Cultivating and Nurturing an Interchain Portfolio

I am an avid farmer, but not in the traditional definition of the profession. The seeds I like to plant are cryptocurrency tokens and the crops I harvest are incentive rewards. Liquidity providing is interwoven into the fabric of cryptocurrency microeconomies and stable tokens are one of the key components of a thriving economic ecosystem.

When the Inter Stable Token launched, I kept a close eye on the strategic partnerships that the Inter Team developed. There is no other type of token that I like to cultivate more than a stable token. Because of their predictable value, using them as a liquidity provider shifts the risk curve in my favor and improves my risk reward trade-offs. With a native stable token like IST, I am able to nurture a well-balanced portfolio of Interchain assets, using a mix of LP and single staking token positions.

In this article, I would like to accomplish several objectives:

- Provide an overview of the farming opportunities, using IST.

- Introduce several strategies to maximize LP and staking rewards.

- Provide an update as to where IST is positioned in the greater Cosmos ecosystem, as a native stable token.

- Discuss exciting new opportunities, already in the works.

- Offer some suggestions for even more opportunities.

Crescent Network

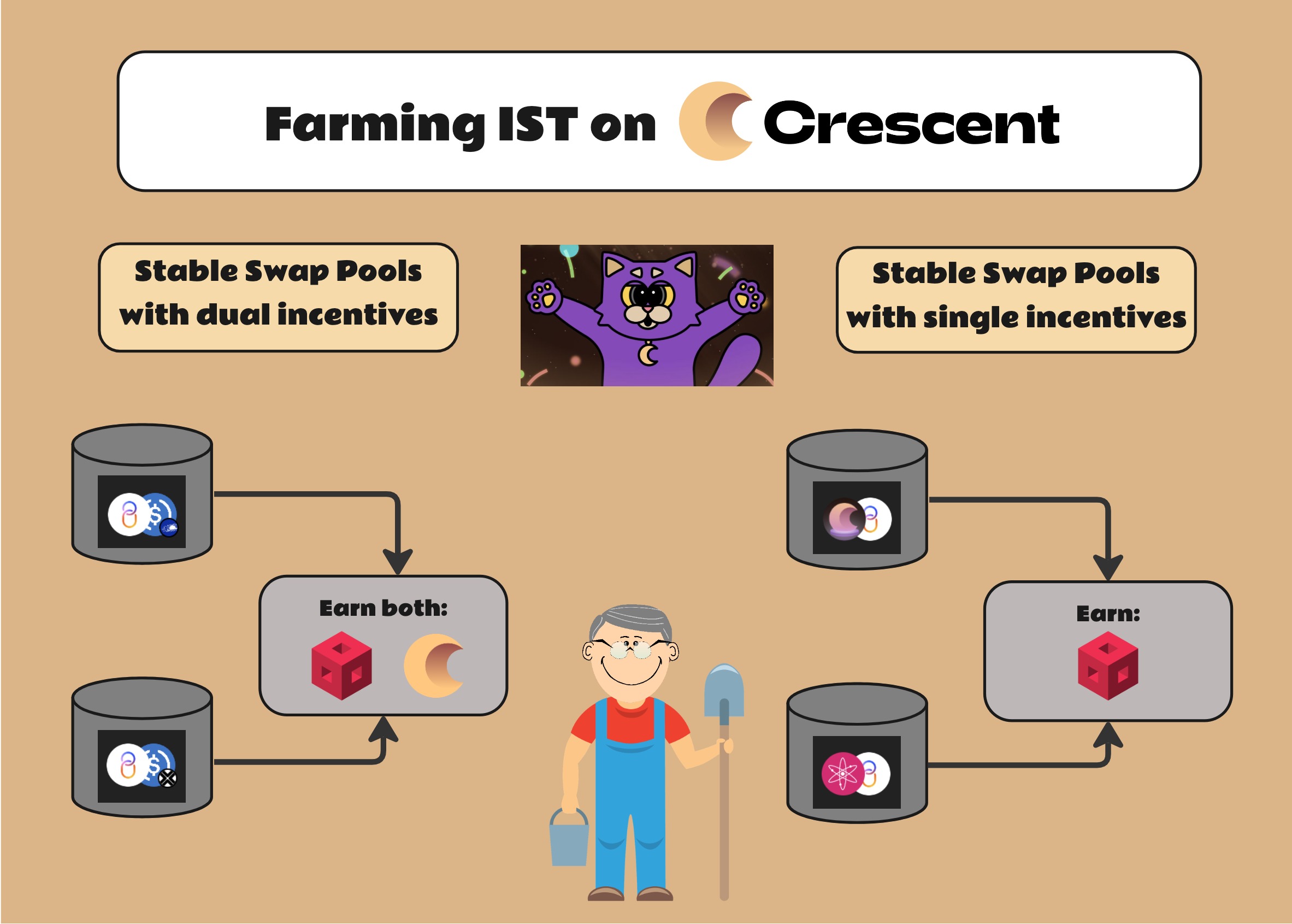

The Teams at Inter Protocol and Crescent Network forged partnerships early on and the fruits of their labor are on full display now. There are four liquidity pairs with IST on Crescent’s AMM and the farming opportunities in these stable swap pools are abundant. See the picture below.

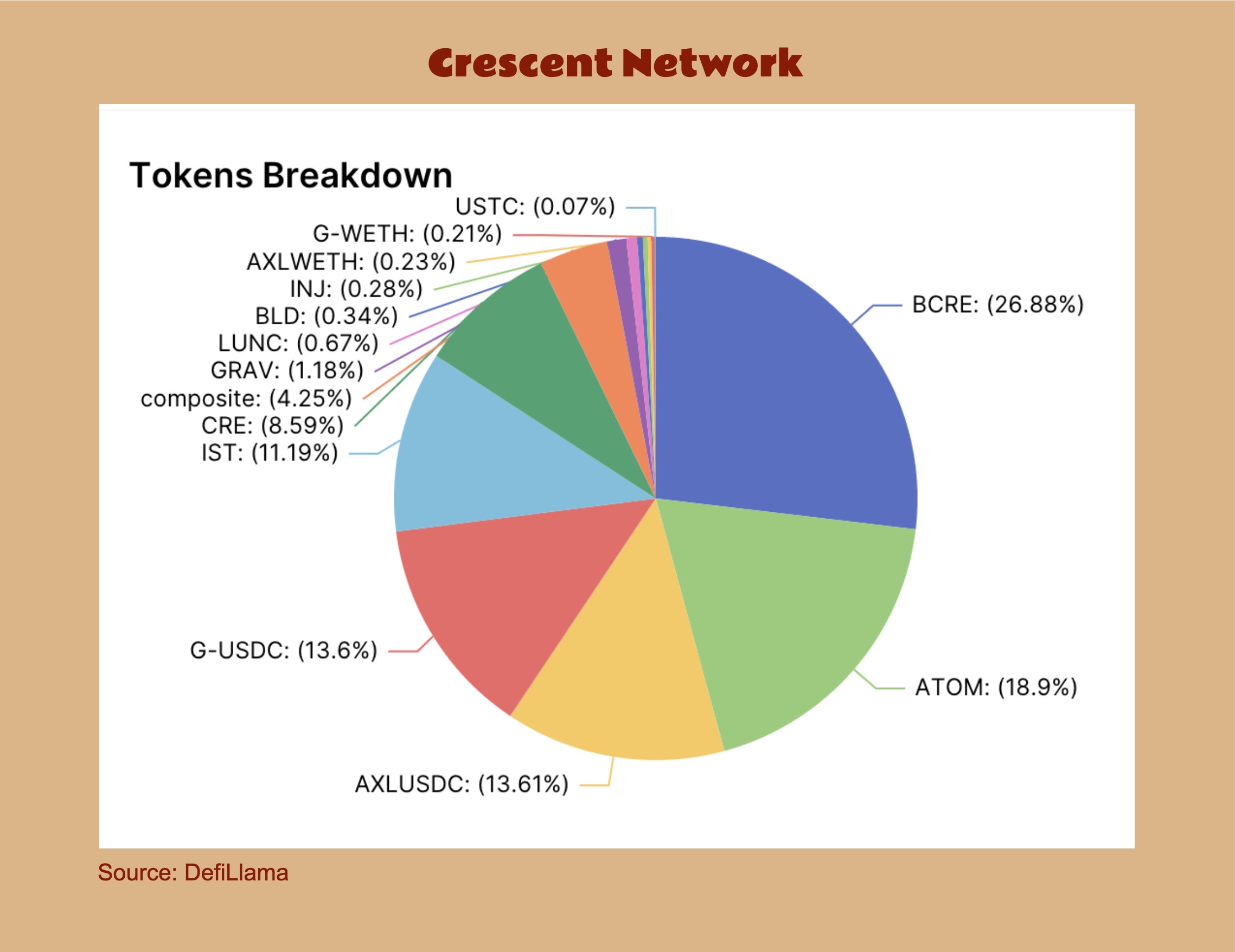

After just having launched, these liquidity pools are demonstrating promising adoption, with already over a million dollars of value locked. And, IST already accounts for more than 11% of the token distribution on the Crescent blockchain.

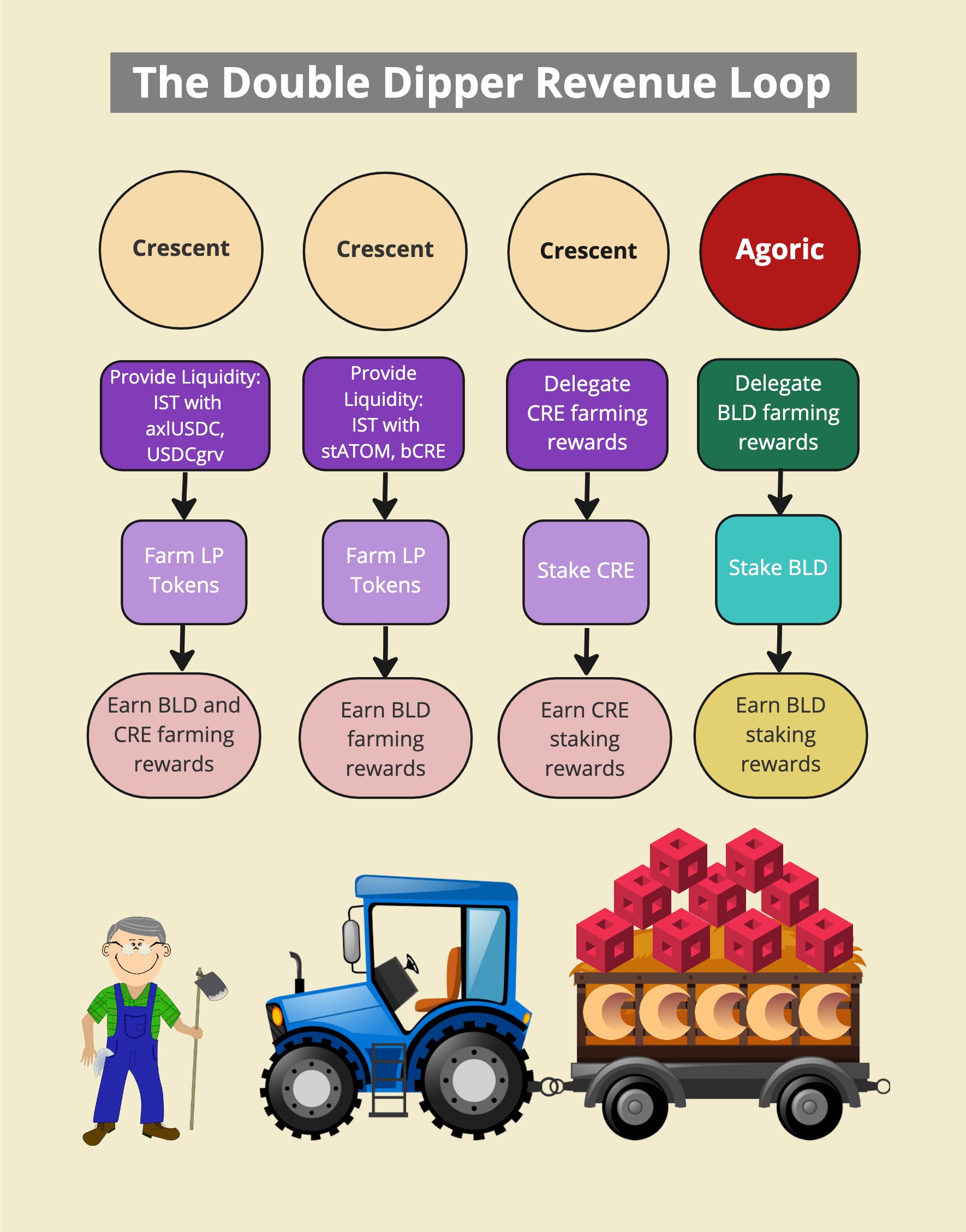

From a strategic perspective, by farming the LP tokens from these liquidity pools, we can start a “double dipper revenue loop”. We can earn BLD farming rewards, IBC transfer them to Agoric and stake them for even more BLD rewards. The same is true for the CRE farming rewards, which can be staked on Crescent for even more CRE rewards.

A combined approach of LP and single staking farming maximizes rewards. See the picture below.

Osmosis Zone

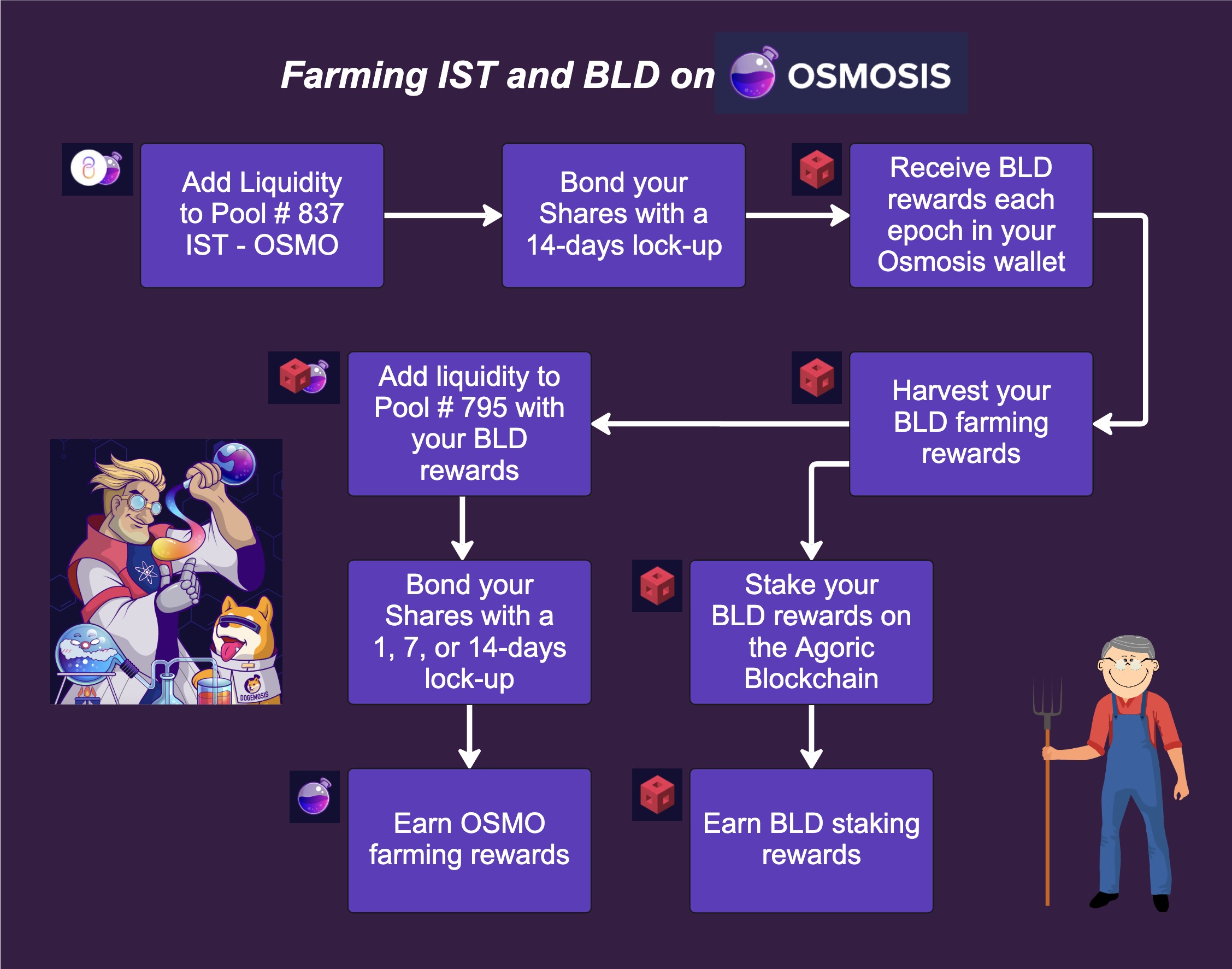

Providing liquidity on the Osmosis AMM with the Inter Stable Token presents a unique opportunity to earn BLD farming rewards when pairing IST with OSMO. Once these BLD tokens are harvested, they can be paired with OSMO to earn OSMO farming rewards in yet another liquidity pool. Subsequent BLD rewards can also be withdrawn to the Agoric blockchain (via IBC) and staked there for even more BLD rewards. See the picture below for how this process flows.

This is a super lucrative method to build up a portfolio of sought after tokens. When you regard all three tokens (IST, BLD, and OSMO) as desirable like I do, LP rebalancing does not present itself as a negative factor; instead, it can be embraced. Values go up and down and the 50/50 split is constantly rebalanced; however, the eventual mix of tokens is always made up of just the assets you prefer to own or trade in your portfolio.

By the Numbers

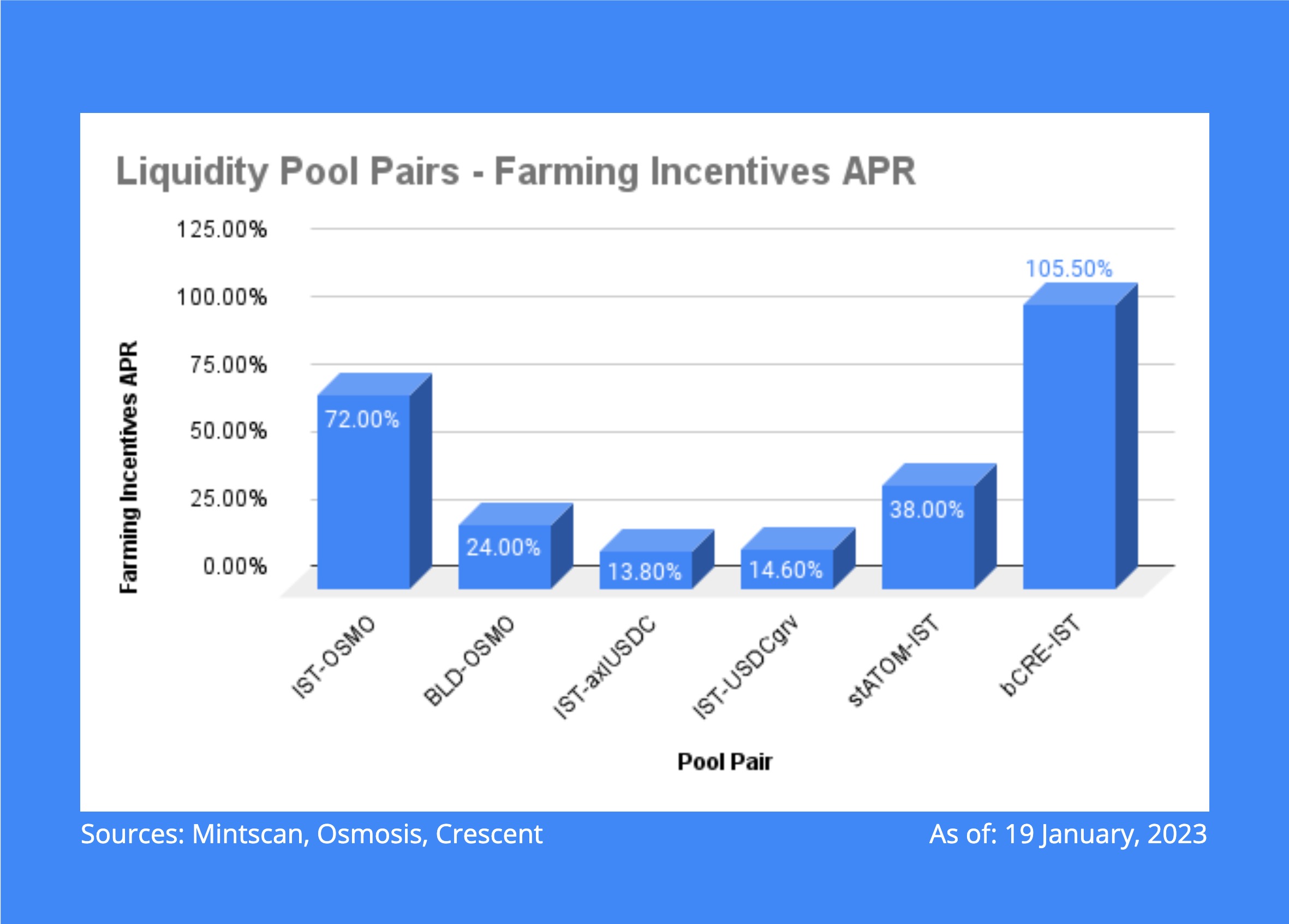

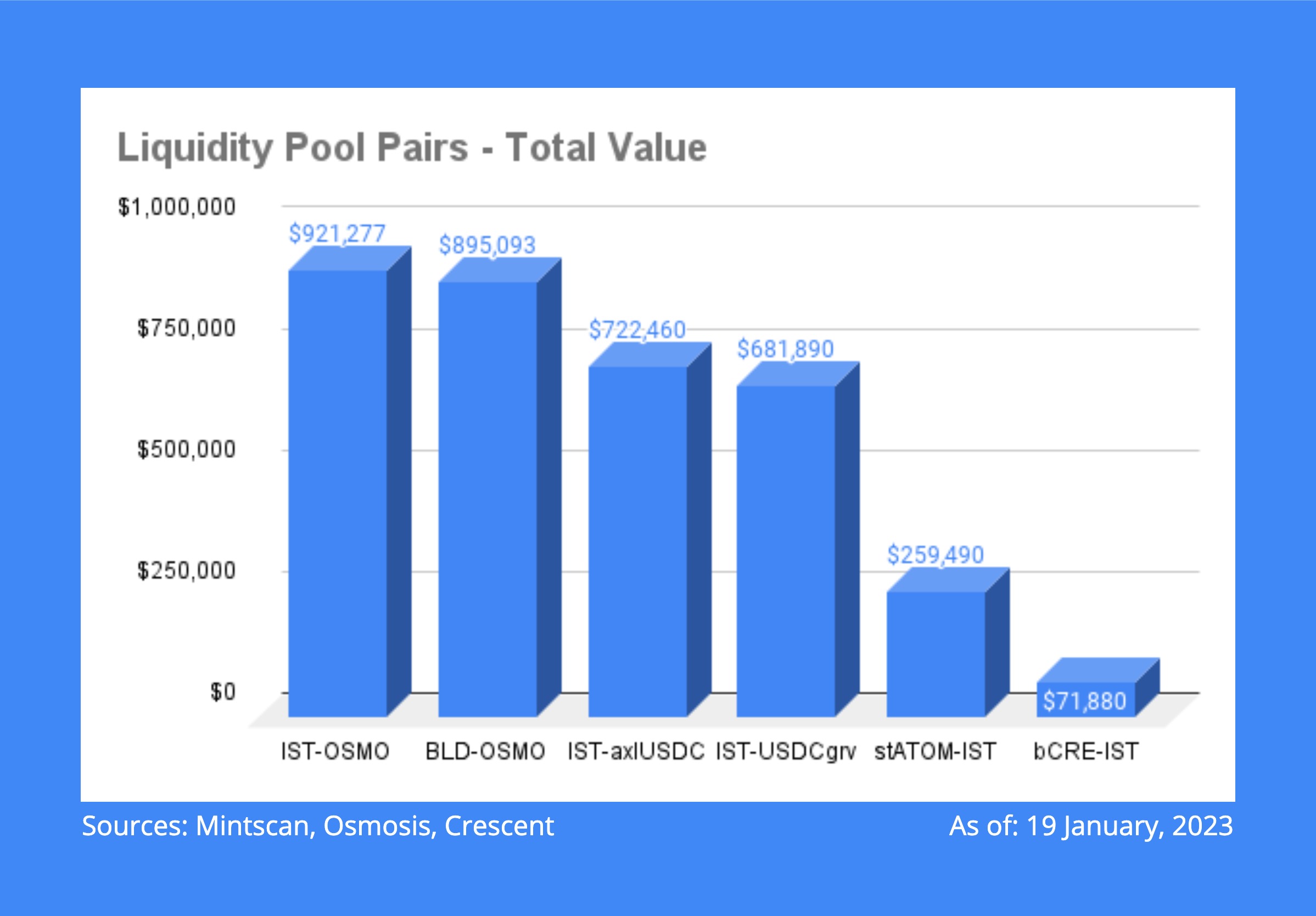

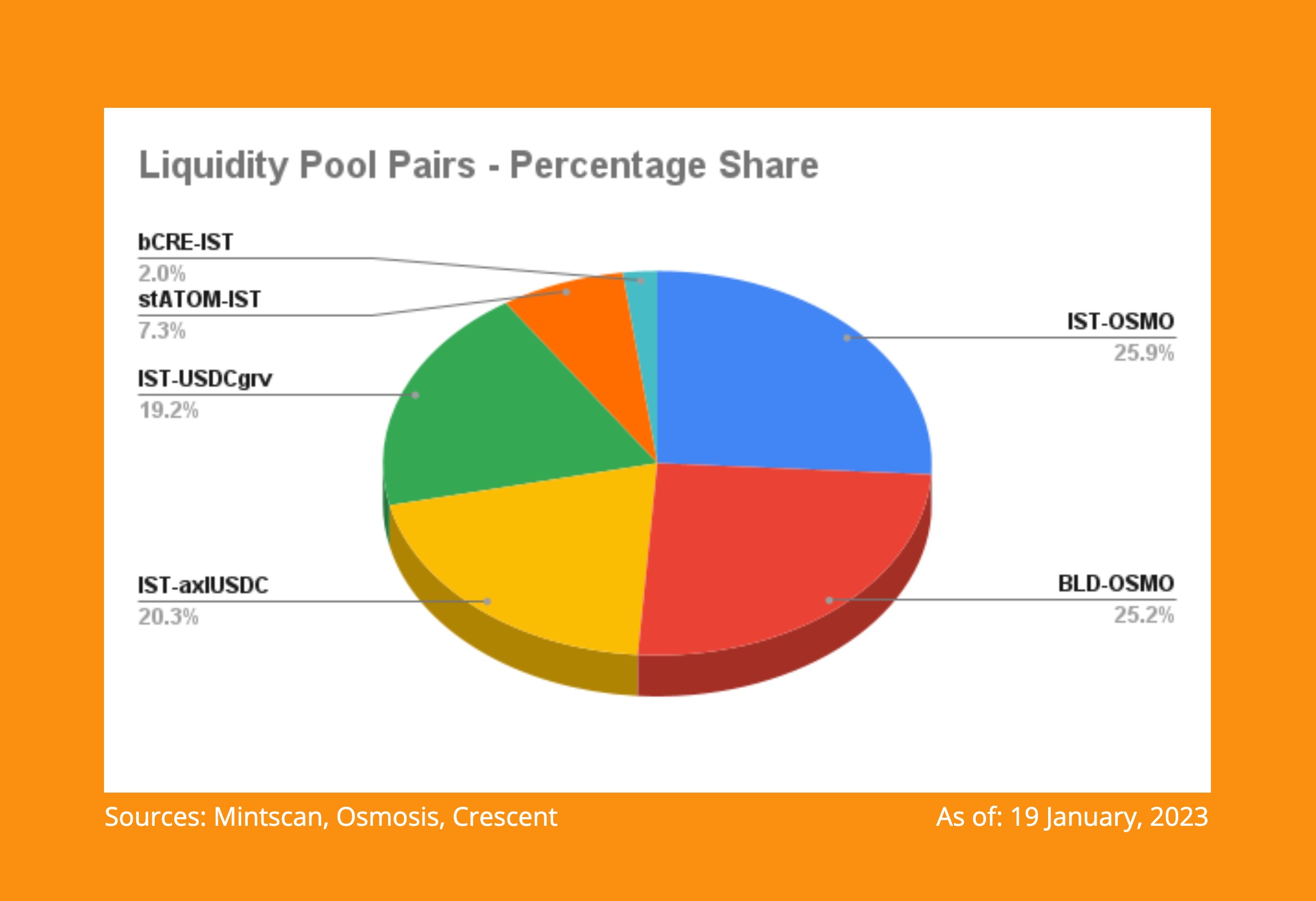

Let’s take a look at the numbers to compare the farming opportunities with IST.

These charts compare the APRs and the dollar values being farmed in these pools.

When comparing all six pools, we see that the two Osmosis pools account for the majority share, but the newer Crescent pools are quickly catching up. What is impressive to me is the overall amount of liquidity in these six pools has already surpassed $3.5 million in a very short period of time, and all while we are in a bear market!

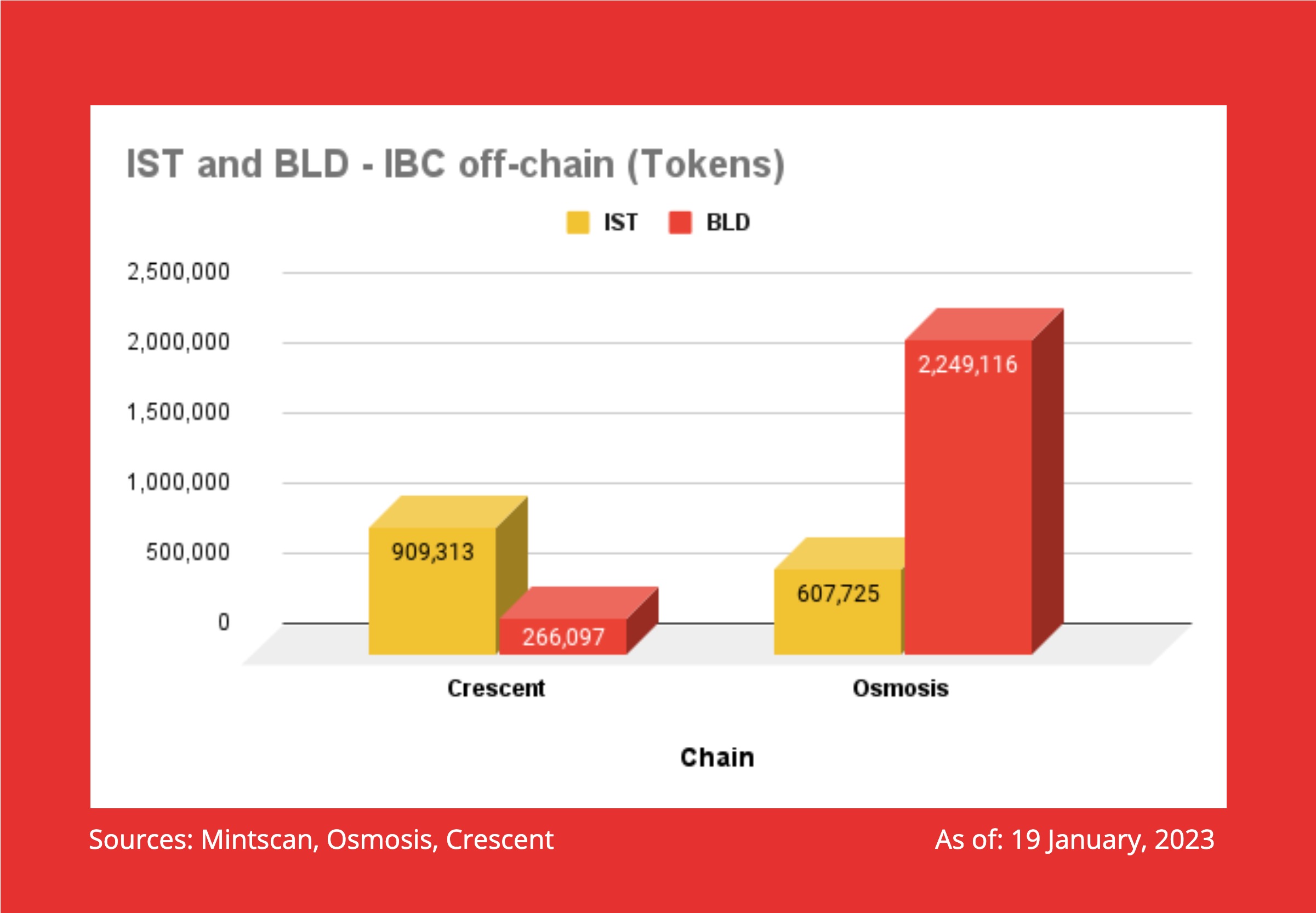

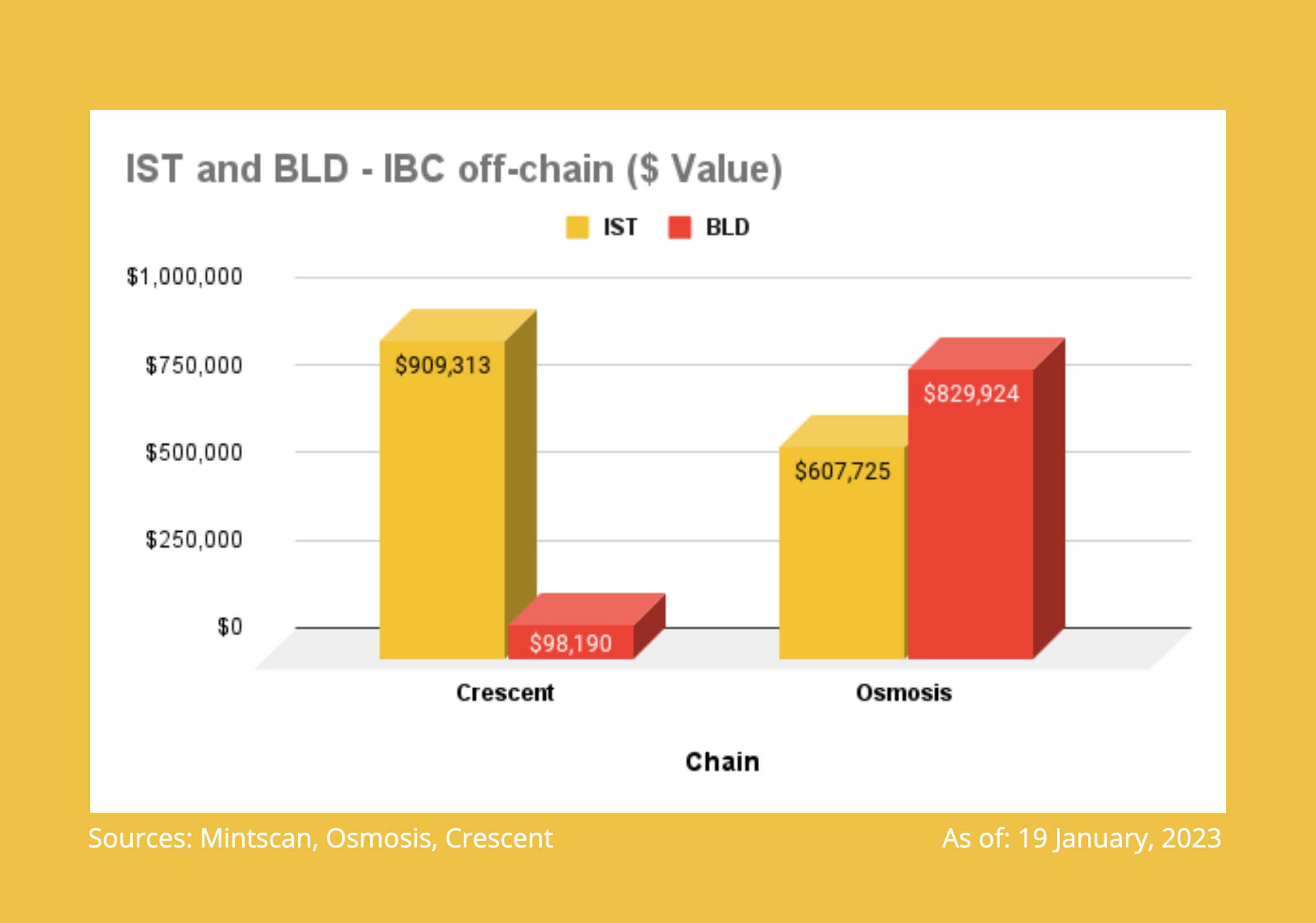

Another interesting factor is the amount of IST and BLD that have moved off-chain (via IBC).

Native Stable Tokens

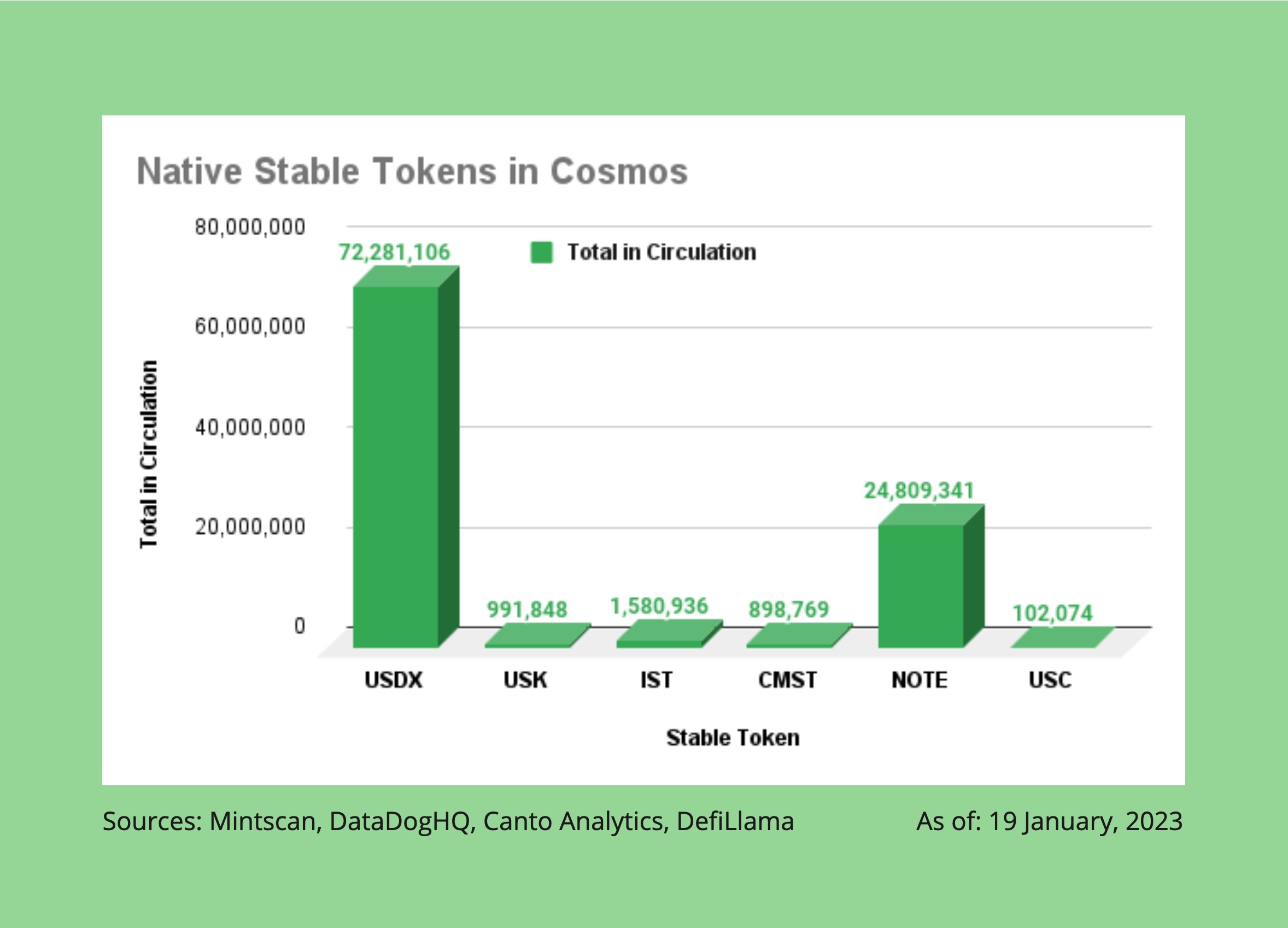

The field of native stable tokens is growing in the Cosmos, with just over 100 million tokens in circulation. However, the lion’s share reside on the Kava and Canto blockchains.

I identified six for analysis here; however, several more are launching soon. For example, Shade Protocol will launch SILK in the coming months on the Secret Network blockchain. And, Capapult Protocol will introduce SOLID on the Terra blockchain.

Native stable tokens are more desirable as they are minted right here in the Cosmos ecosystem. As great as they are, the Ethereum stable tokens (USDC, USDT, DAI, and FRAX) used widely today in the Cosmos are all bridged in by a cadre of bridge providers, led by Axelar and Gravity Bridge.

Interestingly, most Cosmos stable tokens stay home and don’t travel beyond the borders of their respective blockchains where they were minted. It appears that the stable tokens for the Kava, Canto, and Carbon blockchains were specifically designed for the purpose of supporting their local DeFi dApps. However, I will keep an eye on this to see whether this changes, since we are still early in this economic growth phase.

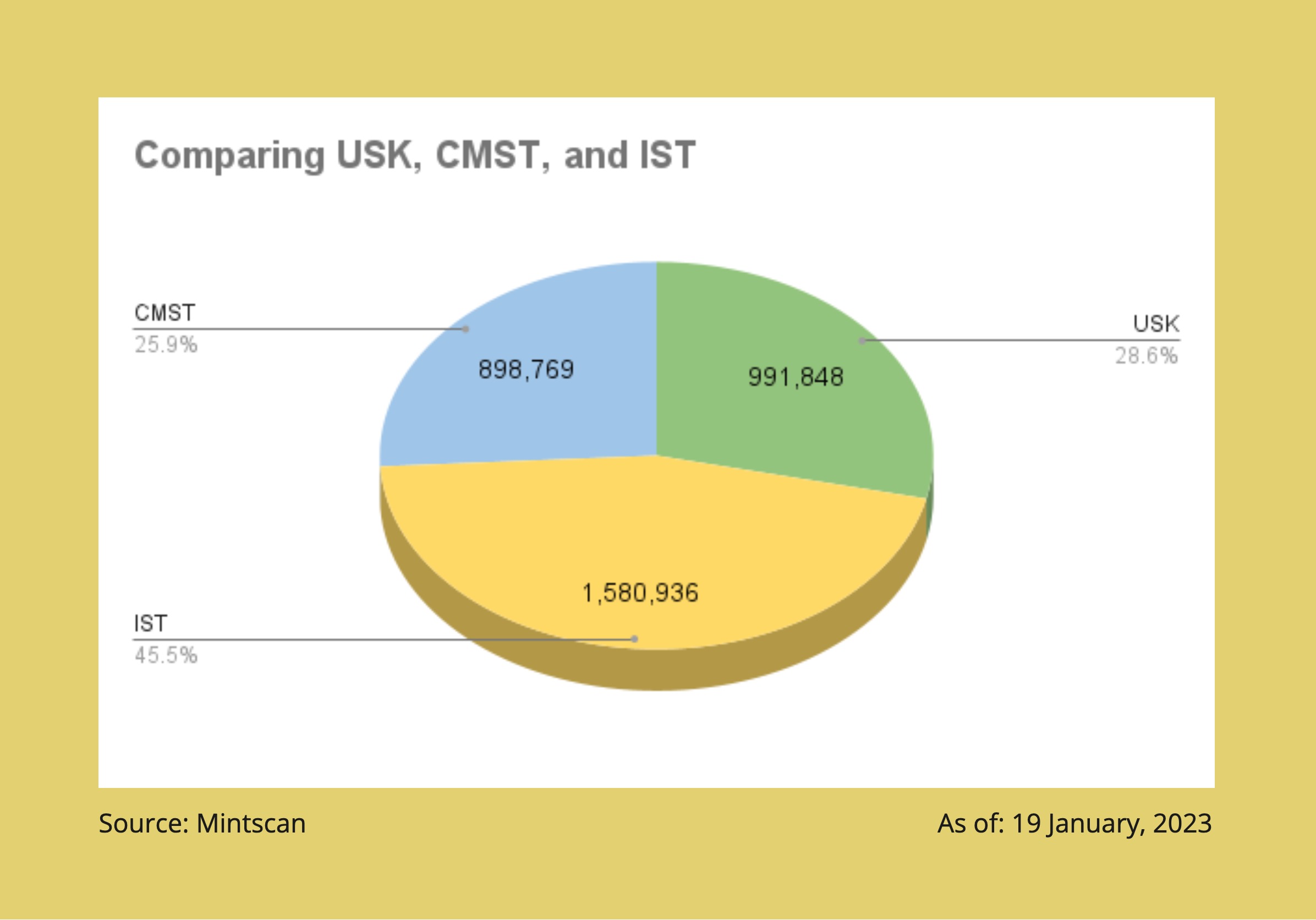

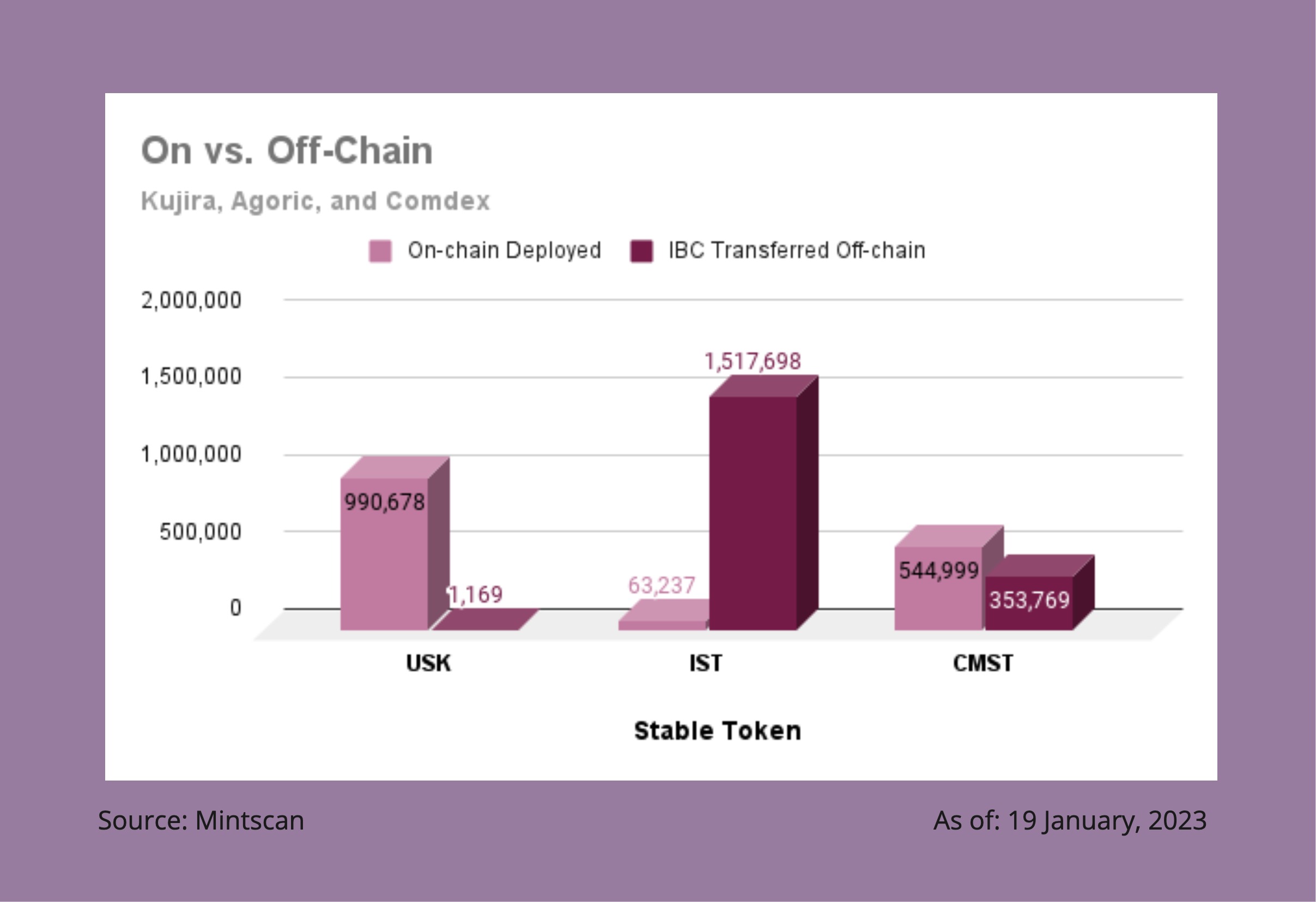

Comparing IST to the other two stable tokens that are cosmic bound (CMST and USK), please see the chart below.

IST is currently the one that has traveled away from home the most. This matches the goals of the Inter Team to make IST available wherever the community members participate in Cosmos DeFi.

Upcoming Opportunities

IST has just embarked on its travels across the Cosmos by landing on Crescent and Osmosis. Partnerships are being forged as we speak and the first one has been officially announced.

IST will initially trade in a liquidity pool on the new ShadeSwap with axlUSDC. In the subsequent phased roll-out of this exciting new AMM on the Secret Network, IST will be paired with SILK, Shade Protocol’s new stable token. BLD will also be paired with SHD, the governance token for the protocol. And, those last two pools will be incentivized with farming rewards!

Another two exciting partnerships were just announced:

- IST will trade on the spot markets of the Injective blockchain.

- IST will be available in the lending and borrowing markets of the Umee blockchain.

My Two Tokens

New decentralized exchanges are launching soon and with these come more chances at establishing strategic partnerships to spread IST further across the Cosmos.

In my opinion, the Juno Network needs a native stable token and the opportunity for IST to travel to Juno is right around the corner. Wynd DAO is launching a brand new DEX and much of the liquidity from the JunoSwap DEX will automatically migrate over. I think that IST representation in the liquidity pools of WyndDEX would be amazing!

Two more exciting new decentralized exchanges are in the final stages of preparing their launches. Dexter on the Persistence blockchain is branding itself as the Interchain DEX and has announced that it will introduce stable swap liquidity pools, as well as three-token and five-token pools. Duality is the other exchange and it has announced both AMM and order book functionality. These present yet even more opportunities for IST to grow and expand.

“The farmer has to be an optimist or he wouldn’t still be a farmer.”

I frequently reference this quote by Will Rogers, because I firmly believe that Cosmos DeFi will see an explosion of growth in 2023 and beyond. I base this view on the tremendous amount of building I see going on in the ecosystem. After having embedded myself in Cosmos for a year and a half, I can say that this is the most activity of new dApp and protocol building I have seen.

Cultivating LPs and single staking farms is no exception as more liquidity is the most sought after component of all this economic activity and more are being introduced all the time. The mechanisms are getting more complex and the variety of pools are growing. Providing liquidity with IST in the pools offered across the top AMMs in the ecosystem makes a farmer like myself get out of bed every morning with a spring in his step.

Nothing in DeFi is without smart contract risk; however, by carefully nourishing my portfolio, I can manage the amount of LP and staking risk I want to take on with the excellent tools available to me. My lowest risk pools are where IST is paired with another stable token, with the medium risk coming into play where IST is paired with another volatile asset. I limit taking LP positions in the highest risk category, with two volatile assets, to just those pools where both sides are on my list of blue-chip or most promising tokens.

It has only been less than three months since the Parity Stability Module launched on Inter Protocol, when we created our Agoric smart wallet, and began minting IST. In that short period of time, the Inter Team has already forged many strategic partnerships across the Cosmos ecosystem and there are more to come. Because of this, community members and avid farmers like myself can actively participate in this economy and cultivate our modern crops.

Tot ziens – Opa.

Sources, References, and Further Reading

Agoric - https://agoric.com/

Agoric’s Twitter - @agoric

Inter Protocol - https://inter.trade/

Inter’s Twitter - @inter_protocol

Inter PSM - https://psm.inter.trade/

Agoric Wallet - https://wallet.agoric.app/wallet/

Overview of Inter Protocol - https://leofinance.io/@kaaskop/inter-explained-in-pictures

The Launch of IST - https://leofinance.io/@kaaskop/uniting-the-interchain-with-ist

Crescent - https://app.crescent.network/

Osmosis - https://app.osmosis.zone/

Shade - https://app.shadeprotocol.io/

Injective - https://injective.com/

Umee - https://app.umee.cc/#/markets

Wynd - https://www.wynddao.com/

Dexter - https://www.dexter.zone/

Duality - https://duality.xyz/

You can find me here:

Twitter - @KaasKop_Opa

Medium - https://medium.com/@KaasKop_Opa

Loop - https://www.loop.markets/user/52879

Leo Finance - https://leofinance.io/@kaaskop

Posted Using LeoFinance Beta