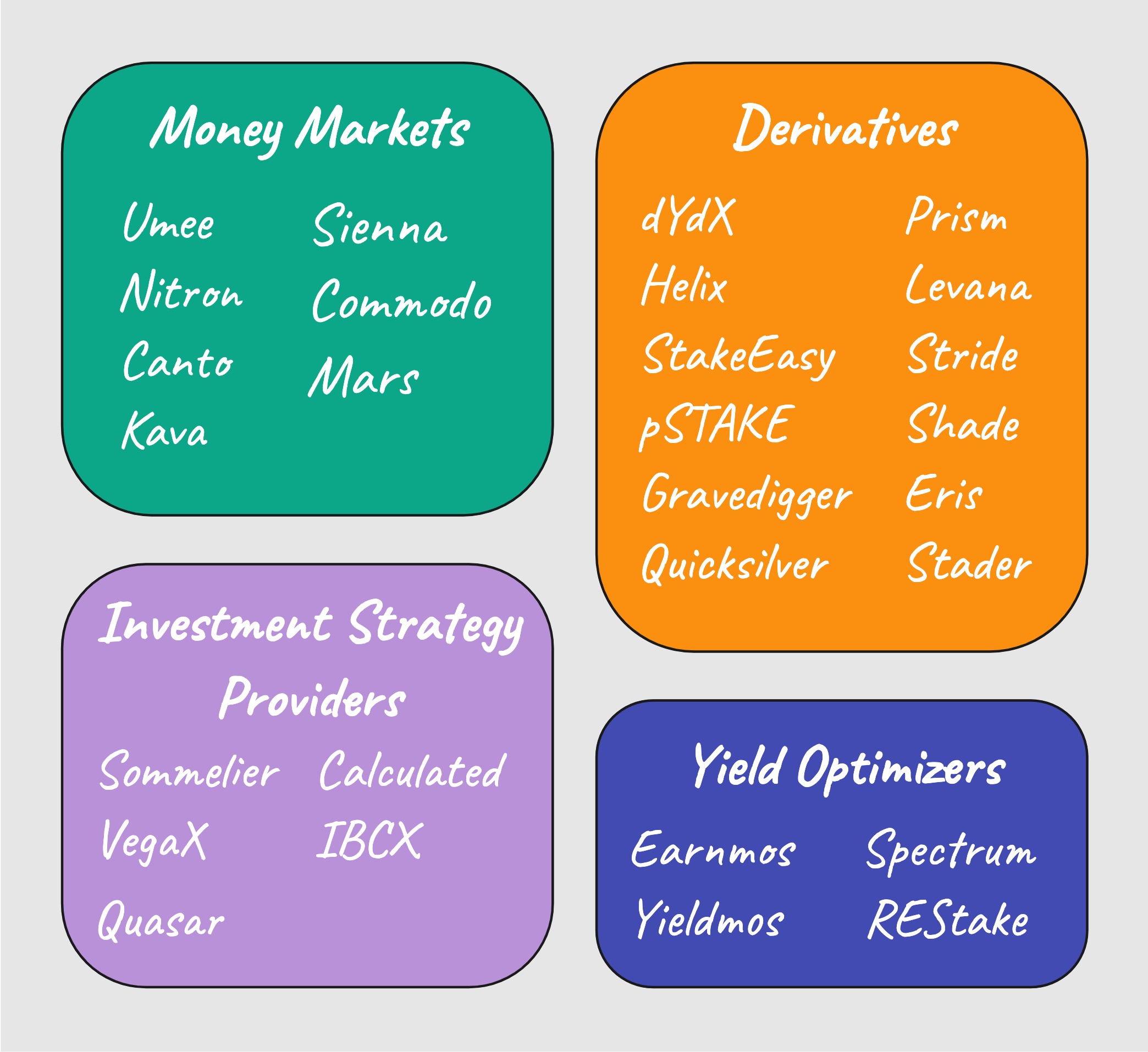

The emergence of dApps recently launching and more going live in the coming months will fuel the expansion of the DeFi sector in Cosmos. See the picture below for some that have already launched or are getting ready to do so in 2023.

On and Off Ramps

Teaming up with builders such as Kado Money to set-up fiat on and off ramps to all the protocols and blockchains will greatly help with external liquidity onboarding from fiat currencies directly into Cosmos.

This has already been successfully implemented at many Cosmos blockchains, including Osmosis, Juno, Kujira, Terra, and Injective. Connections to more Cosmos blockchains are needed to support widespread adoption moving forward.

Far and Wide

I have made the case that the Cosmos is about to experience a DeFi boom, an explosion of cosmic proportions. I believe that a decentralized ecosystem of digital currencies has great advantages over traditional, centralized finance alternatives. These include:

- faster transaction processing

- lower costs

- increased transparency

- easier access

- high levels of automation

- more flexibility

- interconnected applications

- trustless transactions

- borderless operations.

The Cosmos ecosystem is uniquely positioned to capitalize on its advanced infrastructure and realize the advantages of decentralized finance.

In my opinion, stable tokens offer the best opportunities for growth and widespread adoption of our new digital economies. While many teams are already working together, I also believe more strategic partnerships are critically important to support the boom of DeFi dApps in 2023. The ecosystem’s built-in interconnectivity features are ideal to foster these and all participants will benefit from an expanded DeFi landscape.

As we ring in the new year, I will look ahead to a year filled with hope for a greater and better ecosystem. I plan on hitching a ride and come along on this exciting journey towards building a thriving Cosmos economy!

Het avontuur gaat door - Opa.

Sources, References, and Further Reading

Kujira:

Kujira - https://kujira.app/

Kujira’s Twitter - @TeamKujira

FIN - https://fin.kujira.app/trade/

Orca - https://orca.kujira.app/

Blue - https://blue.kujira.app/

BOW - https://bow.kujira.app/

Black Whale - https://blackwhale.money/

Calculated Finance - https://app.calculated.fi/

Finder - https://finder.kujira.app/kaiyo-1

Track - https://kujira-track.app/

First Impressions: Kujira Blue and FIN - https://medium.com/coinmonks/first-impressions-kujira-blue-and-fin-e85e123b2a0e

Agoric:

Agoric - https://agoric.com/

Agoric’s Twitter - @agoric

Inter Protocol - https://inter.trade/

Inter’s Twitter - @inter_protocol

Inter PSM - https://psm.inter.trade/

Agoric Wallet - https://wallet.agoric.app/wallet/

Inter Explained in Pictures - https://medium.com/coinmonks/inter-explained-in-pictures-ee9ebed092fd

The Launch of IST - https://medium.com/@KaasKop_Opa/uniting-the-interchain-with-ist-3e658946bc27

DEXes and Aggregators:

Osmosis - https://app.osmosis.zone/

Crescent - https://app.crescent.network/swap

TFM - https://osmosis.tfm.com/osmosis/trade/swap

Loop - https://juno.loop.markets/#Swap

Rango - https://app.rango.exchange/swap/

Coinhall - https://coinhall.org/

Helix - https://helixapp.com/markets

Demex - https://app.dem.exchange/markets

Diffusion - https://app.diffusion.fi/#/swap

Kinesis - https://app.kinesislabs.co/#/

EvmoSwap - https://app.evmoswap.org/swap

Astroport - https://astroport.fi/en

Phoenix - https://app.phoenixfi.so/swap

TerraSwap - https://app.terraswap.io/

Wynd - https://www.wynddao.com/

Shade - https://app.shadeprotocol.io/

DeFi Sector Specific Blockchains, Protocols, and dApps:

Umee - https://app.umee.cc/#/markets

Nitron - https://app.dem.exchange/nitron

Canto - https://canto.io/lending

Kava - https://app.kava.io/lend

Sienna - https://sienna.network/

Commodo - https://docs.commodo.one/lending-assets

Mars - https://marsprotocol.io/

Sommelier - https://www.sommelier.finance/

VegaX - https://vegaxholdings.com/about

IBCX - https://index.ion.wtf/

Quasar - https://www.quasar.fi/

Earnmos - https://earnmos.fi/

Spectrum - https://terra.spec.finance/vaults

Yieldmos - https://www.yieldmos.com/

REStake - https://restake.app/

Sei - https://www.seinetwork.io/

dYdX - https://dydx.exchange/

Prism - https://home.prismprotocol.app/

Helix - https://helixapp.com/

Nomic - https://nomic.io/

Duality - https://duality.xyz/

Quasar - https://www.quasar.fi/

Levana - https://www.levana.finance/

StakeEasy on Juno - https://juno.stakeeasy.finance/

StakeEasy on Secret - https://app.stakeeasy.finance/

Stride - https://app.stride.zone/

pSTAKE - https://pstake.finance/

Gravedigger - https://gravedigger.backbonelabs.io/

Eris - https://www.erisprotocol.com/

Quicksilver - https://quicksilver.zone/

Stader - https://www.staderlabs.com/

Capapult - https://capapult.finance/

Harbor - https://harborprotocol.one/home

Onboarding:

Kado - https://app.kado.money/

Posted Using LeoFinance Beta

Thank you @kaaskop for investing your time into this comprehensive guide on "all things COSMOS" ...

In the "depths of crypto winter," we can both hope 2023 provides a reasonable ROI to those who are working so diligently on all of these protocols / projects.

Congratulations @kaaskop! You received a personal badge!

You can view your badges on your board and compare yourself to others in the Ranking

Check out our last posts:

Support the HiveBuzz project. Vote for our proposal!