ICYMI the Uniswap decentralized exchange (DEX) on Ethereum decided to mint and airdrop their very own governance token. From what I gather, this was always a part of the Uniswap roadmap, but it was more likely to come with V3 of the interface.

Serving as proof that things don't always go according to plan, Sushiswap and other Uniswap forks popped up all over the place after Uniswap's recent boom in volume. The key difference with each fork is that they launched with a "governance token" whereas Uniswap hadn't launched their token (yet).

So became a new practice called "Vampire Mining". This is essentially where you clone another liquidity project (i.e. Uniswap) and spin it up almost identical to the original. Then you add a governance token and offer it to people who migrate their liquidity from Uniswap to your fork.

This is what Sushi and many others did. As you can see from the volume and liquidity charts, Uniswap dipped from its ATH's within a few days of these forks being released.

The general consensus around the industry is that many of these forks weren't actually anonymous dealings entirely. It was a plot by centralized exchanges (CEXes) to overthrow Uniswap and take back some of the trading volume.

Keep in mind that every $1 of volume done on Uniswap is $1 less of volume that could be done on Binance, Bittrex and others. It's not a far reach to say that these exchanges would do anything in their power to take back this $500M + daily volume that is happening on Uniswap.

UNI Stimulus Check

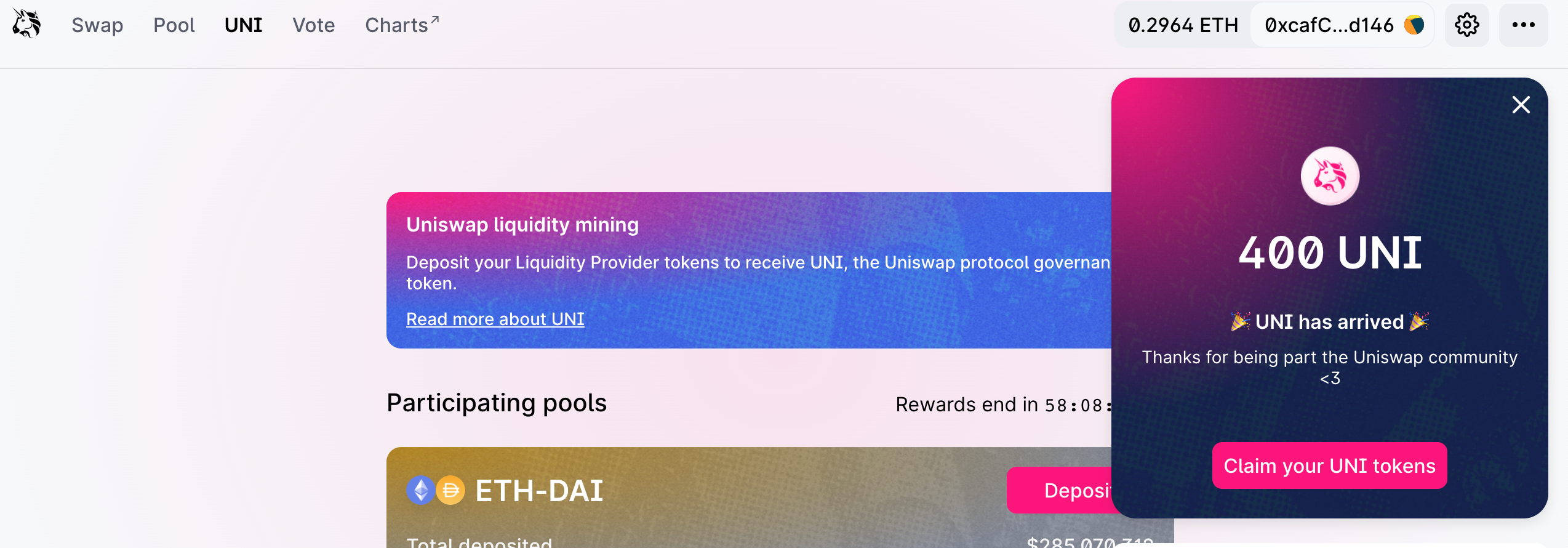

The new meme in crypto is that Uniswap just gave us a UNI sized stimulus check. The U.S. gov gave out a stimulus check for $1,200 to most adults. My UNI airdrop is currently worth $2,800. Maybe the U.S. should take a page out of Uniswap's playbook and learn how to stimulate an economy :)

I've been waiting to claim my UNI airdrop because I had a gut feeling that the token price would pump.

Turns out that I was right. When UNI was released and I heard about it on Wednesday night, I saw the token price at ~$2. Then it jumped to $2.97 and I decided that it was a risky bet, but well worth the potential reward. I bought up some UNI on Binance and then held it.

To date, I've only sold my cost basis back and still have a decent amount of UNI freerolling. On top of that, I've got the airdrop to claim.

UNI is now trading at $7. $10 seems pretty likely in the next day or so.

The universe has a funny way of intersecting. wLEO was set to make its first debut on an external exchange (outside of Hive) on Thursday morning but the UNI airdrop blew up the ETH network and forced us to push the launch to next week.

The DEX Craze Isn't Over

A lot of people are still blind to the fact that this is a long-term change in the crypto markets. This is not a boom/bust cycle where the whole industry gets rug pulled (pun intended) in one night and all of the infrastructure disappears.

I've been saying that DEXes will take over the CEXes since I got into the crypto space and learned how the industry worked. I haven't been alone in saying that. The DEX revolution is just getting started.

The conspiracy about CEXes launching things like Sushiswap (or at least having a hand in their growth) and also buying up UNI so that they can control the fee structure is not off base. The CEXes realize that this looming threat of DeFi is not a fleeting idea.

Much of the infrastructure we're seeing today will exist tomorrow and will continually be improved and built upon.

This, along with many other reasons, is the primary driver of launching wLEO. List yourself where the people are and move where they move.

For all its faults, ETH is still the most dynamic blockchain in this industry. It has the most dApps, the most trading volume, the highest # of users... It's an incredible blockchain in spite of its poor technology.

Bridging Hive --> ETH gives us the best of both worlds as we foray into a space that is still nascent, but incredibly useful.

Join Our Hive Community & Earn LEO Rewards!

Earn LEO + HIVE rewards by creating crypto/finance-related content in our PeakD community or directly from our hive-based interface at leofinance.io or LeoFinance Beta

| Track Hive Data | New Interface! | About Us |

|---|---|---|

| Hivestats | LeoFinance Beta | Learn More |

|  |  |

Posted Using LeoFinance Beta

I sold 200 @ $2.75 and another 200 @ $3 :( Well, it's still free 6k HIVE.

Could have been more than 15K HIVE though.

Free is free :)

Posted Using LeoFinance Beta

Pickles are coming.

Posted Using LeoFinance Beta

Pickles? Is that a new coin?

Posted Using LeoFinance Beta

I sold everything at around $6. Swapped it to Hive and then bought 6000 LEOM with it :)

Posted Using LeoFinance Beta

haha you made a big splash with your 6k LEOM buy (and previous ones). I saw the buzz in Discord and a few other places.

I know @rollandthomas will be upset with you, he was just talking on the podcast the other day about his plan to buy up the remaining sell wall 🤣

Posted Using LeoFinance Beta

Haha. Everything I get right now are going into the miners. I feel I have a limited time to buy those because when they go they will be worth a mint afterwards. I had to do it this way because I didn't have the ETH to back up my massive stake.

Posted Using LeoFinance Beta

I bought it for 2 $ too. These hours that I am in doubt whether to see or not. I think about the long term. In the course I would already be able to get more than 100% of the invested, but if in the long run it is worth thinking, I prefer to wait for the moment. Just like my Leo Tokens! :)

Posted Using LeoFinance Beta

Long-term thinking can get you far. I may hold some UNI for the long play but will also take advantage of the short-term speculation cycle

Posted Using LeoFinance Beta

Man I missed this one..congrats on the free money..

Posted Using LeoFinance

lol thanks.

Hopefully won't be the last one :)

Posted Using LeoFinance Beta

The question now becomes, what are you going to do with your free monies? :)

Posted Using LeoFinance

I can’t speak for anyone else, but I’m going to swap mine to ETH and deploy it to this great up and coming token pool that’s supposedly launching in a week :)

Posted Using LeoFinance Beta

i heard it's a total shitcoin :(

eth? :-)

He always calls LEO a shitcoin.

But I've realized that he does that to try and dump the price so he can add to his 200k+ stack 🤷🏽♂️

Posted Using LeoFinance Beta

Wish I had that much, but I was stupid and stopped buying when I reached about 70k 😭😭😭😭

Still sounds like dreams to my head that an airdrop is worth as much as $2,800. That amount hehehe... This means it's possible for LEO to hit $1 after few days of launch.

Posted Using LeoFinance

hehe it's a weird feeling to get something like this sent to you without feeling like you did something worth the value received.

It is a testament to this industry that LEO is now jumping into. There's a lot of money and opportunity here. What I'm most excited about is providing a platform to onboard the users of DeFi into a community where they can blog, earn and hang out

Posted Using LeoFinance Beta

Lucky for me i had problems when claiming my UNI due to low gas fee. I finally received them today and swapped them for $2400 worth of $BART

Now i need to get ready to swap my LEO for wLEO and provide ETH in Liquidity. Is that correct? Where can i find instructions of what / how to do this please @khaleelkhazi ?

Posted Using LeoFinance

haha nice.

We're going to do some detailed instructions soon. You can keep up to date with all the content we've made about wLEO at https://leopedia.io/wleo. More is added every day :)

Posted Using LeoFinance Beta

Discord Server.This post has been manually curated by @steemflow from Indiaunited community. Join us on our

Do you know that you can earn a passive income by delegating to @indiaunited. We share 80 % of the curation rewards with the delegators.

Here are some handy links for delegations: 100HP, 250HP, 500HP, 1000HP.

Read our latest announcement post to get more information.

Please contribute to the community by upvoting this comment and posts made by @indiaunited.

Congratulations @khaleelkazi! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPlol

@tipu curate

I wish I waited longer but I am still happy of where I sold.

Yeah it’s hard to go wrong with free money :)

I may dump the majority if not all around $10

Posted Using LeoFinance Beta

#moneyfromthesky

Yeah, it's free money but my head is like "it could be more!". Stupid head...

I'm just wondering who is paying for it.

It's one of the biggest crypto exchanges now, having a vote what tokens / projects it should support is probably important for many whales. I could imagine that also old, centralised exchanges want to have something to say when it comes to uniswap development.

On the other hand CRV token from curve defi platform went to dust after initial pump. But they didn't have $1.6B daily volume.

While I made a post here arguing why it should be delayed, per the announcement:

UNI holders can vote at some point to start taking 1/6th of any liquidity pool. So, the coin does have some actual value.

I think a lot of governance tokens suffer from their initial distribution, they end up controlled by get-in get-out yield farmers with no long term plans, so they basically have to dump to a point those who want it can afford it (or end up ran by vulture capitalists that will skin the sheep). Hopefully UNI's distribution helps.

Posted Using LeoFinance

Exactly. Why paying for it so much now when a lot of UNI tokens aren't still distributed?

All I got to say, a useless token called hotdog was $4,000 and dropped to $1 in 5 minutes. People do silly things.