The benefits of cryptocurrency and the digital currency introduced by the central bank have created an opportunity to bypass the Western regulated financial system.

Source: Image surce

Russia has been embroiled in renewed financial sanctions since the start of military operations in Ukraine. It has imposed restrictions on financial transactions with a number of banks, public and private financial institutions, industrialists, and their family members. Under these circumstances, Russia's a trade and commerce would naturally suffer.

But the world is no longer under the sole domination of the United States — the financial system is no longer just dollar and Swift-dependent. The benefits of cryptocurrency and the digital currency introduced by the central bank have created an opportunity to bypass the Western regulated financial system.

image source: image

Several countries, including the United States, the European Union, the United Kingdom, Australia, Canada, and Japan, have imposed sanctions on Russia over the Ukraine crisis. Russia has also announced plans to seize the assets of a number of public and private financial institutions and industrialists. Some countries have even banned Russian tourists. However, some Russian currency experts believe that many Russians will be able to avoid the ban by using Bitcoin, even if it is initially difficult. Analysts also see the possibility that the Chinese transaction system CIPS and its digital yuan could become an alternative currency.

Digital currency experts say there is already a growing tendency among Russian citizens to invest in cryptocurrencies, relying on bitcoin to avoid future risks. The United States is well aware of this problem. A few months ago, the country's finance ministry warned that digital currency was undermining US sanctions. The warning also called for effective measures to prevent individuals and entities on the sanctions list from saving and transferring funds outside the traditional financial system.

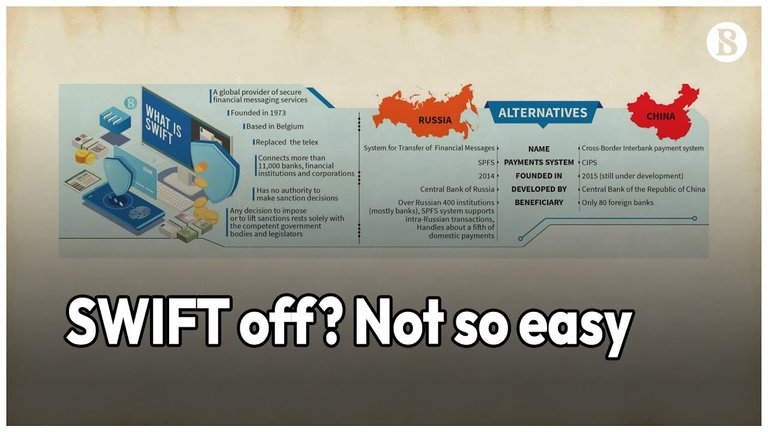

Excluded from Swift

The biggest news on the economic front of this war since the beginning of Russia's military aggression on Ukraine is the exclusion of some Russian banks from the international payment system Swift. The United States, the United Kingdom, and the European Union have imposed sanctions. European Union President Ursula von der Leyen said a decision had been made to exclude several Russian banks from Swift. As a result, those banks will no longer be able to operate in the whole world. Russia's imports and exports will be affected. The decision was made in consultation with the United States, Canada, and the United Kingdom, Ursula said. The European Union (EU) has said in a statement that it will not allow Russian billionaires to use its assets in the EU's financial markets.

The Society for Worldwide Interbank Financial Telecommunication or Swift started its journey in 1983. Headquartered in Belgium. At present, 11,000 financial institutions in 200 countries transact through Swift. In 2021, an average of 4 crores 20 lakh messages were exchanged daily through Swift.

The European Union is the largest buyer of Russian gas and oil. Through Swift, they pay off the debts of Russian companies. As a result, many in the European Union are demanding that Russia be completely separated from Swift. But in that case, the European Union could also suffer huge trade losses.

Swift is headquartered in Brussels, but its database is in Virginia, USA. As a result, they have the opportunity to monitor almost all financial transactions in the world. This is the trump card in his hand.

In addition to Swift, the other two trump cards they have in their hands are the dollar and chips-clearing house interbank payment system. It is like the commercial club of the world's financial institutions, with 43 members. In order to transact through this, the US Federal Reserve has to open an account with Federal Reserve and deposit money in advance. About 1 lakh 60 thousand crore dollars are traded daily through chips. Its members have to open offices in the United States. And everything is governed by US law. As a result, they can catch anyone at any time. As a result, the United States has levied 1.3 trillion in fines over the past decade on those who have done business with Iran, despite sanctions.

image: source

The rise of China

This use of chips did not escape the attention of China. That is why they have developed the Cross Border Interbank Payment System (CIPS). Now Russian banks are also considering CIPS as a viable alternative to Swift and chips. The rise in the value of the CIPS suggests that the Chinese currency, the yuan, is more likely than the Russian ruble to compete with the dollar internationally.

However, CIPS still has a long way to go to gain an acceptable position as an alternative to Swift. The Chinese currency, the yuan, is less than 2 percent used in international financial transactions, and the US dollar is 40 percent. Even the yuan lags behind the euro, the British pound, or the Japanese currency, the yen.

However, analysts say that CIPS could become a regional alternative to Swift in the current context, despite its low usage. In the Eurasian region, for example, its single-use may begin. In addition, Russia's reliance on CIPS is increasing. Recently, 23 Russian banks have joined the CIPS system, while only the Bank of China has joined Russia's SPFS system. So the big question is, will China take Russia's SPFS as an alternative to Swift, or will it want to expand CIPS on its own?

# Digital currency

Digital currency is the Internet-based currency, the most well-known example of which is Bitcoin. However, it is private. There are also official digital currencies in the world, such as the digital yuan. Analysts believe that with the help of this digital yuan, China could establish CIPS as an alternative to Swift in international transactions.

In the age of digital currency, customers will not have to open an account with a commercial bank but will transact directly with the central bank. Apps like Ali Pay or Venmore will be in the middle. Instead of writing checks or paying using credit cards online, transactions will be done directly in the digital currency provided by the central bank. As a result, Swift will no longer be needed.

However, this passage will not be so easy. Countries like Russia and China need to trade with the United States and its Western allies. So they have to accept the conditions of the West. As a result, analysts believe that the Earth is moving from a unipolar or bipolar system to a multipolar system, where the name CIPS will also be pronounced with Swift.

Posted Using LeoFinance Beta