A Wave of Liquidity

I covered liquid staking protocols in the Cosmos extensively during 2022, starting in January with Prism’s incredible refracted derivatives all the way to last month’s feature on StakeEasy’s novel, multifaceted token model. The pace of innovation is not slowing down and 2023 has already seen many exciting announcements and launches from protocols, including: pSTAKE, Shade, Stride, BackBone Labs, and Quicksilver.

The objective of this article is to provide an updated overview of most of the liquid staking derivatives (LSDs) currently available in the Cosmos. More importantly, I want to check the barometer and see how much usage these dApps, protocols, and blockchains are getting. By comparing them, I uncovered some surprising adoption results. Read on to the end, because I will also share some incredible technological features with you, all launching this year. And, you can also find links to all the protocols discussed here in the Sources section below.

LSDs in the Cosmos

Take a look at the pictures below for a rundown of the protocols offering liquid staking derivatives in the Cosmos, as well as the names of all the tokens in circulation. As you can see, the field has become more crowded!

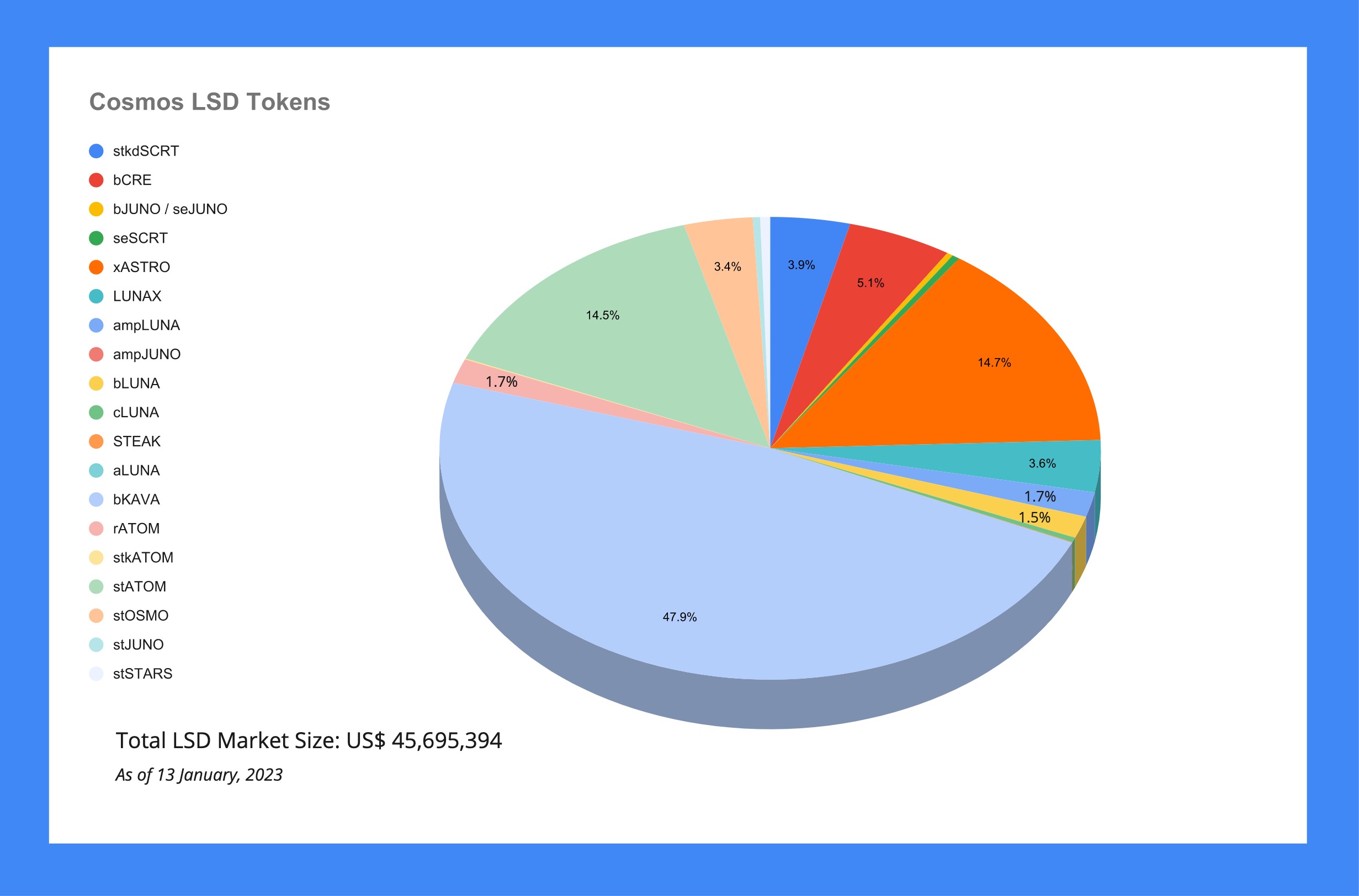

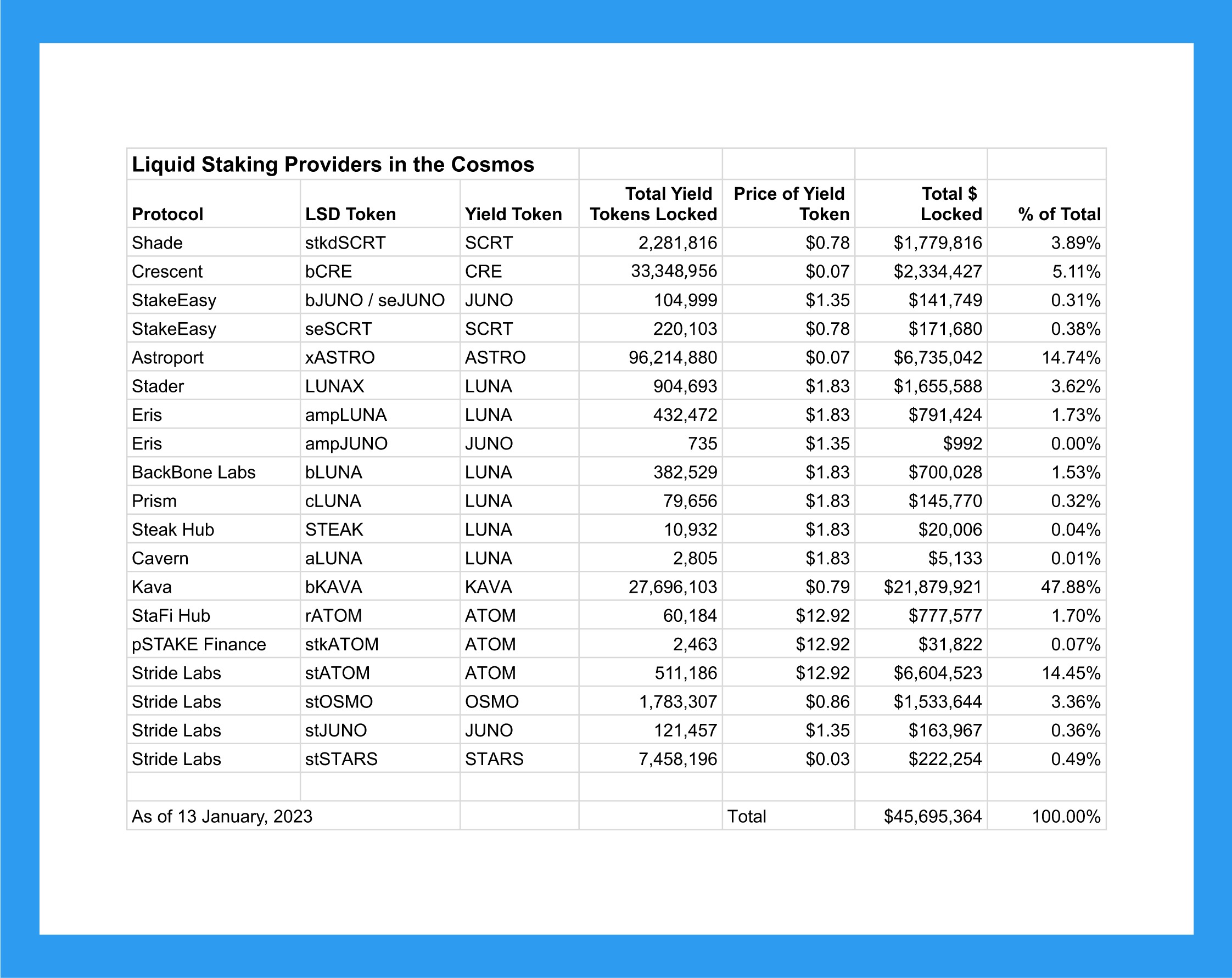

LSDs by the Numbers

The number of LSD tokens and the associated values are steadily rising, as their popularity increases and more cosmonauts take advantage of their economic benefits. The chart and table below summarize the current state of the LSD market.

New Features and Opportunities

Several exciting new technological advancements have been built by the talented development teams at the Cosmos Hub and other blockchains across the ecosystem. In addition to rolling out these advanced features, DeFi in Cosmos is growing rapidly and more lucrative opportunities are introduced regularly.

Governance

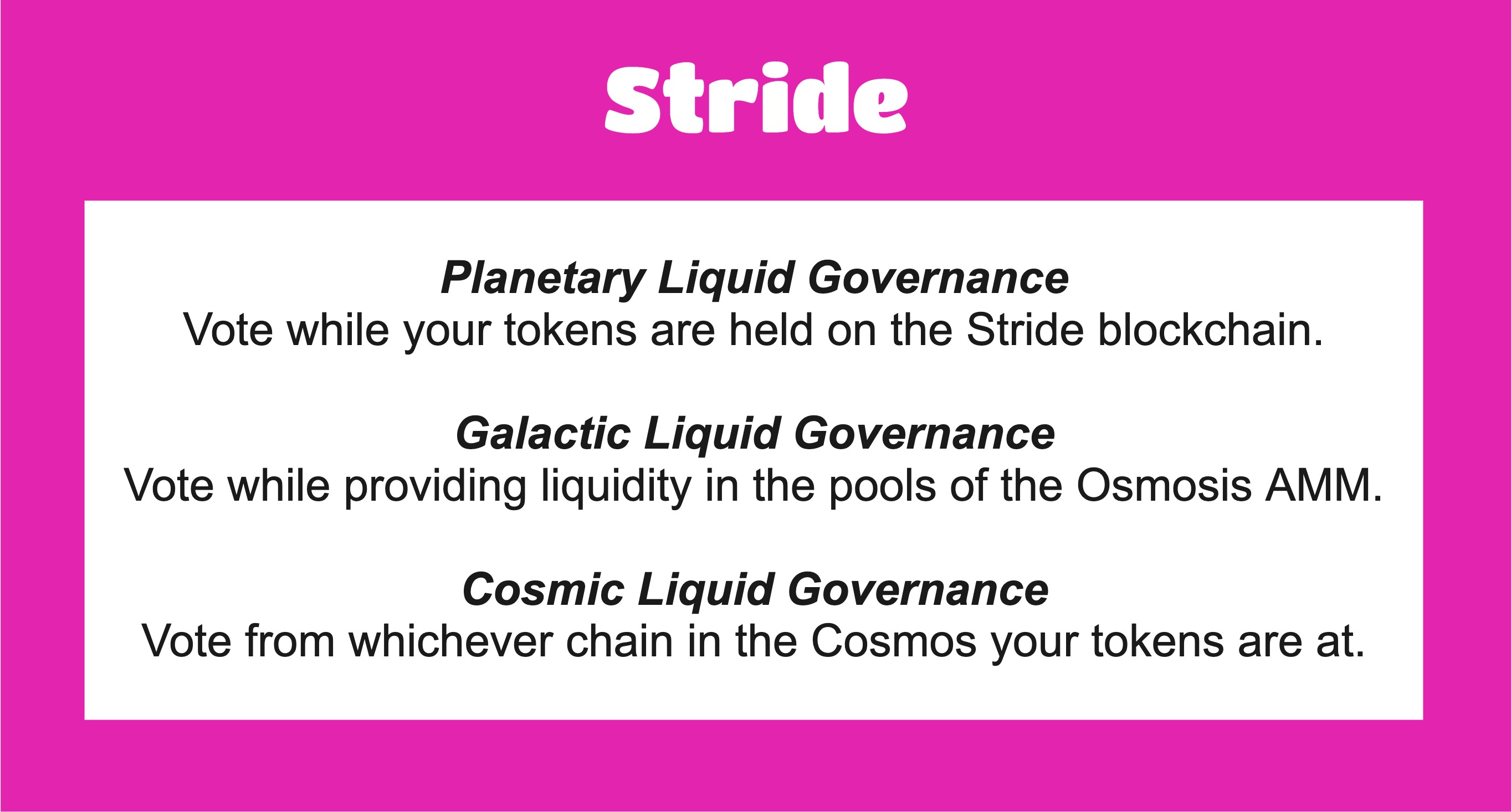

Normally, when you deploy your tokens in DeFi, you give up the ability to participate in governance voting. However, blockchains like Stride and Quicksilver will use interchain accounts to resolve this and enable users who stake their assets with liquid staking providers to also participate in governance.

A perfect example of this feature is the Stride Team, which recently announced their updated roadmap. Those of us using their products will be able to participate in governance, as the Team rolls out their Liquid Governance program in phases (see picture below).

Quicksilver is launching its initial suite of qAssets this month with Stargaze’s STARS, followed by Juno Network’s JUNO, and Osmosis’ OSMO. After these first three, ATOM from the Cosmos Hub will follow. The Team has announced that liquidity pools will be created for its qAssets on Osmosis.

Liquid Staking Module

One of the most sought after features is the Liquid Staking Module (LSM). This will allow users to transfer their delegations to liquid staking providers without having to first un-bond them.

I expect that allowing liquid staking providers to mint LSDs against already locked up governance tokens will significantly increase the usage of the providers’ products, as well as participation in Cosmos DeFi.

Note that the liquid staking providers are not yet offering this functionality, currently. Many protocols have announced they will start incorporating this immediately when the Liquid Staking Module (LSM) is released from the Cosmos Hub.

Liquidity Pool Incentives

All the protocols are actively establishing partnerships with exchanges around the Cosmos to create new DeFi opportunities. For example, Stride and Shade have made joint announcements regarding new liquidity pools for derivative tokens when ShadeSwap launches, including:

- stATOM - ATOM

- stOSMO - OSMO

- stJUNO - JUNO

- stATOM - stOSMO

- SHD - stATOM

- stkdSCRT - sSCRT.

And, some of these pools will earn dual incentives.

External incentives are also provided by the protocols to reward participants to deploy their LSDs in DeFi, including on the Osmosis, Astroport, Crescent, KavaSwap, SiennaSwap, rDEX, and Loop AMM’s. Liquid staking providers offering incentives include:

- StakeEasy - SEASY

- Stride - STRD

- Crescent - CRE

- Kava - KAVA

- StaFi Hub - FIS

- Astroport - ASTRO.

For example, StakeEasy has set the bar high with regard to liquidity pool incentives, partnering with the Loop AMM on the Juno Network to pay triple rewards in the form of LOOP, SEASY, and bJUNO tokens. In addition, StakeEasy’s LSDs will prominently feature on the brand new Wynd DEX, also on the Juno Network.

Lending

Liquid staking tokens will also be accepted as collateral by lending dApps. For example, SiennaLend accepts seSCRT as collateral and many more are in the pipeline at lending protocols across the Cosmos.

Airdrops

Finally, the protocols are also airdropping their tokens. Stride has already begun their airdrop program and others have announced upcoming airdrops of their governance tokens, including StakeEasy and Quicksilver.

For example, the Quicksilver Team has announced continuous airdrops, in which the QCK token will be airdropped to stakers of new blockchains as they are onboarded. The Team has also announced a participation rewards program with which users can earn additional QCK tokens based on their validator choices. The goal here is to promote decentralization and incentivize delegations to validators with lower levels of voting power, but high performance levels.

Rapid Growth

The growth of liquid staking in the Cosmos has reached a feverish pace. Surprisingly, one of the earliest blockchains to offer LSDs in the Cosmos (Terra in 2021) still has an impressive suite of options to choose from. Another protocol that can claim to have been one of the first to offer LSDs in Cosmos is pSTAKE. The Team’s original product even pre-dated IBC and was developed as an EVM-based solution. Their latest offering, a new and improved stkATOM, just launched and is now fully IBC and interchain accounts enabled.

A relative late comer, yet one of the fastest risers, has been the Kava blockchain’s LSD, bKAVA, which launched less than three months ago. The chain rewards participants with higher yields when staking bKAVA in its Earn and Boost programs.

A Looming Economic Expansion

As more DeFi dApps launch their products in the coming months, the opportunities to deploy LSDs will only expand. It is not just the increasing quantity of tokens that are being staked that is impressive. The overall dollar equivalent value of staked assets is also on the rise, as a result of new LSD products launching. This is especially impressive in light of the depressed token prices in this bear market.

The constant uptick in usage, will also result in larger daily transaction volumes in Cosmos DeFi. This is a welcome development, since standard staking and LP APRs have been steadily declining across the ecosystem.

Finally, the positive effects of fee revenue growth will be critical for the economic health of the ecosystem. And, assuming that the protocols will be true to their decentralization mantras, a steady growth of staked assets will greatly aid the business of securing the blockchains.

Wordt vervolgd – Opa.

Sources, References, and Further Reading

Shade - https://app.shadeprotocol.io/staking-derivatives/stake

StakeEasy on Secret - https://app.stakeeasy.finance/

StakeEasy on Juno - https://juno.stakeeasy.finance/

Stride - https://app.stride.zone/

pSTAKE - https://cosmos.pstake.finance/

Quicksilver - https://quicksilver.zone/

Kava - https://app.kava.io/earn/kava

Stafi Hub - https://app.stafihub.io/rToken

Crescent - https://app.crescent.network/staking

Astroport - https://app.astroport.fi/governance

Stader - https://terra.staderlabs.com/liquid-staking

Eris - https://www.erisprotocol.com/

BackBone - https://gravedigger.backbonelabs.io/

Prism - https://prismprotocol.app/

SteakHub - https://liquidstaking.app/

Cavern - https://cavernprotocol.com/#/

Osmosis - https://app.osmosis.zone/pools

rDEX - https://app.rdex.finance/stafihub/liquidity

Loop - https://juno.loop.markets/farm

Wynd - https://www.wynddao.com/

Sienna - https://sienna.network/

My most recent liquid staking articles:

Boosting your Rewards with the Liquid Staking Turbocharger - https://leofinance.io/@kaaskop/boosting-your-rewards-with-the-liquid-staking-turbocharger

The Benefits and Risks of Liquid Staking - https://leofinance.io/@kaaskop/the-benefits-and-the-risks-of-liquid-staking

Effortless DeFi with StakeEasy - https://leofinance.io/@kaaskop/effortless-defi-with-stakeeasy

You can find me here:

Twitter - @KaasKop_Opa

Medium - https://medium.com/@KaasKop_Opa

Loop - https://www.loop.markets/user/52879

Leo Finance - https://leofinance.io/@kaaskop

Posted Using LeoFinance Beta