News broke just 2 days ago that the SEC filed charges against Binance for illegally operating in the U.S. They also included a bunch of filings about how Binance misled customers and openly told people to use a VPN to access their exchange.

1 day later (yesterday), the SEC announced actions against Coinbase.

Today, another news story broke that the SEC is seeking to freeze Binance.US assets to "protect customer funds".

All of this news is stacking up against Binance. This is all not great for the BNB token, which is now down 8%.

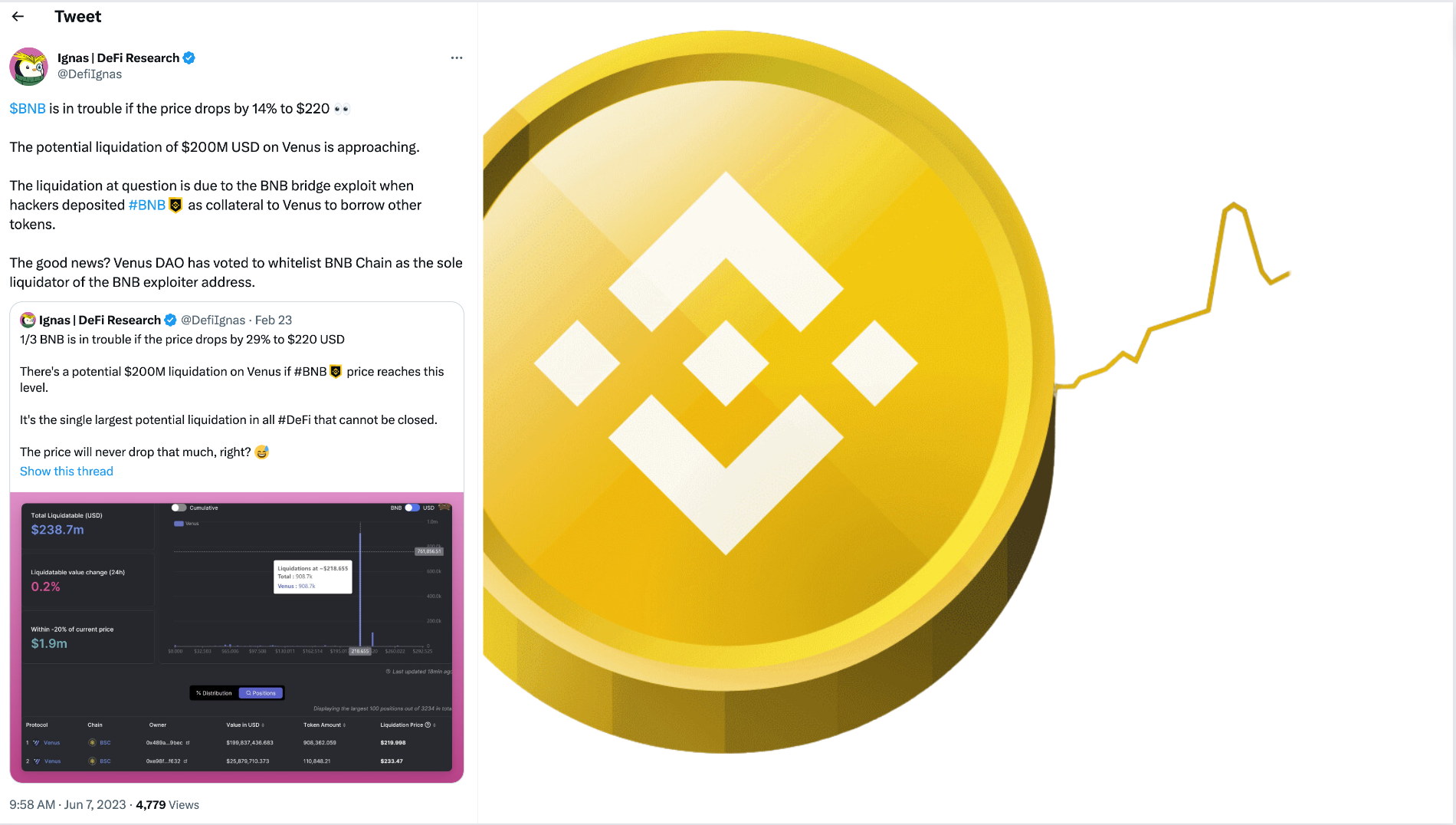

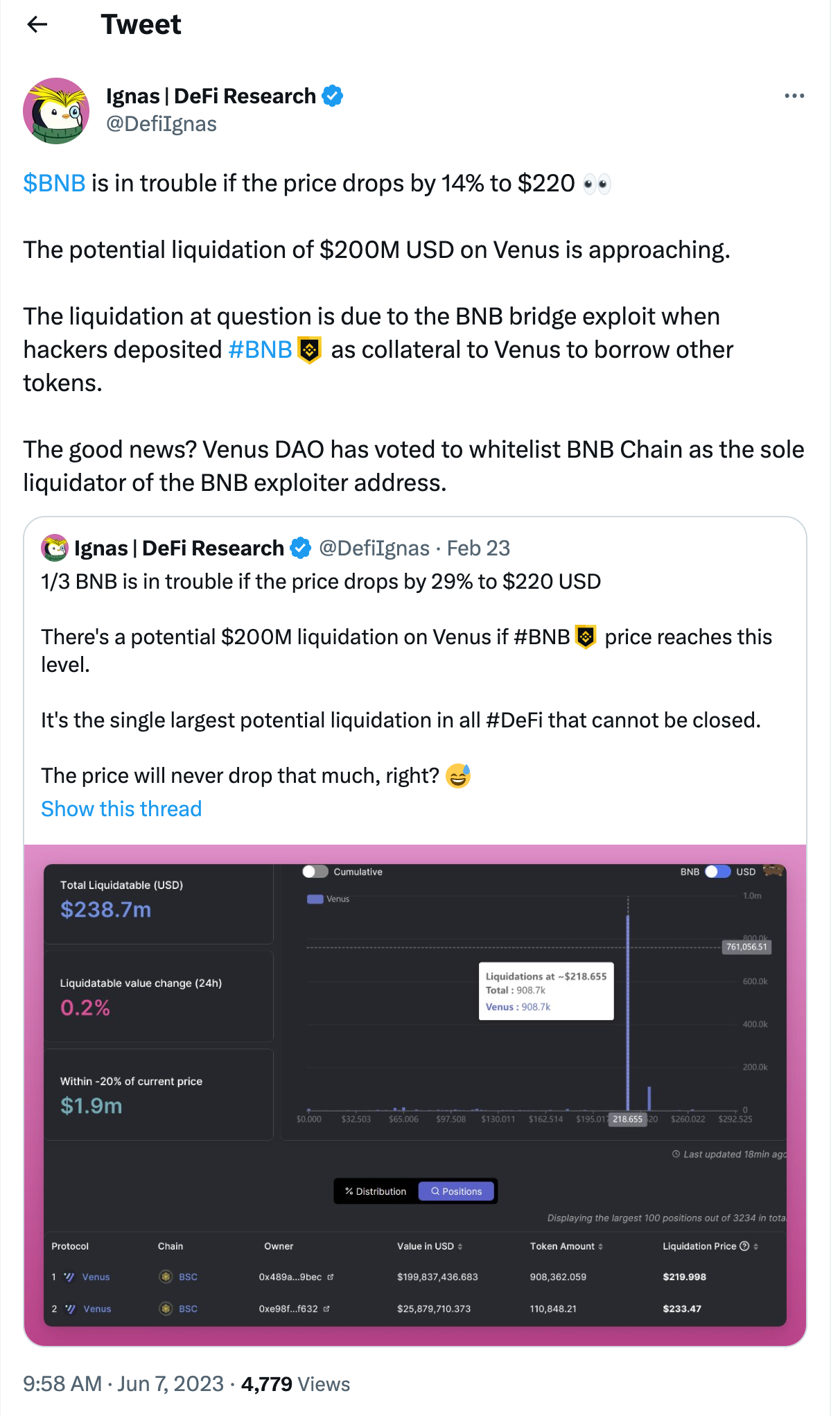

Back in February, $200M worth of BNB was added to the Venus protocol and this could be a liquidation event if the price of BNB drops from $260 (current) to $225.

Let's unpack the news events and then talk about this potential BNB liquidation event.

Crypto Exchanges Under Attack in the U.S.

It is no secret that exchanges are being attacked by the SEC. I tend to stand somewhere on the side of Coinbase where they have said (I'm paraphrasing) that the SEC is attacking crypto exchanges on an enforcement-only basis.

Enforcement-only basis means that the SEC isn't providing clear guidelines for how companies can be compliant.

They are simply coming after these companies. There is no warning. There is no collaboration. There is no rule setting and rule breaking.

Can you break rules if there are none?

Gensler's SEC was asked numerous times - recently in a congressional hearing - to provide clear guidelines on which cryptos are a security as well as their compliance expectations.

No answers were provided.

Instead, Gensler planned an attack on the backend to simply enforce rules that he never laid out to anyone. The charges filed by the SEC are a clear indication of this enforcement-only approach. At no point in history did these subjects / guidelines get publicly discussed.

Agencies are here to protect users and customers. This is what I want. Crypto needs this. Our industry is laden with fraud and scams.

It's a GOOD thing to have regulation.

But what the SEC is doing is not regulation, it is enforcement. Regulation implies that there are rules to follow and if you don't follow them, you get enforcement actions. What's happening now is a clear attack to the industry.

I recently listened to a podcast that explained only about 15% of trading volume in crypto is done within US borders and this has been exponentially decreasing.

Transaction volume and industry activity / innovation is being moved overseas. I believe that the U.S. has a unique opportunity to change the tides and start accepting innovation and profiting from it through taxes and other means.

I am a firm supporter of good regulation. That's not a popular thing to say in crypto, but I said it. What we're seeing now isn't even bad regulation, it is no regulation at all. I hope this song changes before 100% of trading volume and activity leaves the U.S.

Liquidation on BNB?

Some people are curious if there is a liquidation event coming for BNB.

This is not an impossibility. Frankly, I think Binance has been the target of a lot of FUD and while the metrics are there that show if the price of BNB hits $220, we'll see a $200M liquidation on BNB tokens, there are some key things preventing this.

- Binance has typically battled FUD with incredible effect

- This $200M BNB that is to be liquidated was voted over to BNB Chain as the sole liquidator

What #2 means is that the Venus DAO ran a proposal post-hack of the BNB bridge and this BNB can only be liquidated by BNB Chain itself.

I am optimistic that they wouldn't go out and damage the market. CZ and Binance have taken such actions in the past to "prop up" the BNB price in similar scenarios.

So overall, I am not buying into this FUD. I do think this is generally negative for Binance on a global scale but I also don't think BNB is going to come crashing down.

What are your thoughts? Drop a comment below!

About LeoFinance

LeoFinance is a blockchain-based Web3 community that builds innovative applications on the Hive, BSC, ETH and Polygon blockchains. Our flagship application: LeoFinance.io allows users and creators to engage & share micro and long-form content on the blockchain while earning cryptocurrency rewards.

Our mission is to democratize financial knowledge and access with Web3.

Twitter

Discord

Whitepaper: https://twitter.com/FinanceLeo: https://discord.gg/E4jePHe: https://whitepaper.leofinance.io

Our Hive Applications

Join Web3

Microblog on Hive:

Delegate HIVE POWER: Earn 16% APR, Paid Daily. Currently @ 2.8M HP

Hivestats

LeoDex

LeoFi

BSC HBD (bHBD)

BSC HIVE (bHIVE)

Earn 50%+ APR on HIVE/HBD: https://leofinance.io/ https://leofinance.io/threads: https://hivestats.io: https://leodex.io: https://leofi.io: https://wleo.io/hbd-bsc/: https://wleo.io/hive-bsc/: https://cubdefi.com/farms

Web3 & DeFi

Web3 is about more than social media. It encompasses a personal revolution in financial awareness and data ownership. We've merged the two with our Social Apps and our DeFi Apps:

CubFinance (BSC)

PolyCUB (Polygon)

Multi-Token Bridge (Bridge HIVE, HBD, LEO): https://cubdefi.com: https://polycub.com: https://wleo.io

Posted Using LeoFinance Alpha

Enforcement only will make it quite hard for crypto exchanges to fight back. The SEC is really not planning to regulate crypto in the US but to remove it out of there. In some way, this is just impossible.

The US government has gone on record in the past that they view crypto as a threat to national security. People don't regulate something like that. They seek to stop it, or at the least, turn it into something that can't cause them any further worry.

This post has been manually curated by the VYB curation project, to get the maximum benefit, please consider using the VYB and Proofofbrain tags

always try to see how to disturb so that their hegemony does not fall, what would happen if they let the people choose how they want to do transactions

Looking for "Good Regulation" from this US government is like looking for a unicorn, you are simply NOT going to find it.

Totally agree regulation is needed and not enforcement as exchanges are working in the dark here not knowing trying to do the best they can. BNB may be a good buying opportunity if it does crash as COTI is down 20% after being listed by the SEC 2 days ago as a security and have been buying slowly in case it drops more.

The address is blacklisted and the liquidation wouldn't take place.

CZ retweeted the information, so I assume it's reliable.

My thoughts on Hive and how it has devolved, and why I'm quitting after being here from day 1.