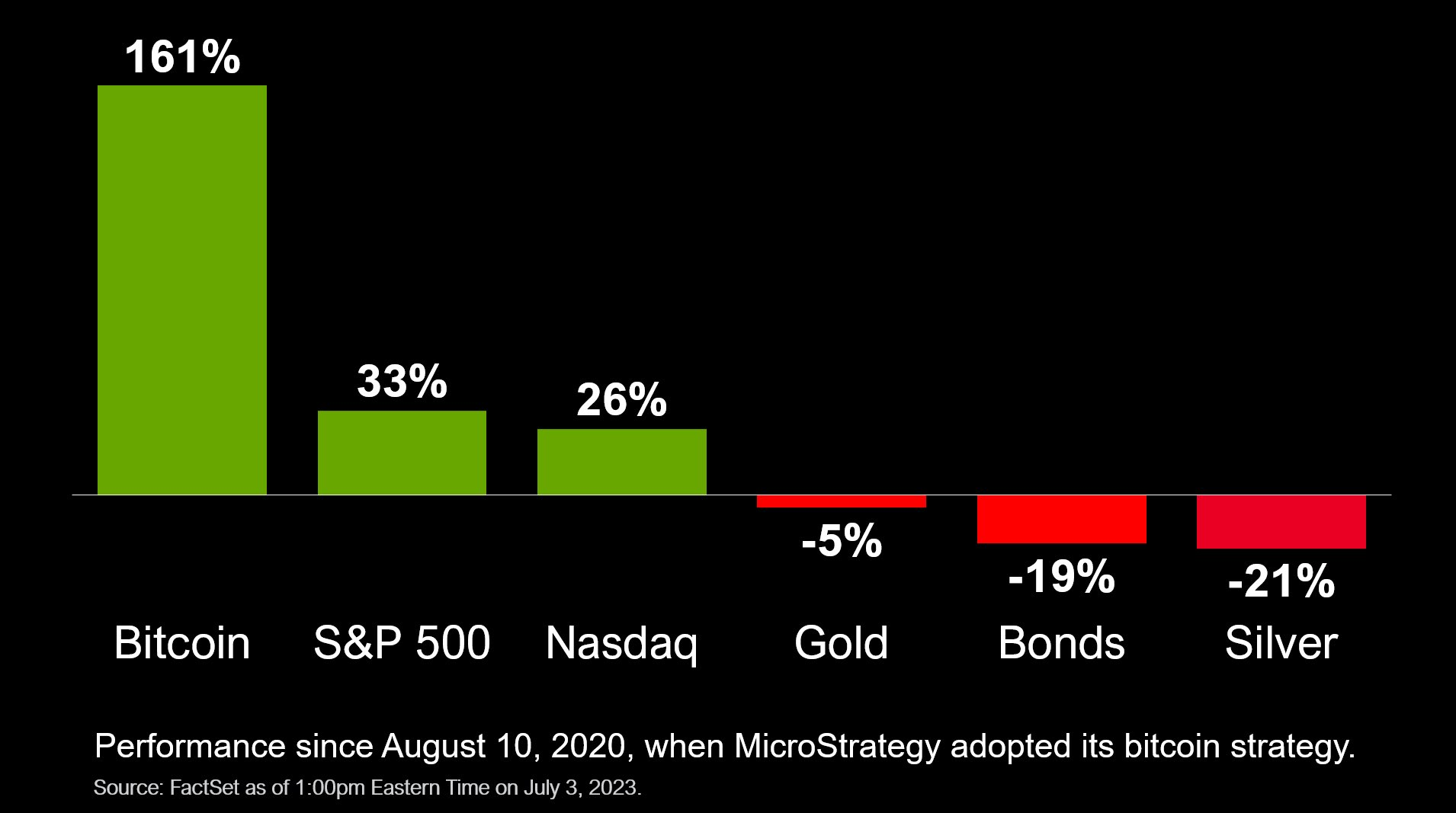

Earlier today, Michael Saylor posted the above chart talking about Bitcoin's price performance since August 10th, 2020 when Microstrategy adopted BTC as their treasury reserve asset.

Microstrategy decided to keep BTC on their balance sheet for their cash reserves instead of actual USD Cash. This move shocked the industry and was something that many of us talked about for years. We all knew that one day, a company would be smart enough to start using Bitcoin as a strategic reserve asset.

If you knew on August 10th, 2020 that 3 years later, Bitcoin would trade for 161% more than it was, would you have put your entire life savings into it?

The answer is (most likely) a resounding yes. I mean, if you could travel back in time and know for sure that something was going to be more valuable and you also knew exactly when and how much more valuable it would be, it would be a no brainer.

A Random Walk Down (Wall Street)

A random walk down wall street discusses the idea that markets are completely random. Nobody truly knows what is going to happen next. Afterall, if someone did, they would be a trillionaire and able to print unlimited capital by profiting consistently and predictably.

The thing about Bitcoin and about any market or investment is that we don't know what will happen next.

We make investments and we have a thesis. Then we are forced to wait as the market plays out our thesis.

If we are right and do the right things, we make money.

If we are wrong and/or do the wrong things, we lose money.

That's the game of investing. One of the things I love most about it is that there is a global scoreboard. It's easy to tell who is and isn't good at investing because you have a literal score keeping method in the form of money.

How to Win in the Next Bull Cycle

We've begun an incredible run in the price of BTC. This has a lot of people excited. We're not quite near all-time highs of ~$60k quite just yet, but people seem to believe that the bull market is upon us and it's only a matter of time until we reach the coveted ATHs that are so promised.

Despite all of the short-term price action, an investor needs to be ultra-wise and ultra-disciplined in the current market.

It's easy to buy when it's at lows.

It's easy to sell when it's at highs.

But what the hell do you do when it's at "mediums"?

Not too long ago, BTC was at $15k.

Not too long ago, BTC was at $60k.

Now it's at $30k. At $30k, the game gets interesting as it feels like a proverbial coin flip as to whether the price of BTC will start creeping higher or will drop back down and test the lows.

If you believe in Bitcoin and the long-term prospect of the market cap, use case and adoption growing, then it's easy to say that it will be higher in the next few years.

But that being said, why is it so hard to buy right now?

To Determine Whether to Buy, Search Within Yourself

I've talked to a lot of people who want to get more exposure to crypto. They want to earn more and everyone loves the idea of making money.

That being said, they don't have a clue if they should buy BTC or not.

Let me ask you this - go back to our initial question. If you knew on August 10th, 2020 that Bitcoin would be 161% more valuable 3 years later, would you have bought more Bitcoin?

Now let me ask you, do you believe Bitcoin will be greater or less than $30k in 3 more years? July 5th, 2026.

And if you zoom out further, do you believe BTC will be more or less than $30k in 10 years? July 5th, 2033?

When you zoom out, a clearer picture presents itself.

I think you know how I am acting in this current market. Put a 10 year lens on it and the world becomes clear.

About LeoFinance

LeoFinance is a blockchain-based Web3 community that builds innovative applications on the Hive, BSC, ETH and Polygon blockchains. Our flagship application: LeoFinance.io allows users and creators to engage & share micro and long-form content on the blockchain while earning cryptocurrency rewards.

Our mission is to democratize financial knowledge and access with Web3.

Twitter

Discord

Whitepaper: https://twitter.com/FinanceLeo: https://discord.gg/E4jePHe: https://whitepaper.leofinance.io

Our Hive Applications

Join Web3

Microblog on Hive:

Delegate HIVE POWER: Earn 16% APR, Paid Daily. Currently @ 3.8M HP

Hivestats

LeoDex

LeoFi

BSC HBD (bHBD)

BSC HIVE (bHIVE)

Earn 50%+ APR on HIVE/HBD: https://leofinance.io/ https://leofinance.io/threads: https://hivestats.io: https://leodex.io: https://leofi.io: https://wleo.io/hbd-bsc/: https://wleo.io/hive-bsc/: https://cubdefi.com/farms

Web3 & DeFi

Web3 is about more than social media. It encompasses a personal revolution in financial awareness and data ownership. We've merged the two with our Social Apps and our DeFi Apps:

CubFinance (BSC)

PolyCUB (Polygon)

Multi-Token Bridge (Bridge HIVE, HBD, LEO): https://cubdefi.com: https://polycub.com: https://wleo.io

Posted Using LeoFinance Alpha

I like the sounds of the 10 year lens. I ask myself same question everyday. It's too late to go back to 2029, but today we can keep stacking those sats! Everyday I'm stacking them!

As you said nobody knows the future that's why we can't say anything about Bitcoin will become more valuable after 3 years or five years or not the best thing is accumulating Bitcoin or I mean profits, holding Bitcoin is not enough who knows Bitcoin goes up and then goes down again after 3 or 5 years 😂

You have to think long term to see things clearly and people need to get out of thinking a time frame of 6 months or 12 months as it is just too short. Those of us who have been building their portfolios over the last 5 years and have been stacking instead of selling are going to be worth a small fortune within the next 5 -10 years.

Before the last ATH, we knew that Btc would break the previous ATH ($20K) but no one knew $60k was visible. I'd say Elon(Tesla) adopting Btc as a means of payment at the time really pushed it too. Sadly, he's also one reason why the bear market was rough on us after his negative comment on the rapidly increasing use of fossil fuels for Bitcoin mining.

Microstrategy on the other hand has really represented us well.

I also believe the Bears and Bulls have the same power at the moment ($30k). Glad that we are seeing more positive news (spot ETF).

I am currently on a DCA plan for my long-term holding.

10years from, we should be above $100k