Bitcoin is without a doubt one of the most fascinating inventions of the 21st century. We are living in the transition period from physical reality to digital reality. The emergence of digital technologies has and will continue to change our lives. Some think for the worse, others think for the better.

BTC has changed my life in a lot of ways. Since I was young, I was always obsessed with finance. Going back to when I was just a little kid, people used to ask what I wanted to be when I was older and I would say "I want to own a hedge fund".

Collateralized Lending Vaults

I've written several articles talking about Collateralized Lending Vaults and also a few other strategies I leverage to trade around my BTC core position.

This core position is rather large relative to all of my other investments. I have a firm belief in Bitcoin in the coming decades and I put my money where my mouth is many years ago when I first became a sat stacker.

Buy Low, Borrow, Sell High, Repay

The biggest strategy I use to trade around my BTC core portfolio position is to stack sats when Bitcoin is low, borrow stablecoins against that BTC to pay for any expenses I have and then wait.

What am I waiting for?

The bull market. It feels like we're just in the early stages of this bull market right now. With Bitcoin hovering at $27k-$29k.

I accumulated a lot of BTC under $20k. I started buying when we dipped below $30k but got really heavy around $16k-$18k.

Now that we're starting to enter a potential bull market, I am starting to look at the numbers of repaying my BTC vault. It's not time to start paying off the debt just yet. I think BTC has a much longer run ahead of it in the coming years, but it's good to look.

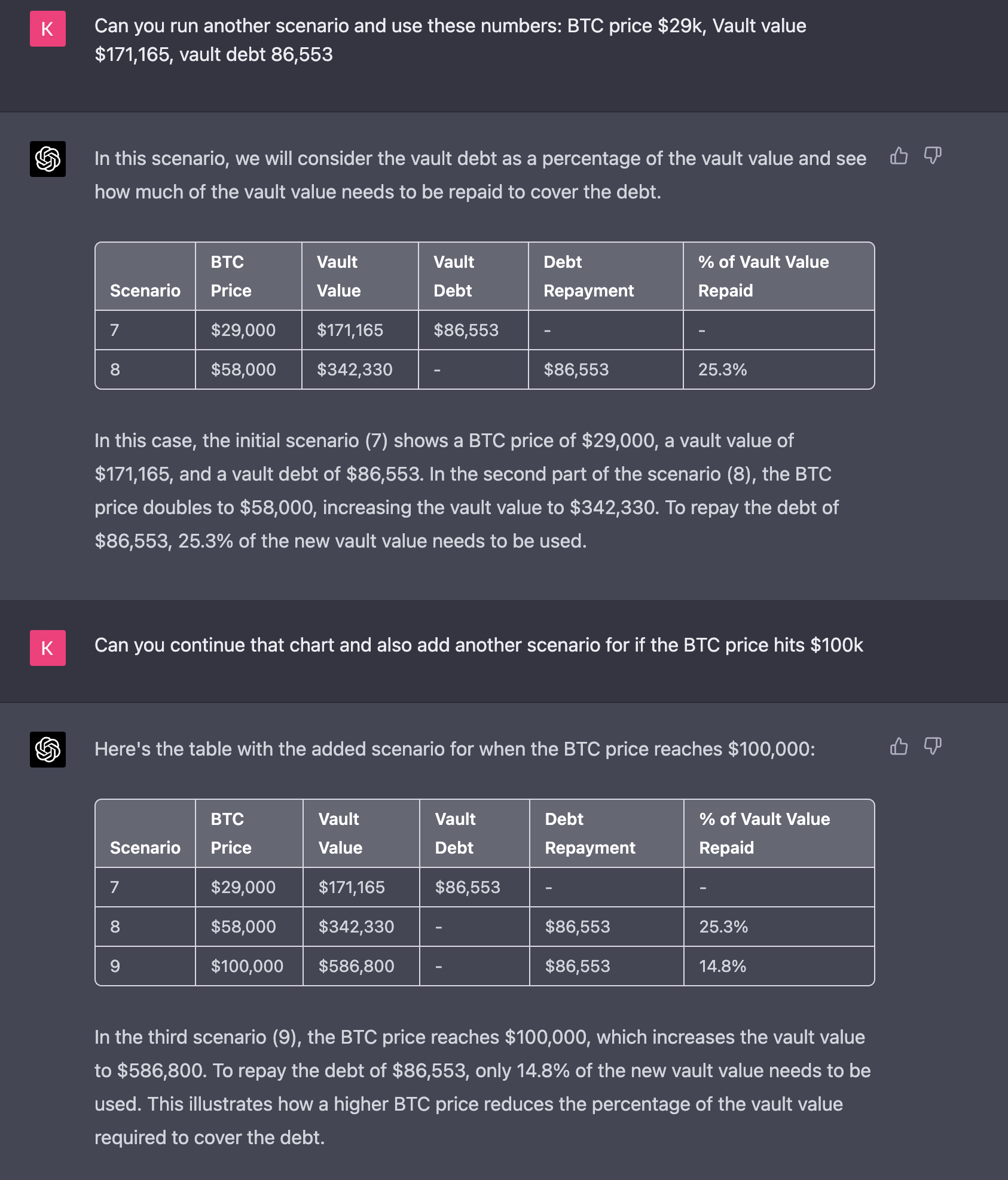

I could've plugged the values in a spreadsheet, but I've been enjoying playing around with GPT-4 for a few things. One awesome thing is scenarios and calculations.

I gave GPT-4 some numbers from one of my WBTC vaults and asked it to run a few scenarios from me.

You can see Scenario 7 as the current status of the vault. BTC is $29k, the Vault Value is currently $171,165. That vault currently has a DAI debt of $86,553.

If Bitcoin doubled to $58k, then the vault would be worth $342k and I could then repay the debt by selling 25.3% of the vault's WBTC holdings.

If BTC went to $100k, then I could repay the whole DAI loan by selling just 14.8% of the vault's BTC.

Why Does Any of this Matter

Hindsight is 20/20 but let's use some foresight. If you believe in Bitcoin long-term, then the BTC price reaching $58k or $100k feels like an inevitability.

I could pay my bills using income today. Or I could use my income to buy Bitcoin, put it in a WBTC vault, borrow DAI collateral and pay my bills using the DAI collateral.

If BTC one day goes to the prices in these scenarios, then I sell a % of the BTC in that vault to pay back the debt I took to pay for bills.

In a bear market to bull market scenario, this will make you look like a genius.

You're effectively:

- Stacking sats

- Collateralizing sats for a loan

- Using loan to pay for immediate expenses

- Waiting for bull market to pay back the loan using less BTC than you bought (since BTC is more valuable than the debt)

In this vault, I bought most of the BTC under $18k. This means that I am sitting on a pretty handsome profit. The key is waiting as long as possible for the bull market to pay off the DAI debt.

Doing so will mean that I need to sell a smaller and smaller % of the vault. Ideally, I would see BTC hit $100k and then sell 14.8% of the vault to pay off the entire $86k debt balance.

Now I've got $500,000 in BTC that I otherwise wouldn't have - since my choice is to either pay bills directly or buy BTC -> take on debt -> then pay my bills.

Downsides

There are some downsides and I think my next post on collateralized loans will dive into those:

- counter-party risk (since we're using WBTC)

- liquidation risk (if you can't cover with more collateral in the event of BTC dropping rapidly in price)

About LeoFinance

LeoFinance is a blockchain-based Web3 community that builds innovative applications on the Hive, BSC, ETH and Polygon blockchains. Our flagship application: LeoFinance.io allows users and creators to engage & share micro and long-form content on the blockchain while earning cryptocurrency rewards.

Our mission is to democratize financial knowledge and access with Web3.

Twitter

Discord

Whitepaper: https://twitter.com/FinanceLeo: https://discord.gg/E4jePHe: https://whitepaper.leofinance.io

Our Hive Applications

Join Web3

Microblog on Hive:

LeoMobile (IOS)

LeoMobile (Android)

Delegate HIVE POWER: Earn 16% APR, Paid Daily. Currently @ 2.8M HP

Hivestats

LeoDex

LeoFi

BSC HBD (bHBD)

BSC HIVE (bHIVE)

Earn 50%+ APR on HIVE/HBD: https://leofinance.io/ https://leofinance.io/threads: https://testflight.apple.com/join/cskYPK1a: https://play.google.com/store/apps/details?id=io.leofi.mobile: https://hivestats.io: https://leodex.io: https://leofi.io: https://wleo.io/hbd-bsc/: https://wleo.io/hive-bsc/: https://cubdefi.com/farms

Web3 & DeFi

Web3 is about more than social media. It encompasses a personal revolution in financial awareness and data ownership. We've merged the two with our Social Apps and our DeFi Apps:

CubFinance (BSC)

PolyCUB (Polygon)

Multi-Token Bridge (Bridge HIVE, HBD, LEO): https://cubdefi.com: https://polycub.com: https://wleo.io

Posted Using LeoFinance Alpha

Nice, but the risks are too high. You can´t be sure, if BTC really pumps to 50K. SEC and other authorities could start a massive selling attack plus spreading FUD anytime. Plus the macroeconomic risks.

Lol I just don’t see that happening

Even a full-scale U.S. ban wouldn’t take down BTC. They’ve tried and failed at that.

Innovation always wins long-term

Posted Using LeoFinance Beta

Everything makes sense with this strategy, just that one needs to be able to take this risk. I wouldn't mind doing it for few thousands, but once things move upper from here and the risk escalates, I simply cannot afford it. But who has the funds for it, this looks like a round strategy to keep on using other's assets to grow your stash and keep rolling your business.

Posted Using LeoFinance Beta

It’s definitely a great way to leverage your stash of BTC to keep growing

Also Carries several risks, I’ll talk about those in my next post!

Posted Using LeoFinance Beta

Live now pay later basically is what you are doing and banking on a favorable price in the future which we know will happen. I haven't spent any crypto yet and I am still busy stacking but happy to see you have worked out a strategy that works for you. maybe in the next cycle I will have enough to play these types of games and will call on you for advice.

Feel free to call on me whenever you start doing it! It's a valuable strategy to have in your toolkit. A great way to keep hodling that BTC when you know you don't want to sell it but might need some liquidity

Posted Using LeoFinance Alpha

The strategy seems sound but a few issues are that it is dependent on only one variable, BTC. Second, given that the market is still in bear, can he survive the duration of the bear market without exhausting many resources himself?Should you use another person's resource, you would still be in debt.

Posted Using LeoFinance Beta

Yes in a bear market, you need to hold out and not get liquidated. That is your directive

The bull market is what you need to wait for. The light at the end of the tunnel that will pay off all the DAI debt and leave you with a handsome BTC profit

Posted Using LeoFinance Alpha

You rate of taking risks really baffles me sometimes, but, I love the way you yield better results most of the time

Efficiency is jey

Posted Using LeoFinance Beta

Yeah, you are right brother

You actually killed it boss. Since your post that can be attributed to this, i have tried to wonder about the magic behind this, but low, you have said it all. The analysis using GBT-4 is quite analytical and statistically true. Please boss how did you get GBT-4, i seriously need it?

$20/mo for GPT-4! Just get GPT+ subscription

Posted Using LeoFinance Beta

Okay boss, thank you. Do you have a link through to the subscription?

chat.openai.com!

Posted Using LeoFinance Alpha

Thanks boss

The rewards earned on this comment will go directly to the people( @hironakamura ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

I am aiming to do this once I get a job after college. My personal preference would be a combo of BTC, ETH and risky assets.

I hope it is not too late to start this. Buy and hodl seems not enough.

Hmmm, just thinking out loud, I guess if you buy BTC, then borrow stables, and then pay back the loan, there's no tax to pay on that, right?

Posted Using LeoFinance Beta

Technically you would be taxed on any $ of #BTC you sell - but you wouldn't be taxed on any of the loaned DAI

It's almost like holding off on paying taxes until you pay off the debt in the vault

Posted Using LeoFinance Alpha

Seems like an efficient approach that is working for you. I admire your risk appetite. Even though I may be confident about the up-and-coming bull market, I would surely be weary of any sharp price falls/drops.

Posted Using LeoFinance Beta