Last week on the LEO roundtable podcast, @rolllandthomas peppered me with questions about the way I invest/trade. His question about articulating what happens in my head when I decide to buy/sell, etc. has been bugging me all week, so I spent some time and wrote this post about my general allocation strategy for crypto.

I'll probably follow this up with a few posts that dive further into some adjacent ideas and also share some of my stock portfolio strategy as well.

Everything happening in crypto is still so nascent. Whether you're looking at BTC, ETH, BAT or HIVE, we're still in the very early stages of price discovery, value propositions and core feature sets.

When I first got into crypto circa 4 years ago, I initially bought Bitcoin - as most do. Shortly thereafter, I heard about this thing called Ethereum and was instantly intrigued by the proposition of a "global supercomputer" and this crazy thing called Smart Contracts.

Since then, the markets for BTC and ETH have evolved a great deal and with it, my knowledge of the value that these "cryptocurrencies" bring to the world. I've also spent the last ~3.5 years on Hive, which has shaped my approach and understanding of crypto and the tech that underpins it.

In my mind, BTC is a long-term store of value. To me, it's a forgone conclusion that Bitcoin will go up in price over a long time frame. The questions then are -- how long is that time frame and will something like ETH outpace the growth of BTC in terms of appreciation.

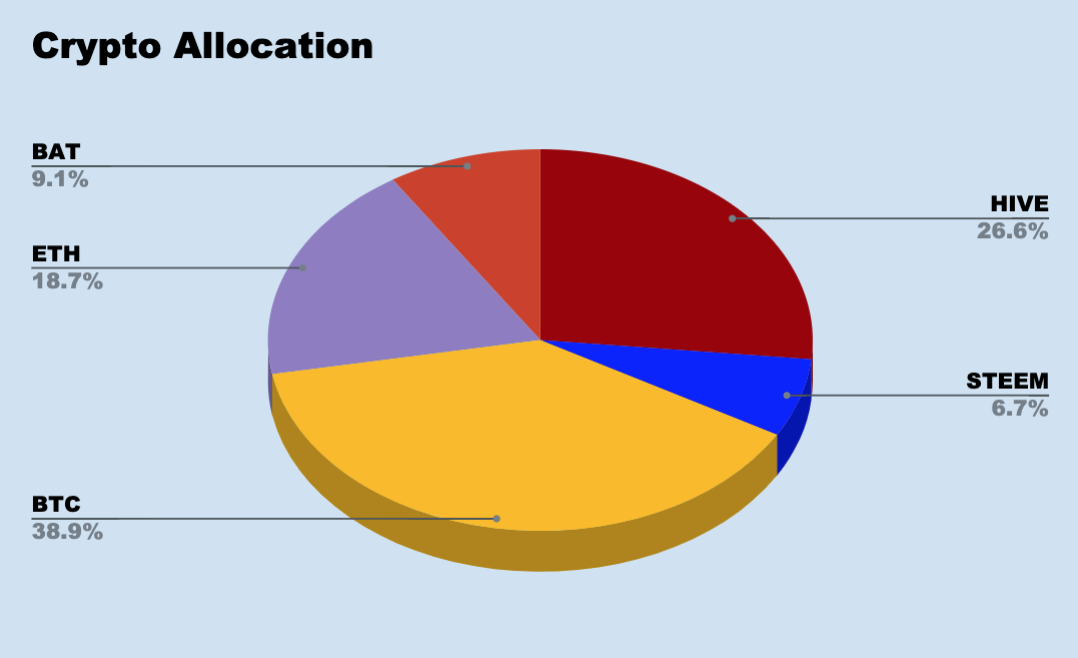

I use this as the reasoning for my portfolio allocation - a majority of my crypto is in BTC but I still allocate a sizable chunk to ETH and also HIVE. BAT is a smaller allocation but still significant.

During the ICO/alt craze in 2017, I amassed a wide portfolio of altcoins. I don't have the spreadsheet right in front of me at the moment, but back then I had a portfolio with over 20 altcoins in it.

Luckily, I was smart (or just lucky) enough to sell most of my alts during the big bubble shortly after BTC hit $20k. Over the months that followed, I consolidated a vast majority of my money from alts into BTC, ETH STEEM (now HIVE), and BAT.

Just 4 cryptos that I firmly believe in. I have a few tiny wallets wallets with some other tokens like GNT in there but I really don't consider that a part of this portfolio (in total, those other positions would be less than 1% of this portfolio).

How I Approach Profits & Risk Management

The fun thing about a portfolio that is only made up of 4 assets is that I can easily track/move things around. When 1 of these currencies is performing far better than the others, I can easily shift the holdings and even take some profits out of the portfolio entirely.

Usually when I take profits, however, I'm just pushing them from HIVE/BAT/ETH into BTC. BTC has become more like a money to me than I ever would have expected.

I think that famous saying goes something like this:

I don't keep much liquid cash on hand, but when I do, I keep it in BTC.

Earning APY

APY stands for Annual Percentage Yield and I look for it on both of my portfolios (stocks & crypto) - it is a fundamental part of how I decide where to invest and when.

For this crypto portfolio, I have a few ways of earning yield:

- BTC lending protocols: deposit BTC and let others borrow it and pay interest (averaging me about 6% APY)

- ETH lending protocols: DeFi based - things like MakerDAO (I collateralize my ETH, get DAI and use it for investing/generating a return. Often buying something like HIVE where I can actually earn a yield on that DAI investment as well. The yield is hard to frame up as it depends on my performance as an investor. Let's call it a rough 20-40% APY on average)

- BAT lending protocols (same exact thing I do with ETH, but I just use BAT for collateral on certain platforms)

- HIVE (POWER) - I use some for curation, some for building the LeoFinance community & project (we could measure the yield on my HIVE POWER as a rough average APR of curation, LeoFinance activities, etc.. around 15% APY)

What I'm Doing On a Day-to-Day

What I'm doing right now in terms of allocation is slowly using some BTC to buy HIVE when I believe it's cheap in terms of the HIVE/BTC pairing (recent fills for me were around 2300 sats).

I've also been selling off some of my stocks for obvious reasons and have been using some FIAT to actually buy into ETH. I think we're in the beginning stages of a long-term bull run for ETH as BTC aims at its previous ATH and the long-awaited ETH 2.0 roadmap is completed.

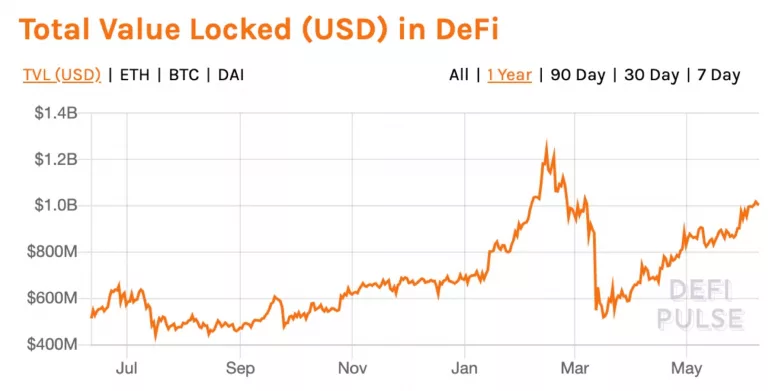

Another thing that I've been watching is the amount of money getting locked up in DeFi. There's a lot of interesting data out there on ETH related to DeFi participation, demand for 32 ETH (because of the expected PoS functionality that requires exactly 32 ETH), etc.

Source: DeFi Pulse

Overall, I'm extremely bullish on BTC, ETH, HIVE and BAT, which is why I put my money where my mouth is and take positions in these 4 above all else.

You might have also noticed the 6.7% allocation to STEEM. That's the remaining amount that I have in my Steem accounts and like many, I'm still only part of the way through the process of dumping it off for HIVE each week.

Leo Witness

p.s. We just launched the LeoFinance community witness node today. We'll put out the official announcement tomorrow, but if you like what we do for the Hive ecosystem consider giving @leofinance a witness vote 🦁🦁

Posted Using LeoFinance

Any stablecoins in the portfolio like USDT?

Or you are using BTC for that :)

Also you may add LEO to that pie ....

P.S. I like holding small number of coins as well, its easier to keep a close eye on them rather than having 20 or 50 etc ... and just get lost with them.

Posted Using LeoFinance

Throw some Zil in there fast

Sometimes I temporarily hold USDT, but I’m not a huge fan of these stable coins at the moment. I don’t feel as secure with them as I feel that we should with any stablecoin.

I thought about including LEO in the chart, but I don’t really view it as an investment like these other currencies. LEO is a bit more of a business to me, so I actually put it on a higher pedestal than just an investment 🚀

100%. I have just enough in those small ones to where it’ll be nice if they work out but not enough to the point where I check up on them to see their value on a month to month basis

Posted Using LeoFinance

Same here. I hold as few as possible and would prefer them to win... against 50 tiny profits.

All boils to how big the capital is... and how much time I can dedicate.

Used to spread myself too thin with thousands and hundreds spread around. Now tightening those ends and focusing only on a couple of tokens!

Serving well so far.

Posted Using LeoFinance

When getting into a trade, always know what will push you out before you enter it.

Usually what caused the buy will be the reason to get out if it goes against the trade.

Posted Using LeoFinance

Yea, I am definitely one who likes to consider the trade from multiple angles, understanding why you think something is cheap is a great exercise

Posted Using LeoFinance

Good stuff, I look forward to your series "into the mind of @khaleelkazi " You have influenced me as well, as I'm narrowing my scope of assets I want to focus on and trade because I was all over the place, looking at everything, instead of become a sniper with just a handful of asset classes.

Posted Using LeoFinance

It's interesting to sit down and write it out. I'm looking forward to the process myself.

p.s. I put on a SQ spread today after our roundtable. If this goes well, I'll follow your advice and continue to look for ways to sell similar spreads on my "children" stocks :)

Posted Using LeoFinance

I still have far too many tiny bags of junk, but worth so little I may as well hold on.

Great to read your cryptocurrency investment portfolio. Do you actually maintain the above proportions of holdings or do they alternate due to price directions?

Posted Using LeoFinance

Cheers for sharing this, mate. It's a pretty good portfolio all around, and well-balanced between the big, and small fishes in the pond. These tokens are getting quite bullish now, particularly BTC following Halving, and ETH with the 2.0 upgrade coming up.

HIVE's stabilised a bit in the past few weeks, just finding the balance it needs and the right price point. I've personally not invested much into BAT, except for when Publish0x is involved. STEEM is well, being STEEM, as it does. I'm almost done with the liquidation process myself, too!

Are you using any particular app or service to aggregate manage your portfolio, or do you just track them yourself? I've also noticed quite the handsome returns on that APY for DeFi. It's certainly better than what most banks can offer as interest, even for high-yield accounts. But how are those numbers when inflation is taken into account?

Creepy...Literally the same looking portfolio as me.

I just think the biggest upsides are in those tokens and coins.

Of course, hive-engine tribes factor into that as well, but very similar man.

If I'm close to what you hold, I'll be doing ok I'm sure lol

I really like the simplicity of that Portfolio, I imagine many on here have got a similar top four (once you take Steem out), just with a different spread.

I really need to look at buying more BAT, that is something that interests me, I feel like I don't hold quite enough!

Unfortunately I've still got my alt bags, I'd probably have another 0.3BTC or so if I'd have sold them when you did, but since I updated my Blockfolio account i haven't even bothered to enter them to track them, they're all just sitting on exchanges on hopeful limit sells.

Interesting that you don't include LEO in your crypto analysis, it is a cryptocurrency though?!?

Posted Using LeoFinance

I think I need to stack some ETH now. I just started getting back into tracking my portfolio. I try to minimize buying into random alt coins.

I have to take a deep look inside the loophole of ETH + DAI combo, but it is really profitable?

I mean, let's say that you lock 100$ worth of eth.

To be safe you only generate 40 DAI to be collateralized in a ~250%.

Now you move your DAI around and generate a profit/loss.

If you want to recover your 100$ worth of eth, you have to pay the stability fee as I see. How much is that stability fee and how it varies? I read ~6% in some places, 3% in others... what has been your experience so far?

I'm thinking about touching it, but what happened in march scares me a little.

Any tip?

Thx

Posted Using LeoFinance

I also hold ETH in my portfolio. It’s even the biggest part because I think it has the best shot on longterm gains for reasons you explained. Maybe I should invest some ETH in DeFi? Is it “safe”?

The rest is NEO, BTS and Hive. But I consider them a lost cause. But hey..who knows!

Interesting to read this. Almost a copy of my portfolio. Juts BTC & ETH has a bit larger % proportions here. I got into ETH on the first day of ETH presale, one year before it's official launch. :) And some satoshis I hodl are mined back in 2012 yet with CPU and GPU

Posted Using LeoFinance

So good that you got out at the top of 2017. This post reminds me of cleaning out my portfolio.

So refreshing to have found a podcast when it comes to Hive talk.

Cheers!

Posted Using LeoFinance

Quite useful, you keep few coins and focus on those solely. Thanks for sharing!

Just a quick question, on eth collateralization and getting the DAI equivalent tokens, is there an impose risk if the ETH's value goes down for like 50% as an example after collateralizing?

Congratulations @khaleelkazi! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board And compare to others on the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPSupport the HiveBuzz project. Vote for our proposal!

Thanks for sharing. :) It's nice to hear what others are investing in and how they diversify their portfolio. I aim to learn more and more about investing. I have been playing in the markets with minimal amounts (>$1,000) at a time for a year or so and enjoy it very much. Learning new things all the time. I appreciate your helping me learn a little about what works for you and I hope to catch your coming post on stocks. :D

@khaleelkazi

Thanks for sharing your crypto journey with us...

You did well by taking profits at some point I’ve been considering that in my future as well...

And good you stick to good projects.

Myself I also like BAT token and few more projects, for me personally I think crypto is still on a bear market so I’m waiting for another x5 drop at least to start accumulating some more crypto.

Namaste 🙏

Diversification in crypto is a misnomer. Most think of diversification as a way to hedge bets and play it safe. However, with crypto it is the exact opposite. The best way to play it safe is to be a Bitcoin maximalist.

Posted Using LeoFinance

Many thanks for the insightful article. What is the best way of lending out bitcoin? I was not aware this is an option.