The StakeEasy Team has focused on creating strategic partnerships across the Cosmos. In a short period of time, they have established a foothold on the Secret Network, Juno Network, and the Osmosis Zone. They have worked together with multiple teams to create DeFi opportunities for the users of its dApps.

Currently, we are able to stake either JUNO or SCRT using StakeEasy’s dApps and receive liquid staking tokens in return. The liquid staking tokens can be deployed at several DEXes around Cosmos with additional opportunities to earn rewards.

Let’s take a look at each of these. I have left links to the various sites and apps for StakeEasy in the Sources section below.

seJUNO

When staking JUNO at StakeEasy, one of the two possible choices for receiving a liquid staking token is seJUNO. This token appreciates from auto-compounding the yield from JUNO. In other words, when we redeem seJUNO for JUNO at a later date, we will receive more JUNO back than what we originally staked.

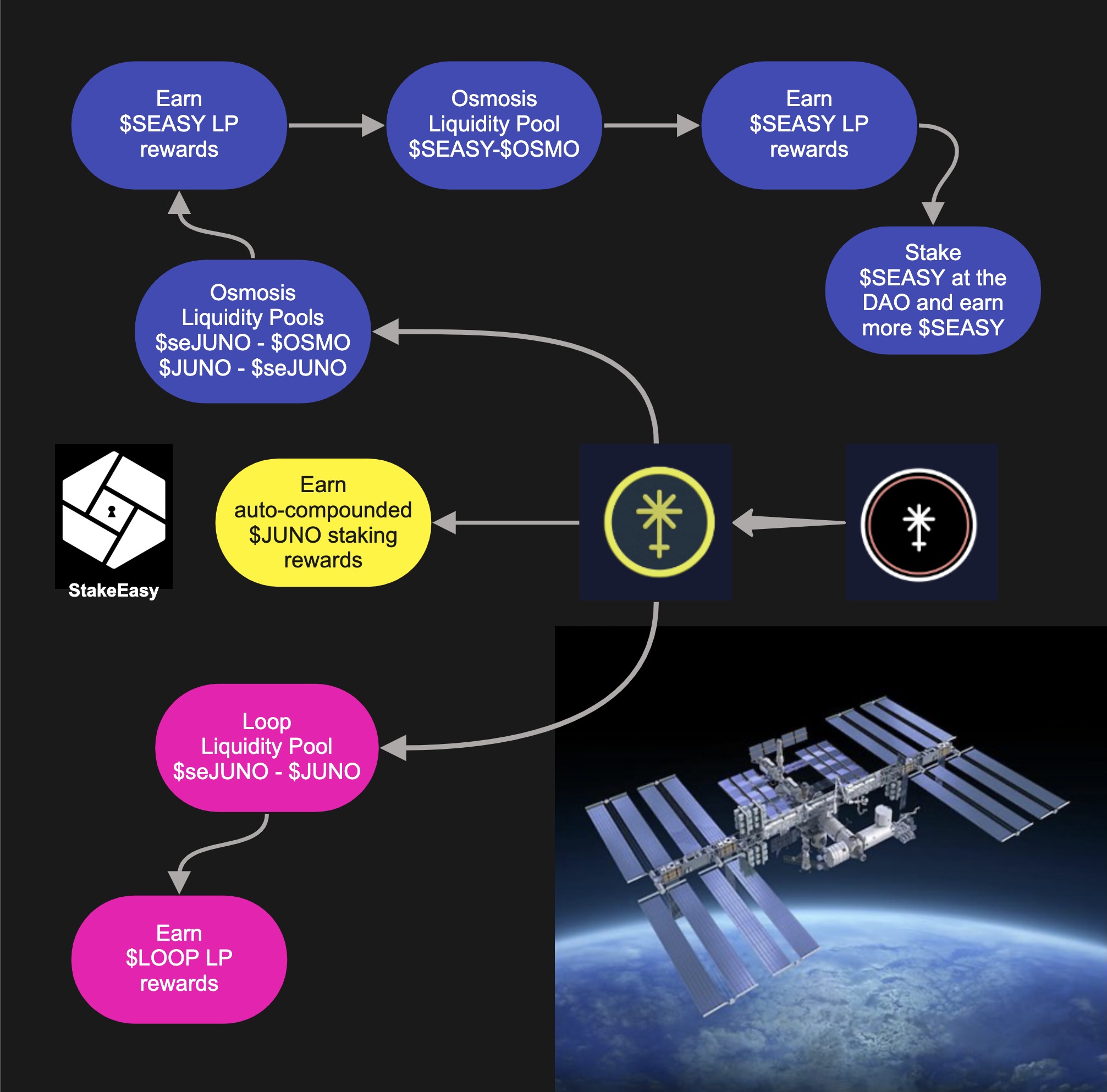

As you can see in the tree chart below, seJUNO can also be deployed in DeFi at the Osmosis and Loop DEXes. A further opportunity to earn additional rewards exists by staking the SEASY rewards at the SEASY DAO.

Note that there are also pools on the JunoSwap DEX; however, I have left them out of the chart, because it is shutting down and the pools will migrate over to a new DEX being developed by the Wynd DAO Team.

bJUNO

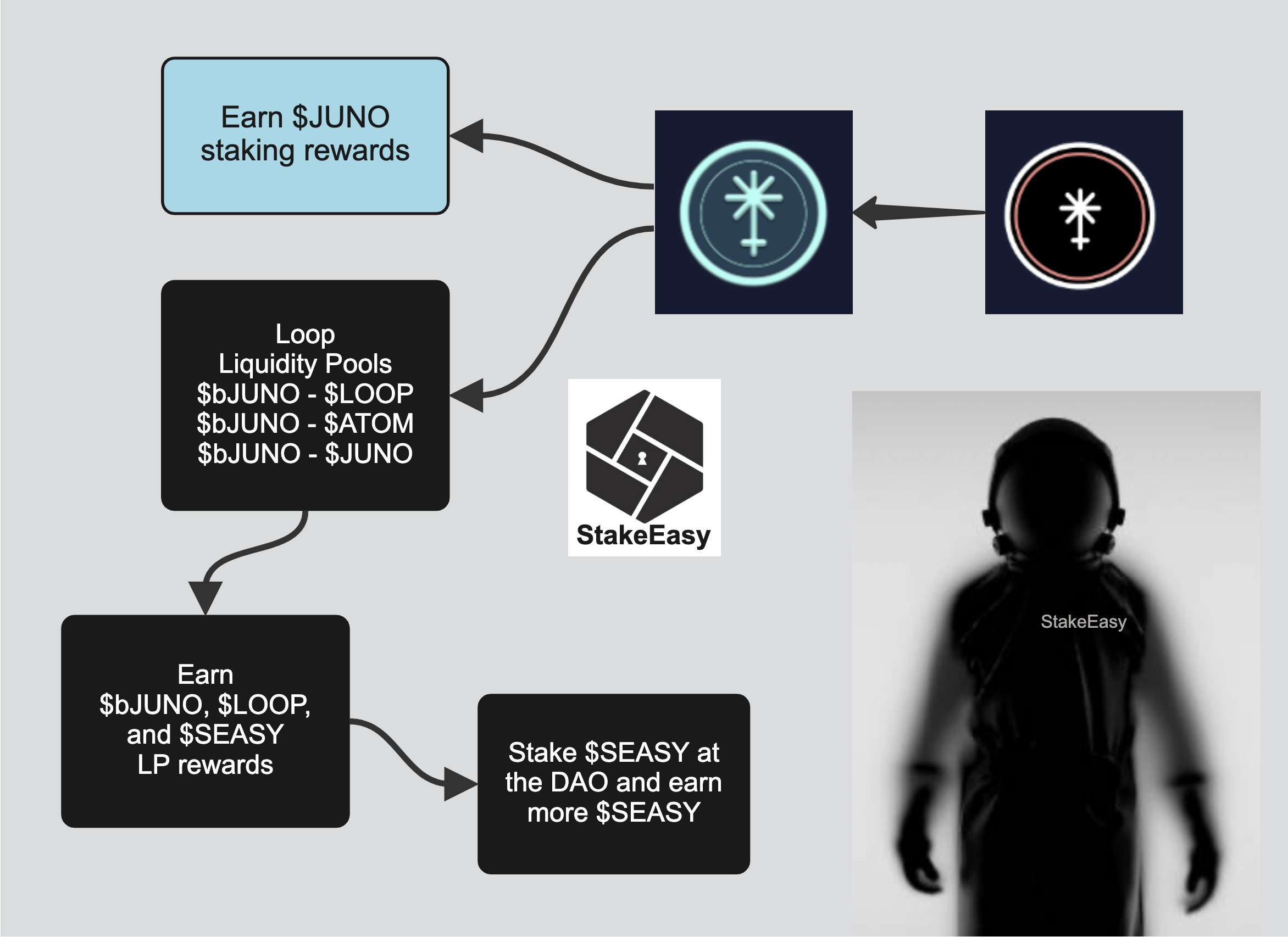

The other choice for staking JUNO at StakeEasy is to receive the bJUNO liquid staking token. It is not an auto-compounding token; instead, we can earn JUNO rewards and manually collect them, just from holding bJUNO. However, once we deploy bJUNO in DeFi, it stops earning JUNO rewards. This is really not a deterrent to using bJUNO in DeFi, though.

The three pools on the Loop DEX that have bJUNO in the pair earn triple rewards: LOOP, SEASY, and bJUNO. The APRs are really high and when you compound the rewards, the APYs are off-the-chart.

The details are in the tree chart below.

seSCRT

Staking SCRT at StakeEasy’s dApp on the Secret Network is simple and the liquid staking token seSCRT is also an auto-compounding token.

Once we have our seSCRT tokens, they can be deployed in Secret DeFi in a pool on SecretSwap (sSCRT-seSCRT), three pools on SiennaSwap (sSCRT-seSCRT, Sienna-seSCRT, and sUSDC-seSCRT), and the liquid token can even be used in SiennaLend as collateral.

Please see the tree chart below for an overview of the possibilities. I did not include all the options mentioned above, due to the current state of DeFi in Secret and the lack of rewards available. I am hopeful that when ShadeSwap and ShadeLend launch, we will see a resurgence of DeFi on the Secret Network.

Focus on DeFi Opportunities through Partnerships

I have been eager to engage with StakeEasy’s dApss and my experience has been completely positive. I have especially found the DeFi opportunities for seJUNO and bJUNO to be lucrative!

There are of course risks associated with liquid staking and these include:

- centralization of staked tokens with a small group of validators

- loss of governance rights for the governance token

- loss of tokens as a result of LP rebalancing

- loss of tokens as a result of liquidations

- smart contract risks due to exploits

- depegging risk with the native, governance token.

The benefits of liquid staking are plentiful, including:

- boost rewards from staking the derivative tokens

- bypass the un-staking period by swapping the derivative

- increase earnings with liquidity pools rewards

- LP pairs with the native token don’t suffer from the effects of rebalancing

- earn interest from depositing the derivative as collateral

- take advantage of arbitrage opportunities from price deviations

- gain new governance rights for the liquid staking provider DAO

- gain new governance tokens for this new DAO.

StakeEasy was amongst the first group of protocols offering liquid staking as a service in the Cosmos. I think they have done a fantastic job expanding their protocol, in the depths of the bear market. These are the sizable amounts of tokens that StakeEasy has locked in their smart contracts:

- JUNO - 111,618

- SCRT - 216,572

- SEASY - 101,079.

The current situation with the JunoSwap DEX shutting down is unfortunate; however, the team at StakeEasy has already announced more liquid staking partnerships that are in the works (ATOM and OSMO, for example). StakeEasy’s liquid staking tokens are also available from aggregators, including TFM and ButtonSwap. The trading pairs are also listed on Coinhall, the great token listing site for several blockchains in the Cosmos, including Juno Network.

I am already a big fan of StakeEasy’s product offerings and I am looking forward to additional DeFi opportunities that result from all of these strategic partnerships.

Tot ziens – Opa.

Sources, References, and Further Reading

StakeEasy – https://www.stakeeasy.finance/

Twitter – @StakeEasy

StakeEasy on Juno App - https://juno.stakeeasy.finance/

StakeEasy on Secret App - https://app.stakeeasy.finance/

StakeEasy Blog on Medium – https://stakeeasy.medium.com/

Loop - https://juno.loop.markets/farm

Osmosis - https://frontier.osmosis.zone/pools

Sienna - https://sienna.network/

Coinhall - https://coinhall.org/pairs

TFM - https://juno.tfm.com/

ButtonSwap - https://btn.group/secret_network/button_swap

Posted Using LeoFinance Beta