Microstrategy (MSTR) has become one of the most talked about players in the Bitcoin space. As of April 5th, they now hold 140,000 Bitcoins after acquiring another 1,045 recently for $29.3M.

Michael Saylor has become one of the biggest proponents of Bitcoin since his company got into the space. He's not just pushing Bitcoin ideologies on Twitter, he's also doing a lot of hand-to-hand combat meeting with top executives, billionaires and hedge funders and trying to convince them to gain some exposure to Bitcoin.

Dollar Cost Averaging into a $4B Position

"Saylor’s MicroStrategy recently repaid its Silvergate loan and bought 6,500 BTC at the end of March. The company’s Bitcoin strategy appears to be dollar-cost averaging but with vast amounts of money." CT

Dollar Cost Averaging (DCA) is something that I've talked about extensively in my posts. It's at the core of my portfolio strategy when investing in... literally anything.

With Bitcoin, I have dollar cost averaged for the past 7 years. It has worked extraordinarily well for me.

As I've said, I DCA in but I also DCA out. Most people think of DCA as being a way to simply buy into assets, but they don't see that it's also a fundamentally sound way to take profits on those assets after they hit a target price level.

For example, you can DCA into BTC for an average price per BTC of $22k... When Bitcoin eventually rises to, say, $30k (or whatever price target you set prior), you can start to DCA out with the same size that you DCA'd in.

This means taking profits every single day, week or month while BTC is above $30k.

I like to DCA either on a daily or weekly basis. I have some autonomous DCA buying on a daily basis set and then once a week I'll do a bigger buy.

Once BTC hits a target price, I'll do the exact same thing but instead of buying, I'll be selling. That's how you take your own monkey mind out of the idea of "timing the market". I've found that nobody can time the market and there is no point in trying.

Michael Saylor knows this as well. Microstrategy has dollar-cost averaged into Bitcoin... Albeit on a much bigger scale than anyone else.

Why Buy More?

Microstrategy has 140,000 BTC... Why do they keep buying more?

Saylor has outlined this strategy many times. He can't explicitly say this but he has implied many times that MSTR is essentially a Bitcoin proxy derivative. They hold 140k BTC which is currently worth ~$4B.

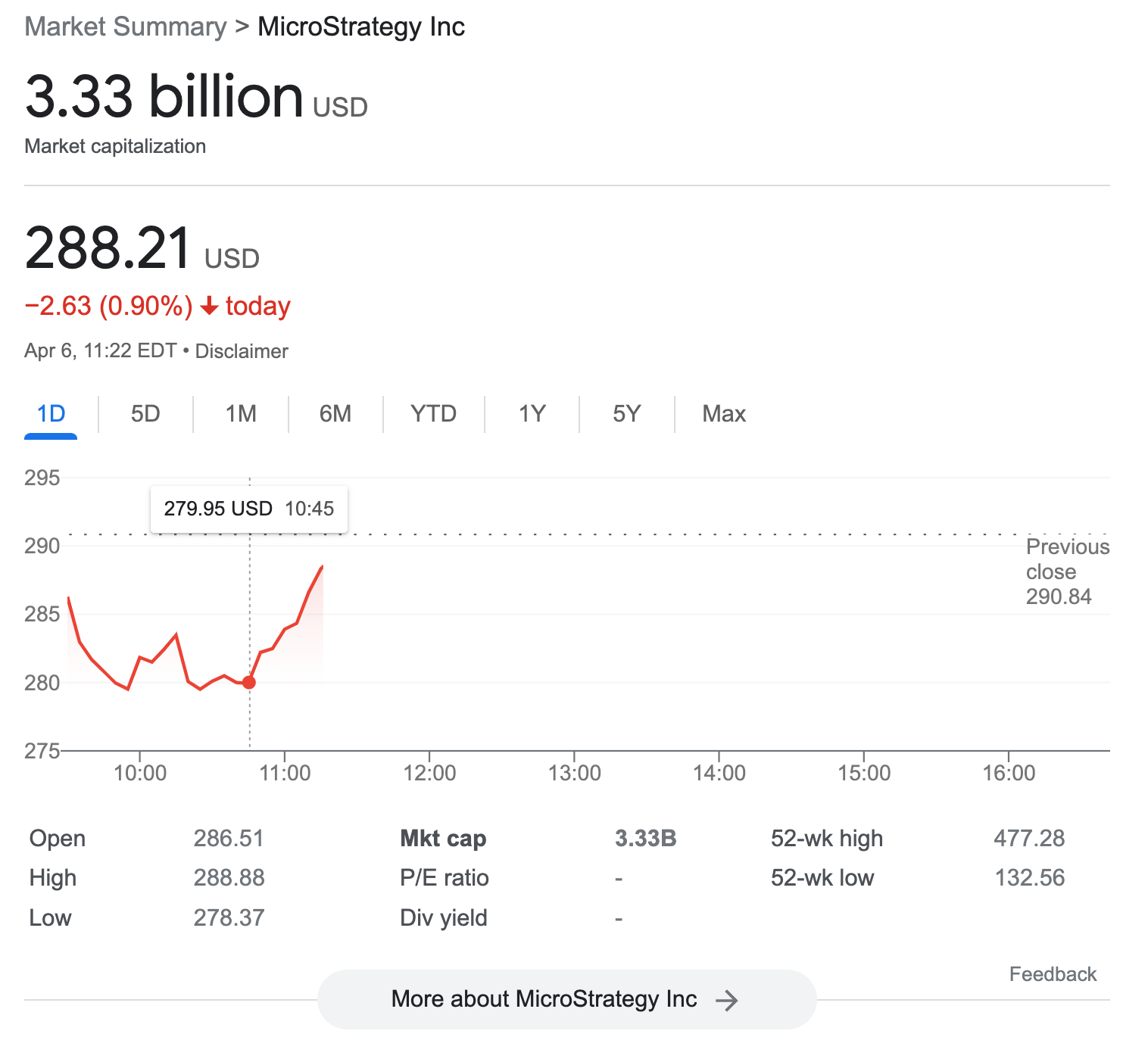

The market cap of MSTR is $3.33B.

In addition to being a proxy derivative, MSTR still generates a positive cash flow. So Saylor has outlined this vision pretty well:

- Build a business intelligence software company that generates a healthy profit each year

- Take those profits and invest in BTC

- Rinse and repeat

Generate profit and DCA into BTC. That's a strategy I can get behind. He's talked about hodl'ing the BTC forever but I think we all know that there will be selling at some point.

As a publicly traded company, imagine that his BTC bet really pays off and Bitcoin rises to $100k+. MSTR is going to be sitting on potentially $20B+ worth of Bitcoin... Their stock price will follow the price of BTC and 4-5x. They're going to look like geniuses and investors will want to stave some risk by selling some BTC and at the bare minimum, pay some of the debt they've taken on to acquire BTC.

My Thoughts: Stupid or Best Bet In History?

I'm a huge believer in Bitcoin. I always have been. I believe it's still in the semi-nascent stages of becoming digital gold. We still have a ways to go until we flippen the gold market cap, but I forsee that happening at some point.

Gold has a $13T market cap.

BTC has a 540B market cap.

A 26x in the price of BTC is required to see us flippen gold's mcap. That's a price of ~728k per BTC.

I believe that will happen some day. Most normal people probably find that crazy but if you believe in the technology, decentralization and predictable monetary policy, then you probably don't find it that crazy.

Michael Saylor buys into this vision. He's put $4B where his mouth is. If this vision is right and he holds on until we flippen Gold's MCAP, his BTC stack will be worth over $104 Billion and he might go down in history as one of the best investors of all time.

About LeoFinance

LeoFinance is a blockchain-based Web3 community that builds innovative applications on the Hive, BSC, ETH and Polygon blockchains. Our flagship application: LeoFinance.io allows users and creators to engage & share micro and long-form content on the blockchain while earning cryptocurrency rewards.

Our mission is to democratize financial knowledge and access with Web3.

Twitter

Discord

Whitepaper: https://twitter.com/FinanceLeo: https://discord.gg/E4jePHe: https://whitepaper.leofinance.io

Our Hive Applications

Join Web3

Microblog on Hive:

LeoMobile (IOS)

LeoMobile (Android)

Delegate HIVE POWER: Earn 16% APR, Paid Daily. Currently @ 2.8M HP

Hivestats

LeoDex

LeoFi

BSC HBD (bHBD)

BSC HIVE (bHIVE)

Earn 50%+ APR on HIVE/HBD: https://leofinance.io/ https://leofinance.io/threads: https://testflight.apple.com/join/cskYPK1a: https://play.google.com/store/apps/details?id=io.leofi.mobile: https://hivestats.io: https://leodex.io: https://leofi.io: https://wleo.io/hbd-bsc/: https://wleo.io/hive-bsc/: https://cubdefi.com/farms

Web3 & DeFi

Web3 is about more than social media. It encompasses a personal revolution in financial awareness and data ownership. We've merged the two with our Social Apps and our DeFi Apps:

CubFinance (BSC)

PolyCUB (Polygon)

Multi-Token Bridge (Bridge HIVE, HBD, LEO): https://cubdefi.com: https://polycub.com: https://wleo.io

Posted Using LeoFinance Alpha

Smart people and companies make the smart moves when the market is undecisive. These are still good times for accumulation and it gives me trust and hope that a bull market is yet to make stronger moves. Understanding the space and the moves of big players on the market can give opportunities for others to follow. I believe we'll see new ATHs!

Posted Using LeoFinance Beta

Whales like saylor are always super connected. We can assume that he’s got a lot more info than we do

That doesn’t make him unable to make missteps but it does mean that he’s likely far more informed than the average investor in Btc

Posted Using LeoFinance Beta

Having a better understanding of how the market moves is very important , that is why companies who understand it moves on most occasion takes advantage of that too.

Posted Using LeoFinance Beta

I think Saylor knows the future of BTC pretty well

Posted Using LeoFinance Beta

Discord Server.This post has been manually curated by @bhattg from Indiaunited community. Join us on our

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.

En cuanto a la posibilidad de que veamos nuevos ATH (máximos históricos), es posible que ocurra en el futuro, pero no hay garantías. El mercado de criptomonedas es altamente volátil y puede ser difícil predecir su comportamiento a largo plazo. Por lo tanto, es importante tener una estrategia de inversión sólida y estar preparado para los altibajos del mercado.

Great point about also DCAing out of a position ! Totally agree that it's not worth trying to time the market.

Michael Saylor's thinkin' big with this move, and if it pays off like he's hopin', he might just go down in history as one of the best investors of all time.

Posted Using LeoFinance Beta

Congratulations @khaleelkazi! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 12000 comments.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts:

Support the HiveBuzz project. Vote for our proposal!